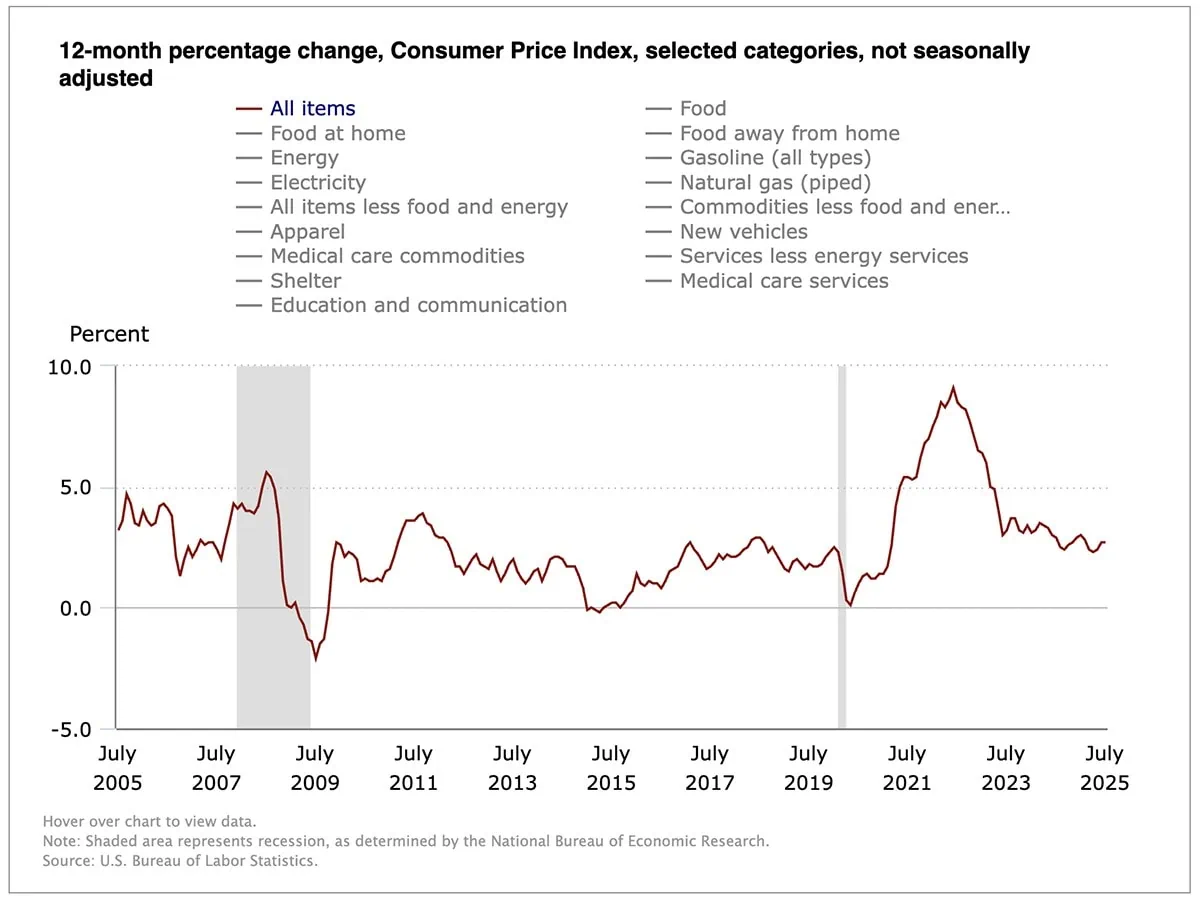

Inflation data for July provided a mixed picture of consumer prices and uncertainty about how much tariffs had actually entered the picture, as last month’s headline consumer price index (CPI) number came in shy of estimates, but the “core” number backing out more volatile items was higher than expected.

The U.S. Bureau of Labor Statistics said Tuesday that July’s CPI, which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.2% month-over-month—in line with consensus expectations and a touch slower than June, which saw consumer prices increase by 0.3%.

On a year-over-year basis, consumer prices were up 2.7%, matching June’s 12-month rate and well below economists’ expectations of a 3.0% 12-month increase to the CPI.

“Core” CPI, which excludes food and energy costs (which are more volatile than the other costs tracked by the Labor Department) came in 0.3% higher, above June’s 0.2% core growth but in line with predictions. However, the 12-month reading of 3.1% was hotter than both last month’s YoY reading of 2.9%, and faster than the 3.0% that economists had been calling for.

3 Dandy Dividend-Growth ETFs to Buy

“Today’s number wasn’t great, but it could have been worse,” says David Russell, Global Head of Market Strategy at TradeStation. “Lower energy prices kept a lid on the worst of the price increases, but we still saw core CPI return above 3%. Wall Street is breathing a sigh of relief, with September in play for a Fed rate cut … but anxiety will likely continue as tariffs work their way through supply chains.”

