Discovering, evaluating and choosing which stocks to buy can take a significant amount of time. For this reason, many people choose to use stock picking services, newsletters, subscriptions and sites.

Using these services doesn’t mean you’re off the hook for doing any of your own due diligence, but they can save you a lot of time. Plus, stock picks from an expert stock advisor are likely more accurate than yours if you’re only a novice or intermediate trader.

There are many options for stock advice, so let’s go over what to look for in a stock picking service and the top choices you should consider.

Best Stock Picking Service, Subscription & Sites—Top Picks

|

4.7

|

4.8

|

4.7

|

4.3

|

|

$99 for 1st year; $199 renewal

|

Premium: 7-day free trial, then $269/yr. ($30 discount)* Pro: 1 month for $99, then $2,400/yr.**

|

$299 for 1st year; $499 renewal

|

$449/yr. ($50 discount)*

|

Best Stock Picking Services

1. Motley Fool Stock Advisor (Best for Consistent Market Outperformance)

- Available: Sign up here

- Best Stock Picking Service For: Buy-and-hold growth investors

- Price: Discounted price for first year

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders. Over a decade ago, they advised subscribers to buy companies such as Netflix and Disney, which have been hugely successful.

As a subscriber, you’re granted access to Stock Advisor’s history of recommendations and can see for yourself how it has done over the years.

The Motley Fool Stock Advisor stock subscription service has returned 740% through July 24, 2024, since its inception in February 2002. This number is calculated by averaging the return of all stock recommendations it has made over the past 22 years. Comparatively, the S&P 500 Index has returned 163% over that same time frame.

What to Expect from Motley Fool’s Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Consider signing up for Stock Advisor today.

Read more in our Motley Fool Stock Advisor review.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

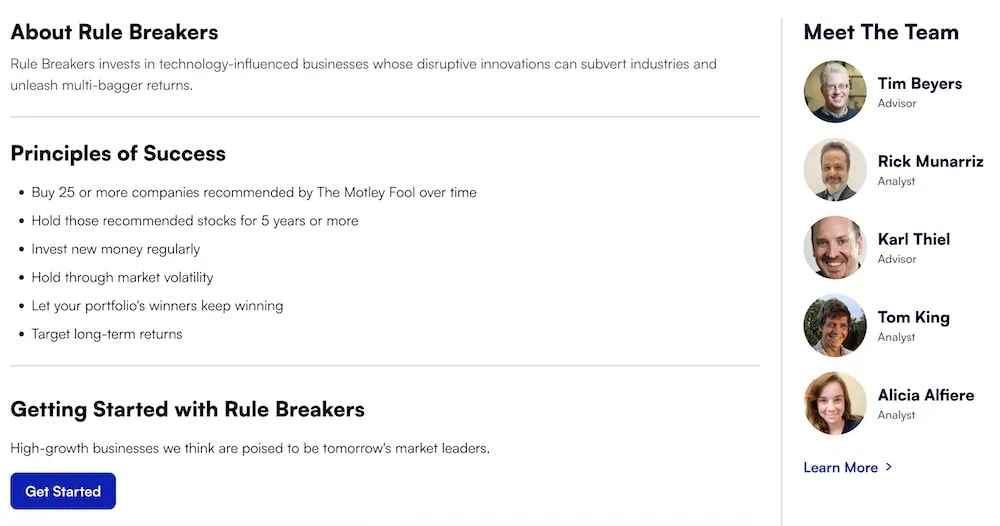

2. Motley Fool Rule Breakers (Best for Long-Term Investors Looking for Growth Stocks)

- Available: Sign up here (must subscribe to Motley Fool Epic to get Rule Breakers)

- Best Stock Picking Service for: Investors who want growth-stock picks

- Price: Discounted price for the first year (shown below)

Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, recommends stocks that the Rule Breakers team believes have massive growth potential. In some cases, these companies are at the forefront of emerging industries—in others, they’re disrupting the status quo in long-established industries.

This technology-centric portfolio isn’t about picking what’s popular now—it’s about looking for stocks that will eventually become the next big thing. That means these Motley Fool picks have the potential to be nauseatingly volatile … but also to rocket higher exponentially.

