The oldest rule for thinking about how to start investing money is also the simplest: “Buy low, sell high.” While it seems blindingly obvious and begs the question of why anyone would want to do anything else when investing, you might be surprised how hard it is to put into practice.

Investing is a discipline which plays not only on astute analysis and remarkable luck but also on people’s behavioral responses. Holding onto your stocks during periods of intense stock market volatility takes a lot of courage and isn’t what the human brain is wired to withstand.

But how do you approach investing if you don’t have a background in it? Without much prior experience, it’s tough to say how to invest your money. There’s an ocean of information out there and sorting through it requires deliberate, thoughtful reflection when piecing together what you’ve read.

When it comes to growing your wealth and working toward financial independence, investing is an important tool.

Through investing, you can buy assets which, hopefully, grow in value, whether it is real estate like your home, a tax-advantaged investment (e.g., retirement account, health savings account), stocks, bonds or alternative investments.

All of these, when balanced appropriately and included in an investment portfolio, represent the best investments for young adults.

Let’s walk through some simple steps on how to begin to invest your money.

Table of Contents

First, Invest in Yourself

Recently, I attended a wedding with my wife and her family where my brother-in-law approached me with a conversation about how to invest money.

He wanted to know how he could replicate the performance seen by the world’s greatest investors and learn how to start investing with little money. Specifically, he yearned to turn a small sum of money into an account balance with two commas in quick fashion.

Boy, if only I knew the sure-fire way to make that path my own reality, we wouldn’t have driven to the wedding in a rented mid-tier subcompact.

I cautioned him that those investors are truly gifted and the exception to the norm. While it is important for him to know how to start investing young, I told him the common trait these legendary financiers share: following a systematic and disciplined approach to investing.

Further, they learned how to invest in yourself and gained a true appreciation for studying the stock market and the players working in it. These high income skills have yielded them significant returns over time.

I followed this with saying regardless of investing style, time frame, or philosophy, these great investors all have discipline, transact based on logical, informed thinking and do not let emotions drive their decision-making.

These are the most important elements required for investing success.

The investing styles are merely a means to an end and are developed later. Any investor starting out should focus on these core principles and learn to stick to them during times of good and bad.

How to Start Investing Your Money: Develop Your Investing Approach

As I explained this to my brother-in-law, I could see his disappointment in my not knowing any shortcuts to overnight investing success.

However, we launched into a discussion around how he could develop his own disciplined investing approach by first becoming a student of markets.

Knowing that this discussion could become overly cumbersome in just one conversation, I decided to share only introductory steps, which I outline below.

Investing isn’t easy but, at the same time, it shouldn’t be seen as a frightening endeavor. If done wisely and consistently, investing can separate you from retiring comfortably at a reasonable age and working into your golden years out of necessity.

We all want a comfortable retirement, so why shouldn’t we make smart decisions to get there?

With that thinking, I will do the same here. Short of a formal education in finance, my five high-level steps for gaining familiarity with investing in the stock market are as follows:

1. Read a Lot About the Stock Market

Sounds logical, right? You may be surprised by how many people I’ve heard say they got into a stock simply because so-and-so recommended it.

This person winds up not doing a lick of due diligence before investing and often doesn’t know what was happening in the stock market, nor anything about the company.

To counteract this, I suggest first beginning by reading reputable stock market investment websites that discuss markets (e.g., stock news publications).

As you read more, I really suggest approaching every article with a heavy dose of skepticism.

This will make you more likely to piece together content from multiple sources and form your own thinking about markets and the companies in them.

As an exercise, take a moment to read this 2018 U.S.-China trade war article about the earnings estimates for public companies. After you’ve read it, what were the main, salient points that stood out to you? I found the following to be most important:

- Many investors seem to think lackluster stock market movement during this quarter’s earnings announcements indicates peaking corporate profits. When companies announce record earnings and the stock market barely moves, it must mean expectations were high and future earnings don’t look to get any better.

