Take advantage of the offers below to make at least $10 fast and give your finances a near-instant boost. The more deals you utilize, the more money you can make.

Best Ways to Earn $10 Quickly—Our Top Picks

|

4.1

|

|

Up to $300 in bonus cash.

|

How to Get $10 (Or Even More) Fast

Below, I’ll go through a number of ways you can easily score $10—or in most cases, even more—pretty quickly, and sometimes even instantly.

1. Investment Account Sign-Up Bonuses

First up: Sign-up bonuses for starting an investment account. This is a very common way for online stock brokers to attract fresh customers—most brokers offer some sort of giveaway or bonus, though they often change over time.

Below are a handful of our favorite brokerage sign-up bonuses.

Plynk™ Invest ($85 in free cash bonuses)

- Available: Sign up here

- Platforms: Mobile app (Apple iOS, Android)

- Promotion: Earn $10 for signing up; Plynk will also double your deposit up to $75

Plynk™ is an app designed to help you start investing and learn along the way, and they’re currently offering up to $60 in bonuses for new accounts.

The Plynk app helps beginner investors put their money into an investment portfolio. The platform uses straightforward, easy-to-understand language to explain investing concepts. No jargon. No complex charts and tables. Just simple-language tips and how-tos.

One of Plynk’s most interesting features involves, of all things, gift cards. Specifically, you can redeem unused gift cards for money that you can use to buy stocks in your favorite companies.

If this sounds interesting to you, consider opening an account with Plynk. To make it more worth your while, they have a few special offers.

→ How to get free bonuses with Plynk

Simply open an account and link your bank account to get a $10 signup bonus. Plynk is also offering a special bonus promotion through Feb. 15, 2024. If you make a deposit, Plynk will double it to $75. Customers must have a minimum of $25 in net deposits during the promotional period to receive a match. That means you may be eligible for up to $85 in signup bonuses from Plynk by taking qualifying actions.

- Start investing for as little as $1.

- Answer just a few questions, and find suitable investments for your needs.

- Invest in stocks, exchange-traded funds (ETFs), mutual funds and crypto commission-free**.

- Plynk™ lets you redeem unused gift cards for money that you can use to invest in your favorite companies.

- Signup bonus: Plynk offers two signup bonuses worth up to $85 combined: (1) Plynk will match up to $75 in net deposits made to your account through Feb. 15, 2024, subject to certain terms; (2) Plynk will pay a $10 sign-up bonus for downloading the Plynk app, opening an account and linking a bank account as a new customer (or existing customer who hasn't previously linked a bank account).

- Designed for beginning investors

- Redeem unused gift cards to invest

- Helpful educational resources

- Some features may require a fee in the future

Fidelity Youth™ Account ($50 bonus for teens, $100 for parents)

- Available: Sign up here

- Price: No account fees, no account minimum, no trading commissions*

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: Teens get $501 on Fidelity® when they download the Fidelity Youth™ app and activate their Youth Account; parents get $100 when they fund a new account

Learning early about saving, spending and investing can pay off big when you start on the right foot. And one tool that can help your teen get that jump is the Fidelity Youth™ Account—an account owned by teens 13 to 17 that’s designed to help them start their money journey. They can start investing by buying most U.S. stocks, exchange-traded funds (ETFs), and Fidelity mutual funds for as little as $1!⁴

Your teen will also get a free debit card with no subscription fees, no account fees³, no minimum balances, and no domestic ATM fees⁵. And they can use this free debit card for teens to manage their cash and spend it whenever they need.

A parent or guardian must have or open a brokerage account with Fidelity® to open a Fidelity Youth™ Account. For new Fidelity® customers, opening an account is easy, and there are no minimums and no account fees.

→ How to earn the Fidelity cash bonus

Open a Fidelity Youth™ Account for your teen, and Fidelity will drop $50 into their account. Get $100 for yourself when you open a new Fidelity account and fund with $50¹.

- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

Robinhood ($5-$200 worth of free stock)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotions: Free stock worth between $5 and $200

Robinhood is a pioneer of commission-free trading, jumping into the investing public’s consciousness in 2013 when they rolled out commission-free trading. They remain a standout option for cost-minded investors thanks to their continued $0 commissions on stocks, ETFs, and options, as well as for its fractional trading, which allows people to invest with as little as $1.