Rule Breakers’ team has six rules it follows before making stock recommendations to subscribers:

- Only invest in “top dog” companies in an emerging industry. As Motley Fool puts it: “It doesn’t matter if you’re the big player in floppy drives—the industry is falling apart.”

- The company must have a sustainable advantage.

- The company must have strong past price appreciation.

- The company needs to have strong and competent management.

- There must be strong consumer appeal.

- Financial media must overvalue the company.

In other words, Rule Breakers’ team considers a number of factors before it ever recommends a stock to its users. If it’s not a well-run company with a sustainable advantage over its competitors, and it’s not in an emerging industry, it probably won’t get past Rule Breakers’ velvet ropes.

What to expect from Motley Fool’s Rule Breakers

In addition to getting access to the whole Motley Fool Rule Breakers portfolio, you’ll receive one new stock pick every month (complete with full analysis and risk profile) and a ranking of the team’s 10 favorite picks out of Rule Breakers’ hundreds of recommendations.

And because you must subscribe to Epic to get Rule Breakers, you’ll also unlock:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. You can also subscribe to Stock Advisor individually.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.”

- Dividend Investor: Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

- Fool IQ+: An upgraded version of Stock Advisor’s Fool IQ. This tool provides detailed financial data, analysis, and news about all publicly traded, U.S.-listed stocks, as well as advanced charting options.

- GamePlan+: An upgraded version of Stock Advisor’s GamePlan. GamePlan is a hub of financial planning content and tools; GamePlan+ delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can get Epic at a discounted rate for your first year, and it has a 30-day membership-fee-back period. If you’re interested in Rule Breakers, you can learn more in our Epic review or sign up for Epic today.

- Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, puts investors in the heart of innovation, focusing on growth recommendations centered around emerging industries.

- The Motley Fool has discontinued the standalone Rule Breakers service. Now, you can access Rule Breakers as part of Motley Fool's Epic subscription, which also includes Stock Advisor, Hidden Gems, Dividend Investor.

- Through Epic, you will also enjoy access to the Fool IQ+ research and data platform, the GamePlan+ financial planning platform, and the Epic Opportunities podcast.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan+ financial planning content and tools

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Related: Motley Fool Stock Advisor vs Rule Breakers

3. Seeking Alpha (Best Stock Analysis Website for Investment Research + Stock Recommendations)

- Available: Sign up here

- Best Stock Picking Service for: Investment research + stock recommendations

- Price: Premium: 7-day free trial, then $269/yr. ($30 off)* Pro: 1 month for $99, then $2,400/yr.**

Even the free version of Seeking Alpha ranks among the best stock research websites. But we’re going to specifically highlight Seeking Alpha Premium, which caters to intermediate and advanced investors looking for an affordable, all-inclusive, one-stop shop for their investing needs.

Seeking Alpha itself has more than 16,000 active contributors sharing stock analysis. In-house editors vet these pieces before they’re read and discussed by millions of people. Reading different opinions about the same stock helps investors develop their own informed opinions on the likelihood a stock will rise or fall. I recommend this approach when learning how to research stocks.

SA also offers stock research tools, real-time news updates, crowdsourced debates, and market data. Users can create their own portfolio of favorite stocks, see how they perform, and receive email alerts or push notifications about their investments.

However, while the basic SA website has a significant amount of information, some features remain reserved for the Premium Plan and Pro Plan members.

Seeking Alpha Premium

With a Seeking Alpha Premium subscription, you will enjoy unparalleled access with an ad-lite user experience.

SA Premium is an all-in-one investing research and recommendation service that offers insightful analysis, financial news, stock research, and more—all designed to help you make better investing decisions.

Seeking Alpha Premium can help you manage your stock portfolio by putting you in touch with a large investing community—one that can help you research stocks and understand the financial world and provide you with ideas for your next great investment.

Premium plan members can see the ratings of authors whose articles they read. (After all, it’s useful to know whether you’re reading the opinion of someone with a top record, or someone who’s whiffing a lot.) And Premium subscribers unlock analyses from SA-designated “experts.”

