America’s employment situation took a turn for the worse in July, prompting Wall Street experts to urge caution as U.S. job creation fell well short of estimates for the month, and robust figures for the prior two months were severely pared back.

The Labor Department reported Friday that nonfarm payrolls grew by just 73,000 in July—sharply below economists’ expectations for 105,000 jobs created. That came in ahead of both June and May, but only because both months’ totals were significantly reduced, to a respective 14,000 (down 133,000 jobs from the prior reading) and 19,000 (down 125,000 jobs from the prior reading). In fact, June’s revised number represented the lowest jobs-growth figure since December 2020, during President Donald Trump’s first term.

July’s number was enough to qualify as America’s 55th consecutive month of payroll gains, but represents a drastic slowdown in job growth from earlier in the year.

“Today’s print drops us below the critical 80K-100K replacement level, flashing warning signs as the labor market cools—the U.S. slowdown is starting to take shape,” says Alexandra Wilson-Elizondo, Global Co-CIO of Multi-Asset Solutions at Goldman Sachs Asset Management.

3 Dandy Dividend-Growth ETFs to Buy

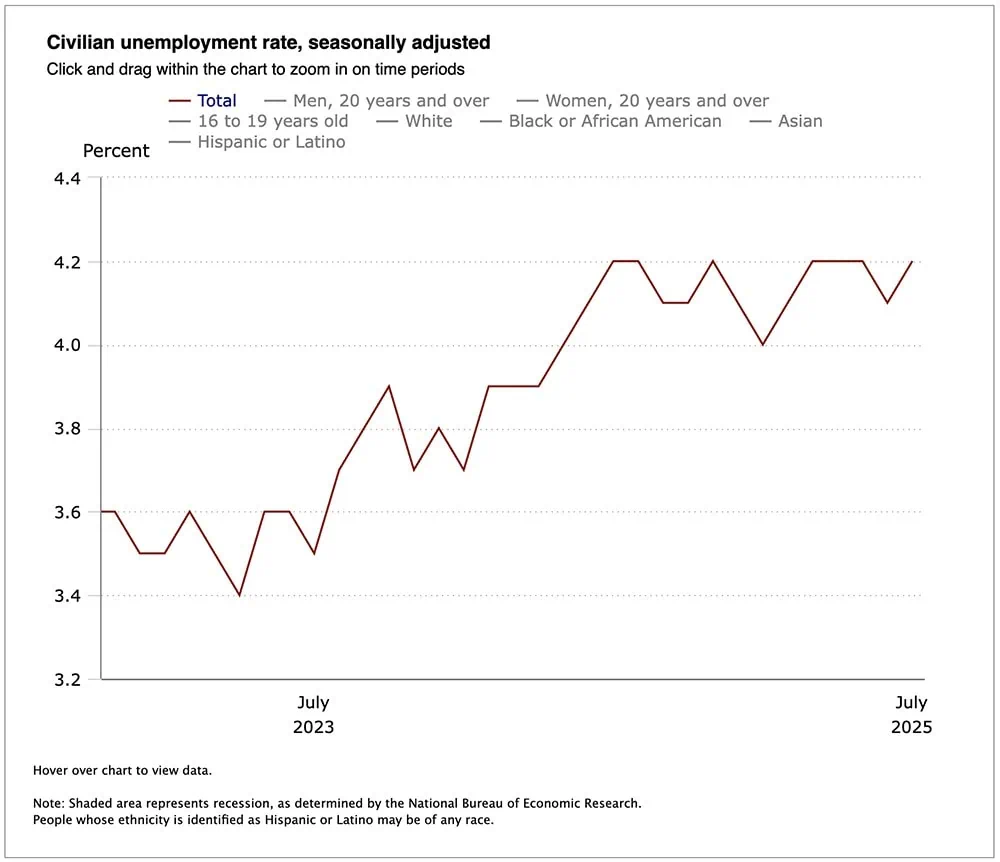

Unemployment continued to remain static, coming in at 4.2%. That’s higher than June’s figure but in line with economists’ expectations, and falls within the 4.0%-4.2% range that has held over the past year-plus.

Also coming in right at forecasts was the July hourly earnings figure, which grew by 0.3% month-over-month, to $36.44. Over the past year, average hourly earnings have grown by 3.9%.

