Your landlord is legally required to rent you a habitable property—and if they don’t, establishing a rent escrow account is one way to ensure it happens.

You should feel safe where you live. And your rental home shouldn’t pose health risks. Many landlords provide this kind of environment—many, but not all. Sometimes, you might have to share your concerns with your landlord and ask them to fix the issue.

But what action can you take if the landlord fails to make the necessary repairs?

Not paying rent is a quick way to snatch a landlord’s attention. However, if you simply stop paying rent, your landlord might have the right to evict you. But through the proper legal channels—which includes sending your rent to an escrow account, rather than straight to your landlord—you might be able to force the landlord’s hand, ensuring they make repairs that provide you with the habitable property you’re paying for.

But how does the entire rent escrow legal process work? Read on as we explain that, who qualifies for rent escrow accounts, whether your credit score will be affected, where to open a bank account for rent escrow, and more.

Top Escrow Account Picks for Holding Rental Security Deposits

|

Primary Rating:

4.7

|

Primary Rating:

4.0

|

|

Free, no fees. Get $150 to fund a bank account and start collecting rent.

|

Standard: No monthly fees. Plus: 1 month free, then $30/mo.* Premier: 1 month free, then $95/mo.*

|

What Is Rent Escrow?

Rent escrow, sometimes called rent withholding, is a legal process where a tenant pays rent to a third party, such as a court, as opposed to directly to a landlord. Rent is paid this way until the landlord makes the necessary repairs or until the case is otherwise decided.

Related: How to Open an Escrow Account for A Security Deposit

When Do You Need a Rent Escrow Account?

Typically, state laws require a landlord to make necessary repairs to make a property habitable within a certain “reasonable” period of time—say, 30 days, for example—after being notified of the issue. If the landlord has failed to do so within that time period, and you have no reason to believe the landlord will perform their duty, you should look into taking your case before a judge and creating a rent escrow account immediately.

And again: It’s vital to go through the proper channels for rent escrow; don’t just stop paying rent. Sending rent payments to an escrow account shows you are able and willing to pay your rent. If you stop paying for your rental property altogether, you might be evicted—and in a worst-case situation, you might still be on the hook for that unpaid rent.

If your residence is currently uninhabitable and the landlord isn’t taking action to fix the issues, follow your state’s procedure to begin paying rent in escrow, including notifying your landlord that you are doing so.

What’s Required to Withhold Rent in an Escrow Account?

Laws vary by state, but in general, to withhold rent, it must be for a serious reason that you (or a guest) did not cause; it can’t just be a minor inconvenience. You also must be up-to-date on your rent payments, and you mustn’t be facing any other lease violations. And you might have to meet other conditions, too, depending on the state you reside in.

You also have to properly document and report the problem. Most legal experts suggest submitting every repair request in writing, so there’s documentation. Direct emails also provide you a way to prove you’ve notified the landlord. (Resident portals, however, often don’t provide you with an adequate way of proving you sent a request.) You should also take photos and/or videos as evidence of the issue.

You’ll also want to provide any proof of expenses incurred as a result of the issue. For instance, if your heat is broken and you bought a space heater, provide a receipt of that purchase. Lastly, we also suggest gathering bank account statements and any other evidence that you’re current on rent, so you have proof in case you need it.

In the event the landlord refuses to fix the problem or take steps toward addressing it, you can ask a local court to start the escrow process. This typically starts with an application, petition, complaint or some other filing to the court. Usually, you will also need to submit documentation including a copy of your lease, personal identification, and related bills.

In some cases, you will not have to pay rent to an escrow account until the judge hears the case; in other cases, you’ll be asked to pay into escrow immediately, even if the case will be heard later.

Lastly, you’re required to provide written notice that the escrow process has begun, and that you will be withholding rent. This notification should include why the rent escrow process was started, how much money is in the account, and where the rent in escrow is being held. Depending on your state, you might be required to send the notice via certified mail. (However, even if it’s not required, we recommend using certified mail anyways.)

Related: 9 Best Rent Collection Apps & Software for Landlords

What Is a Habitable Property?

The crux of many situations that lead to escrow is the definition of a habitable property. While individual states might have their own definitions, broadly speaking, a habitable property is safe and fit for people to live in with a reasonable amount of comfort. It cannot pose a risk to tenants’ health or safety.

Aesthetics, minor inconveniences—anything that doesn’t make a home unlivable—are not part of what makes a property habitable.

What Might Make a Property Uninhabitable?

Issues that might make a property uninhabitable include (but aren’t limited to):

- Pest infestations

- No heat during winter months

- Exposed wiring

- Hazardous substances

- Mold formation on walls

- Asbestos

- Lead paint

- Structural defects

- Broken doors

- No running water

Again: This is not a comprehensive list of everything that makes a property uninhabitable. And what’s considered uninhabitable can vary by state. For example, in hotter states, air conditioning might be considered essential; in colder states, it might not.