- Analysts, or those people who follow stocks and publish opinions on them, seem to disagree and are increasing their profit projections at the largest rate in 6 years. This is where the skepticism should come into play. This conflict means someone is wrong, but who? Perhaps both are right and yet both are wrong. The truth likely lies somewhere in between.

- A growing economy and corporate tax reform have benefited companies but trade war activity makes for an uncertain outlook. To illustrate uncertainty, reporting companies have seen the most volatile trading in two years immediately after announcing earnings results. However, it appears this trading reaction could be the result of poor understanding of the effects of the recent tax reform legislation and clouds the visibility for accurately forecasting future earnings. So the volatility merely highlights poor forecasting abilities, not necessarily anything indicative of market direction.

- A lot of positive developments exist to push the stock market higher but looming risks serve to temper optimism usually present with such strong earnings growth.

- Bottom line: there doesn’t appear to be a strong case for a plummeting stock market but neither for a sustained rally.

As you read more pieces like this, reflect after each one and begin to piece together content from what you’ve read. Building this understanding won’t happen overnight.

2. Start Looking into Individual Companies

Naturally, you will come across individual companies. You should identify companies consistently performing well or making strides to improve.

I recommend starting by researching five companies you admire (preferably in different industries) and cultivating ideas about the strategies of each firm, their competitive advantages, and the core value they provide.

If you don’t believe any of these items to be durable over time, I would suggest moving on. You should recognize:

- what sets these companies apart from their peers,

- the prospects for the markets in which they operate (e.g., growing market vs. declining market), and

- how the stock market values them

The last item remains particularly important as the asset doesn’t so much matter but the price paid for it does. You can buy the most dogged companies for a fantastic price and earn a positive return while you can buy the most overpriced fantastic companies and lose money.

The point is you should pay considerable attention to the price companies trade for as this will be the greatest predictor of your potential returns: pay too much and risk losing money or pay too little and extract some value the stock market didn’t assign the stock.

As far as the underlying businesses themselves, you should cast aside companies if you uncover something you don’t like. Don’t let sunk costs guide your thinking.

Ultimately, a stock represents a piece of a company, so sustainable profitability is an important factor.

Companies who continually produce losses, by definition, cannot survive without endless investor appetite for losses (a rare occurrence as long-term investors are in the business of buying profitable companies).

You really want to assess how profitable these companies can be, because before you decide how much to pay for a stock, you need to understand how much money that company makes.

If the company makes a lot of money consistently, you will likely have to pay more to acquire the stock.

How to Find Individual Companies Worth Buying

The best stock picking services consider all of the variables discussed above when making their selections to subscribers. Have a look at two Motley Fool stock research services subscribed to by millions of investors.

Either subscription makes for a great short-listing system to find good stocks worth investigating yourself—and possibly even buying for your portfolio for the long-term. Both services recommend buying and holding for no less than five years, departing with some of the other swing trade alerts services people use to find short-term profit potential in the stock market.

Motley Fool Stock Advisor: Best for Buy-and-Hold Investors

- Available: Sign up here

- Best for: Buy-and-hold growth investors

- Price: Discounted rate for the first year (shown below)

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders.

Stock Advisor is an online investment service that espouses my favorite, plain-vanilla trading style: buy-and-hold. Fool analysts provide recommendations for both “Steady Eddies” and potential high-flying stocks with sound fundamentals—an ideal combination of holdings if you want to generate strong performance without risking extremely high volatility.

Importantly, Stock Advisor doesn’t just give you a list of tickers and call it a day—it also provides investment rationales and research for each pick to help educate you before you buy.

And now, Stock Advisor membership provides access to Motley Fool GamePlan: a hub for retirement and financial planning content and tools to improve not just your portfolio, but your entire financial life. GamePlan outlines three portfolio strategies—Cautious, Moderate, and Aggressive—with picks for mutual funds, exchange-traded funds (ETFs), and stocks, including allocation recommendations. It also hosts a library of content about financial planning, including topics such as everyday finances, health and wellness, and estate planning. And it boasts tools including a variety of calculators, such as credit card interest and mortgage calculators.

