The U.S. consumer price index (CPI) accelerated more than expected last month as the American job market continued to show signs of weakening.

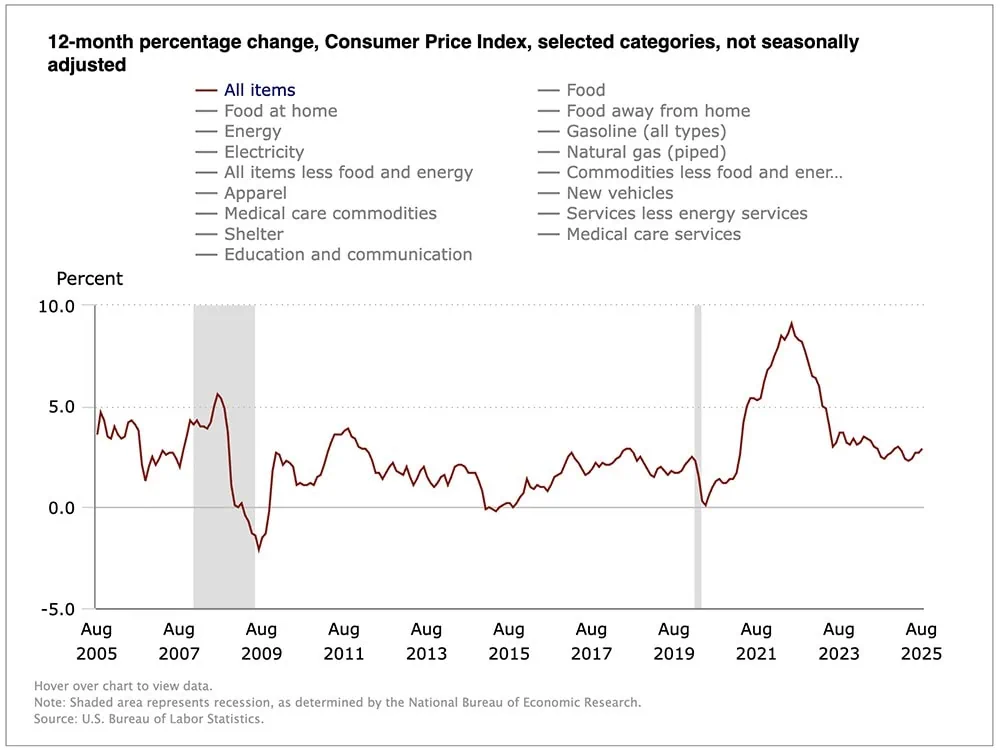

The U.S. Bureau of Labor Statistics said Thursday that August’s CPI, which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.4% month-over-month—both ahead of consensus expectations for 0.3%, and faster than July’s 0.2% rate of growth. On a year-over-year basis, consumer prices were up 2.9%, ahead of June’s 12-month rate of 2.7% and in line with analysts’ heightened estimates.

Alongside the higher-than-expected CPI was a worse-than-expected weekly jobless claims report, which showed 263,000 weekly unemployment compensation filings for the week ended Sept. 6—the highest level since October 2021 and far above estimates for 235,000.

“For the first time in a long time, CPI is being overshadowed on its release day by another data series: initial jobless claims,” says Josh Jamner, Senior Investment Strategy Analyst at ClearBridge Investments. “A spike in initial jobless claims to the highest level in four years helped briefly push the 10-year Treasury below 4% this morning, despite a larger-than-expected increase in the consumer price index. This dynamic illustrates the Fed’s focus on the ‘maximum employment’ half of the dual mandate, with today’s inflation print not hot enough in our view to derail a 25-basis-point interest-rate cut at next week’s FOMC meeting.”

“Core” CPI, which excludes food and energy costs (which are more volatile than the other costs tracked by the Labor Department) came in 0.3% higher, which was level with both July’s increase and economists’ predictions. The year-over-year core reading of 3.1% was also in line with both last month’s reading and expectations.

10 Ways Tariffs Affect Small Businesses

A quick look at August’s key CPI figures:

- MoM CPI: +0.4% (estimate: +0.3%)

- YoY CPI: +2.9% (estimate: +2.9%)

- MoM Core CPI: +0.3% (estimate: +0.3%)

- YoY Core CPI: +3.1% (estimate: +3.1%)

August’s most noteworthy cost increases were in gasoline (+1.9% MoM), which pushed energy commodities broadly up 1.7%, though prices for both are still significantly down (6%-plus) year-over-year. Used cars and trucks rose by 1.0%, as did transportation services. Food prices at home were up 0.6%, while apparel climbed by 0.5%.

“Core CPI has barely improved over the last year and is now firmly above 3% again after dipping into the high 2s during Q1 of this year,” says John Kerschner, Global Head of Securitized Products and Portfolio Manager at Janus Henderson Investors. “More worrisome, the three-month annualized number is inching toward 4%, showing the trend is going in the decidedly wrong direction.

“Even the recent bright spot on the inflation front, OER (owner’s equivalent rent), was hotter than expected, coming in at 0.381%,or 4.0% annualized. OER has been ticking down stemming from the fact that housing supply continues to increase (U.S. new homes now have a 9.2-month supply), and home price appreciation is actually trending slightly negative in several areas of the country. However, today’s number is still far away from the average OER of 3% we saw during 2021.”

