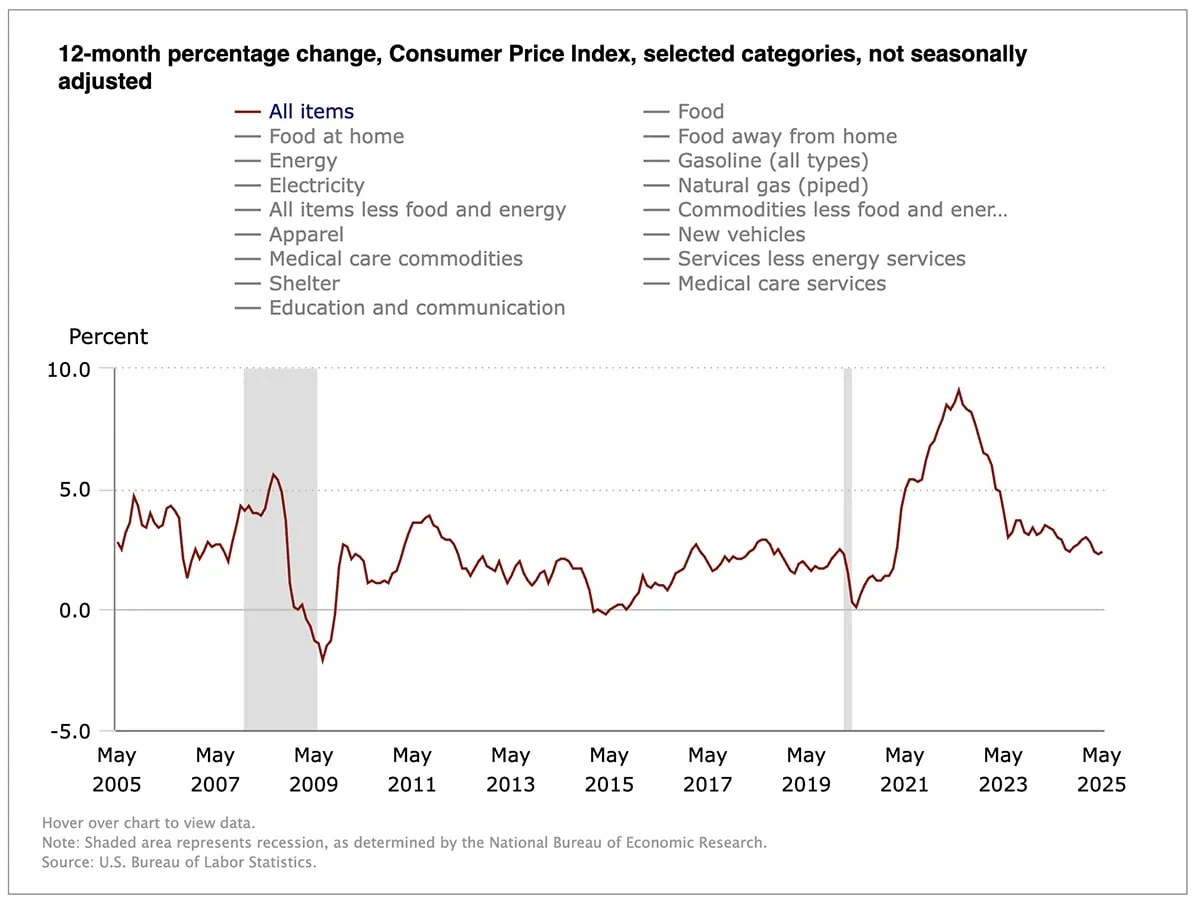

Consumer prices rose below estimates for the fourth consecutive month as President Donald Trump’s tariffs yet again showed little impact on the consumer price index (CPI) report.

The U.S. Bureau of Labor Statistics said Wednesday that May’s CPI, which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.1% month-over-month—below consensus expectations for a 0.2% rise and down from April’s 0.2% increase in consumer prices. On a year-over-year basis, prices rose by 2.4%, which also was less than economists anticipated (2.5%).

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—also grew by just 0.1% on a month-over-month basis, falling below estimates for a 0.3% expansion. Year-over-year, core CPI growth of 2.8% was also shy of expectations for a 2.9% increase.

Much like after April’s CPI report, economists and analysts continued to believe that import taxes would eventually begin to bleed through into future CPI reports. That said, thoughts on the severity of the tariff impact varied from expert to the next.

“Inflation in May was lower than anticipated, suggesting the tariffs aren’t having a large immediate impact because companies have been using existing inventories or slowly adjusting prices due to uncertain demand,” says Alexandra Wilson-Elizondo, Global Co-CIO of Multi-Asset Solutions in Goldman Sachs Asset Management. “While we might see some price increases on goods later, service prices are expected to remain stable, suggesting any rise in inflation is likely to be temporary.”

A quick look at May’s key CPI figures:

- MoM CPI: +0.1% (estimate: +0.2%)

- YoY CPI: +2.4% (estimate: +2.5%)

- MoM Core CPI: +0.1% (estimate: +0.3%)

- YoY Core CPI: +2.8% (estimate: +2.9%)

Few items showed significant price growth in May. Electricity and fuel oil prices were each up 0.9% month-over-month, and medical care commodity costs were up 0.6%. Shelter and food costs were each up 0.3%.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Meanwhile, consumers felt significant relief at the pump, with gasoline prices dipping 2.6%. Utility gas service declined by 1%, prices on used cars and trucks were 0.5% lower, apparel prices were down 0.4%, and new-vehicle prices shrank by 0.3%.