If your property is uninhabitable through no fault of your own, give your landlord proper notice to fix the problem.

What Happens If You Withhold Rent?

The results of rent withholding depends on where you live and whether you went through the proper channels.

If your state allows rent escrow, you have a valid reason to use it, and you follow the legal process for withholding rent payments, the situation will usually work out well for you.

Withholding rent through rent escrow doesn’t mean you haven’t paid rent. It means that instead of paying rent to your landlord, you’re sending it to a third-party account to hold until after the rent escrow hearing. Following the hearing, the rent might be released to the landlord (after fees), though in some situations, you might receive some or all of the money back. If the landlord fails to fix the problem in a timely manner, the lease might be terminated or the tenant might be told to continue paying rent through the escrow account.

However, if you withhold rent without doing so via an escrow account, it’s very possible (indeed, likely) that the landlord will try to evict you for nonpayment of rent.

Does Withholding Rent Affect Credit?

Withholding rent certainly has risks, including to your credit score. And in fact, even following the correct steps can still result in a negative outcome.

Typically, if you don’t go through the proper rent withholding channels and simply stop paying rent, your credit score will eventually be dinged. Typically, rent isn’t considered late until it’s late for at least 30 days, and even then, many landlords don’t report unpaid rent to credit bureaus. However, if you continuously withhold your rent through improper channels and the landlord reports you as delinquent, it will negatively impact your score.

Continued delinquency could result in an eviction, too. Now, evictions don’t directly show up on your report. But if your landlord then goes to a debt collection agency to collect on your unpaid rent, that could deliver a massive black eye to your credit report.

However, let’s say you went through the court, set up an escrow account, and made all the necessary timely payments to that account. Even then, if your property was ruled habitable, the judge might decide that rent escrow wasn’t warranted. In that case, your landlord might be able to evict you. While that eviction won’t show up on your credit report, it still will be logged into the public record, which could come up in future landlords’ background checks—hurting your ability to secure a residence in the future.

To avoid any sort of negative hit to your credit report or ability to find new housing, you’ll not only have to properly pay rent in escrow and correctly follow all the proper steps—the judge will also have to find that your dwelling was uninhabitable, making the landlord responsible for repairs.

Related: 8 Best Online Rent Payment Systems [Rent Collection Services]

What Happens to Rent Payments With a Rent Escrow Account?

As we mentioned earlier: If your rent escrow application is approved by a judge, you will send your rent money to an escrow account to ensure you’re compliant with your lease agreement, either starting right away or after the scheduled hearing.

If the landlord is ordered to fix the issue, they will be given a certain amount of time to do so. (The amount of time depends on the jurisdiction, but typically it will fall between 14 and 30 days.) The landlord might ask the judge to access some of the escrow funds to use toward repairs.

At some point in the process, there will be a rent escrow hearing where the judge decides if your requests were necessary and if the landlord successfully fixed the issues. Usually, the escrowed money will be released to the landlord after the problems are resolved, minus any inspection or court fees.

You might be rewarded some or all of the withheld rent depending on the severity of the issue and the amount of time it took the landlord to fix the problem. Occasionally, a judge might decide your requests were unwarranted; if so, the rent likely will be distributed to the landlord.

How Do I Open an Escrow Account for Rent Payments?

Some states require tenants to deposit rent through a specified local district court, while others are more flexible. It’s important to put your rent into an escrow account controlled by some neutral third party, however, so it’s clear you aren’t trying to avoid paying rent.

If the court doesn’t give more specific guidelines, you can ask your attorney to put the money in a trust account or you can open a completely separate bank account yourself.

Use the account only for the rent you’re withholding and nothing else.

Landlords should do what they can to make storing a security deposit as stress-free as possible. Setting up an ideal account to hold them in is an important part of that process.

Find an Escrow Bank Account That Meets Your Needs

Carefully choose the bank account where you want to hold security deposits. Some bank accounts are designed specifically for landlords and their needs. The best accounts for keeping security deposit funds, in our opinion, can do more than just hold on to your money. We suggest also seeking out some or all of the following features:

Interest-bearing account

Some states and municipalities require landlords to hold security deposits in an interest-bearing escrow account, trust account, or regular bank account. Even if your location doesn’t require it, it can be wise to do so as some places let you keep that interest.

According to the FDIC, the national average annual percentage yield (APY) for a savings account is around 0.45%. This number can fluctuate; it’s currently higher than it has been in a couple years. Store each security deposit you receive in an escrow account that provides you with a higher-than-average rate. All things equal, the higher the APY, the better.

