The Acorns app is an investment, saving and spending app geared towards minors, young adults and young families who are just beginning to handle, save and invest money.

The company’s investing philosophy comes rooted in the time-tested power of compounding, diversification, and sticking with it over long periods of time. They symbolize this with their branding and calling themselves “Acorns.”

Through starting small and consistently watering an acorn over enough time with the right soil conditions and care, it can grow into a mighty oak.

Relating this analogy to investing, that means adding more money (water) to your diversified portfolio (soil conditions) capable of weathering many storms (market volatility) and growing larger later in life (mighty oak tree).

The company strongly believes in the long game and simplifying how you invest. To this end, the company chooses not to offer individual stock investing as this can cause undue risk if chosen poorly.

Instead, the company helps to give your money a chance to grow over time, without being dependent on one stock and through making steady contributions.

In this Acorns review, we discuss what the app offers new investors, the plans, products and features available, what we like and don’t like, how to set up your account and finally who the service is right for.

Table of Contents

What Is Acorns?

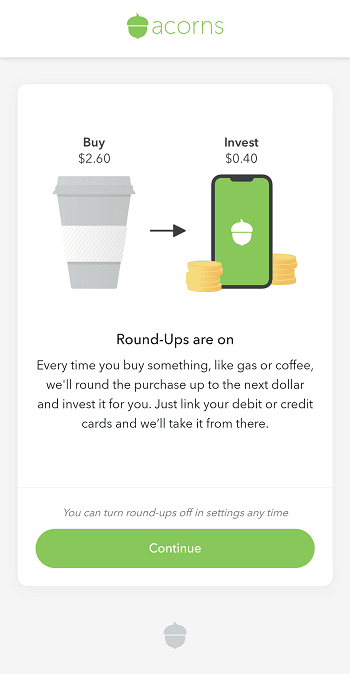

The Acorns app first started by introducing the novel idea of “Round-Ups,” which work by taking purchases you’ve made on a credit card or debit card linked to your Acorns account and topping them up to the nearest dollar.

This money then gets swept into a robo-advisor-managed investment portfolio which automatically invests them into stock market index funds on your behalf.

This useful saving feature has enabled the service’s users to save $30 extra per month on average on top of their routine contributions made into the account—something that can grow from the tiniest of acorns into the mightiest of oaks—if you keep watering it with additional contributions.

Acorns includes three membership tiers as of July 2023:

Acorns Personal ($3 per month):

- Acorns Invest: Index fund investing capabilities through “Round-Ups” and account contributions

- Acorns Later: Offers tax-advantaged investment options like individual retirement accounts (IRAs)

- Acorns Checking: This service acts as your bank account, offering free withdrawals at over 55,000 ATMs nationwide, no account fees and the ability to earn up to 10% in bonus investments

Acorns Personal Plus ($6 per month):

- Everything in Acorns Personal (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

Acorns Premium ($12 per month):

- Everything in Acorns Personal Plus, as well as Acorns Early. This allows you to open an investment account for kids, or a custodial account, for your child and begin investing for them as a minor. You also get access to live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Personal Plus and Premium subscribers also get access to a powerful way to accelerate their savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Personal Plus and Premium subscribers, respectively.

As a note for any Acorns investors who joined prior to a plan change made effective in May 2020, your account may still reside under the pricing structure available at the time. Unless you have changed your plan, you have been grandfathered in on your plan at that time.

The primary difference between that plan menu and the one available now is the removal of the $1-per-month Acorns Lite tier (as of September 2021) and the $2-per-month subscription offering fewer products at the time (only Invest and Later, not Acorns Spend or Checking).

You can remain in place on the $2-per-month tier or upgrade to the $3-per-month Personal to add Acorns Checking.

How Does Acorns Work?

Acorns provides money tools to look after the financial best interests of up-and-coming, beginner investors through micro-investing, banking, retirement saving and investment accounts for kids.

They’ve simplified many of these products to make them accessible to everyone without the intimidating task of figuring it out yourself.

The service works as a robo-advisor to place your Round-Ups, recurring contributions and one-time contributions into age, income, risk tolerance and time horizon-appropriate exchanged-traded funds (ETFs).

Your portfolio can invest in exchange traded funds, or investment vehicles which invest in multiple underlying securities as opposed to a single stock or bond, which focus on large-company stocks, small-company stocks, international stocks, corporate and government bonds, and more.