How has Motley Fool Stock Advisor performed?

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has returned 740% through July 24, 2024, since its inception in February 2002. This number is calculated by averaging the return of all stock recommendations it has made over the past 22 years. Comparatively, the S&P 500 Index has returned 163% over that same time frame.

What to expect from Motley Fool Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Read more in our Motley Fool Stock Advisor review, or sign up for Stock Advisor today.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

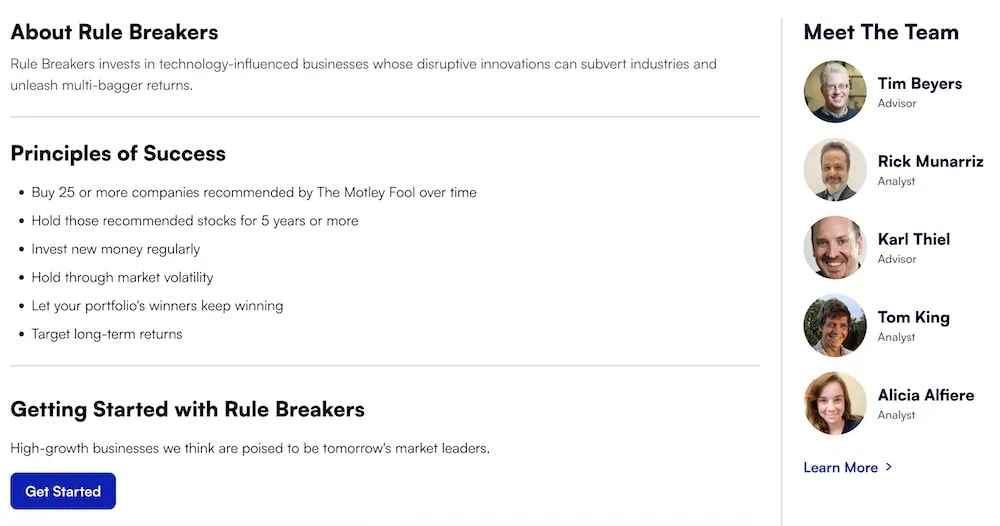

Motley Fool Rule Breakers (Now Part of Epic): Best for Long-Term Investors Looking for Growth Stocks

- Available: Sign up here (must subscribe to Motley Fool Epic to get Rule Breakers)

- Best for: Investors who want growth-stock picks

- Price: Discounted price for the first year (shown below)

Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, recommends stocks that the Rule Breakers team believes have massive growth potential. In some cases, these companies are at the forefront of emerging industries—in others, they’re disrupting the status quo in long-established industries.

This technology-centric portfolio isn’t about picking what’s popular now—it’s about looking for stocks that will eventually become the next big thing. That means these Motley Fool picks have the potential to be nauseatingly volatile … but also to rocket higher exponentially.

Rule Breakers’ team has six rules it follows before making stock recommendations to subscribers:

- Only invest in “top dog” companies in an emerging industry. As Motley Fool puts it: “It doesn’t matter if you’re the big player in floppy drives—the industry is falling apart.”

- The company must have a sustainable advantage.

- The company must have strong past price appreciation.

- The company needs to have strong and competent management.

- There must be strong consumer appeal.

- Financial media must overvalue the company.

In other words, Rule Breakers’ team considers a number of factors before it ever recommends a stock to its users. If it’s not a well-run company with a sustainable advantage over its competitors, and it’s not in an emerging industry, it probably won’t get past Rule Breakers’ velvet ropes.

What to expect from Motley Fool’s Rule Breakers

In addition to getting access to the whole Motley Fool Rule Breakers portfolio, you’ll receive one new stock pick every month (complete with full analysis and risk profile) and a ranking of the team’s 10 favorite picks out of Rule Breakers’ hundreds of recommendations.