Among the other benefits:

- A stock screener that lets you filter by average analyst rating

- Earnings conference call transcripts

- 10 years’ worth of financial statements

- Ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

How Has Seeking Alpha Premium Performed?

SA’s Premium subscription provides full access to the service’s Stock Quant Ratings. These are collections of the best (to the worst)-rated stocks according to three independent investment resources provided on Seeking Alpha’s website. These cross checks and validations come from: (1) the Seeking Alpha Quant Model, (2) independent SA contributors, and (3) Wall Street analysts. The list of best stock recommendations gets further vetted by quantitative and fundamental analysis.

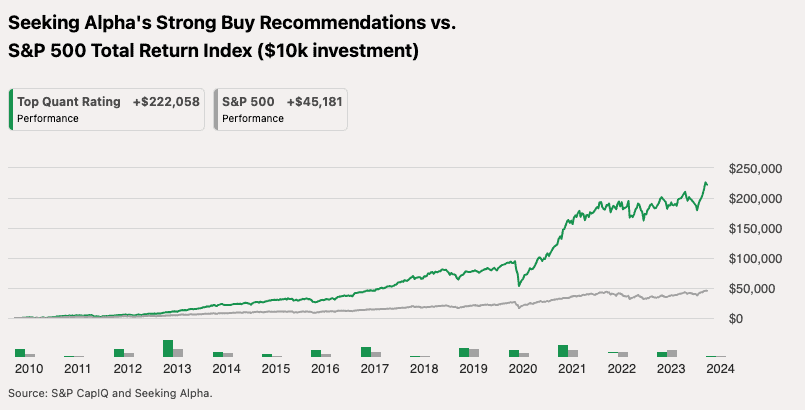

Look at the dramatic market outperformance seen by these quant-fueled “Strong Buy” stock picks as compared to the S&P 500 (total return with dividends reinvested):

Check out our Seeking Alpha Premium review to learn even more.

Seeking Alpha Pro

A Seeking Alpha Pro subscription includes all of the features offered by Seeking Alpha Premium, then packs on additional services, such as:

- The Top Ideas recommendation list

- Exclusive newsletter subscriptions and interviews

- VIP Editorial Concierge

- Seeking Alpha Pro stock screener for investing ideas

- A completely ad-free experience

In short: The Pro tier, which is geared toward professional investors, is more expensive than the Premium tier—but it comes with more goodies.

Why Subscribe to Seeking Alpha?

Seeking Alpha distills relevant financial information for you so you don’t have to—making it easy for anyone interested in self-directed investing to have a chance at outperforming the market.

Consider starting a free trial to take advantage of SA’s Premium services and see if they make sense for your needs.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities.

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations.

- Get access to the world's largest investing community.

- Use Seeking Alpha Premium's Seeking Alpha Stock Ratings to find stocks likely to outperform and make you money.

- Seeking Alpha Premium's proprietary quant records have an impressive track record leading to massive market outperformance.

- Special offer on Premium: New subscribers through our link receive a $30 discount off the price of Seeking Alpha Premium in their first year.*

- Special offer on Pro: New subscribers through our link receive one month of Pro for $99.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Best Seeking Alpha Alternatives [Competitors’ Sites to Consider]

4. Seeking Alpha’s Alpha Picks (Best Data-Driven Stock Recommendation Service)

- Available: Sign up here

- Price: $449/yr. ($50 off)*

Are you looking for a way to beat the market consistently? Seeking Alpha’s Alpha Picks might be a great option to consider.

Alpha Picks is a stock selection service that provides you with two of the best stock picks each month that SA determines have the greatest chance for price upside. They base their selections on fundamentals such as valuation, growth, profitability, and momentum—not hype.

The stock selection process relies on Seeking Alpha’s proprietary, data-driven computer scoring system to screen and recommend stocks for more conservative “buy-and-hold” investors.