You can answer basic questions about yourself and the goals you have for opening this Acorns account to put your investments into assets which align with your needs.

And not only does this robo-advisor service invest your money, this platform offers you the ability to do so in small amounts over time.

Investing small amounts regularly in a diversified portfolio gives your money a chance to grow long-term. When the market is up, you get a chance to watch your money ride the high.

When the market dips—and it will, but that’s OK!—you can invest at lower prices, and stick with it for potential gains over time. Set it, forget it, and let spare change change your future!

As we’ll discuss later in this Acorns review, you’ll also want to consider whether this makes the most sense for your money or if you should also consider contributing more to your account to overcome the monthly fees charged by the service.

Once you open your account, you can tap into our automated tools like Round-Ups and Recurring Investments to save and invest every day.

To jumpstart your contributions, the service offers multiple products like Found Money, Earn, and Round-Ups to build a diversified portfolio quicker.

Acorns Products

Acorns Round-Ups

Acorns Round-Ups is one of the app’s most popular features. When you use your Acorns Visa debit card, or a different linked debit or credit card, it rounds your transaction amount up to the nearest dollar.

For instance, if you spend $10.60, it rounds the transaction up to $11.

If you used your Acorns Visa debit card, the rounded up amount (in this scenario, that would be 40 cents), is pulled from your Checking account and put into your investing account where it can begin growing.

When you use a different linked card, the money is set aside until it reaches at least $5 and then it is transferred into your investing account.

The more you use your Acorns card or other linked cards, the more money you save! On average, the service’s users invest over $30 worth of spare change and returns a month with their Round Up feature.

Properly invested, these small amounts can grow significantly over time.

Related: Best Debit Cards for Teens

Acorns Round-Up Multiplier

Want to save money faster? If you aren’t saving as much money as you want with Acorns Round-Ups, you can enable the Round-Ups Multiplier.

You choose if you want your Round-Ups to be multiplied by 2x, 3x, or 10x. For example, you might choose the 3x multiplier. Then, instead of saving 40 cents from a purchase, you would be saving $1.20.

This is an easy way to set aside more money without much thought. You can change the multiply amount, or disable it, at any time.

Acorns Earn

Acorns Earn provides you with more ways to earn, save, and invest money. One way to earn money is by inviting friends. Both you and your friend each receive $5 to invest if you invite them.

Additionally, the company has a Job Finder feature. They partnered with ZipRecruiter to help users find jobs easier. Finally you can earn through Acorns’ Found Money Feature (discussed below).

Acorns Found Money

Acorns lets you earn money by shopping for certain brands. There are over 350 leading brands that will invest a percentage of your purchase, or a set amount of money, directly into your Acorns Invest account when you shop with them.

Just a few examples of these brands are Apple, Chevron, Expedia, Kohl’s, and Nike. Downloading the free Acorns Earn Chrome Extension makes it easy to earn as you shop online.

Acorns Invest

Acorns’ investing app allows beginners to start investing small amounts of money as they spend money as well as make recurring investments through a linked checking account.

As you begin investing through the Acorns app’s brokerage account, you build a diversified portfolio selected from five categories of index exchange traded funds options consisting of stocks and bonds.

They range from Conservative (all bonds) to Aggressive (all stocks) portfolio positions, depending on your risk tolerance and investing goals.

You can set up recurring deposits to supplement your “Round-Ups” directly transferred from your credit or debit card into your brokerage account to grow your account balance faster.

Market performance isn’t guaranteed and different asset classes perform differently over time. That said, if you hold your funds in any accounts with significant exposure to stocks like the Moderately Conservative, Moderate, Moderately Aggressive or Aggressive portfolios, stocks tend to perform well over long periods of time.

Acorns works like many robo-advisors by building a portfolio suitable to your investment goals and risk profile. Robo-advisors attempt to create low-cost, diversified portfolios in alignment with your investment objectives. More risk entails more exposure to stocks, while less means more held in bonds.

Acorns Later

Acorns Later is designed to help you save for retirement.

Often, retirement accounts require a minimum deposit that can be intimidating for some people. For example, M1 Finance requires $500 to open a traditional or Roth IRA (even a custodial Roth IRA for kids).

Comparatively, you can start a Later retirement account with only $5, allowing you to begin investing sooner.