And because you must subscribe to Epic to get Rule Breakers, you’ll also unlock:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. You can also subscribe to Stock Advisor individually.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.”

- Dividend Investor: Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

- Fool IQ+: An upgraded version of Stock Advisor’s Fool IQ. This tool provides detailed financial data, analysis, and news about all publicly traded, U.S.-listed stocks, as well as advanced charting options.

- GamePlan+: An upgraded version of Stock Advisor’s GamePlan. GamePlan is a hub of financial planning content and tools; GamePlan+ delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can get Epic at a discounted rate for your first year, and it has a 30-day membership-fee-back period. If you’re interested in Rule Breakers, you can learn more in our Epic review or sign up for Epic today.

- Motley Fool Rule Breakers, which is now an exclusive part of Motley Fool Epic, puts investors in the heart of innovation, focusing on growth recommendations centered around emerging industries.

- The Motley Fool has discontinued the standalone Rule Breakers service. Now, you can access Rule Breakers as part of Motley Fool's Epic subscription, which also includes Stock Advisor, Hidden Gems, Dividend Investor.

- Through Epic, you will also enjoy access to the Fool IQ+ research and data platform, the GamePlan+ financial planning platform, and the Epic Opportunities podcast.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan+ financial planning content and tools

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Related: 7 Best Seeking Alpha Alternatives [Competitors’ Sites to Use]

3. Consider Investing in Index Funds and Mutual Funds

Investing is hard. It’s more art than exact science. By writing this investing step-by-step guide, my goal is not to simplify it.

In fact, what I want to convey as clearly as possible is just how difficult it is to invest in individual stocks.

Investing is so much more than following some rules of thumb. Getting an edge is difficult, so you shouldn’t develop irrational self-confidence and think you have an investing edge when you really don’t.

Usually, being humble and saying to yourself that you don’t really know can be great to steady your decision-making.

If you don’t have confidence in selecting individual companies to outperform the market, another strategy is to invest in index funds like exchange traded funds (ETFs), mutual funds or some combination of the best target date funds.

What is an Exchange-Traded Fund (ETF)?

An ETF is a marketable instrument that tracks an index or collection of assets. ETFs function like stocks, which you can buy and sell at any time on the market.

ETF prices fluctuate based on supply and demand, just like any security. ETFs are a type of investment that can be passive or active.

Passive ETF investments automatically go to work for you by purchasing a basket of underlying assets in an index as you invest your dollars, while active ETFs give investors options with custom management and even exposure to indexes as well.

ETFs don’t need to track stock market indices—they may also invest in specific industries or sectors.

Because of the various investment options available through passive and active ETFs, holders face varying charges for having their funds managed by ETF managers.

Management, administrative, and operational costs are common expenses for the fund.

What is a Mutual Fund?

Mutual funds are a great way for investors to diversify their portfolio and receive the benefits of professional management. When many people put their money together and pool it, they can buy a common portfolio of assets to achieve the mutual fund’s objective.

A mutual fund is a collection of investments, typically stocks and bonds. Many investors come together by pooling their money to invest in this group instead of purchasing them separately or through an investment advisor, stock brokerage or other means of purchasing investments.

They can be managed by either a professional investing team or passively as an index fund. Active funds tend to have more input from the manager while passive ones have less reliance on managers’ decisions because the investments track an index.

Unlike ETFs, investors can select different mutual funds with unique features and operational fees.

Mutual funds also come in two varieties: closed-ended or open-ended.

- Closed-ended mutual funds: Closed-ended mutual funds work in a similar manner as ETFs by issuing a fixed number of shares through an initial public offering. From there, these closed-ended mutual fund shares trade openly on the market like stocks or ETFs.

- Open-ended mutual funds: Open-ended mutual funds differ by offering new shares to the investors who place money with the mutual fund or redeeming them from investors who sell their shares back to the mutual fund.