And if results from their backtest (run from 2010 to 2022) are any indication, historical simulations of the methodology behind their strategy prove it has worked: Alpha Picks’ recommendations outperformed the S&P 500 Index by 180 percentage points (+470% for SA vs. +290% for the S&P 500).

A bit more detail about how this works: Alpha Picks relies on the existing Seeking Alpha Quant model available to Seeking Alpha Premium and Pro users, but with a bit of modification. Namely, all recommendations must meet the following criteria:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Market cap greater than $500 million

- Stock price greater than $10

- Is a publicly traded common stock (no American Depository Receipts [ADRs])

- Be the highest-rated stock at the time of selection that has not been previously recommended within the past year (Alpha Picks releases one pick at the start of the month, another in the middle).

If you sign up for the service, you can expect the following:

- Two long-term stock picks to buy and hold for at least two years, delivered every month

- Detailed explanations from Seeking Alpha behind why they rate each stock pick so highly

- Notifications when a recommendation changes

- Regular updates on current Buy recommendations

The service, designed for busy professionals interested in building a portfolio that outpaces the market but without the time to commit to finding these opportunities, is worth considering. If you’re interested, you can sign up for a discounted first-year price.

- Seeking Alpha's Alpha Picks is a stock picking service designed for busy professionals who might not have the time needed to select stocks for their own portfolio.

- Using a proprietary computer-scoring model, Alpha Picks makes "buy-and-hold" picks that last at least two years.

- Since its launch in 2022, Alpha Picks has delivered market-beating performance, with a remarkable 180% increase compared to the S&P 500's 61%.

- Rigorous backtesting also has shown Alpha Picks' methodology would have strongly outperformed the S&P 500 index between 2010 and 2022 (+470% vs. +290%).

- Special offer: Receive $50 off the first year's subscription price by signing up via our link.*

- Data-driven, computer-generated stock selection process

- Avoids human bias

- Strong backtest performance vs. S&P 500 index

- Competitive price point

- Not enough actual performance data

- No frills, just stock picks and info about them

Related: Best Investing Research & Stock Analysis Websites

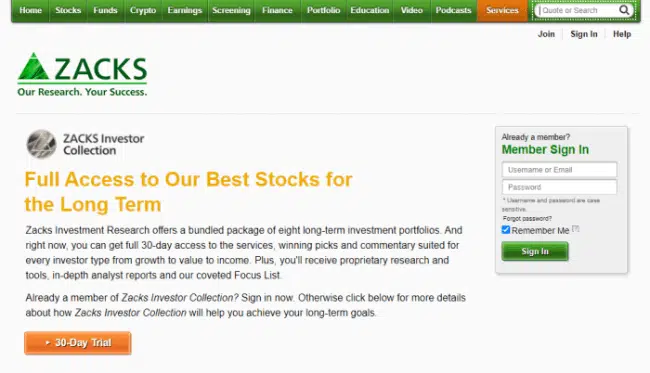

5. Zacks Investment Research (Best for Fundamental Analysis and Earnings Activity)

- Available: Sign up here

- Best for: Fundamental investors

- Price: Premium: $249/yr.

Zacks Investment Research also sits among the best stock market research websites, delivering a subscription-based service that you can use to improve your own due diligence or lean on for stock selection.

The investment research site has a free service that provides general market data and information about the financial markets and business news. One of its popular features is the Bull and Bear of the Day, where the service selects two stocks and rates them as a Bull (strong buy) or Bear (strong sell) pick.

However, the Zacks Premium service unlocks access to:

- The Zacks #1 Rank List to develop your investment strategies

- Focus List portfolio of long-term stocks

- Custom stock screener

- Equity research reports and more

The Portfolio Tracker provides constant monitoring of your stocks to help you decide if you should buy, hold, or sell.

If you want even more firepower, Zacks Investor Collection provides access to Zacks Premium and other services, including ETF Investor and Stocks Under $10. You can try the service for 30 days for just $1. After that, it’s $59/mo. or discounted to $495/yr. if paid upfront.

Investors who desire even more information can get Zacks Ultimate. This plan provides even more exclusive services, including Black Box Trader, Blockchain Innovators, Marijuana Innovators, Options Trader, and more. After a $1 30-day trial, Zacks Ultimate costs $299 per month.