Based on your goals and timeline, the app will recommend an Individual Retirement Account (IRA) and a portfolio that fits your situation. You can save for retirement daily, weekly, or monthly with automatic recurring contributions. No need to manually put money into your account. Your account will get rebalanced regularly to ensure it’s still growing and makes sense for how close you are to retirement.

Acorns starts you off with a more aggressive investing approach when you are younger and makes it more conservative as you age, much like a target-date fund.

Personal Plus and Premium subscribers can amplify their IRA savings through Later Match. Acorns will match 1% of new IRA contributions if you’re a Personal Plus subscriber, and 3% if you’re a Premium subscriber. Contributions will be automatically invested.

Acorns Checking (Spend)

If you have a Personal account, it includes an Acorns Checking account. Your checking account comes with a heavy-metal bank card with your signature custom-engraved. You’re able to do everything digitally, from mobile check deposits, to sending checks, and more.

There are more than 55,000 fee-free ATMs nationwide you can use to pull out cash. Your money is FDIC-insured up to $250,000 and there is fraud protection to keep it safe.

Acorns Checking works best when you combine it with other features, such as investing.

Acorns Early

Acorns Early is an investment account for children. It works as an UTMA/UGMA account, meaning the money can be used for anything that benefits your child and it can be transferred to them when they’re old enough. You can set recurring investments daily, weekly, or monthly.

It’s a simple “set it and forget it” method that adds up quickly. These accounts are aggressive and have the potential to earn significant amounts. You must subscribe to the Acorns Premium tier ($12/mo.), but you can add multiple children for no additional cost.

Plus, there are possible tax advantages. As a bonus, the company provides financial literacy content so you and your kids learn valuable skills on how to manage money.

Acorns Gift Cards

Not sure what to get somebody as a present? Consider getting them an Acorns gift card.

After the recipient invests their money, it can grow into more over time! You don’t need to have an Acorns account to purchase a gift card, but your recipient needs to sign up to be a customer to redeem the gift card, if they don’t already have an account.

Right now, gift cards are $25 each and you can purchase as many as you like.

How to Create an Acorns Account

You’ll have two bank accounts to monitor: one for rounding up purchases and the other for making deposits into your brokerage account.

1. Link Your Bank Account

The first step after opening your Acorns account is to link your bank account. This allows you to make investments, deposits and withdrawals in your Acorns account. This bank account will act as your Round Up account you will monitor.

You can connect more than one account if you’d like multiple cards to act as round up eligible. This account differs from your checking account, which is where your funds will transfer from to fund your account.

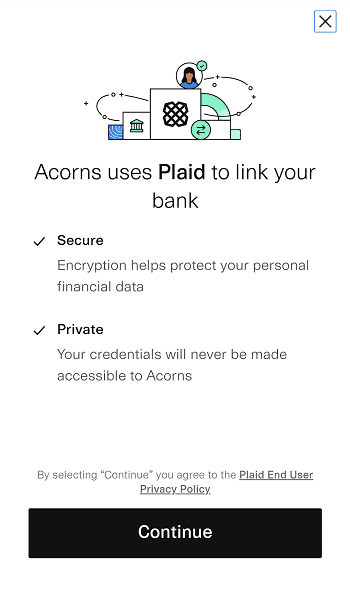

2. Link Your Bank Account with Plaid

Next, the prompts will ask you to link your bank account through a secure and private Plaid financial data transfer system.

This allows the company to have access to your encrypted bank account information, enabling transfers and ongoing contributions as well as when you round up your purchases.

3. Create Your Invest Account

You will be asked to provide your personal information to verify your identity, address and citizenship.

The U.S. Patriot Act requires collection of this information by all financial institutions to guard against numerous nefarious purposes like funding terrorism, laundering money and more. In other words, this is standard practice.

You’ll also need to answer three questions asked by every investment company:

- Are you or have you been affiliated with a broker-dealer?

- Has the IRS notified you of being subject to backup withholding?

- Are you a 10% shareholder of a publicly traded company?

Most likely as a user of the platform, you won’t answer “Yes” to any of these. That said, answer correctly and truthfully. The SEC requires you to answer these questions when opening a brokerage account.

4. Provide Your Employment Information, Income and Investment Rationale

In this step, you will provide these pieces of information for the service to understand your background and financial resources.

Based on how you answer, the company’s algorithm may make certain investment recommendations suited to your situation and goals.

