“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffett

Sometimes, trading in your time for money barely seems worth it. Wouldn’t it be great if you could learn how to make money while you sleep? As it turns out, you can. In some situations, you can literally get paid to sleep, while others require upfront work creating a passive income, and still other methods get the money you already have to increase itself.

If you have interest in learning about the art of making money in your sleep, continue reading below for the top proven ways people have invested in income-producing assets or activities used to date.

Table of Contents

Making Money While You Sleep—Our Top Picks

|

4.5

|

4.4

|

4.8

|

|

No commissions on stock and ETF trades.

|

Free (no monthly maintenance fees).

|

$10 minimum investment

|

How to Make Money While You Sleep

1. Invest in the Stock Market

You’ve likely heard the phrase, “it takes money to make money.” Indeed, having some money makes it easier to get more. A wonderful way to passively make money long-term is to invest. When people think of investments, they often think of the stock market.

When you start investing money in stocks that are considered safe (no stock is 100% guaranteed to make you money), you typically end up with a profit for doing nothing but letting the asset increase in value. That’s why the stock market is one of the best investment for young adults. You can buy stocks with a brokerage geared toward beginners like Public.com.

The services allows you to create a diversified portfolio with no costs for making trades nor maintaining account minimums. Once you create an account and deposit money, you can use the app as an automated investing tool, allowing you to add money and have the app handle how it gets invested.

A diversified, low-cost portfolio held across long periods of time can easily result in making money while you sleep.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Earn a 5.3% yield with Public.com's Treasury Account, which allows you to earn state- and local-tax-exempt income from T-bills.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Fractional shares

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

2. Invest in Alternative Investments

The stock market isn’t the only way to invest. Given the recent market volatility we’ve seen in the stock market related to a global health scare, sometimes having a non-correlated asset allocation in your investment portfolio is a wise choice.

Alternative investments might provide added diversification for you to continue building wealth. Many options exist for investing your money in alternative investments as fintech companies have unlocked access to markets once only available to wealthy investors. From markets like real estate investing, fine wine investing, rare art and more, you can tap into investments which have continued to appreciate over time.

Have a look at some well-regarded alternative investments available below.

Consider Investing in Alternative Investments

Consider diversifying your investment portfolio beyond stocks and bonds.

Review some of the available alternative investment options available to you as a result of fintech companies opening markets to all investors which previously only provided access to the wealthiest investors. Some require as little as $500 to get started.

- Crowdsourced residential and commercial real estate for non-accredited investors with Fundrise ($500 minimum)

- Crowdsourced commercial real estate for accredited investors with EquityMultiple ($5,000 minimum)

Related: 11 Best Fundrise Alternatives [Accredited & Non-Accredited Apps]

3. Open a High-Yield Savings Account

Another way to make money you already have work for you is by putting it in a high-yield savings account or certificate of deposit (CD). A standard savings account offers an interest rate of around 0.01%. Meanwhile, high-yield checking and savings accounts can have interest rates exceeding 1% (meaning they’re about 100 times better at building interest than a typical savings account).

However, recent economic developments have pushed many of these accounts below the 1% threshold for the time being. With time, these accounts will likely index back to have superior rates to most standard savings accounts found at megabanks. In exchange for these higher rates, some accounts can have you lock in your money for a set amount of time.

Before creating an account not easily accessible at any time, make sure you have an emergency savings account you can always access.