Are ETFs and Mutual Funds the Best Way to Invest Your Money?

My preferred investing strategy involves investing in low-cost index fund ETFs or mutual funds for the long-term through brokerages which don’t charge trading commissions like M1 Finance or Public.com.

You can also choose to invest in index funds on Robinhood or many of the best Robinhood alternatives, all of which come with their strengths and weaknesses.

Index funds are the best way to invest your money if you aren’t sure of how best to invest in stocks. They allow you to invest your money in the stock market without it being extremely hard.

So, if you have little experience or confidence in your own judgement, index funds through ETFs and mutual funds are great options.

Related: Best Investments for Kids

What is Diversification?

It’s also advisable to hold some of the best ETFs and mutual funds for diversification purposes.

Diversification is a way to invest your money in the stocks of multiple companies at once, reducing your direct risk or exposure to any one company’s actions or profit potential.

As an example of diversification and how it can reduce uncertainty and come in alignment with your risk tolerance, consider investing in stocks of multiple companies versus in just one.

You could invest your money among the top 100 best companies in the market or choose to invest in 5 companies grabbing headlines.

The former is what I recommend as it provides you exposure across many more industries and makes for a diversified portfolio.

By limiting your concentration in only a handful of stocks and opting for a broader portfolio, when one company underperforms, it has less drag on your returns. As a counterpoint, if one stock outperforms, your broadly-diversified portfolio will lag behind.

On the whole, this should converge to average annual expected market returns, minimizing the volatility and hopefully orienting toward a steadier return upward in the long-term.

While no returns are guaranteed and past performance isn’t a predictor of the future, with time, choosing to invest your money in stocks should perform well in a diversified portfolio.

How to Start Investing Money

Many options exist for starting to invest money—even with small amounts—thanks to many new brokerages on the market.

Several offer fractional shares to invest your money, meaning instead of forking over $150 for a single share of Google (GOOGL), you can purchase a smaller fraction in line with the amount of money you have to invest and your desired investment.

Additionally, the best brokers and robo-advisors also avoid charging trading commissions for your investments, meaning you can contribute in increments as small as you can afford.

This is of particular importance to Millennials and Gen-Zers who may not have significant sums of money to invest all at once, but rather have small amounts of cash which come available after accounting for all of the expenses in the monthly budget.

Read below for some of the most popular financial apps for young adults or anyone looking at starting to invest your money.

1. Public.com: Best Free Stock App for Beginners to Invest Money

- Available via desktop, Apple iOS and Android App on Google Play

- Best For: New investors with limited capital

- Sign up here

Public.com is a commission-free investing app that targets Millennials and Gen-Zers who have attuned their senses to social media. These age groups want to align their investing with their social preferences as well as keep good company to socialize and learn from others.

The stock investing app boasts an increasingly-common feature geared toward younger investors who may not have enough money to buy some higher cost shares at one time: fractional investing.

This product feature plays on the company’s mission of making the stock market an inclusive, educational investment opportunity which can be fun. They accomplish the latter point by allowing people to invest alongside friends and other well-regarded investors.

Much like social media platforms who provide the standard blue check mark logo to verify public figures, Public.com provides visibility into trade activity and other insights these verified investors wish to provide to the Public.com community.

Read more in our Public.com investing app review.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Earn a 5.3% yield with Public.com's Treasury Account, which allows you to earn state- and local-tax-exempt income from T-bills.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Fractional shares

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

Related: 8 Best Fractional Share Brokerages to Buy Partial Stocks & ETFs

2. M1 Finance: Best Way to Invest Money Automatically

- Available: Sign up here

- Price: Free to open account; no commissions on stock/ETF trades

For those looking to fund an investment account with on-going contributions and letting the robo-advisor handle all of the decisions, you should look at M1 Finance.

This service provides the option to invest in “pies,” or mini portfolios which have underlying stock and ETF selections to create a diversified portfolio.

The service allows you to create your own “pies” or rely on over 80 expertly-created portfolios to align your investment with your stated financial objectives.