Online rent collection

Online rent collection doesn’t just make the job of a landlord or property manager easier, it makes tenants happier too. The more options for how residents can pay (ACH, credit cards, debit cards, etc.), the better.

Preferably, your online rent collection app or provider has the option for tenants to make automatic monthly rent payments—that will help cut down on late rent. Automatic payments reduce stress for tenants and cut down on time landlords waste hunting down rent.

Financial tracking and reporting

Landlord banking can be time-consuming. Rather than deal with the human error of spreadsheets, choose a financial institution that provides financial tracking and reporting. That means the program should track your cash flow, give you insights into your expenses, generate your cash-on-cash return reports, and more.

Assistance with rental property taxes

Even if you have an accountant or general tax software, rental property taxes can be complex. Fortunately, there is banking software that can greatly simplify your taxes and make tax season simple.

Landlord banking software can help you spot deductions, categorize transactions, calculate interest earned from security deposits, and more. The more properties you have, the more tax assistance you’re likely to need.

Access to additional rental products and services

Rather than piece together all the rental products and services you need as a landlord, it’s better to use an all-in-one financial institution or platform. Open an escrow account for security deposits with a company that provides ample services.

Bookkeeping services to track and organize rental finances

Consider getting multiple accounts with the financial institution you choose: say, an escrow account for the security deposit(s), an account to hold each month’s rent, and possibly an account that holds money for maintenance projects.

The best banks and landlord platforms will be able to integrate with existing accounts, provide real-time property metrics, and keep all of your rental finances organized. A debit card is a must—a debit card that automatically categorizes expenses might feel like a luxury at first, but in time, you’ll realize how useful that feature is.

Our top pick for escrow accounts to hold rental security deposits: Baselane

Baselane is an excellent option for holding a tenant’s security deposit, as it not only allows you to open an escrow account, but it offers all of the features above.

One-click, smart categorization with Schedule E and property tags greatly simplifies your bookkeeping, making there no need to fear tax time. Users can quickly see insights into the current state of their finances, such as cash flow, expenses, and more.

Tenants will also enjoy the convenience of Baselane, which allows residents to easily pay each month’s rent online.

It also satisfies any needs for an interest-bearing account. Baselane’s accounts offer a highly competitive APY, which is substantially higher than most savings accounts.

Landlords can earn unlimited 1% cash back (and up to 5% cash back on home improvement spend) with Baselane’s rewards debit card, which can be used to pay for repairs and other property expenses. Better still: Each purchase made with the card is conveniently categorized.

Baselane lets you set up an account for free and supports multiple accounts per property. There are no hidden fees, monthly fees, or fees for account opening, nor are there minimum balances or overdrafts. Get started today in just minutes.

You can learn more in our Baselane review.

- Baselane is a complete rental property financial management system.

- Baselane's bank accounts for landlords have no fees and offer high yields on all balances (up to 3.35% APY as of 1/17/2025*). Other features include check writing, same-day ACH payments, and up to $3 million in FDIC insurance.

- Baselane also offers bookkeeping, rent collection, analytics, and more.

- Special Offer ($150 bonus): Earn a $150 bonus after completing four steps with your Baselane Banking account. (1) Make a deposit of greater than $500 into a Baselane banking account within 30 days. (2) Maintain that average balance for 60 days. (3) Make more than $1,500 worth of mortgage payments within 90 days. (4) Collect more than $1,500 of rent via Baselane into Baselane Banking within 90 days.