The answers to these questions will help the company generate customized investment advice and a pre-made, recommended portfolio created by their team of experts.

One of which is a Nobel Prize-winning economist, so you know there’s some research going into these portfolio recommendations.

You can choose from five different reasons for investing:

- Long-term investment

- Short-term investment

- Major purchase

- Children

- General

Finally, the company requires you to provide your Social Security number. The app says this assists with identity verification as well as for tax reporting and fraud detection and prevention.

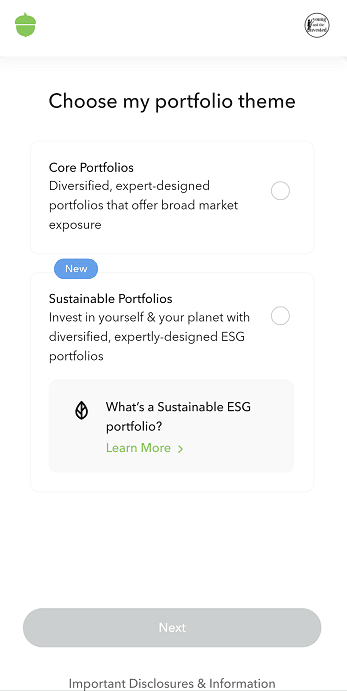

5. Select Your Portfolio

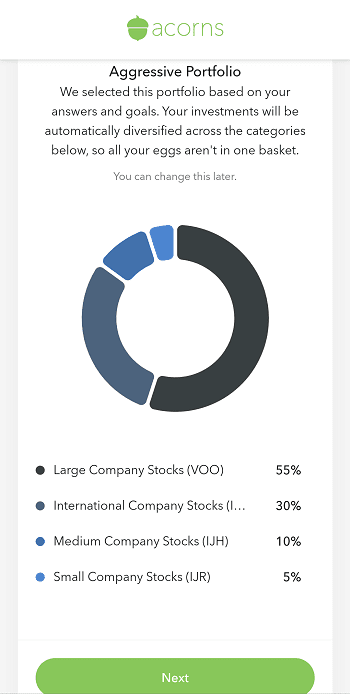

Based on my answers of income, long-term investment horizon and higher risk tolerance, I had the aggressive portfolio recommended to me.

It includes a portfolio 100% invested in stocks and includes ETFs in large company stocks, international stocks, medium and small company stocks.

Depending on your answers to the 7 questions asked by the prompts, your recommended portfolio will vary. We discuss these portfolios in more depth below.

What Investing Portfolios Does Acorns Have?

The platform offers a stepwise function of diversified portfolios containing index funds investing in stocks and bonds as well as real estate (REITs).

- Conservative (100% bonds)

- Moderately Conservative (20% bonds, 80% stocks)

- Moderate (40% bonds, 60% stocks)

- Moderately Aggressive (20% bonds, 80% stocks)

- Aggressive (100% stocks)

Which ETFs Are Available through Acorns’ Robo-Advisors?

Within your preset investment portfolios available through the service, the app offers a number of index funds from iShares, JP Morgan, Goldman Sachs and Vanguard including:

- Large Company Stocks — Vanguard S&P 500 ETF (VOO)

- Medium Company Stocks — iShares Core S&P Mid-Cap ETF (IJH)

- Small Company Stocks — iShares Core S&P Small-Cap ETF (IJR)

- Developed Markets — iShares Core MSCI Total International Stock ETF (IXUS)

- Real Estate — Vanguard REIT ETF (VNQ)

- Corporate Bonds — JP Morgan Ultrashort Term Corporate Bond (JPST)

- Corporate Bonds — BlackRock Ultra Short-Term Bond ETF (ICSH)

- Government Bonds — iShares 1-3 Year Treasury Bond ETF (SHY)

- Government Bonds — Goldman Sachs Access Treasury 0-1 Year ETF (GBIL)

When you’re ready, press the “Confirm Portfolio” button at the bottom of the screen.

Does Acorns Have ESG Options?

Yes. Environmental, social, and corporate governance (ESG) investments are available on the platform.

Acorns Sustainable Portfolios aim to give investors exposure to more sustainable businesses that still perform similarly to traditional portfolios.

Sustainable funds don’t only have a positive impact on the Earth and the people living on it, but they sometimes outperform non-ESG funds as well.

