One of the most basic payments in real estate management is the security deposit. As a landlord, you’ll typically collect this at the start of your relationship with your tenant, along with the first month’s rent.

And like with most aspects of renting out property, there are rules and regulations concerning security deposits. Today, we’re focused specifically on where those deposits need to be held.

Depending on which state the property is in, landlords are required to hold tenants’ security deposits in escrow accounts or other separate accounts. And even where it isn’t mandated, many landlords still choose to hold a resident’s security deposit in a dedicated account.

Today, we’ll review the steps for opening escrow accounts to hold security deposits (also referred to simply as security deposit accounts), discuss why using a designed account for security deposit funds is a smart idea, outline what to look for in a landlord banking account, and more.

Top Rental Security Deposit Account Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.0

|

|

Free, no fees. Get $150 to fund a bank account and start collecting rent.

|

Standard: No monthly fees. Plus: 1 month free, then $30/mo.* Premier: 1 month free, then $95/mo.*

|

Security Deposits: The Basics

If you’re just getting into the landlord business: A security deposit is money a new tenant pays you up front, usually to cover things like necessary repairs caused by renters or a missed rent payment.

The security deposit is usually collected alongside other starting tenant costs, such as first month’s rent and last month’s rent. The amount can be equal to, less than, or even more than one month’s worth of rent; some states limit the maximum sum, so be aware of your state’s rules.

Depending on what happens during the tenant’s time at the property, the tenant will receive all, some, or even none of the security deposit back when they move out. In some states, the landlord must also give the tenant any interest earned on the security deposit money.

Related: Security Deposit Laws in New Jersey [What Landlords Need to Know]

Do Landlords Need to Hold Security Deposits in an Escrow Account?

An escrow account is an account at a bank or other financial institution where money can be held and managed by a neutral third party. For instance, tenants in a dispute with their landlord over necessary repairs not being made can withhold rent in a rent escrow account until the matter is resolved.

Escrow accounts are also used to store tenants’ security deposits—sometimes because it’s required, but sometimes just because it’s simply a good system.

In other cases, trust accounts (very similar to escrow accounts) and even just plain ol’ bank accounts are used to store security deposits. As a landlord, I designated a regular bank account to hold tenants’ deposits in lieu of setting up a formal trust or escrow account.

Whether landlords are required to hold security deposits in an escrow account or a separate bank account depends on the laws of the city, municipality, county (or in my case, parish), or state in which the tenants reside. For instance, even in some states that don’t require escrow accounts, certain municipalities might still require it. (Whether an escrow account is required might also be dictated by other criteria, such as the number of properties the landlord owns.)

Many states that don’t require landlords to maintain a separate escrow account specifically still require security deposit funds to be held at a regulated financial institution (generally meaning being an FDIC or NCUA member). Also, some states have requirements about whether an account (escrow or otherwise) holding security deposits must bear interest.

And even if you live in a state that doesn’t mandate using an escrow account, consider it (or a separate bank account) anyways. We highly recommend landlords not commingle security deposits with other personal or even business funds. In my personal experience, keeping these funds distinct and separate not only cover your legal bases, they also make it easier to track for tax and accounting purposes. I always held rental deposits in a separate account specifically designated for the rental property being leased to tenants.

Which States Require Landlords to Hold Security Deposits in an Escrow Account?

Again, we can’t stress enough: Always follow state laws and local laws alike when determining where and how to store a security deposit.

In some states (but not all!), the landlord is required to hold a tenant’s security deposit in an account of some sort. Depending on the state, that might be an escrow account, a trust account, or a bank account, and they might or might not require the security deposit money be separate from other funds.

The following states have some sort of requirement on the books:

- Alaska

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Illinois

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Tennessee

- Virginia

- Washington

A few states also require the landlord to disclose the location of the security deposit to the tenant. Some states have rules about paying interest on a security deposit as well. Check local regulations for how long you have to return security deposits after tenants move out.