→ How to get your free stock with Robinhood

Robinhood offers anywhere between $5 and $200 in free stock, just for signing up and linking an account.

Once you’ve signed up with this link and are approved for a brokerage account, simply link your bank account or debit card, and Robinhood will give you between $5 and $200 that you can use to buy fractional stock, chosen from a list of “20 of America’s leading companies.”

(Note: You must wait three trading days to sell your gift stock. Once you’ve sold your stock, you can use the money to buy other stocks right away. But if you want to withdraw the funds for cash, you have to wait at least 30 days.)

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

2. Bank Account Bonuses

It’s also very common for banks to offer sign-up bonuses, typically on checking and savings accounts.

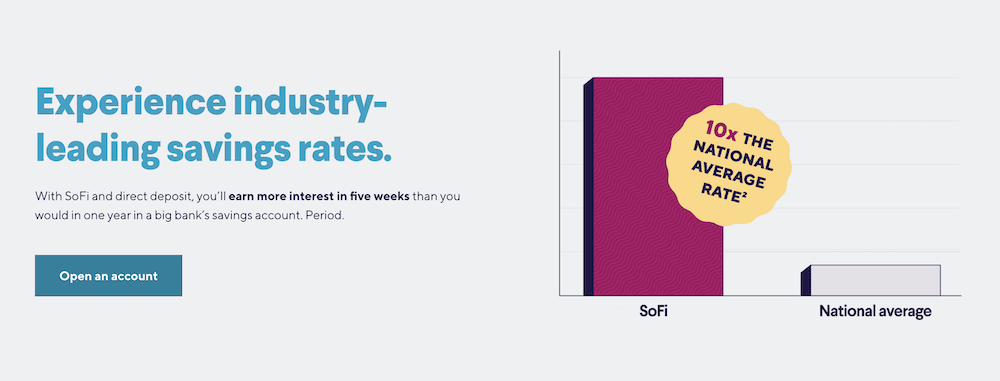

SoFi Checking and Savings Account (Up to $300 in free cash)

- Available: Sign up here

- Platforms: Web, mobile app (iOS, Android)

- Promotion: Earn $50 to $300 in free cash

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $50 to $300 upon sign-up.

Sofi Checking and Savings covers all of the basics: no monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition. Features include:

- Early paycheck reception when you sign up for direct deposit

- FDIC insurance of up to $2 million (vs. $250,000 for most accounts)

- Up to 15% cash back when you spend with local retailers

- No-fee overdraft coverage up to $50

- Round-ups on debit card purchases, which are deposited into your savings “Vault”

And right now, you can get a head start on your savings with qualifying direct deposits.

→ How to get your free money with SoFi

First, you’ll need to Sign up with SoFi. Then you’ll receive $50 in bonus cash if $1,000.00 to $4,999.99 is sent to your account within a 25-day period, starting from when you receive the first direct deposit. That number jumps to $300 when you receive $5,000 or more.

The higher cash bonus requires you to hit an admittedly high threshold, but the $50 is still a reasonable bonus for a much more manageable threshold.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.00% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Additional available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.0% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

3. Free Cryptocurrency

As I mentioned above, many online brokers frequently offer free stocks or cash as sign-up bonuses. However, on occasion, they also try to reel in customers by offering free cryptocurrency.

SoFi Invest ($10-$100 in free Bitcoin, $5-$1,000 in free stock)

- Available: Desktop sign-up | iOS sign-up | Android sign-up

- Platforms: Desktop, web, mobile (iOS, Android)

- Promotion: $10-$100 in free Bitcoin, $5-$1,000 in free stock

Invest as actively or as passively as you’d like with SoFi Invest.

The Active SoFi Invest Brokerage Account has no required minimum balance, charges no commissions on stock, ETF, and options trades, and its options trading is free of contract fees, too. SoFi also offers 24/7 trading of 30 cryptocurrencies, access to initial public offerings (IPOs), and fractional stock buying for as little as $5.

Want to put your portfolio on autopilot? SoFi’s robo-advisory services will create a portfolio for you free of charge (that can be designed to address one or several goals) and auto-rebalance it for you as necessary over time.