There are four Sustainable Portfolios to choose among. The platform decides which ETFs fit the ESG criteria by the Morgan Stanley Corporate International (MSCI) ratings, which measure a business’s long-term commitment to SRI and ESG investment standards.

How Much Does Acorns Cost?

- Acorns Personal ($3 per month):

- Includes the Invest plan, which invests spare change through the popular “Round-Ups” feature

- Earns bonus investments

- Provides access to financial literacy articles

- Includes Acorns Later for tax-advantaged investment options like individual retirement accounts (IRAs) and Acorns Spend.

- This service acts as your bank account, offering free withdrawals at over 55,000 fee free ATMs nationwide and no account fees and the ability to earn up to 10% bonus investments

- Acorns Personal Plus ($6 per month):

- Everything in Personal (Invest, Later and Spend)

- Premium Education

- Emergency Fund

- 25% bonus on Acorns Earn rewards (up to $200 per month)

- 1% Acorns Later IRA match

- Acorns Premium ($12 per month):

- Everything in Personal Plus

- Access to Acorns Early, a feature that allows you to open a custodial account for your child and begin investing for them as a minor.

- Live Q&As with financial experts

- 50% bonus on Acorns Earn rewards (up to $200 per month)

- 3% Acorns Later IRA match

- $10,000 in life insurance

- Ability to set up a complimentary will

What We Like About Acorns

Ability to Save and Invest Automatically

Where the service shines is through the ability to save and invest mindlessly with automatic saving. What makes this great is it adds more fuel to your savings fire without even thinking about it.

Acorns rounds up your purchases to the nearest dollar, sweeping these small contributions into your brokerage account—great for hands-off investors looking to put their investments on auto-pilot.

You can link as many accounts or cards you want through your Acorns app. Though, if you elect to use their Round-Up feature, the money will come from the same linked checking account.

As a note, while you can set this up to work automatically, you can also review all purchases through the Acorns app and select which roundups you’d like to transfer instead. That removes the automation, but having that toggle ability can add to user satisfaction.

Likewise, you can achieve the same feat through use of an Acorns Spend account with linked cards instantaneously. There isn’t a delay between purchases on a debit or credit card. Real-time round up amounts move to your investment account.

No Minimum Balance

The investment platform thrives on rounding up your purchases and investing the difference to grow your account. Therefore, having a minimum balance might be a tough pill to swallow when the concept of the service relies on a balance as low as $0.01 being viable.

Thankfully, the platform has a good head on its shoulders and doesn’t require a minimum balance in their account. That said, to start investing in one of their five pre-built portfolios, you will need at least a $5 balance.

Though, they offer $10 for opening the account and making a deposit. In other words, if you make any size deposit, you should have enough to begin investing.

Acorns Earn

While rounding up your own purchases seems like a great way to build up a portfolio—it’s certainly a solid start if you can overcome the effective annual fee faced through an Acorns account—you can supercharge it by shopping at almost 10,000 participating companies to get cash back to invest.

You have numerous companies you likely use on a regular basis like AirBnb, Warby Parker, Target, Walmart, Nike and more who give you cash back for shopping there without any additional action on your part.

To take advantage of these offers, use a card on a linked account to make your purchase and you will see this extra money land in your account within 60 to 120 days of purchase.

These bonus investments can add up quickly if you shop strategically and combine this with your rounded up purchases. From there, let the robo-advisors handle your money by funding your investment account, retirement account and even custodial account.

Custodial Accounts

Acorns Early has made investing for kids a cinch. By selecting the Family plan, you can easily create a Uniform Gifts to Minors Act / Uniform Transfer to Minors Act account—known simply as a “custodial account“—to start funding your kid’s own investment balance.

These accounts allow you to contribute funds toward long-term investments but become the property of the child upon receipt. The money can go toward any expenses which benefit the account owner (the minor) but can also remain in place for many years to come.

When the child reaches the age of majority in their state of residence, they take ownership over the account and can use the money however they’d like.

Simplifies Investing

Closely related to automating investments through robo-advisors, the platform takes the complication out of investments by identifying suitable investments for you based on your investment goals, preferences, risk tolerance, time horizon, age, income and net worth.

Based on scientific research, the company selects suitable investments for you automatically, ignoring the need to mind your investments regularly, conduct stock research, consult stock analysis apps, or solicit the suggestions of the best stock picking services or stock newsletters.