Here’s a quick look at July’s key CPI figures:

- MoM CPI: +0.2% (estimate: +0.2%)

- YoY CPI: +2.7% (estimate: +2.8%)

- MoM Core CPI: +3.1% (estimate: +3.0%)

- YoY Core CPI: +0.3% (estimate: +0.3%)

Among the most noteworthy cost increases in July were fuel oil (+1.8% month-over-month); transportation services and medical care services, each of which rose by 0.8% MoM, and used cars and trucks, up 0.5% and 4.8% over the trailing 12 months. Meanwhile, energy prices overall declined by 1.1% MoM, while energy services such as electricity and utility gas service were down 0.3%.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

“Today’s release showed less of a pickup in goods prices than some were expecting as the tariff pass-through is present but to a lesser degree than was seen in June,” says Josh Jamner, Senior Investment Strategy Analyst at ClearBridge Investments. “Given the uncertain and shifting tariff landscape that existed through the month of July and into August, we would be hesitant to read too closely into today’s release.”

“Further complicating the narrative is the reality that tariff uncertainty—and the effects it can have on hiring—is still here,” adds Seth B. Carpenter, Chief Global Economist, Morgan Stanley. “Many ‘trade deals’ have not been fully detailed, and indeed for China, Mexico, and Canada—America’s largest trading partners—outcomes have yet to be negotiated. … Once we reach September, we will get one more jobs print and another CPI print. Again, tariffs could drive both.”

3 Best Utility ETFs You Can Buy

The report helped to solidify Wall Street’s expectations that the Federal Reserve will cut the target range for its benchmark interest rate at the central bank’s rate-setting meeting in September.

Specifically, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, now shows a 92% chance that the target range for the federal funds rate will be cut to between 4.00% to 4.25%, down from the current 4.25% to 4.50% at the next Federal Open Market Committee (FOMC) meeting, scheduled for Sept. 16-17. That figure is up from 86% yesterday.

“The Fed’s policy stance is highly data-dependent, and with inflation contained and labor market softness increasingly evident in revised payroll data, the emphasis will now be skewed toward employment,” says Alexandra Wilson-Elizondo, Global Co-CIO of Multi-Asset Solutions at Goldman Sachs Asset Management. “In essence, this inflation print supports the narrative of an insurance rate cut in September, which will be a key driving force for the markets.”

Complicating the release was the firing of the BLS head following July’s weak jobs report, which also included downward revisions to previously cheerier June and May data.

3 Best Consumer Staples ETFs You Can Buy

“The surprise firing of Erika McEntarfer, Commissioner at the Bureau of Labor Statistics, following the release of the July employment report has raised questions about whether and by how much the quality of official data produced by official U.S. government agencies could be compromised,” says Michael Gapen, Morgan Stanley Chief U.S. Economist, who adds that “there is also clear evidence that the federal hiring freeze and spending cuts have undermined the ability of the Bureau of Labor Statistics (BLS) to collect and estimate CPI inflation.”

Current Acting Commissioner William Watrowski has worked at the agency for decades. However, on Monday, President Donald Trump nominated E.J. Antoni, an economist at the partisan Heritage Foundation who has previously referred to the BLS’s statistics as “phoney baloney.” Antoni will need to receive Senate confirmation to ascend to the role.

What the Experts Think About July’s CPI Report

Here, we outline more thoughts from the experts on what last month’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Scott Helfstein, Head of Investment Strategy, Global X

“Headline CPI actually came in better than expected, but that was partially driven by continued deflationary pressure in energy. Excluding food and energy, consumer inflation came a little higher than expected. Higher core inflation validates the Fed decision to hold rates steady in July, at least until the next jobs report. That said, the news on labor market revisions complicates the picture. The risk to the dual mandate of price stability and full employment is likely rising.”

10 Common Social Security Mistakes You Should Know

Daniel Siluk, Head of Global Short Duration & Liquidity, Janus Henderson Investors

“Core CPI rose 0.3% MoM and 3.1% Yoy, returning to its highest level since February. However, the composition of the print is what matters most for policy. Core goods inflation was softer than expected, and there’s still no clear evidence of tariff passthrough picking up steam. Meanwhile, core services inflation was driven by volatile components like airfares and medical care, categories that have a lower weight in the Fed’s preferred PCE measure.

“Shelter inflation ticked up slightly, but rents continue to run at levels consistent with 2% inflation, suggesting disinflation in housing remains intact.”

Steve Wyett, Chief Investment Strategist, BOK Financial

“From the Fed’s perspective, the numbers show tariffs are having an impact, but the impacts continue to be at more muted levels than which they are worried. The reality is their overnight rate of 4.25%-4.5% is above the current rate of inflation, and while progress to the 2% level has slowed, recent data on the job market would seem to weigh in favor of a downward adjustment to policy. At 4%-4.25% for a fed funds target they would still be restrictive but could provide a bit of a cushion against further deterioration in the all-important job market.”

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“The July CPI report was mostly driven by portions of the consumption basket not directly impacted by tariffs, including services and used vehicles. However, because tariffs have been staged in over time rather than all at once, the window of observation for their effects on prices is relatively wide. For example, many new tariffs were implemented this month, but it may take several months for them to filter through to consumer prices, given the typical lag from import to final sale.”

Jerry Tempelman, VP of Fixed Income Research, Mutual of America Capital Management

“With core inflation now at 3.1%, that 3% level may be a psychological barrier to the Federal Reserve lowering short-term interest rates at its next meeting in September, notwithstanding the soft job growth numbers in recent month. September’s monetary policy decision will depend on the inflation and employment data between now and then.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)