And again: Even if your state doesn’t have this requirement, certain municipalities do. So find and understand the rules wherever your residents reside.

How to Open a Security Deposit Account to Hold Rental Deposits in Escrow

Landlords should do what they can to make storing a security deposit as stress-free as possible. Setting up an ideal account to hold them in is an important part of that process. Here are the typical steps you’ll need to take.

1. Find an Escrow Bank Account That Meets Your Needs

Carefully choose the bank account where you want to hold security deposits. Some bank accounts are designed specifically for landlords and their needs. The best accounts for keeping security deposit funds, in our opinion, can do more than just hold on to your money. We suggest also seeking out some or all of the following features:

Security deposit interest-bearing account

Some states and municipalities require landlords to hold security deposits in an interest-bearing escrow account, trust account, or regular bank account. Even if your location doesn’t require it, it can be wise to do so as some places let you keep that interest.

According to the FDIC, the national average annual percentage yield (APY) for a savings account is around 0.45%. This number can fluctuate; it’s currently higher than it has been in a couple years. Store each security deposit you receive in an escrow account that provides you with a higher-than-average rate. All things equal, the higher the APY, the better.

Online rent collection

Online rent collection doesn’t just make the job of a landlord or property manager easier, it makes tenants happier too. The more options for how residents can pay (ACH, credit cards, debit cards, etc.), the better.

Preferably, your online rent collection app or provider has the option for tenants to make automatic monthly rent payments—that will help cut down on late rent. Automatic payments reduce stress for tenants and cut down on time landlords waste hunting down rent.

Financial tracking and reporting

Landlord banking can be time-consuming. Rather than deal with the human error of spreadsheets, choose a financial institution that provides financial tracking and reporting. That means the program should track your cash flow, give you insights into your expenses, generate your cash-on-cash return reports, and more.

Assistance with rental property taxes

Even if you have an accountant or general tax software, rental property taxes can be complex. Fortunately, there is banking software that can greatly simplify your taxes and make tax season simple.

Landlord banking software can help you spot deductions, categorize transactions, calculate interest earned from security deposits, and more. The more properties you have, the more tax assistance you’re likely to need.

Access to additional rental products and services

Rather than piece together all the rental products and services you need as a landlord, it’s better to use an all-in-one financial institution or platform. Open an escrow account for security deposits with a company that provides ample services.

Bookkeeping services to track and organize rental finances

Consider getting multiple accounts with the financial institution you choose: say, an escrow account for the security deposit(s), an account to hold each month’s rent, and possibly an account that holds money for maintenance projects.

The best banks and landlord platforms will be able to integrate with existing accounts, provide real-time property metrics, and keep all of your rental finances organized. A debit card is a must—a debit card that automatically categorizes expenses might feel like a luxury at first, but in time, you’ll realize how useful that feature is.

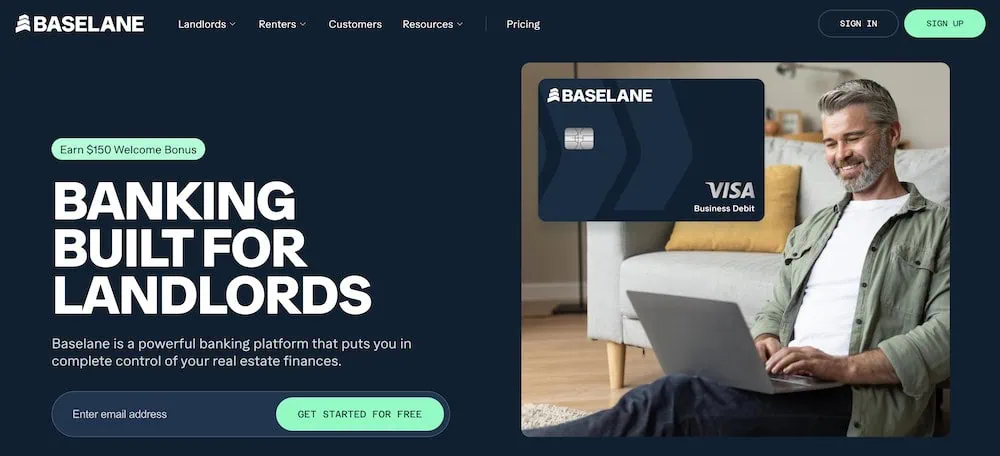

Our top pick for interest-bearing rental security deposit account: Baselane

Baselane is an excellent option for holding a tenant’s security deposit, as it not only allows you to open an escrow account, but it offers all of the features above.