The platform takes the easy approach to investing.

Financial Literacy Development

Want to know more about large company stocks? Government bonds? How a retirement account can save you money on taxes?

The service has a wealth of resources available to answer such questions and they come from highly reputable sources like CNBC (co-owner of Acorns).

The service aims to simplify several financial topics into bite-sized pieces of information you can use to grow your financial knowledge.

Your investment account, checking account and bank card aren’t just a service that invests your money or helps you to make money through your everyday purchases.

The company aims to build your financial confidence and knowledge through regular access to information needed to make the best choices for your financial situation.

What Acorns Could Do Better

Fees as a Percentage of Assets Under Management

Flat management fees can be a problem if you’re not investing enough. For instance, if you only use “Round-Ups” to invest, the monthly fees might eat away any chance of earning a return.

Further, they can even represent a significant assets under management fee relative to your portfolio balance, something most robo-advisors avoid doing.

This outsized fee as a relative percentage of your portfolio happens because if you only invest your spare change, the monthly management fee represents a large percentage of your overall portfolio size.

A low monthly fee is great for an investment account that has a large balance, as it becomes decimal dust when the account balance becomes large enough.

The offered monthly fees might sound cheap for investing spare change, having a checking account and even investing for retirement through a robo advisor.

However, if your account carries a small account balance, you might fail to reach escape velocity to have the fees scale with your investment account balance.

For example, the $3 monthly Personal plan, $6 monthly Personal Plus plan, and $12 monthly Premium plan, amount to $36, $60, and $108 per year if expressed as an annual fee.

- For account balances as low as $100: This equates to 36%, 60%, and 108% assets under management fees, respectively.

- For account balances as low as $500: This equates to 7.2%, 12%, and 21.6% assets under management fees, respectively.

- For account balances as low as $1,000: This equates to 3.6%, 6%, and 10.8% assets under management fees, respectively.

- For account balances as low as $5,000: This equates to 0.72%, 1.2%, and 2.16% assets under management fees, respectively.

- For account balances of $25,000: This equates to 0.14%, 0.24%, and 0.43% assets under management fees, respectively.

For reference on how these plans compare to competitors like Axos Managed Portfolios, Wealthfront and Betterment, these charge 0.24%-0.25%, respectively.

Further, other stock trading platforms for beginners offer competitive services at similar price points.

Stash, for instance, only charges $1 per month for access to a brokerage account as well as a bank account with a debit card with rewards features. If you upgrade to the next tier with Stash for $3 per month, you can also add a traditional or Roth IRA account in line with Acorns Personal.

At this price point, Acorns and Stash provide similar robo-advisor capabilities to manage portfolios.

Tax-Loss Harvesting

Some robo-advisors acting as complete stock trading platforms offer similar levels of service as Acorns except they can also offer one superior product called tax-loss harvesting.

Stock loss harvesting is a service offered by these platforms to minimize the tax burden on your portfolio.

This is where you sell an asset that has lost value and purchase a similar or even better performing one with money from the sale of the first investment, thus allowing you to claim a tax deduction to lower your taxable income.

At this time, the platform does not offer tax-loss harvesting to its users.

Debit Cards for Kids

For parents interested in enrolling in the Family plan to open a custodial account for their kid, they might also have interest in providing their child with a debit card for kids.

These work like a prepaid debit card and often come with parental controls to set up safeguards on where they can and cannot be used.

Competitors like Greenlight offer superior functionality in this arena alongside offering the ability to assign, manage and administer chore plans and allowance payments.

Further, Greenlight’s invest feature also provides the ability to invest in individual stocks to get kids interested in investing (they even offer fractional shares to place any company’s stock within reach).

They can choose to invest in stocks for kids that inspire their interest and get them active in learning more about the stock market and the economy.

This plan clocks in at a higher price per month ($7.98), but it offers superior functionality and acts as a better alternative than a simple Family plan in our opinion.

Related:

Account Fees

Account fees are a part of any financial account, so they’re expected to some point. Many institutions benchmark themselves against one another and often assess similar fees for similar services.

Where the service breaks from many other investment services is through their steep fees levied on transferring from Acorns to other investing apps like Robinhood, Webull, M1 Finance or others.

Specifically, the service charges $50 per ETF you transfer. While certainly not alone for charging Acorns fees like this, other service providers charge fees like this for transferring all of your ETFs at once.