And one thing that sets SoFi apart is your ability to handle many financial tasks within the very same app. SoFi’s app allows you to tackle anything from banking and investing to student loans, insurance, and mortgages.

→ How to earn free Bitcoin with SoFi Invest

You can earn between $10 and $100 worth of Bitcoin when you sign up and make your first cryptocurrency trade. Here’s how:

- Open a new account with SoFi.

- Buy a minimum of $50 worth of any cryptocurrency within seven days.

The following trade sizes earn the corresponding Bitcoin bonuses:

- $50-$99.99 earns $10 worth of Bitcoin.

- $100-$499.99 earns $15 worth of Bitcoin.

- $500-$4,999.99 earns $50 worth of Bitcoin.

- $5,000 or more earns $100 worth of Bitcoin.

→ How to earn free stock with SoFi Invest

You can also earn between $5 and $1,000 worth of free stock from SoFi Invest. Here’s how:

- Open a new account with SoFi.

- Fund your account with at least $10 within 30 days of opening it.

Once you fund your account, you’ll receive $5, $10, $25, $100, or $1,000 worth of stock. (Prize level awarded at random—the greater the prize, the lower the odds.)

- SoFi Invest allows you to trade or invest in stocks, ETFs, and options with no commissions and no account minimums. You can also participate in some initial public offerings (IPOs).

- Invest for as little as $5 with fractional shares.

- Robo-advisory services, including goal planning and auto-rebalancing, available for annual 0.25% AUM fee.

- Subscribe to SoFi Plus to unlock more than $1,000 per year in extra value, including a 1% match on recurring investment deposits, preferred IPO access, higher cash-back rewards on certain SoFi credit cards, a six-month APY boost, and more.

- Special offer: Fund a new account with at least $50 within 30 days of opening an account, and get up to $1,000 in stock.*

- Good selection of available investments

- No options contract fees

- DIY and robo-investing options

- Fractional shares

- No mutual funds

- Limited trading tools

- No tax-loss harvesting

- No socially responsible robo-advisor functionality

4. Cash-Back Apps to Earn Money While Shopping

You’re going to shop anyway. You might as well get some of your money back. Cash-back apps are simple: Spend money, then get some of it back. The “free money” from cash-back apps is, of course, the cash-back rewards you earn, but some of them even offer immediate bonuses for signing up.

Capital One Shopping ($10-$50 bonus)

- Available: Sign up here

- Platforms: Web, mobile app (iOS, Android)

- Sign-up bonus: $10-$50

The Capital One Shopping app can help save you money while shopping online. There’s no need for you to search for deals and clip coupons. The app applies the best available deals at checkout, potentially giving you some jaw-dropping prices. Plus, the service offers rewards you can redeem for free gift cards.

The Capital One Shopping app always compares prices between Amazon and other retailers, helping you potentially pay a lower price. Users can also put items on a watchlist, and the app will notify them when the item goes on sale (or if the price otherwise drops).

The app is free, it works with more than 100,000 stores, and it doesn’t require you to be a Capital One credit card holder to use it.

While the app is convenient, some people may prefer to do their online shopping on a web browser. After downloading the app, you can add Capital One Shopping to Safari as a browser extension and get rewarded there too.

→ How to get your free money with Capital One Shopping

To get your free bonus with Capital One Shopping, you’ll need to download the app to your iPhone and sign up for an account. From there, you’ll be prompted with the option to earn $10 for signing up through the app to install the browser extension on Safari, $10 for installing the desktop app and up to $30 for inviting your friends.

- Capital One Shopping searches for discounts and promo codes while you shop, and it can automatically apply any deals it finds at jaw-dropping prices to your cart.

- Want an item but it's too expensive right now? If you're searching on Amazon, Capital One Shopping can identify whether that item is cheaper elsewhere. And if it's not, you can put the item on a watchlist; the app will alert you when there's a price drop.

- In addition to potentially earning savings, you may be able to accumulate shopping rewards that you can spend on e-gift cards.

- Works with more than 100,000 stores.

- Does not require you to be a Capital One cardholder to use.

- Minimum cash-out: $5.

- Age restrictions: Must be at least 18 years old to participate.