“There wasn’t strong evidence of broad price increases from tariffs. This could change in the coming months,” says Kristy Akullian, Head of iShares Investment Strategy, Americas. “Normally, retailers hold about one to two months’ worth of inventory on items, which kept companies from increasing prices in March and April. In May, companies that sold through their pre-tariff inventories might feel some pressure to increase prices as they import tariffed goods. Notably, Walmart, Lululemon, and Target announced they would increase some prices. Costco already put some price increases through.

“In last week’s ISM services report, prices paid by businesses increased the most since November 2022 and business inventories fell to contractionary territory. Low inventories make it harder for companies to keep prices steady, so going forward, we expect the inflation impacts from tariffs to become more apparent.”

5 Best AI ETFs for the Artificial Intelligence Era

Andrew Hollenhorst, Chief U.S. Economist at Citi, also sees tariff impacts eventually filtering through.

“It’s likely too early to see tariffs pushing goods prices higher,” he says. “Sensitive categories like autos and apparel may rise in coming months, and we would expect to see peak inflationary pressure on goods prices over the summer months.” May’s CPI report also prompted Citi to slightly lower their estimates for May’s core personal consumption expenditures (PCE) inflation, to be released June 27. Economist Veronica Clark says Citi now expects a 0.18% month-over-month increase, down from 0.21% prior to the CPI report.

Wall Street and analysts alike are all but certain that the Federal Reserve has seen everything it needs to see to keep its benchmark interest rate steady later this month.

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, shows a 99% chance that the Fed funds rate will remain between 4.25% and 4.50% at next week’s Federal Open Market Committee (FOMC) meeting, scheduled for June 17-18.

However, chances for a 25-basis-point cut, to a range of 4.00% and 4.25%, inched higher to 16.5% from 14.4% yesterday.

“As we wait for the 90-day tariff pause to pass, the market will be caught between inflation and job prints. If inflation stays under control or the job market weakens, the Federal Reserve will likely consider cutting interest rates down the road,” Wilson-Elizondo says. “We expect the Fed to remain on hold at next week’s meeting, but we see a path to a rate cut later in the year.”

Retirement Buckets: A Simple Strategy for Your Retirement Savings

What the Experts Think About May’s CPI Report

Here, we outline more thoughts from the experts on what last month’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“Although tariffs have yet to make a meaningful impact on headline inflation figures, there are signs beneath the surface that they are starting to flow through. The toys category is particularly important to watch, as it’s a category of goods that has a high import share and high inventory turnover, making it an ideal candidate for judging early signs of tariff impacts. Prices on toys jumped 1.3% in May, which is perhaps a small sign of larger things to come as tariff impacts permeate throughout broader categories of goods.”

Jeff Schulze, Head of Economic and Market Strategy, ClearBridge Investments

“The impact from tariffs did not officially arrive as expected in the May CPI release, with core goods seeing no price increases last month. A look beneath the surface reveals that some categories most exposed to Chinese supply chains such as toys and sporting goods saw a material boost, while others such as apparel and furniture saw prices decline.

“This mixed backdrop is a bit surprising following recent comments from big box retailers around price increases, although companies could be waiting to see how the tariff landscape evolves given elevated uncertainty. The softer print also suggests that companies could face margin pressure in [the second quarter] as they absorb the cost of tariffs, although earnings expectations and the lessons from the previous trade war suggest that companies will eventually pass these costs along, which could lead to firmer core goods prices in the coming months.”

8 Best-in-Class Bond Funds to Buy

David Russell, Global Head of Market Strategy, TradeStation

“The tariffs aren’t filtering through to Main Street as feared and the longer-term moderation in shelter costs continues. The Fed’s tone could soften next week because we’ve probably seen peak hawkishness, especially with other central banks cutting. The door to a July rate cut is inching open again.”

Scott Helfstein, Head of Investment Strategy, Global X

“The Fed should feel comfortable with these numbers. A June cut seems unlikely. Maybe the Fed delivers two cuts to close the year. Based on the dual mandate of employment and price stability, the Fed should be patient.

“Housing continues to be a source of inflation and should be a concern for the Fed. The central bank is leaning towards easier policy, but uncertainty around tariffs and taxes may weigh on markets.”

Steve Wyett, Chief Investment Strategist, BOK Financial

“We are still waiting. At least to this point the upward price pressures on inflation from tariffs are yet to show up. We had some expectation that CPI data in May would reflect the impact of tariffs, yet both headline and core came in at 0.1%, less than expected and keeping year-over-year numbers restrained.

“The Fed’s concerns that tariff related price increases might spread to other areas of the economy are not evident in this release. Instead, this report might shift the focus to a slowing consumer which is reflected in data on car prices and air fares. In any event, fears of significantly higher inflation readings appear unfounded at present.”

John Lloyd, Lead of Multi-Sector Credit Strategies and Portfolio Manager, Janus Henderson Investors

“This release likely won’t change the Fed’s current interest rate policy stance in the near term. We still believe the Fed will need to see the full inflation impacts of trade policy and that market inflation expectations remain well-grounded before they react especially since the economic hard data, including the employment data, remains strong.

“However, this report will provide the Fed with comfort that we are on the correct pathway with regards to underlying inflation. Especially notable from the release was the low goods inflation at 0.0% MoM given the changes in trade policy implemented in April, which should be encouraging for the market. The path for policy rates over the next year is certainly more difficult to forecast as the economy and markets will be impacted by governmental policy decisions in the U.S. and around the world.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)