One-click, smart categorization with Schedule E and property tags greatly simplifies your bookkeeping, making there no need to fear tax time. Users can quickly see insights into the current state of their finances, such as cash flow, expenses, and more.

Tenants will also enjoy the convenience of Baselane, which allows residents to easily pay each month’s rent online. It also satisfies any needs for an interest-bearing account. Baselane’s accounts offer a highly competitive APY, which is substantially higher than most savings accounts.

Baselane’s debit card can be used to pay for repairs and other property expenses. Better still: Each purchase made with the card is conveniently categorized.

Baselane lets you set up an account for free and supports multiple accounts per property. There are no hidden fees, monthly fees, or fees for account opening, nor are there minimum balances or overdrafts. Get started today in just minutes or learn more in our Baselane review.

- Baselane is a complete rental property financial management system.

- Baselane's bank accounts for landlords have no fees and offer high yields on all balances (up to 3.35% APY as of 1/17/2025*). Other features include check writing, same-day ACH payments, and up to $3 million in FDIC insurance.

- Baselane also offers bookkeeping, rent collection, analytics, and more.

- Special Offer ($150 bonus): Earn a $150 bonus after completing four steps with your Baselane Banking account. (1) Make a deposit of greater than $500 into a Baselane banking account within 30 days. (2) Maintain that average balance for 60 days. (3) Make more than $1,500 worth of mortgage payments within 90 days. (4) Collect more than $1,500 of rent via Baselane into Baselane Banking within 90 days.

- Free high-yield bank account

- Free online rent collection

- Same-day ACH payments

- Check writing

- Up to $3 million in FDIC insurance

- 50 states lease creation and e-sign

- Provides Zillow-sourced market values automatically

- No rental property listing capabilities

- No partial rent payment options

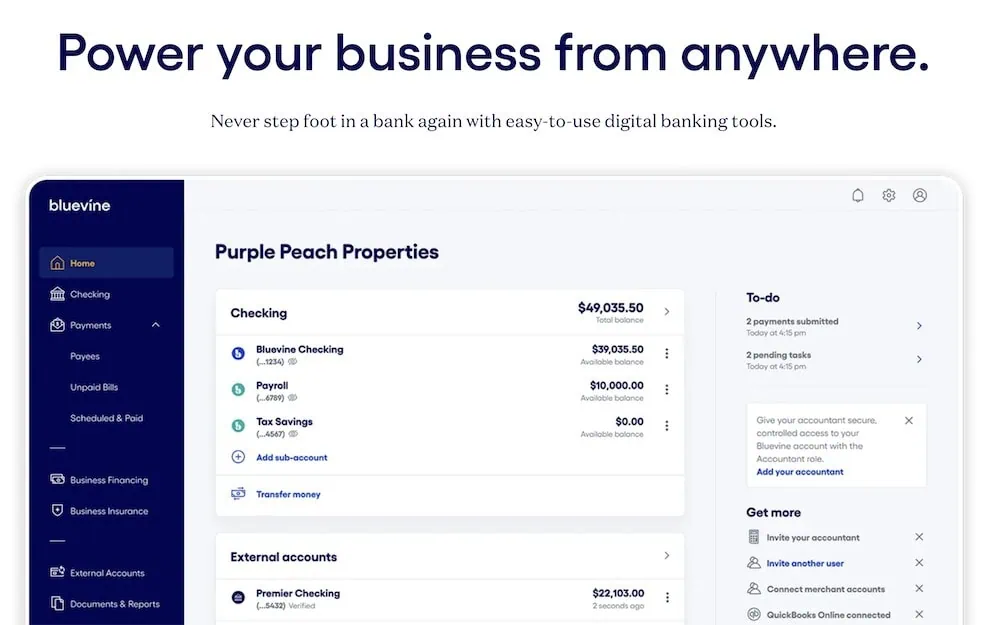

Follow-up pick for security deposit account: Bluevine

Given its array of features, Bluevine Business Checking is a great fit for two very distinct types of real estate investor:

