Today, I’m going to introduce you to several money-saving apps and accounts. These products all boast automated savings features that allow you to save without thinking about it. And in many cases, they also have features that can actually accelerate your saving.

Automatic Savings Tools—Our Top Picks

|

4.6

|

3.6

|

4.1

|

|

No monthly fees.

|

Personal: $3/mo. Personal Plus: $6/mo. Premium: $12/mo.

|

No monthly fees.

|

The Best Automatic Savings Apps + Savings Accounts

1. Current Bank (High-Powered Banking App)

- Available: Sign up here

- Price: Free (no monthly fees)

- Platforms: Mobile app (Apple iOS, Android)

Current provides a wide range of banking services, as well as financial tools and other perks that set it apart from traditional accounts.

Among Current’s most popular features are Savings Pods. Each Current account comes with three Savings Pods, which are like digital envelope savings plans, or like having multiple savings accounts. Most people have more than one savings goal—and Savings Pods allow you to choose how much you want to allocate toward each goal.

Current’s Round-Ups feature allows you to automatically send digital “change” into the Savings Pod of your choice. But note that you can’t use Round-Ups for multiple Savings Pods—the feature can only be enabled for one Pod at a time.

Current offers a high APY on the first $2,000 in each of your three Savings Pods, though the APY on additional balances is close to the national average for all (not just high-yield) savings accounts. Other features include no fees for overdrafts under $200, faster paydays with direct deposit, and points that you can redeem for cash back in your account.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

2. Acorns (Best for Using Round-Ups to Invest)

- Available: Sign up here

- Price: Acorns Personal: $3/mo. Acorns Personal Plus: $6/mo. Acorns Premium: $12/mo.

- Platforms: Web, mobile app (Apple iOS, Android)

Acorns is a micro-investing app geared toward minors, young adults and millennials by offering Round-Ups: The app rounds up purchases made on linked debit and credit cards to the nearest dollar, investing the difference on your behalf.

For example, if you purchase a coffee for $2.60 on a linked credit card, Acorns automatically rounds this charge up to $3.00 and puts the 40-cent difference aside. Once those Round-Ups reach at least $5, they can be transferred to your Acorns account to be invested. You can also invest your Round-Ups more quickly with the Acorns Visa debit card—any time you swipe, your spare change is immediately invested, rather than waiting for your Round-Ups to reach the $5 threshold.

You can also choose to amplify your Round-Ups with the Multiplier feature, which allows you to multiply your Round-Ups investments by 2x, 3x, or 10x. And not sure what to do if the transaction is an even dollar amount? (Say, $1.00 or $2.00.) Whole-Dollar Round-Ups let you select how much to round up whenever this happens.

The Acorns investment offering itself is a simple, automated platform that uses pre-built portfolios of ETFs to keep investors exposed to stocks and bonds. While it doesn’t have much to offer intermediate investors who want variety in their portfolios, Acorns’ basic approach makes it one of the best investment apps for beginners.

Learn more in our Acorns review or sign up today.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

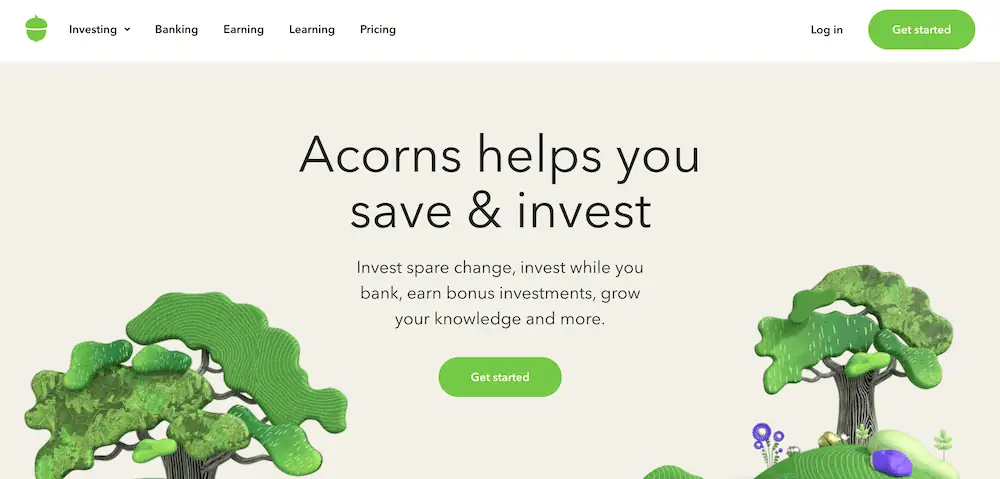

3. SoFi Checking and Savings Account (Up to $300 in Free Cash)

- Function(s): Saving, spending

- Available: Sign up here

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $50 to $300 upon sign-up.

Sofi Checking and Savings covers all of the basics: No monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition. Features include:

- Early paycheck reception when you sign up for direct deposit

- FDIC insurance of up to $2 million (vs. $250,000 for most bank accounts)

- Up to 15% cash back when you spend with local retailers

- No-fee overdraft coverage up to $50

- Round-ups on debit card purchases, which are deposited into your savings “Vault”

And right now, you can get a head-start on your savings with qualifying direct deposits. You’ll receive $50 in bonus cash if $1,000.00 to $4,999.99 is sent to your bank account within a 25-day period, starting from when you receive the first direct deposit. That number jumps to $300 when you receive $5,000 or more. The higher cash bonus requires you to hit an admittedly high threshold, but the $50 is a reasonable bonus for a much more manageable threshold.