- Zacks Investment Research offers several research products to provide the information subscribers want to know about market opportunities

- Features include: Zacks #1 Rank List, Industry Rank List, Premium Screens, Focus List, Research Reports, Earnings ESP Filter, Zacks #5 Rank List

Related: Zacks vs Motley Fool: Which Stock Picking Service is Better?

6. AAII Dividend Investing (Best Income Investing Stock Picking Subscription)

- Available: Sign up here

- Best for: Dividend growth investors

- Price: $2 full trial for 30 days; $199 for 1 year, $359 for 2 years, $399 for 3 years

AAII’s Dividend Investing does all the income investment due diligence work for you. With their proprietary stock-screening and picking process, AAII targets stocks that combine yield and asset quality.

The service also analyzes the company’s management team to make sure it is committed to dividend payouts — not just for today but for tomorrow as well.

Details:

– Target portfolio includes a mix of both GICS Sector (Consumer Staples; Financials) and Geographical Exposure (US Markets) with an emphasis on equities from sectors associated with healthy cash flows such as Utilities or Health Care Services

– AAII’s model Dividend Investing portfolio is managed using AAII’s best practices in order to minimize risk while generating higher income potential

Start your full 30-day trial for just $2 and see if it is a worthwhile income investment subscription for you.

- Use AAII's Dividend Investing newsletter to build a portfolio of dividend-growth stocks that yield more than the market average.

- DI model portfolio stocks are selected based on earnings and dividend histories and projections, cash flow generation, valuation, and more.

- Also enjoy weekly commentary, monthly portfolio reports, AMAs with DI's lead analyst, and more.

- Service unlocks access to other AAII features, including a monthly AAII Journal, weekly stock ideas, and entry into an interactive online community.

Related: Best Stock and Investment Newsletters

7. Mindful Trader (Best Stock Picking Service for Swing Trading)

- Available: Sign up here

- Best for: Swing traders

- Price: $47/mo

Mindful Trader provides members with stock trade alerts over email and text messages. Users receive around five to fifteen trade alerts each week. All recommendations come based on a data-driven approach. Members have access to the creator’s watchlist, his live positions shown in the member dashboard and historical data with the trades conducted since inception.

You can use this paid swing trading stock picking service to take advantage of short-term movements in the market. The service provides trade windows and clear guidance on when to open and or close positions to follow the service’s swing trading methodology.

The price is $47 per month and cancelable at any time.

- Use Mindful Trader's statistical edge to earn alpha in the market and create long-term wealth

- Data-driven trade strategies that rely on historical probabilities to identify swing trade alerts

- Useful for easy-to-follow trade alerts in real-time

8. Tim Alerts (Best for Penny Stock Day Traders)

- Available: Sign up here

- Best for: Penny stock day traders

- Price: $697 per year; $1,297 per year for Pennystocking Silver

Penny stocks (typically considered to be any stock that trades for under $1) have a certain appeal because of their low price point and the hopes of making big gains quickly.

However, they’re among the riskiest investments you can make. Most don’t trade on major exchanges, and thus don’t have many of the requirements that protect investors, such as having to regularly report corporate financials.

If an investor is going to delve into penny stocks, then, they’ll need an educated guide.

Tim Sykes rose to fame by taking around $12,000 in bar mitzvah financial gift money and day trading it on penny stocks. By the time he’d graduated college, he’d become a self-made millionaire with the intent of teaching others how to replicate his success.

Since then, Sykes has created a stock picking service in addition to providing financial services, educational content, and training to retail investors.

Sykes sends his Tim’s Alerts newsletters with penny stock picks every trading day around 8 a.m. EST (5 a.m. PST) with a set of stock watchlists for the day. You can receive this by email, SMS or even push notifications in real time throughout the trading day.

Subscribers also get live chat room access with a paired proprietary trading app. And they can access a library of more than 7,000 videos to train you on how to trade penny stocks and potentially replicate Tim’s success.

