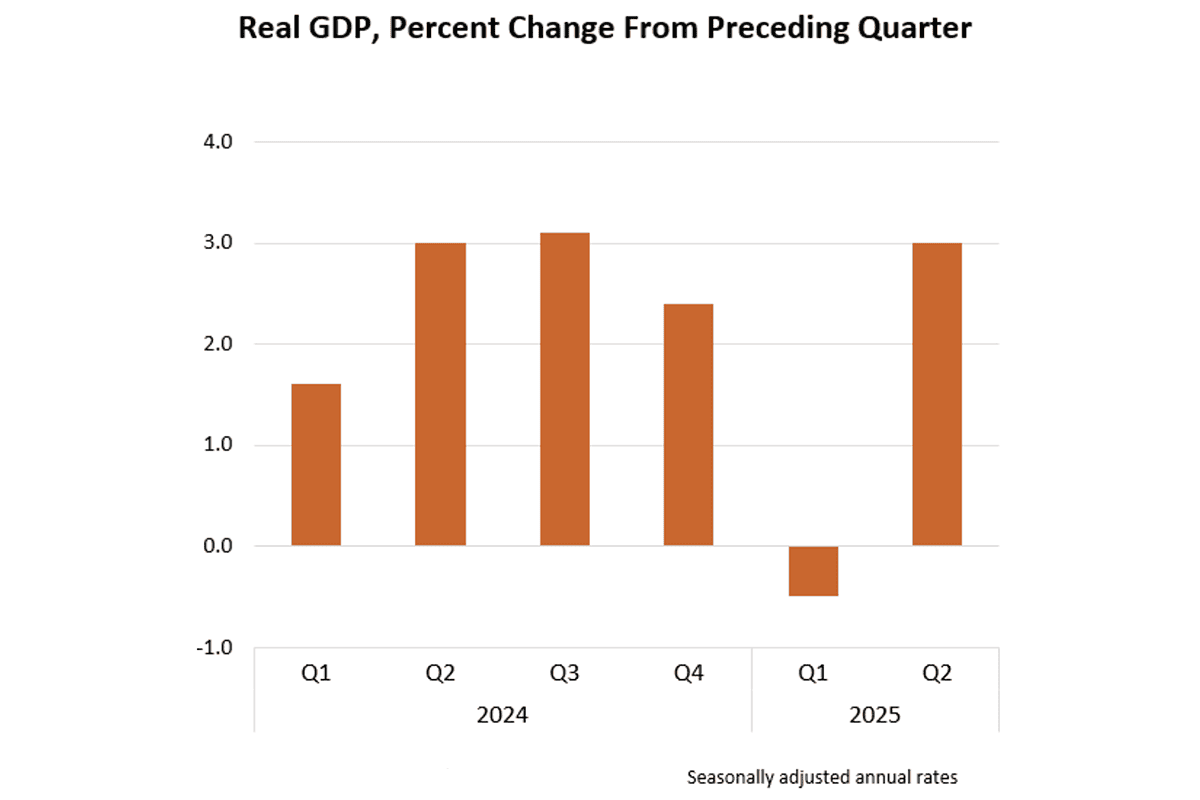

A Wednesday report from the Commerce Department showed that U.S. gross domestic product rebounded sharply a quarter after its first decline in three years. However, economists and strategists had mixed reactions to the underlying data, noting that the reversal could largely be chalked up to a massive swing in the U.S. trade deficit.

The Commerce Department’s Bureau of Economic Analysis (BEA) said that in its advance estimate for the second quarter, GDP across the first three months of 2025 expanded at a seasonally adjusted 3.0% pace. That was well ahead of estimates for GDP growth of 2.4%, and a turnaround from Q1 2025’s final estimate of a 0.5% contraction.

“A messy Q2 GDP report came in ahead of expectations but showed a slower underlying trend of economic momentum once trade-related distortions are accounted for,” says Josh Jamner, Senior Investment Strategy Analyst at ClearBridge Investments. “The 3% GDP print was boosted by a sharp reduction in imports that lifted the headline figure, a reversal of the drag in Q1 as importers rushed to bring goods into the U.S. ahead of Liberation Day tariffs.”