Want to get started on your cash bonus? Sign up with SoFi today.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.00% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Additional available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.0% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

What Is an Automatic Savings App?

An automated savings app, whether it’s connected to a traditional savings account or a financial technology product, helps you save without any extra effort. Once you get everything set up, you just relax and watch your savings grow.

How Do Automatic Savings Apps and Accounts Work?

The exact way you save money might differ depending on the app or savings account you’re using. For instance, you might have automatic transfers of money that flow from your checking account to a savings account. You might have money deposited in your account every time you shop thanks to round-ups, cash-back, or other rewards. The common thread here is that you go about your day as normal, but you save more than you used to save.

Should I Use an Automatic Savings App or Savings Account?

As a general rule, yes. I think most people could benefit from the savings simplicity of an automatic savings app. If you’re already a savings pro, you probably don’t need these apps, per se, but you can still benefit from high APYs, savings matches, and other perks. But the prime candidates for these products are people who aren’t saving as much money as they wish they were.

Features to Look for in Automatic Savings Apps and Accounts

Round-Ups or Tipping

Round-ups, or the ability to “tip” yourself with every purchase, are simple ways to incrementally save. Also, they have the fringe benefit of making you feel slightly less guilty about your purchases given that you’re simultaneously saving.

Recurring Transfers

One of the fastest and easiest ways to save is to set up recurring transfers. That’s when you either have your paychecks automatically transferred into a savings account (or similar account), or have money regularly transferred into savings from a linked bank account.

High APY or Savings Match

The higher the annual percentage yield (APY) of an account, the more money your savings can passively earn. You typically won’t get much of a yield from a traditional savings account, but high-yield savings accounts and some financial apps offer high APYs. Some products will instead (or also) offer a savings match, usually up to a certain dollar amount of savings, which can motivate you to save more.

Cash Back

If you’re shopping anyway, you might as well earn a little money while you’re at it. Cash-back rewards return a certain portion of your purchase price—in some cases, directly into a savings account. Cash-back rewards vary widely by size and type of expenditure, so you’ll want to look around to find the program that will benefit you the most.

Investment Options

Some automatic savings apps put your money in an interest-bearing account, but others deposit that money into an investment account. If you’re interested in investing, but have struggled to put aside money for investing or even haven’t yet opened a brokerage account, a savings account that comes with an investment account could be a great fit for you.

Low or No Fees

Try to choose money-saving apps with little to no fees. Monthly, account minimum, overdraft, and other fees can cut into your ability to save.

Multiple Accounts

Sometimes it can be tough to save when all of your money is flowing in and out of a single account, especially if it’s a checking account. It’s too easy to spend money you planned on saving when it’s coming out of the bucket you usually spend from. At a minimum, you want an app or bank that offers multiple accounts or “buckets”—preferably, at least separate spending and savings accounts so you can silo away money meant for later.

Debit Cards

So, a standard debit card won’t help you with saving money. However, some of the automatic savings apps mentioned above have feature-packed debit cards that will help with your savings efforts. Debit cards that offer round-ups, cash-back, or other rewards are a great way to save.

Automatic Savings Apps: Frequently Asked Questions (FAQs)

Can you automate savings?

Yes. You can and should automate at least some of your savings. Many financial apps and some banks often allow you to set up regular transfers of money into savings. They might also come with features such as round-ups that automatically save for you anytime you make a purchase.

What is the way to auto-save money?

You can auto-save money in a few ways.

One common way is to set up recurring transfers from a checking account to a savings account or other interest-bearing bank account.

Another way is to use a money-saving app. These apps can automatically help you save cash through round-ups, cash-back rewards, savings matches, and more. The more savings features you opt into, the more you can save.

Do savings apps work?

Savings apps are a great tool, but depending on the app and the amount of effort you put in, results will vary.

For instance, some apps save you money by rounding up your purchases and sending the spare change to a savings account. The more frequently someone makes purchases with a linked card, the more money is set aside. If you don’t use the card often, you won’t save as much.

Similarly, the more money you have in a high-interest account, the more you will save. The more often and the higher the dollar amount of automatic transfers, the faster one’s savings will accumulate.

And if the savings app is connected with a spending account, you should use the app to analyze your spending and income patterns so you can better understand when you make good (or bad) decisions.

Lastly, you have to be dedicated to saving to some degree. If you frequently pull money out of your savings account to spend on things you don’t need, you can’t blame the app.

How can I trick myself to save money?

Saving money can be difficult. Maybe you think you don’t have extra money to spare, or maybe you’re just forgetful about socking away a few dollars. The good news is, that by putting your savings on autopilot, you’re essentially “tricking” yourself into saving.

Are savings apps safe?

Some people find it comforting to handle all of their finances through banks with physical locations, such as Bank of America or JPMorgan Chase. However, fintech companies without brick-and-mortar buildings can keep your money just as safe—you just need to ensure they have the right protections in place.

For instance, you’ll want to see security features such as encryption technology, secure login, biometric authentication. You’ll also want to make sure your account is insured by the FDIC, National Credit Union Administration (NCUA) or SIPC.