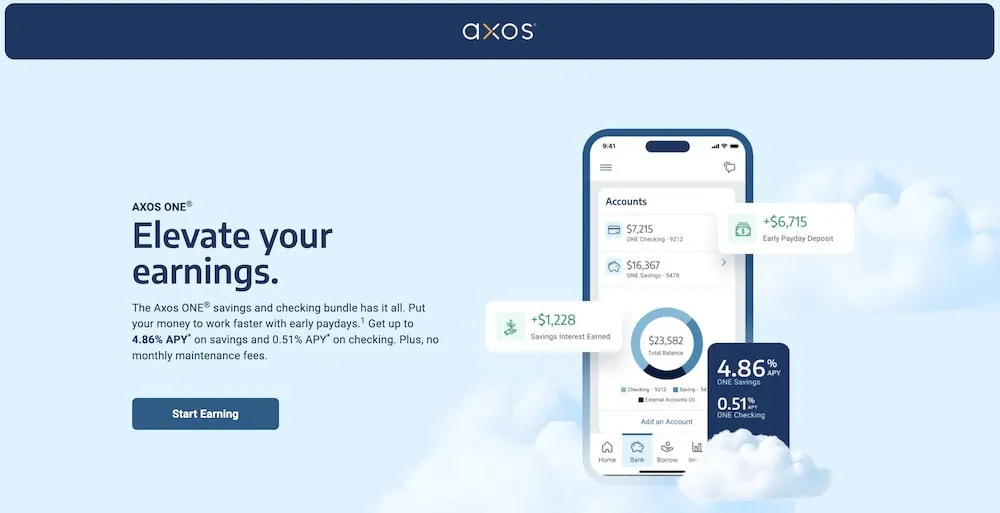

Consider placing your money in one of the most competitive high-yield savings accounts available on the market through Axos Bank. Their Axos One bundled checking and savings account product offers an easy application process (about five minutes), extremely competitive rates, no service fees, and mobile banking functionality. Read more about the product below.

Earn a High Yield and Pay No Monthly Maintenance Fees With Axos One

- Available: Sign up here

- Platforms: Web, mobile (iOS, Android)

Axos Bank is an online-only bank that offers a potent high-yield checking and high-yield savings account bundle called Axos ONE. The competitive APYs on both accounts, when combined with the zero monthly maintenance fees, make this account pairing a highly desirable combination to hold your cash.

Additionally, the bank has access to over 95,000 ATMs nationwide with withdrawal fee-reimbursement, no overdraft fees, and no minimum account balances.

Check out the Axos ONE checking and savings bundle to earn more, for less, on your money.

- Axos ONE is a bundled high-yield checking and savings product offering early paydays and competitive APY rates

- Savings Account: 4.86% APY*

- Checking Account: 0.51% APY*

- Age requirement: 18 or older

- Minimum deposit: None

- Minimum balance required: None

- Fee-free ATM Network: 95,000+ locations

- No monthly fees

- High APY for checking

- Mobile app

- Online bill pay

- Spend tracking

- Unlimited ATM reimbursements

- No physical branches

A second option to consider comes from Bread Savings:

Save + Earn a High Yield With Bread Savings

- Available: Sign up here

Bread Financial (formerly Comenity) is a financial tech platform offering spending, lending, and savings solutions, including the Bread Savings High-Yield Savings Account.

Bread Savings’ HYSA is a free, FDIC-insured account that offers an extremely competitive APY that currently beats the national average by a decent margin. You’ll also get to save a lot more of your money thanks to Bread’s wallet-friendly fee policies. Bread doesn’t charge a fee for monthly maintenance, online statements, ACH transfers, or incoming wire transfers. You can also make unlimited ACH and mobile check deposits.

Because Bread Savings is a tech service, not a bank, you won’t have access to brick-and-mortar locations. Instead, you access your account via the web or its mobile app, which is available on both iOS and Android. Bread also offers live-chat customer service seven days a week.

Bread Savings requires a $100 minimum deposit. Put your money to work with Bread via our link.

- Bread Savings High-Yield Savings Accounts are free, take just minutes to open, and carry highly competitive rates (currently 4.25% APY).

- Get started with this FDIC-insured account for as little as $100.

- Interest accrues and compounds daily, and is credited monthly.

4. Fine Wine

Fine wine as an investment has performed admirably over the last twenty years, outpacing even the S&P 500 during an equivalent period while seeing less overall volatility. Tapping into fine wine investing might prove a challenge if you don’t have the necessary capital and infrastructure to source, store and sell fine wine over long periods of time. One alternative is investing through a company like Vint.

Vint is an SEC-qualified fine wine and rare spirits investing platform that makes diversified investing accessible to all investors. Vint offers fractional ownership of investment-grade collections sourced by a team of experienced wine and investment professionals. Vint’s low minimums, sourcing, and securitized offerings make them unique in the alternative investment space.

The company allows you to invest as little (get started for around $50) or as much as you want in collections curated by a team of wine industry experts. When you invest, you own a piece of the collection, giving you unique diversified exposure to many labels and not just one or two bottles.