If you held 6 ETFs with the service, prepare to pay $50 per ETF, or $300.

These fees (in addition to the monthly fee) are just one of the many ways Acorns makes money.

Does Acorns Really Help You Save and Invest?

The more you use the service, the more you save. Somebody who always uses their Acorns card or a linked card for purchases is going to save a lot more than somebody who only uses it sparingly.

Similarly, somebody who has recurring payments sent to their investment account weekly is going to save much more long-term than somebody who only manually adds money every few months.

The service is what you make it. If you have strategic settings, you can save a lot with Acorns. It’s all about creating a set-it-and-forget system.

Who is Acorns Best For?

People Who Need an Automated Solution

Acorns works well for people who need an automated solution to investing. If you don’t have the time or financial knowledge to invest your money, Acorns can take care of everything for you.

Anybody who isn’t living paycheck to paycheck and wants to invest for their future, but also can’t help spending extra money benefits from Acorns. It accumulates investment money incrementally so your bank account doesn’t suddenly empty.

People Who Don’t Want to Make a Minimum Investment

There is no minimum investment required to open an Acorns account. You don’t have to save up to open an account and there isn’t anything intimidating about getting started.

When it comes to investing, the sooner you start, the better. Get started with whatever amount you have or start by using the Round-Up and Found Money features.

People Who Want to Earn Significant Cash Back

Who doesn’t like cash back? If you frequently shop from any of the 350+ brands that provide cash back to Acorns users, you can earn back a substantial amount of your spending.

For instance, Bark Box and Chewy both work with Acorns, so if you use those for your pets, that recurring expense becomes recurring savings.

People Who Want to Invest for Kids

Acorns Early is one of Acorns’ best features. If you want to start investing for your child’s future early, this is a great option that can cumulatively save significant amounts.

Acorns Early requires a subscription to the $12 monthly Acorns Premium tier. But since it doesn’t cost extra to add more children, the more kids you have, the more appealing Acorns should seem.

People Interested in Developing Financial Literacy

Acorns is dedicated to improving people’s financial literacy. You can read many of their free articles at grow.acorns.com.

They also have tools, such as a compound interest calculator and a child tax credit calculator.

One of the best ways to learn finance is through practice and Acorns makes it easy to start investing without much monthly.

People Who Can Invest Enough to Overcome the Monthly Fees

You need to be investing enough to be earning more than you spend in fees.

The most affordable Acorns plan is $3 a month, so you need the ability to earn at least $36 per year through cash back and investment interest.

Acorns Review

The acorn serves as a symbol of growth and the potential to turn a small amount into a mighty oak. Acorns chose this image because it represents what one can achieve with their app for their journey of personal finance.

For a monthly fee, you can embark on your own financial wellness journey through investing spare change in stock or bond ETFs.

You’ll also bank smarter by automatically rounding up purchases to the next dollar—then depositing that difference into your Acorns account—rather than spending it on something else.

Acorns has become one of the most popular investing apps for minors and young adults but also offers a robust money management platform extending beyond just investing.

The full suite of offerings includes the ability to establish custodial accounts for minors to invest, regular and retirement investment accounts for adults and a bank account with linked card.

If you sign up for the Acorns Checking product available through Personal and Family plans, it creates a bank account that carries FDIC Insurance protection for up to $250,000.

While not a free stock trading app, Acorns does give you the following subscription options:

- Acorns Personal ($3 per month)

- Acorns Personal Plus ($6 per month)

- Acorns Premium ($12 per month)

For a limited time, the service also offers a $20 sign-up bonus for people who open an account. This can be useful for learning how to start investing money.

The company has helped almost 10 million people start investing for the first time by building a service which caters to hands off investors looking to save money without the hassle of making specific investment selections.

It takes your money and invests it in a portfolio of diversified asset classes and allows you to continue adding money through several means.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts with a 1% match.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions.

- Special offer: Get $20 to start*.

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

![40+ Ways to Make Money as a Teenager [Fast + Smart] 36 ways to make money as a teenager](https://youngandtheinvested.com/wp-content/uploads/ways-to-make-money-as-a-teenager-600x403.jpg.webp)

![9 Best Banking Apps for Kids & Teens [Kid + Teen Banking] 38 banking apps for kids and teens](https://youngandtheinvested.com/wp-content/uploads/banking-apps-for-kids-and-teens.webp)