3 Dandy Dividend-Growth ETFs to Buy

Indeed, the increase in the second quarter’s real GDP predominantly reflected a stark 30% decline in imports (imports subtract from GDP), following a 37.9% jump during Q1. That contributed 5.2 points toward the final GDP number.

Consumer spending also picked up a little during Q2, led by health care, food services and accommodations, and financial services and insurance.

“Personal consumption, the primary contributor to GDP, came in at 1.4%, a sign the consumer is still strong on the surface,” says Lara Castleton, U.S. Head of Portfolio Construction and Strategy (PCS) at Janus Henderson Investors. “Where caution is warranted is with business and residential fixed investment, which were weaker and a potential sign domestic demand is slowing.”

“With that activity having played out, consumers and businesses are retrenching and final sales to private domestic purchasers—a ‘core’ GDP concept that excludes trade, inventories, and government spending—rose just 1.2%, the weakest reading since late 2022,” Jamner adds.

The GDP number would’ve been larger if not for a sharp drop in gross private domestic investment, which fell by nearly 16% after jumping 24% in Q1, as well as a thin decrease in exports, largely in goods such as automotive vehicles, engines, and parts.

While Wall Street was largely expecting a strong Q2, experts don’t necessarily think the economy is out of the woods yet.

“With the ensuing relents on trade policy, the consensus for Q2 GDP has not only recouped the decline but is now at the highest it’s been this year,” a team of Deutsche Bank Research strategists wrote prior to the report. But they added that the consensus for Q3 and Q4 have not rebounded given continued worries about the full effects of tariffs on inflation and growth.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

“All-in, this release shows that recession calls are misplaced, the economy is stronger than many would have expected, but sorting through the data will be important to fund sustainable growth for the remainder of the year,” Castleton says. “Positive contributors should be AI infrastructure investment and fiscal spend from the OBBA but all eyes will be on the consumer and labor market, which are resilient but showing cracks beneath the surface.”

Following Wednesday’s GDP report, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, showed little change from the day prior. Futures still indicate a 98% chance the Fed will keep the range on its benchmark interest rate set at 4.25% to 4.50% later today during its Federal Open Market Committee (FOMC) meeting.

“The GDP release implies a stronger core PCE reading tomorrow as well as upward revisions to prior months,” Jamner says, “which chips away at the case for Fed rate cuts in the near term, pushing Treasury yields higher across the curve this morning.”

Additional Insights on Q2 GDP

A look at what other economists and market strategists have to say about America’s second-quarter GDP reading:

Michael Reynolds, Vice President of Investment Strategy, Glenmede

“A significant inventory drawdown seems to suggest that companies have been working off of existing stockpiles that may have been accumulated before recent tariff increases. This is consistent with recent CPI reports that have showed little impact from tariffs so far, as existing pre-tariff inventories continue to be worked through.

“Real GDP growth in the neighborhood of 3% is likely a function of an unusually noisy macroeconomic backdrop and is unlikely to be sustained through the second half of the year. However, the resilience of consumer spending beneath this noise is a welcome sign that changes to trade policy do not appear to only have had modest effects on the core economic growth run rate so far.”

3 Best Utility ETFs You Can Buy

Peter Graf, Chief Investment Officer, Nikko Asset Management Americas

“The reversal of last quarter’s pre-tariff import binge makes for a punchy advance GDP headline, but the report’s details reinforce concerns about underlying weakness in the U.S. economy. The drag from real estate investment and non-defense Federal spending has accelerated. Consumer spending improved from Q1 but remains tepid compared to last year.

“On a positive note, price increases were well contained, but this also means a slowing nominal growth that will do little to improve the US fiscal picture. With further consumption impact from tariffs likely still in the pipeline, investors need to ask themselves whether an economy can live on corporate capex alone.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)