- Free high-yield bank account

- Free online rent collection

- Same-day ACH payments

- Check writing

- Up to $3 million in FDIC insurance

- 50 states lease creation and e-sign

- Provides Zillow-sourced market values automatically

- No rental property listing capabilities

- No partial rent payment options

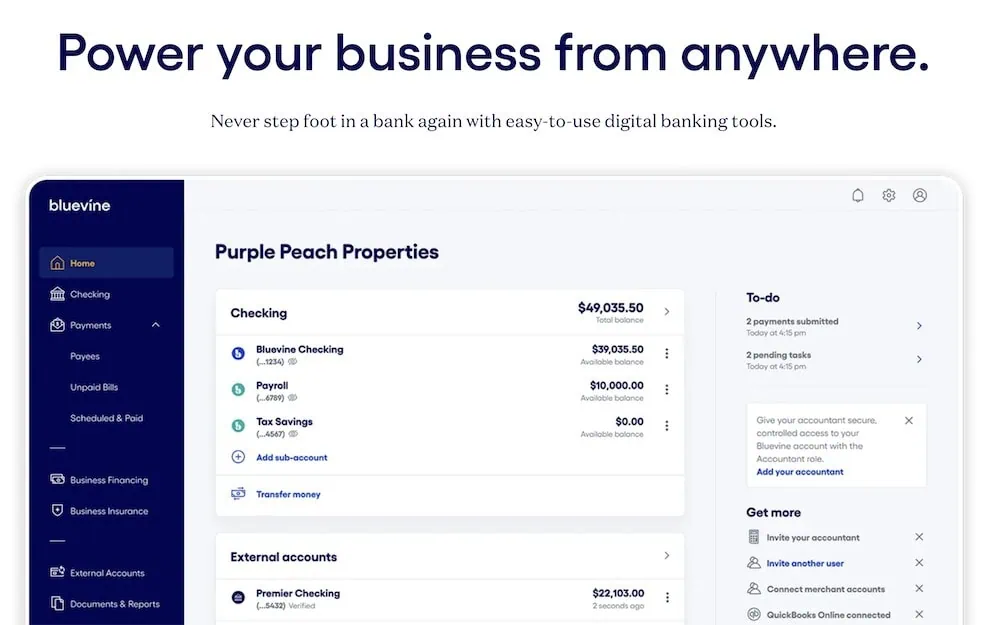

Follow-up pick for security deposit account: Bluevine

Given its array of features, Bluevine Business Checking is a great fit for two very distinct types of real estate investor:

- Beginners

- More established real estate investors who need a line of credit

Bluevine isn’t a brick-and-mortar bank where you can hold your security deposits for tenants—it’s a fintech that provides solutions for small and midsized businesses. Its Bluevine Business Checking account is a stellar option for starters just given its favorable entry points: You can open a Standard account with no monthly fees, no overdraft fees, and no minimum balance required. The application process is quicker than many other business accounts we’ve reviewed, too.

The account itself delivers features such as the ability to receive unlimited standard ACH payments and incoming wires, automated accounts payable features, mobile check deposit, adding sub-accounts (up to five sub-accounts), secure access sharing with an accountant, and software integrations with essential programs like QuickBooks.

Bluevine also offers a variety of ways to earn money, including varying APYs on varying balance levels depending on your account level, tiered cash-back rewards with its Bluevine Business Debit Mastercard, and unlimited cash back on its Bluevine Business Cashback Mastercard.

All of the above generally makes Bluevine a great choice for small businesses. It’s a decent choice for beginner real estate investors, too, though our opinion would improve even more if Bluevine ever added industry-specific functions.

More experienced investors might be repelled by the same lack of real estate features, as well, though a few might nonetheless be drawn in by Bluevine’s business checking line of credit.

Bluevine offers a line of credit of up to $250,000, with rates starting at 6.2%. (Like with any other line of credit, you only pay interest on the credit you actually use; Bluevine doesn’t charge fees for opening, maintaining, or closing the account.) The terms are somewhat tight, however. Among its minimum qualifications, applicants must have at least $40,000 in monthly revenue, a personal FICO score of at least 625, be in business for 24 months, and be in good standing with your secretary of state.

Interested in learning more or want to open an account today? Learn more or sign up at Bluevine.

- Bluevine offers cost-effective business checking accounts with a variety of features, including accounts payable automation, software integrations with programs like QuickBooks, shared accountant access, and live customer support.

- No monthly or overdraft fees, no minimum balance, and receive unlimited standard ACH payments and incoming wires.

- Bluevine's business checking accounts currently offer a 2.0% annual percentage yield (APY) on balances up to $250,000 (Standard)**, a 3.0% APY on balances up to $250,000 (Plus), and a 4.25% APY on balances up to $3 million (Premier).**

- Earn 1% cash-back rewards on fuel for business travel, 4% cash back for eligible hotels and eligible restaurants for business purposes, and up to 20% cash back for a range of business services with the Bluevine Business Debit Mastercard.

- Earn unlimited 1.5% cash-back rewards on business purchases with the Bluevine Business Cashback Mastercard.

- Depositors enjoy up to $3 million in FDIC insurance.

- Receive discounts on standard payment fees, as well as free printed and mailed checks, with Bluevine's Plus and Premier accounts.

- Up to $3 million in FDIC insurance

- Generous cash-back terms on debit card

- Business line of credit

- No real estate-specific functions

- No physical locations

Does Rent Escrow Differ By State?

Yes, yes, and yes. While the escrow process is very broadly similar across the nation, each state has their own individual rules and regulations.

More importantly, take note of the small number of states that don’t have any rent-withholding statute:

- Georgia

- Idaho

- Indiana

- Louisiana

- Mississippi

- North Carolina

- North Dakota

- Texas

- Utah

If your state doesn’t have a rent escrow statute, you might check to see whether it has a “repair and deduct” law in place. In this system, the tenants either pay for repairs themselves and then deduct the costs from their rent payments, or they continue paying rent then sue their landlords for the amount they paid for repairs.

To learn if your state has a rent escrow statute, check out your tenant rights information supplied by the U.S. Department of Housing and Urban Development.