Here’s a brief look at the July jobs report’s most pertinent details:

- July payrolls: +73,000 MoM (estimate: +105,000)

- July unemployment: 4.2% (estimate: 4.2%)

- July hourly earnings: +0.3% MoM (estimate: +0.3%)

- June payrolls (revised): +14,000 (+147,000 previously)

- May payrolls (revised): +19,000 (+144,000 previously)

“Importantly, the underlying deterioration is grabbing our attention,” Wilson-Elizondo says. “Cyclical employment has flatlined while falling participation rates are somewhat masking unemployment weakness. While overall levels are not flashing red, the trend is cause for concern.”

Health care continued to be a source of strength, coming in at 55,000 new jobs created—far better than its 12-month average of 42,000. Social assistance employment was better too, by 18,000.

10 Common Social Security Mistakes You Should Know

However, federal employment continued to wither, losing 12,000 jobs in July to mark an 84,000-job decline since peaking in January. Meanwhile, professional and business services industries lost 14,000, while manufacturing lost 11,000 jobs, entirely within the nondurable goods segment.

Expectations for a Fed Rate Cut Spike

Wall Street immediately became more convinced that the Federal Reserve will cut its benchmark interest rate next month.

“This is the first jobs number to miss estimates in months and finally provides air cover for the Fed to possibly move in September,” says Scott Helfstein, Global X’s Head of Investment Strategy. “That might actually trigger a small contrarian market rally as expectations around rates shift.”

The CME FedWatch Tool, which uses Fed funds futures prices to track the probability of a change to the federal funds rate, now shows a 67% chance that the central bank will reduce its benchmark rate by a quarter-point, to a range of 4.0%-4.25%, during the next Federal Open Market Committee (FOMC) meeting, set for Sept. 16-17. That’s a jump from the 38% probability projected by Fed funds futures a day ago.

“No employment report is ‘clean’ these days, so the revisions to payroll growth are even more important in analyzing the current U.S. employment situation. Given that, the July report was weak,” says Jack McIntyre, Portfolio Manager at Brandywine Global. “It supports Fed Governors Waller and Bowman being more right than Powell in calling for immediate rate cuts.

“The internal battle at the Fed will be must-watch TV over the next six weeks as those fixated with the unemployment report will want to hold rates steady while those focused on payroll growth will clamor for rate cuts.”

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

More Expert Reactions to July’s Jobs Report

Here’s what other strategists, financial managers, and experts had to say about last month’s employment situation:

Jeff Schulze, Head of Economic and Market Strategy at Clearbridge Investments

“This payroll report kicks the door wide open for a September rate cut. Although the effects of tariff pass-through still lie ahead, the Fed will not want to wait too long to begin its cutting cycle with the nonfarm payrolls flatlining at 35,000 on average over the past three months and the unemployment rate ticking higher.

“While investors have been viewing the commencement of the Fed cutting cycle as a positive catalyst for risk assets, today’s release is best characterized as ‘bad news is bad news’ in our view. With job creation at stall speed levels and the tariff headwind lying ahead, there’s a strong possibility of a negative payroll print in the coming months which may conjure up fears of a recession. This print should pressure risk assets and cause safe haven buying in U.S. Treasuries.”

Steve Rick, Chief Economist, TruStage

“Despite positive news on the economic front with signs of inflation easing, this morning’s July jobs report fell short of expectations. The latest data suggests employers are beginning to show signs of hesitation, likely as a result of sustained uncertainty around tariffs and global demand.

How to Plan for Health Care Expenses in Retirement

“That said, economic growth is expected to slow substantially through the end of 2025, according to The Conference Board. A weaker outlook may weigh on hiring decisions as companies shift into risk-management mode. While jobless claims have ticked down in recent weeks, long-term unemployment is quietly rising. Some laid-off workers are facing extended periods without re-employment, signaling that while layoffs remain modest, re-hiring is slower than in prior months.”

Adam Hetts, Global Head of Multi-Asset and Portfolio Manager, Janus Henderson Investors

“Headline [nonfarm payrolls] at 73,000 is a miss, but perhaps more concerning is -258,000 net revisions to the prior two months. These revisions put May’s headline NFP at 19,000 and June’s at 14,000. Had those figures been the initial prints a month or two ago it would have significantly changed the labor market narrative over the entire summer. Indeed, odds of a September rate cut are increasing significantly on the back of this data release.”

10 Retirement Questions: Are You Ready to Leave the Workforce?

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“The slowdown in the labor market without an outright decline is setting the Federal Reserve up for an ongoing robust debate. FOMC participants could both legitimately argue that the labor market is fine and needs no intervention or that the economy and labor market are operating at below-normal levels due to restrictive monetary policy. Each soft labor market report strengthens this latter argument, supporting the case for the 1-2 rate cuts priced into markets this year.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)