Additionally, M1 Finance provides automatic rebalancing between funds to mitigate your asset allocation straying too far from the optimum selection.

The service does this as you contribute money, make withdrawals and over time if you do nothing. Thus makes M1 Finance one of the best investing apps for beginners, in my opinion.

Kids can even use this money app to start investing early with the help of their parents managing their investments through a custodial account. Index funds are the best investments for a teenager to learn how to start investing.

My wife and I use a robo-advisor to handle all of our individual retirement account (IRA) investments because it takes the guesswork out of deciding which stocks or index fund ETFs to buy.

This automated diversification and fee minimization aligns with our investing philosophy and allows us to focus on attention elsewhere while our money works for us in the background.

Read more in our M1 Finance review.

- M1's Smart Money Management gives you choice and control of how you want to invest automatically, borrow, and spend your money—with available high-yield checking and low borrowing rates.

- Includes an FDIC-insured checking account and an M1 Visa debit card that delivers 1% cash back.

- Unlock perks including higher cash-back rewards on the M1 Owner's Rewards Credit Card, 4.25% APY from high-yield savings, ATM reimbursements, and 0% international fees.

- Invest in stocks, ETFs, and cryptocurrencies.

- Robo-advisor with self-directed investing capability

- Attractive cash-back and APY opportunities

- Doesn't support mutual funds

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

3. Acorns: Best Way to Invest Money through Your Spare Change

- Available via Apple iOS and Google Android

- Best For: Beginning Investors looking for a complete personal finance solution

- Sign up here

Acorns is a robo-advisor-like service that helps minors and young adults start to invest money. With enough time, your money should grow into a large portfolio.

When you set up an account, you answer questions related to your risk tolerance, financial goals and how much money you have to invest in stocks and bonds in your Acorns brokerage account. Consider these questions akin to what a financial advisor might ask when setting up an account to manage. Based on your answers, it makes recommendations for investment vehicles like stocks, bonds and real estate to create a diversified investment portfolio.

The service doesn’t charge money to make trades on your behalf, but it does charge an account fee depending on the services you select for your account. These subscriptions provide various services designed to help young adults achieve their goals, making Acorns one of the best money apps for kids. Their plans are as follows:

- Acorns Personal ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Personal Plus ($6 per month): Everything in Acorns Personal (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Premium ($12 per month): Everything in Acorns Personal Plus, plus Acorns Early, which allows you to open a custodial investment account for your child so you can begin investing for them while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

Personal Plus and Premium subscribers also get access to a powerful way to accelerate their savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Personal Plus and Premium subscribers, respectively.

Learn more in our Acorns review.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts with a 1% match.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions.

- Special offer: Get $20 to start*.

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Silver and Gold)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Gold for any self-directed investing options

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

4. Take Action

Once you’ve gotten a decent handle on the overall market’s activity and analyzed a set of attractively-valued companies you think stand out from the rest, it’s your time to pull the trigger.

Alternatively, as I mentioned in step 3, consider investing in low-cost index fund exchange traded funds through a robo-advisor like M1 Finance, a self-directed broker like Public or a micro-investing app like Acorns.

5. Continue Following the Companies and the Stock Market

By doing your due diligence, you will be able to follow these companies and see if they continue to perform as you expect. If a company makes a decision you don’t agree with or think will adversely impact its value going forward, it might be a good idea to cut your losses short and move on.

Investing well can produce very rewarding experiences you share with those you love. For me, it allowed me to buy my first home and now to grow my assets enough to purchase my next one together with my wife to start our family.

In general, developing your own disciplined investing approach based on rational, informed decision-making can lead to financial peace of mind.

Learning how to invest wisely at a young age will have you maximize your youth by allowing compounding to work to your benefit and see how to build wealth.

Do yourself a favor and invest in stocks by following these 5 steps on how to start investing money.