- Use Tim Sykes' weekly videos to become a better penny stock trader.

- Pairs with real-time alerts or just a standalone alerts service.

- Gain chatroom access, daily stock watchlists, push, email and SMS alerts and more.

What Is a Stock Picking Service, Advisor, Subscription or Site?

Stock picking services give their subscribers specific stock recommendations. The services compile and analyze extensive stock data sets such as quarterly earnings, market share and more. By analyzing and providing suggestions of what to buy, they take much of the work out of strategic stock buying.

Often, the terms “stock picking service,” “stock picking subscription,” and “stock picking site” are used interchangeably. Newsletter often implies emails or physical mail, such as a magazine or newspaper. Subscriptions may range from smartphone apps, to private website access, or also refer to newsletters. Focus less on the terms and more on what different services offer.

Stock picking services and newsletters provide general advice, not personalized advice for individual subscribers. If you want individualized advice, seek out a financial advisor. Materials should be impartial, rather than promotional.

Finally, these services shouldn’t make guarantees that any stock will rise.

What Makes a Good Stock Picking Service or Advisor?

Take into account the following factors when choosing a stock picking service.

→ Proven Track Record.

Choose a stock picking service that outperforms across long periods. You want a service that chooses investments that earn a great return, meaning better than similar companies or a comparable benchmark index. Stocks fluctuate, so it’s essential they choose growth stocks that continue to perform over time.

Transparency is key, both in how the stock picking service works and how they are choosing stocks. Avoid any services with hidden fees or those that seem to have secret sponsors. The stock picking services shouldn’t just be telling you what stocks are likely to rise, but why they are likely to rise as well.

Recommendations should be backed up with facts. Services should mention actionable signals, which tell us why a price will move.

→ Replicable Trading Capabilities.

The recommendations made must be replicable by you. Suggested stocks shouldn’t be ones only available to institutional investors and you should be able to pay roughly the same prices as the stock picking service. Otherwise, returns won’t be the same.

Consider an Initial Public Offering (IPO), which is a stock that recently became publicly traded or will be shortly. Institutional investors may have access to the stock at a lower price right before it hits the market. If so, they will have superior overall returns than someone who buys it a few days later at a higher price.

→ Low / Worth the Cost.

At minimum, a good investment service should pay for itself. You should recoup your subscription costs based on the recommendations the stock picking service provides. Ideally, you make a profit and the higher the profit the better. The lower the price of the stock picking service, the greater your overall profit margin.

Quality of recommendations is more important than cost, but if recommendation quality is equal, the service that costs less will net you more. This lets you buy low and sell high with profit in mind.

→ Educational.

In addition to sending investment picks, the best stock picking services also provide educational resources that teach you how to research and analyze stocks on your own. With the right educational materials, you won’t have to be completely reliant on a stock advisor and will be capable of doing your own research.

It’s unlikely you have the funds to purchase every recommendation. They provide a shortlist of investment picks and you can teach yourself how to be even more selective.

Should You Buy Recommendations From These Services?

If you have serious interest in investing with these stock picking services, I suggest starting small and cautiously with their recommendations.

Consider following along with a paper trading account available through free stock apps. These accounts allow you to place trades without placing actual trades and putting your money at risk. Apps like Webull, a trading app like Robinhood, offer this functionality for free.

By using a free paper trading service, you can test the recommendations of the stock picking service and how they perform relative to the market.

Always Perform Your Own Due Diligence

I recommend several services here because you should never let one single source represent your stock investing choices. If you find an interesting stock pick, research it more on your own.

Only after performing your own due diligence should you invest. Consider pairing an investment research service like Stock Rover to your subscription to get more in-depth and objective views of the stocks recommended.

Best Stock Picking Services, Newsletters, Subscriptions & Sites

The best stock picking service for you will depend on whether you’re a day trader or long-term investor, your level of trading expertise, and your budget for services.

You aren’t limited to one service. It’s common for investors to choose multiple services to fit different needs. If you’re unsure which service(s) is best for you, take advantage of free trial offers.

No matter what service you use, always remember to do your due diligence after reading stock recommendations.