- Easily earn savings for shopping

- Offers e-gift card rewards

- Convenient Chrome extension

- Limited gift card selection

- Long time (up to 60 days) for rewards to appear

Upside (Earn cash back)

- Available: Sign up here

- Platforms: Mobile app (iOS, Android)

Upside lets users earn cash back on purchases with minimal extra effort.

Upside can provide cash back at grocery stores, restaurants, gas stations, and more, and it can work alongside other discounts, coupons, and loyalty programs. And there’s no limit to how much you can earn.

Here’s how it works: You claim an offer through the app, then pay as you normally would with a credit card or debit card. From there, you either “Check In” your purchase (or upload a photo of the receipt), and cash back will be deposited into your Upside account. Finally, you can cash out as you wish via e-gift card, PayPal cash, or bank transfer.

Upside currently doesn’t offer a bonus, but you can still easily make $10 simply by making the purchases you normally make.

- Upside lets users earn cash back on gas, restaurant, grocery, and other purchases with minimal extra effort.

- Check into the app to log your purchases, or upload a photo of your receipt, to earn cash-back rewards.

- Minimum cash-out: None, but must cash out at least $10 for gift cards or $15 for PayPal to avoid a $1 fee.

- Age restrictions: Must be at least 16 years old to participate. Teens age 16 and 17 must have parental consent.

- Easily earn cash back for everyday purchases

- Offers gift cards

- Offers cash back

- No minimum cash-out amount

- Some teens can participate (16+)

- Fees apply to small cash-out amounts

6. IRA Matches

You might be asking yourself, “Wait, what do you mean an IRA match?”

Individual retirement accounts (IRAs) are a type of retirement account that enjoys certain tax benefits. However, unlike with 401(k)s, which are run through employers and often offer a match, you directly open up an IRA through a broker. So whereas you might very well receive an employer match when you contribute to a 401(k), brokers, generous as they might be, don’t pony up money for your IRA.

Or at least, they didn’t … until recently.

Robinhood (1% or 3% IRA match)

- Available: Sign up here

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: 1% match on IRA contributions (3% match with Robinhood Gold)

Robinhood has evolved from a bare-bones app appealing to mostly beginner investors to a fuller-featured account suitable for a wider range of experience levels. For instance, Robinhood now offers individual retirement accounts (IRAs) and Roth IRAs via Robinhood Retirement.

And Robinhood is back to innovating by becoming the first IRA to offer a match on contributions.

→ How to get your free money in an IRA with Robinhood

If you open up an IRA with Robinhood Retirement, Robinhood will match 1% of any contributions, IRA transfers, or 401(k) rollovers into your account—and 3% if you pay for the Robinhood Gold service ($5 per month). The match, which typically hits your account almost immediately, applies to any contributions up to the IRS’s annual limits but does not count toward your contribution limit. So for instance, if you’re under age 30 in 2023, and contribute the maximum allowable $6,500 …

- If you have a Robinhood Retirement account, Robinhood would match 1%, giving you an additional $65 in IRA funds.

- If you have a Robinhood Retirement account and subscribe to Robinhood Gold, Robinhood would match 3%, giving you an additional $195 in IRA funds. (That’s $130 more than the normal account, more than paying for the $60 per year you’d spend on Robinhood Gold.)

(Friendly message from your WealthUp tax expert: The reason the IRA match doesn’t count toward your annual IRA contribution limit is because Robinhood treats it as interest income in your IRA.)

Robinhood’s IRA itself doesn’t offer as many investment options as other brokerages’ IRAs (for instance, you can’t get mutual funds through Robinhood), but if all you need is stocks and exchange-traded funds, it will get the job done. You can choose your IRA investments yourself, but Robinhood’s Portfolio Builder can also provide you with a custom recommended portfolio made up of five to eight ETFs.

Get your free IRA money by signing up for a Robinhood retirement account today.

- Robinhood is a pioneer in the investing app world, offering no-commission equity trades on stocks and ETFs, plus on options and cryptocurrency.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Extensive educational library

- Robo-advisory service (Robinhood Strategies)

- No mutual funds

- Match doesn't apply to Robinhood Strategies accounts

How to Get Paid $10 Instantly: FAQs

Can I make 10 dollars fast completing paid surveys?

Yes. Online surveys are an easy way to make extra money. The more paid surveys you are qualified to take, the more money you can earn. If you’re looking for two of the highest-paying survey sites, join Branded Surveys and Survey Junkie.