- Beginners

- More established real estate investors who need a line of credit

Bluevine isn’t a brick-and-mortar bank where you can hold your security deposits for tenants—it’s a fintech that provides solutions for small and midsized businesses. Its Bluevine Business Checking account is a stellar option for starters just given its favorable entry points: You can open a Standard account with no monthly fees, no overdraft fees, and no minimum balance required. The application process is quicker than many other business accounts we’ve reviewed, too.

The account itself delivers features such as the ability to receive unlimited standard ACH payments and incoming wires, automated accounts payable features, mobile check deposit, adding sub-accounts (up to five sub-accounts), secure access sharing with an accountant, and software integrations with essential programs like QuickBooks.

Bluevine also offers a variety of ways to earn money, including varying APYs on varying balance levels depending on your account level, tiered cash-back rewards with its Bluevine Business Debit Mastercard, and unlimited cash back on its Bluevine Business Cashback Mastercard.

All of the above generally makes Bluevine a great choice for small businesses. It’s a decent choice for beginner real estate investors, too, though our opinion would improve even more if Bluevine ever added industry-specific functions.

More experienced investors might be repelled by the same lack of real estate features, as well, though a few might nonetheless be drawn in by Bluevine’s business checking line of credit.

Bluevine offers a line of credit of up to $250,000, with rates starting at 6.2%. (Like with any other line of credit, you only pay interest on the credit you actually use; Bluevine doesn’t charge fees for opening, maintaining, or closing the account.) The terms are somewhat tight, however. Among its minimum qualifications, applicants must have at least $40,000 in monthly revenue, a personal FICO score of at least 625, be in business for 24 months, and be in good standing with your secretary of state.

Interested in learning more or want to open an account today? Learn more or sign up at Bluevine.

- Bluevine offers cost-effective business checking accounts with a variety of features, including accounts payable automation, software integrations with programs like QuickBooks, shared accountant access, and live customer support.

- No monthly or overdraft fees, no minimum balance, and receive unlimited standard ACH payments and incoming wires.

- Bluevine's business checking accounts currently offer a 2.0% annual percentage yield (APY) on balances up to $250,000 (Standard)**, a 3.0% APY on balances up to $250,000 (Plus), and a 4.25% APY on balances up to $3 million (Premier).**

- Earn 1% cash-back rewards on fuel for business travel, 4% cash back for eligible hotels and eligible restaurants for business purposes, and up to 20% cash back for a range of business services with the Bluevine Business Debit Mastercard.

- Earn unlimited 1.5% cash-back rewards on business purchases with the Bluevine Business Cashback Mastercard.

- Depositors enjoy up to $3 million in FDIC insurance.

- Receive discounts on standard payment fees, as well as free printed and mailed checks, with Bluevine's Plus and Premier accounts.

- Up to $3 million in FDIC insurance

- Generous cash-back terms on debit card

- Business line of credit

- No real estate-specific functions

- No physical locations

2. Set Up Your Escrow Bank Account

When you apply for and set up your bank account, you’ll likely need to establish whether you’re opening it as an individual or a business entity.

Your application process will require identifying information—typically data such as your name, driver’s license number and Social Security number—so the bank can perform the appropriate background checks.

If you’re applying for a business bank account, you typically will need to provide a federal Employer Identification Number (EIN) and other basic information about your company.