Finishing the conversation with my brother-in-law, as I laid out this process to meet his interest in becoming a student of markets, I stressed how these are the first steps to developing a disciplined investing approach.

Taking the mindset that informed investing can lead to real gains, I saw he wanted to jump in and work toward developing his own investing approach and investment plan.

He may not become the next Warren Buffett but following through will allow him to have his (wedding) cake, and eat it too.

How to Invest in Stocks for Beginners with Little Money

Below, read more questions and answers about how to invest money in stocks, including the considerations you should make for the time to start investing in the stock market.

When Should I Start Investing in the Stock Market?

Step 1: Investing in Stocks is Long-Term; Focus First on Today’s Needs

First, you shouldn’t save anything for the long-term if you’ve got needs that must be addressed today.

- Behind on bills?

- Need to eliminate costly credit card debt?

- Have to fund an emergency savings fund to guard against backsliding into debt even further?

Don’t let these expenses get out of hand. Instead, you need to build a solid financial rock upon which you can grow.

- Establish an emergency fund: This entails saving a minimum of 3-6 months (or even 12) of your on-going monthly expenses. While this might sound like a lot if you’ve got nothing currently, start small with $100, then $1,000 and eventually $5,000. Make sure you’re realistic with your budget and fully fund this personal finance priority before contributing anything meaningful toward retirement.

- Pay off credit card debt: You’re not alone if you’ve got credit card debt that’s been piling up. Paying off your credit card debt is a must before saving for retirement because it will save you money in the long-term. The interest rates paid on credit card debt almost always outweigh what you could receive by investing for retirement in stocks and bonds. Credit cards usually charge in excess of 15% APYs, sometimes north of 20%. While stocks and bonds can have years where they return this amount, over very long periods of time, you’re more likely to encounter returns between 7-10% per year on average with a well-diversified portfolio of equities and fixed income. If you have any amount of credit card debt, make sure to pay it off as soon as possible so you can start saving for retirement without worrying about this emergency expense.

- Get current on bills: You might be thinking that you should save for retirement before paying off your bills, but this is a mistake. If you’re behind on your monthly bills then you need to take care of these past due expenses before saving for retirement. Getting current on all of your financial obligations is important because it will make sure that if anything were to happen in the future where you couldn’t work or had emergency expenses come up, then there would be no debt hanging over your head.

You can lower your credit card debt quicker by signing up for an app like Tally, which extends a lower cost line of credit to cover your existing credit card debt and putting an end to late payment fees.

For student loans, you may have received a reprieve from governmental orders during the COVID-19 pandemic, but payments resumed in October 2023. Now, you’ll need to resume payments but can lower the interest rate you pay by using a student loan refinancing marketplace.

The service pulls real-time quotes from several refinancing lenders in the market to give you a sense of the best refinancing option available to you.

My wife used a loan refinancing marketplace when her first round of student loans required payments to start and she dropped her rate from 8.00% to 2.85%, reducing her average rate by 515 basis points and saving us thousands in interest!

If you’re in a similar situation with high-cost student loans, consider using a student loan refinancing provider to find your best rate and lowering your cost of repayment. Depending on the savings you can receive, this guaranteed savings often makes for a wise financial decision.

Once you can get a handle on your high cost debt and student loans responsibly, you should look to invest money in your retirement accounts, like a 401(k) or IRA, and taxable brokerage accounts to grow for the long-term.

Step 2: Invest Early, Invest Often (and Diversify)

I’m a huge believer in working toward financial independence, or having the financial resources to make decisions not guided by money.

That means you need to have enough saved and invested. To get there faster, you’ll need to save more now.

I suggest saving more than the standard 10-15% of your income per year if you can afford. This will give you either A) a more comfortable and secure retirement at the traditional age (65-68) or B) a chance to retire earlier.

How much earlier depends on when you start saving, how much you contribute, the portfolio you choose and the investment returns you receive.