The company makes it a point to put transparency first, providing regular updates on their collections and sharing investment theses with all investors so they have full control around their investment decisions. The company is on a mission to bring wine and spirits to every portfolio.

If you think adding fine wine to your investment portfolio makes a sound decision after learning about Vint, consider joining now and funding an account with as low as $50.

- Vint is a fine wine and spirits investment platform that allows accredited investors to buy SEC-qualified shares of elite alcoholic beverages from around the world.

- Vint takes care of everything—sourcing, transportation, storing, insurance, and selling.

- Vint invests alongside shareholders

- Simple user interface

- Potentially very high fees

- Accredited investors only

- Extremely illiquid investment (1- to 7-year holding periods, no secondary market for shares)

Related: Best Wine Investing Apps and Platforms

Also Consider These Other Top Investments for a Broadly-Diversified Portfolio

In addition to investing in index funds and individual stocks, you might also consider investing in non-traditional investments outside of the stock market. These types of investments allow you to tap into assets which might not directly correlate with the stock market, diversifying your portfolio beyond just equities.

Some of these investing platforms also offer access to equities, but others allow you to buy into less travelled markets. Consider reviewing these investing opportunities for whether they make sense for your investment objectives and goals.

|

4.5

|

4.4

|

4.0

|

|

Commission-free trading. Robinhood Gold: Free 30-day trial, then $5/mo.

|

Most funds: 0.85% annual fee. Fundrise Innovation Fund: 1.85% annual fee.

|

Minimum investment: $1,000

|

5. Real Estate Investment Trusts (REITs)

Some people consider real estate investment trusts (REITs) to be the mutual funds of real estate. REITs are a collection of properties operated by a company that uses money investors give them to buy and develop real estate. You can choose to invest in trusts that build condos, apartment buildings, business complexes, or other facilities.

REITs pay you dividends. These are a fitting income-producing asset for people who want an easy way to get involved with real estate investing without having to purchase property themselves.

6. Start a YouTube Channel

If you would rather create videos that aren’t live and not of you sleeping, consider starting a YouTube channel. This method doesn’t earn money on day one and it takes a lot of initial work to get started. Plus, the amount of money people make varies widely. However, if you create quality content, you can earn money through ad revenue, sponsorships, and by creating your own products (such as swag or courses).

When you have enough subscribers and people consistently watching your videos, you can take breaks and still earn money. You might be sleeping, but others are watching your videos and sending ad revenue your way.

7. Turn Yourself into a Product

Perhaps you’ve found personal success—or you are firmly on the road to it—and have seen many promising opportunities to promote yourself as a brand. When you position yourself as the authority in your target market, you can develop products and services to leverage this trust while simultaneously helping those people with problems you can uniquely solve.

If you have an inspiring story or successful secrets to share, you could turn your experience into a video series, a blog, or write a book to make money while you sleep.

In any of these examples, you put the hard work in upfront, develop a marketing mix with the 4 Ps and then you simply collect proceeds while you move on to your next project. In addition to generating income directly from one of these products, you’ll also discover these products can dramatically improve the visibility of your personal brand, thereby boosting sales for your company.

In the end, you will not only yield a profit for yourself through creating a new revenue stream, but you will also have improved an existing stream through any business ventures you currently have.

8. Live-Stream Yourself Sleeping (Seriously)

A new TikTok trend has users stream themselves sleeping (or even just their room as they sleep). One 18-year-old made about $10 as people watched him sleep. A 24-year-old man live-streamed his Tesla “sleeping” overnight and made $50. On Douyin, TikTok’s Chinese counterpart, 18.5 million viewers tuned in to watch a man sleep. He earned over $4,000 while he slept.

Viewers don’t just enjoy watching people sleep, but chatting with other people watching as well. Want to generate money while you sleep? Stream it.

9. Affiliate Marketing

Affiliate marketing doesn’t just have to be done on a blog. If you have an email, this is a great option. Instagram is also a popular platform for affiliate marketing. People who have high followings, with engaged followers, can put affiliate links in their profile and call attention to the links. Whenever somebody clicks that link and buys a product, the influencer gets a kickback.

10. Online Courses and Webinars

Webinars are often live, which won’t make you money in your sleep, but you can create automated webinars people can watch at any time. While a webinar typically stands alone, online courses provide more in-depth knowledge and might have several sections.

