Do you want to learn how to build wealth? Of course you do. Everyone loves the idea of being wealthy as much as they love a fairytale ending. The two characters destined to end up together walk off hand in hand into the sunset after vanquishing some villain or overcoming some harrowing difficulty. It’s a moving story of perseverance, effort, and patience.

To reach this ending, usually the hero has some unique attribute, possesses an edge others simply lack, or faces circumstances which provide the opportunity to seize the day. But what if someone who has none of these advantages could also rise above? Or better yet, what if this person found a way to walk this path while ignoring the stress suffered by the stereotypical hero?

Let’s explore how an ordinary person can be the hero of his or her own financial future by building wealth through the incredible compounding machine known as the stock market.

Compounding Returns – Your Secret Super Power to Building Wealth

Examining the success of a traditional hero in the stock market, one could presume he or she has some combination of superior intelligence, access to non-public influential information, or an incredible sense of timing. These heroes do exist, but make no mistake that an ordinary investor does not need to possess any of these in great supply to be successful when learning how to start investing money and realizing his or her own financial success.

The most reliable method to growing wealth is utilizing the last real edge in investing: time spent in quality investments. Albert Einstein is widely credited with claiming compounding interest to be the most powerful force in the universe. To see proof, look no further than Warren Buffett, the investing paragon widely recognized as the best investor in modern history.

He relies on compounding for building wealth year after year. Ideally, his investment horizon is forever. That takes conviction to stick with an investment that long. While he is not always accurate with his stock selections, he wisely couples the force of compounding with three major investing criteria:

- Finding an exceptional business that can compete over time;

- Paying only a fair (or discounted) price for the investment; and

- Employing only quality managers who deliver sustainable, industry-leading returns.

Buffett succinctly states of investing, “All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.”

Sure, it sounds simple, but if it’s so easy, why doesn’t everyone do it? Many try to replicate Buffett by using his value investing approach and only invest in durable businesses run by competent managers. Usually where folks go wrong is that second criterion, or not having patience for an investment to perform over time. Staying in an investment requires true conviction, especially when the going gets rough.

However, if our aspiring hero held stock in a company which meets all three of Buffett’s investing requirements and he or she did not need the money, why should there be a sale? In truth, if there isn’t a need for the money and the three requirements are still met, holding the investment is a much wiser decision. This is a hard but important step in learning how to build your wealth.

But Why Pick One Stock When Saving for Retirement?

That’s all well and good, but what if a person feels unsure of selecting the companies which might meet those criteria? When it comes to building wealth in a diversified manner, Buffett has an answer for that as well: investing in index funds. He suggests purchasing a low-cost S&P 500 exchange-traded fund (ETF) (or something similar like VTI, the Vanguard Total Market Index Fund) and reinvesting the dividends across time.