To get started, consider the following investing strategy:

- Pay off debt, save an emergency fund. This again? Yes. These short-term needs aren’t something you can avoid. Prioritize the now in this instance as the costs of being behind on bills, credit card debt or student loans is far greater than the upside you’d see long-term for investing from retirement. Those costs you see in your mail are certain. You can always save more if you get started a bit later on your retirement with a chance to catch up.

- Work your way up the retirement savings account ladder. This means starting with an order of investment accounts to capture the greatest return for yourself. It starts with an emergency fund but then quickly goes into investment accounts. If you work for an employer who offers a retirement match, or money they agree to contribute alongside yourself into a 401k, 403b or 457 plan, you should start here. Make sure the investment options provided make sense and are lower cost. If they have index funds in the employer-sponsored plan menu, you’ve found a good set of investments to hold for decades to come. If you get a match, take full advantage of it! That’s free money you can call yours risk-free. Invest up to the match at a minimum. That means if your company offers a 4% match on your contributions, invest at least 4% of your annual pay.

- Contribute to an IRA. Next up are individual retirement accounts, or IRAs. These accounts come in two types: traditional and Roth. Traditional IRAs allow you to deduct your contributions in the year you make them (subject to certain income limitations) and pay taxes when you withdraw money in retirement on a tax-deferred basis while Roth IRAs work the opposite: pay taxes upfront and see your investments grow tax-free. If you’d like to open an IRA, consider whether you think you’re paying higher taxes now or whether that’ll happen in retirement. If you think taxes are higher now, contribute to a traditional account. If you think they’ll be higher for you in retirement, contribute to a Roth IRA with M1 Finance or other investing companies that don’t charge commissions.

- Standard brokerage accounts. If you have all these bases covered and you’re hitting the maximum for all of them, consider investing in a taxable brokerage account deemed as one of the best investing apps for beginners. This after-tax money isn’t tax-efficient, but it does provide you with liquidity if you need money before retirement.

Step 3: Rinse and Repeat (and Repeat)

Micro investing is an easy way to start investing because of the low capital commitment and minimal (if any) investment minimums. Though, for it to really make a difference for your financial needs, it can’t be the only way you save for retirement.

In fact, you’ll need to supercharge these contributions in short order to take advantage of compounding returns over time on increasingly larger sums of money.

Said differently, you want to contribute as much as you can as early as you can to allow compounding returns in diversified investments to do the heavy lifting if you want to actually live out your retirement dreams.

The great news is that the earlier you get started, the more time you have to put your money to work. That’s the power of compound growth! Here’s what that could look like for you:

Let’s say you’re 30 years old, making the average household income of around $66,000. You decide to invest $600 per month in your retirement accounts, all inclusive of any employer match you’d receive.

That amounts to just over 10% of your income every year. If you retire at age 67, you could have over $2.1 million in your retirement savings.

This assumes an average 9% annual return, which is a bit under the inflation-adjusted average annual return of the S&P 500 of the last 50 years.

In short, a realistic growth rate if you leave your funds investing in a S&P 500 index fund over multiple decades.

That sounds pretty great, right? But it gets even better. Of that total $2.1 million, your contributions only make up around $266,500.

That means 90% of that total is money provided by the market—not your wallet!

But, if you made the same decision to start investing $300 per month at age 22, you’d have $2.2 million. $600 a month? $4.4 million!

And if you really want to save and retire early, say at age 55, consider investing $1,000 per month starting at age 22. Certainly a steep contribution to start, but if you can manage it, that decision will pay off significantly: $2.4 million.

If you can manage $2,000 per month, you could retire at 50 with $3.0 million.

The lesson here: start early and invest as much as you can as early as you can.

Where Should I Keep Money Outside of the Stock Market for Short-Term Needs?

Set aside money in an emergency fund and short-term financial goals like buying a house by opening savings accounts. This money is FDIC-insured, meaning there is low risk of your funds getting lost if the amount if below $250,000 at one bank.

You can even earn passive income from short-term interest rates paid on these savings accounts.