You can create online courses on platforms such as Udemy or Teachable. It takes time to create your course, but once it’s up, very little maintenance is required.

11. Sell Stock Content

Do you enjoy photography, taking short video clips, creating music, or designing? Your creative hobby can become a passive income. Go through your old photoshoots, unused music clips, and extra film footage. Find a stock content site to sell it on. Just make sure to ask permission from anyone in your photos or videos.

For photography, some of the most popular stock sites are Shutterstock, Getty Images, and Pixabay. Upload your content, choose a price, and let it sell as you sleep.

12. Build an App to Make Money While You Sleep

If you have any coding knowledge, you can create a basic app to sell on app stores. It might even be considered one of the best financial apps or best productivity apps! Alternatively, you can find a coder and designer to hire to do the work for you. Some people will work in return for a profit share, but others will require payment upfront.

If your app does well, you’ll be making sales at all times of the day and anything past what it costs to get started is profit. Remember that apps have different payment models. Sometimes you can make more money with a “freemium” model where parts of the app are free than by charging for initial access to the app.

You can also learn how to choose the right finance app to make by considering what opportunities exist in the market.

13. Sell on Amazon FBA

Much like Shopify, you can sell your products and services on other ecommerce platforms as well. A popular alternative is Amazon FBA, or Fulfillment by Amazon. This service lets individual sellers find products they want to sell and then have Amazon handle the business and logistics part of the equation. Amazon will host the product on their site, facilitate the transaction with the customer, and deliver the product.

Some of the more popular options people sell through Amazon FBA include:

- Investing Books for Kids, Teens and Young Adults

- Movies

- Retail arbitrage

- Wholesale items

- DVDs

When you consider that Amazon handles listing, selling, shipping, collecting and sending payment, and any customer service needs, you can see how it’s pretty passive income. It certainly qualifies as an avenue for making money while you sleep once you find what you want to sell.

14. Rent a Room in Your House or Apartment

By renting out space in your home (or your entire home), you can make money both while you sleep and while others sleep. Airbnb is one of the most popular ways to rent out space to visitors. On average, Airbnb hosts make around $924 a month. This number can vary drastically depending on what city you live in, if you’re renting a room or entire home, and how often your space is available to rent.

You need to arrange cleaners after guests and be available to answer visitor’s questions (consider creating a guide book), but you can still be raking in cash while you sleep. Alternatively, rather than hosting guests, you could also just rent out a room as a storage unit instead. It’s an extremely hands-off way to make money off of any extra space you might have around your house, condo or apartment.

15. Sell Print-on-Demand Products

You can easily sell physical objects as well. Have a cool graphic design or photo that would look good on a t-shirt, backpack, hat, or anything else? You don’t need to print it on those items and then try to sell it. You can wait until you have orders ready to fill.

A popular marketplace for this is CafePress, which sells almost anything a design could be printed on. You can even list other people’s products for a referral fee.

16. Dropshipping

With dropshipping, you also never physically touch the products. You don’t even have to design them -you just pick them out. The items you want are in a warehouse, labeled, and shipped with your name, so you don’t incur overhead feels. You just put in an order (after people order from you), pay a fee, and then ship it where appropriate.

However, you should note that most dropshipping involves ordering goods from other countries, particularly China. Since you never physically interact with the items, there may be quality control issues and you don’t know the conditions your items were made under. If you choose to dropship, make sure to find a reputable company.

How to Make Money While You Sleep

Working around the clock isn’t feasible long-term, but that doesn’t mean you can’t be earning money around the clock. With a combination of passive income streams and making your current saved money work for you, you can see firsthand how to build wealth significantly.

Despite the laundry list of ways to make money while you sleep above, I won’t pretend that it’s easy to wake up richer than you were the day before. There is no denying that business startup costs – both financial and emotional – can be grueling to bear.

What I will highlight, however, is the silver lining to the storm cloud. Once you’ve seen your business grow to a certain point and find it to have become successful and thriving, you can branch out to find ways to make money while you sleep. While it takes time to create passive income sources or set up financial plans with an advisor, the time investment pays off later when you’re not working, but still making money.

Invest in yourself now to make money while you sleep later.