Branded Surveys rewards users with points when they complete surveys. The points convert to cash at a ratio of 100 points to $1. While some of Branded Surveys’ paid surveys only pay out 50 points, longer surveys can pay out several hundred points, and members who are part of the loyalty program can earn even more.

Most surveys pay between $1-$3. Branded Surveys offers payment through free PayPal money, direct deposit, gift cards, or nonprofit donations.

- Branded Surveys, which boasts more than 3 million users, pays you to take surveys to share your thoughts on future products and services.

- You earn points for completing each survey and can redeem them toward cash (paid via direct deposit or PayPal), gift cards at more than 100 merchants including Amazon and Apple, or even donations to your favorite charity.

- Earn anywhere from 50¢ to $5 per completed survey (longer ones tend to pay more).

- Minimum cash-out: $5 (500 points).

- Age restrictions: Must be at least 16 years old to participate normally. Those under 16 must have parental consent and use their parent's account.

- Special offer: Get 100 free points (worth $1) for signing up.

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Teens can participate (younger teens need parental consent)

- Not a lucrative side hustle

According to Survey Junkie, if you complete three online surveys daily, you can earn as much as $40 per month. You’re not going to become rich just from taking surveys, but if you qualify for longer surveys with either company, you definitely have the potential to make 10 dollars fast. Users can get paid with PayPal cash, bank transfers, or free gift cards.

- Survey Junkie lets you get paid for taking surveys and sharing your online browsing history.

- On average, members who take 3 surveys daily and opt-in to share their browsing info earn as much as $40 per month.

- Survey Junkie points can be redeemed for rewards including cash through PayPal or bank transfer and gift cards for Amazon, Target, Walmart, Sephora, Starbucks, Visa, iTunes, and more.

- Minimum cash-out: $5 (500 points).

- Age restrictions: Must be at least 18 years old to participate.

- Pays you for easy tasks

- Offers gift cards from numerous merchants

- Offers cash back

- Some teens can participate (ages 16+)

- Not a lucrative side hustle

How else can I make money online?

You can also earn extra cash if you watch videos, play games, and shop online through specific apps and browsers. These tasks can be done whenever you have a little free time, such as waiting for food in a restaurant or during a commute. If you’re watching videos or playing games every chance you get, you can make $10 fast.

How are you paid when you earn money online?

When you make a little extra money online, you’ll earn either cash prizes or equivalent rewards. Those prizes can come in many forms. Depending on the app, you’ll be paid through one, some, or all of the following methods:

- Direct deposit

- Free PayPal money

- Gift cards

- Stock

- Cryptocurrency

Before you sign up with a site that awards points you then trade in for extra crash, get to know their point conversion systems. Some systems are overly complicated, obscuring how much you’re actually earning.

Plynk Disclosures

Google Play Store and Apple Store Ratings are as of the date referenced (06/22/2023) and provide an average rating of users and do not reflect the experience of an individual customer.

Terms and Conditions for Fidelity Youth™ Account

The Fidelity Youth™ Account can only be opened by a parent/guardian. Account eligibility limited to teens aged 13-17.

* $0.00 commission applies to online U.S. equity trades and exchange-traded funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

¹ Limited Time Offer. Terms Apply. Before opening a Fidelity Youth™ Account, you should carefully read the account agreement and ensure that you fully understand your responsibilities to monitor and supervise your teen’s activity in the account.

² The Fidelity Youth™ app is free to download. Fees associated with your account positions or transacting in your account apply.

³ Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

⁴ Fractional share quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $0.01. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00).

⁵ Your Youth Account will automatically be reimbursed for all ATM fees charged by other institutions while using the Fidelity® Debit Card at any ATM displaying the Visa®, Plus®, or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited. Please note, for foreign transactions, there may be a 1% fee included in the amount charged to your account. The Fidelity® Debit Card is issued by PNC Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other, and Fidelity is not affiliated with PNC Bank or BNY Mellon. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

⁶ Venmo is a service of PayPal, Inc. Fidelity Investments and PayPal are independent entities and are not legally affiliated. Use a Venmo or PayPal account may be subject to their terms and conditions, including age requirements.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917