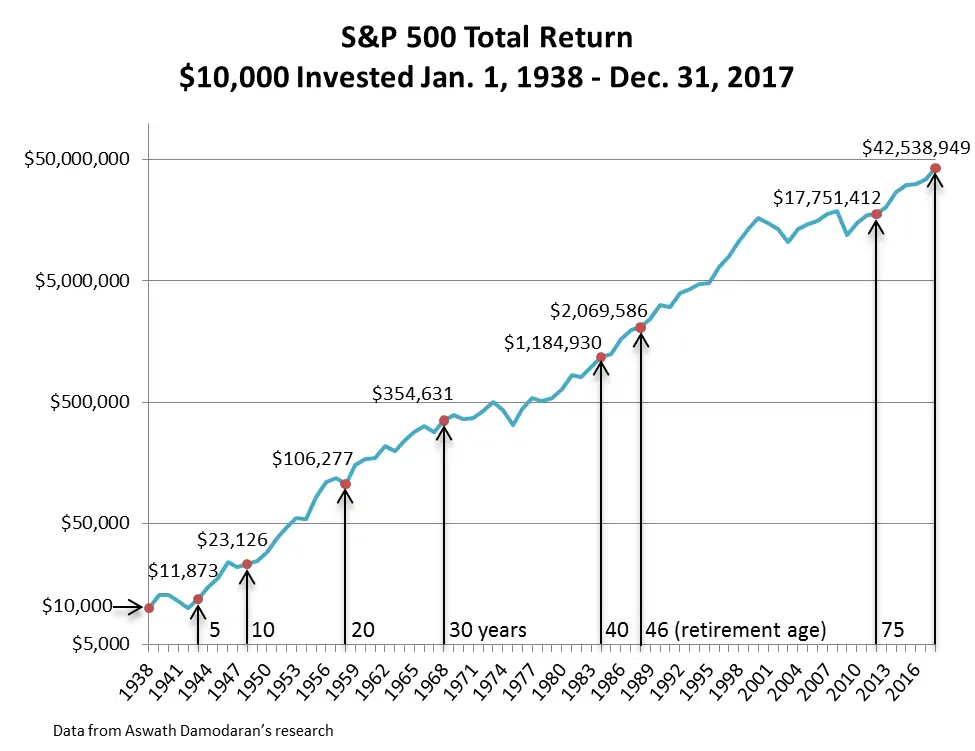

In this scenario, the compounding interest super power still applies. To illustrate, the S&P 500 has averaged an annual total return of just over 11% per year every year from 1938 through 2017. Imagine if you’re just learning how to build wealth in your 20s, this super power could take you far in reaching your financial independence destination. It can also go a great distance towards building generational wealth you can transfer to your heirs way down the road.

To see how this looks with an initial investment of $10,000 at the beginning of 1938, see the chart below (chart assumes reinvestment of dividends, no effects from taxes—assume this is tax-free money growing in a Roth IRA or 401(k)—and no contributions or withdrawals).

The chart shows some fairly remarkable information.

→ Chart Scale

First, you will notice the scale on the left. It is not your typical linear scale with equal spacing between hashes. Instead, it is a logarithmic scale which shows increments increasing by a factor of 10. If you produced the same S&P 500 chart using a typical linear scale, it would produce something very similar to the chart displaying Warren Buffett’s wealth across his lifetime. And even if you cannot manage to amass $10,000 from day one, do not worry.

Several of the best investment apps allow you to invest in small increments without trading commissions. You can learn how to buy fractional shares on micro-investing apps.

You can learn how to build wealth from nothing simply by sticking with small contributions and increasing them across time. The point is to hold these low-cost, diversified investments in the stock market for long periods of time when saving for retirement. The difficulty comes when you’re only learning how to build wealth in your 40’s and you are behind the curve.

→ Past Performance ≠ Future Results

Second, I will point out that while past performance is not necessarily indicative of future results. If a 22-year old would have hypothetically invested $10,000 at the beginning of 1938, set his or her account to reinvest dividends (ignoring tax consequences like in a Roth IRA or 401(k)), this person would have retired (typical 46-year career from age 22 to 68 in today’s economy) with over $2 million in assets.

There’s some wealth creation using compounding returns as your super power and evidence of why low-cost market index funds are great investment ideas for young adults. Even better, imagine how much wealth this person would have created if he or she made regular contributions to this account (made even better by selecting tax-advantaged investments in a traditional or Roth IRA or 401(k) retirement account) or started even earlier (once again, look at Warren’s chart starting at age 14).

You can even manage some healthy returns in real estate, a high-yield investment that provides two types of return: a capital return from price appreciation and serving as an income-generating asset to deliver you passive income. Real estate serves as a great hedge to inflation and also against economic instability.

Needless to say, this person who just stuck with a simple S&P 500 index fund would have done very little and been handsomely rewarded. This person’s wealth would have grown tremendously by doing nothing.

→ Not a Positive Return Every Year

Another takeaway from the chart is seeing that not every year has been positive. In fact, there have been consecutive years during that time which have had significantly negative returns from one year to the next. However, over a sufficient amount of time, stock market returns have always been positive—a great sign for your wealth building.

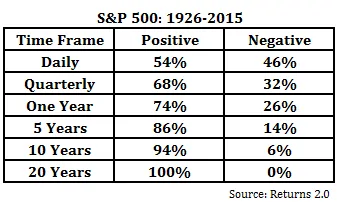

Take a look at the chart below to demonstrate this effect.

Understanding this chart might not be easy at first but by studying it you should notice some telling results. First, you will see the time frame starts with a daily return for the S&P 500 and spans all the way to the performance over a 20-year time horizon.

You will also see that the returns are split into positive and negative returns. Over the 90-year period examined, on average, 54% of daily returns have been positive while 46% have been negative. This shows an average daily bias toward the upside but most importantly, you see that this skews even more in favor of positive returns as time invested increases.