Buy ‘The Future’: 5 Tech Stock ETFs You Should Own

The CPI readout follows yesterday’s producer price index (PPI), which declined marginally (0.1%) month-over-month amid declining energy prices and weak food prices. Core goods were firm, however, up 0.3% MoM.

“Inflationary pressure in PPI appears to be muted overall,” wrote a Citi research team led by Andrew Hollenhorst, the firm’s U.S. chief economist. “We would expect core goods prices for businesses to be a leading indicator for core goods prices for consumers. Core goods PPI is running slightly stronger than over the last year, but does not show signs of a major new inflationary pressure from tariffs.”

Looking ahead to the personal consumption expenditures (PCE) index report due out Sept. 26, Citi now sees August’s core reading—the Fed’s preferred measure of inflation—coming in at 0.2% month-over-month and 2.9% year-over-year. “Surprisingly strong owners’ equivalent rent in CPI will boost PCE inflation by much less due to differences in weightings, while airfares in PPI (which matter for PCE) were much softer than the 5.8% increase in CPI,” says Citi U.S. Economics Analyst Veronica Clark.

Expectations for the Fed

Wall Street remains convinced that the Federal Reserve will cut the target range for its benchmark interest rate at the central bank’s rate-setting meeting next week.

3 Dandy Dividend-Growth ETFs to Buy

“These numbers aren’t perfect but they’re good enough to keep the Fed on track for rate cuts,” Russell says. “Jobless claims were also much higher than expected, which gives weight to the other side of the Fed’s mandate. The weaker the labor market gets, the less inflation matters. It’s a balancing act, and the scales are tipping more toward full employment versus price stability. That’s especially true after this week’s big downward revisions of the annual employment and last week’s poor non-farm payrolls report.”

Specifically, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, now shows an 89% chance that the target range for the federal funds rate will be cut to between 4.00% to 4.25% at the next Federal Open Market Committee (FOMC) meeting, scheduled for Sept. 16-17. While that’s down from 91% before, that’s because the implied likelihood of a 50-basis-point cut, to a range of 3.75% to 4.00%, increased from 9% to 11%.

“While investors may cheer the prospect of rate cuts,” ClearBridge’s Jamner says, “if the pickup in initial jobless claims is sustained in the coming weeks, they may turn more cautious on the economic outlook.”

What About BLS Data Accuracy?

This inflation report comes in the wake of August’s sacking of Erika McEntarfer, Commissioner at the Bureau of Labor Statistics. The surprise firing stunned most of the economic community and, combined with the nomination of a partisan replacement (E.J. Antoni of the Heritage Foundation), has many worried about the politicization of American data.

You can look at our August jobs report recap to learn more about the situation at the BLS.

What the Experts Think About August’s CPI Report

Here, we outline more thoughts from the experts on what last month’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“We expect core good price momentum to build further as Q3 evolves, likely spilling into Q4. Rising goods inflation should help offset the disinflation we anticipate in services for the rest of 2025. What does this mean? Shoppers can expect to feel their spending power shrink further as everyday goods edge higher in price, even as service costs cool.

“For portfolios, that means staying selective: companies with strong pricing power and balance sheets are better positioned to weather this environment. This price dynamic will be important in determining the Fed’s path. Potential goods firming while services easing will be important in shaping the inflation trajectory and Fed policy timing, but we believe labor market dynamics will take central focus in determining the path and depth of interest rate cuts this year.”

6 Major Ways the OBBB Affects Your Business Taxes

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“Within the goods categories, there are some signs that tariffs are starting to impact consumption patterns. Product categories like food and apparel have seen prices accelerate higher. In comparison, prices in discretionary categories like recreational goods have been roughly flat, perhaps reflecting some degree of demand destruction. This may be a sign that households are eating the higher costs where they must but pulling back on spending where they can.

“Because tariffs have been staged in over time rather than all at once, the window of observation for their effects on prices is relatively wide. Many new tariffs were implemented just last month, but it may take several more for them to filter through to consumer prices given the typical lag from import to final sale.”

Scott Helfstein, Head of Investment Strategy, Global X

“The market is likely to take a breather here based on the inflation data. The uptick could be reason for the Fed to hold steady, but the recent jobs revision probably warrants a modest reduction. The rate cutting cycle is likely to resume next week, but the process will be slow. The markets now expect cuts in October and December.

10 Common Social Security Mistakes You Should Know

Housing and utilities remain a major driver of inflation. Higher rates do little to nothing to control costs in those areas, and may even contribute to higher costs. Rents go up when mortgage rates are higher and utilities borrowing costs go up. Lower rates might help to relieve some pressure there over time.”

Simon Dangoor, Head of Fixed Income Macro Strategies, Goldman Sachs Asset Management

“We continue to expect the Fed will cut rates next week due to weak labor market data and think it could follow this up with further easing in October. Although near-term inflationary pressures remain high, and further strong readings are likely in the coming months as businesses run down inventories and pass on cost rises, the Fed is likely to draw comfort from anchored inflation expectations and the absence of overheating in the labor market, which reduce the risks of second round effects.”

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 7 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 8 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)