3. Transfer Your Security Deposit Funds

Depending on the banks you are transferring money to and from, you might or might not have to pay a fee. (Note: Baselane, mentioned above, charges no check, wire, or ACH transfer fees on their end.)

When you transfer security deposit funds, you might want to add a note—for example, a security deposit might be labeled with the tenant’s name and rental address.

Again, we recommend using a separate escrow account for the sole purpose of holding security deposits. You can always open additional bank accounts for other real estate finance needs, such as holding rent or storing money meant for maintenance expenses.

Once the security deposits are in the account, they will sit there (and, if you opened up an interest-bearing account, earn interest) until it’s time to return those funds to the tenant or tap the funds to address tenant-caused issues.

FAQs About Tenant Security Deposit Accounts

Can I keep my tenants’ deposits in my bank account?

Whether you can keep a resident’s security deposit in your own bank account or need a separate financial account depends on the state and municipality in which the rental property is located. Some states require you to use a separate account; even if it doesn’t, the municipality might.

Even where it isn’t required, we still recommend having an account specifically for security deposit funds. For various reasons, it’s wise not to commingle security deposit money with personal or even other business funds.

For instance, with a designated account for a security deposit, you can’t accidentally spend the money as you would any other money in a business checking account. You also know the funds are available as soon as the tenant decides to move out. The amount of time you have to return a security deposit varies by state; you don’t want to miss this deadline, as you might incur fees or even be sued.

Having a separate account also makes it easier to track the accrued interest. Some states and municipalities require landlords to hold each security deposit in an account that earns interest and to return that interest to the tenant, so it’s essential to accurately track any interest accrual. And if your rental property is in a location that requires you to distribute tenant interest, and you don’t, you might be on the hook to pay the tenant much more in interest—in some cases, even double.

Other states might not make you give interest back to the tenant, but you’ll still want accurate information for your own recordkeeping.

How do I account for a security deposit in my rental bookkeeping?

When you receive a refundable security deposit, you should record it as a liability.

Whether you eventually record some or all of that deposit as income depends on the tenant situation. Per the IRS:

- “If you keep part or all of the security deposit because the tenant breaks the lease by vacating the property early, include the amount you keep in your income in that year.”

- “If you keep part or all of the security deposit because the tenant damaged the property and you must make repairs, include the amount you keep in that year if your practice is to deduct the cost of repairs as expenses. To the extent the security deposit reimburses those expenses, don’t include the amount in income if your practice isn’t to deduct the cost of repairs as expenses.

- “If a security deposit amount is to be used as the tenant’s final month’s rent, it is advance rent that you include as income when you receive it, rather than when you apply it to the last month’s rent.”

To accurately do your bookkeeping, you’ll need to keep track of which security deposits have been collected, how much interest accrued, and when (and if) deposits are returned. Given the obvious complications with recording security deposits, it makes sense to keep them in separate escrow accounts or other bank accounts.

And if you’re managing rental properties, rather than trying to do all the bookkeeping yourself for rental properties, you can make things easier on yourself by using landlord accounting software. Some landlord accounting software, including Baselane’s, is both free and comprehensive.

Can I keep the interest earned in a security deposit account that bears interest?

Landlords are sometimes required to keep tenants’ security deposits in an interest-bearing account, while others simply choose to do so. Whether the landlord gets to keep the accrued interest depends on their location and situation.

In locations that require landlords to pay interest to tenants, those who fail to do so must pay back more (often double) the amount of interest paid when it’s eventually paid back. For this reason, it’s important to carefully track the amount of interest security deposits accrue or have software track it for you.

The following states have some rules or requirements concerning security deposit interest payments, though they differ by state:

- Connecticut

- District of Columbia

- Florida

- Illinois

- Iowa

- Kansas

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New Mexico

- New York

- North Dakota

- Ohio

Landlords should always double-check state and local landlord-tenant laws to determine what should be done with interest from an account that holds a tenant’s security deposit.

To learn if your state has a security deposit statute, check out your tenant rights information supplied by the U.S. Department of Housing and Urban Development.