While this does not provide an indication of magnitude, merely that a period which was book-ended by two of the worst economic environments in American history, the S&P 500 still witnessed positive returns. Additionally, this data shows if someone invested at the absolute peak of the market, after 5 years, 86% of the time, the investor would still have experienced a positive return. The probability only increases as more time passes.

This should give people comfort knowing that time and discipline really pay off and why you should always save money in retirement accounts and other investment accounts. If you continue investing, over enough time, your returns will inevitably turn positive. This, along with advancing in your career to make money quicker, taking up side hustles, setting aside money in a savings account for an emergency fund, avoiding credit card debt and student loans (or paying them off as quickly as possible), will allow you to reach your financial goals.

Finally, if you want to diversify your investments further and have no need for liquidity, also consider alternative investments which do not correlate with the stock market but have produced positive returns over long periods of time.

Related: 17 Income-Producing Assets [Invest in Cash Flow]

How to Build Wealth at Any Age: Invest in ETFs, Dabble in Growth Stocks

![How to Build Wealth through Compounding [Grow from Nothing] 2 stock pick investing smartphone app](https://youngandtheinvested.com/wp-content/uploads/young-man-smiling-investing-smartphone-app.webp)

If you are interested in beginning your investing journey and have some money set aside to invest, I’d recommend using a service like Betterment and pursuing a long-term financial goal of wealth creation. This service provides access to low-cost index funds like those from Vanguard, Fidelity and Charles Schwab. All of these fund families have managed to reduce fees to negligible levels, thereby offering more opportunity to mimic the performance of the market.

Alternatively, adding a zero-commission stock trading app like E*Trade to buy and sell individual stocks can add more importance to your investing decisions, potentially leading to better performance over time. That is, of course, not a certainty and where subscribing to top stock research apps and investment research websites come in handy for identifying long-term buy and hold opportunities in growth stocks.

While I strongly support index funds for holding the majority of your assets, holding a portion in growth stocks can add a few additional percentage points to your return, adding substantially to your wealth over time. I’d suggest using a research service like Motley Fool’s Epic to find high-potential growth stocks. The service’s Rule Breakers arm has shown consistent outperformance over time, and I’ve used the service myself to find mega-growth stocks.

Personally, my wife and I use these services for various investing objectives. With our retirement savings, we primarily have individual retirement accounts (IRAs) which invest in a diversified portfolio of the best mutual funds, ETFs, and stocks.

In the past, we subscribed to products from the Motley Fool, which gave us strong growth stock recommendations. The stock picking service continues to outperform and add a bit more to our portfolio each year.

This more scaled up approach to invest both in ETFs with a robo-advisor like Betterment and individual stocks with an investment app like E*Trade takes a lot of the financial worry out of the process of wealth building.

I’d suggest considering use of a robo-advisor to make a higher allocation toward index funds over individual stocks. While the latter has a place in your portfolio, index funds provide a low-cost way to diversify your portfolio. In fact, robo-advisors use scientific research to optimize which index funds you hold and automatically rebalance your holdings across time as you make contributions and withdrawals and assets perform differently.

- The Betterment app gives you the tools, inspiration, and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to set up automatic investing into diversified ETF portfolios.

- You can also invest in diversified preset cryptocurrency portfolios.

- Customize your risk tolerance and investment goals with guidance available at any time.

- By upgrading to Premium, you can unlock unlimited financial guidance from a Certified Financial Planner™.

- Hands-off investment management

- Diversified portfolio that automatically rebalances

- Low-cost investment selection

- Limited investment selections

- Limited crypto diversification in cryptocurrency portfolios

How to Build Wealth By Going from Zero to Hero

Armed with this information, hopefully you will see investing does not need to be as scary as some might think. Held long enough, investments in broad-based stock market index funds produce not only positive returns, but history has shown them to be sizeable.

Starting out at a young age with an initial investment in an S&P 500 ETF (or other preferred market index mutual fund like VTSAX or VFIAX) is a great first step for going from zero to hero when it comes to learning how to build wealth from nothing.

![How to Build Wealth through Compounding [Grow from Nothing] 1 how to build wealth](https://youngandtheinvested.com/wp-content/uploads/2014/09/dollar-currency-money-us-dollar-47344.webp)

![How to Build Wealth through Compounding [Grow from Nothing] 3 Betterment | Investing Made Better](https://youngandtheinvested.com/wp-content/uploads/betterment-logo-color-text.webp)