Let’s talk about the Aristocrats.

No no no. Not those Aristocrats.

I want to talk about the Dividend Aristocrats—a group of Wall Street’s most celebrated dividend-paying companies that should at least be on the radar of any investor interested in generating equity income.

This hallowed group of dividend stocks gained a few new members this year.

What Are The Dividend Aristocrats?

As we’re fond of saying here, investors’ primary interest in stocks tends to be “stocks go up”—in other words, the capital gains you earn when you buy a stock at one price, then sell it at a higher price sometime down the road.

But stocks can pay you in another way—dividends.

Dividends are cash disbursements made from companies directly to their shareholders. It’s a way to provide value to people who have invested in the company—and entice them to continue holding on to (and buy more) shares.

Sure, dividends aren’t as enticing as “OMG my stock went up 15% today,” but long-term, they matter. Depending on the study, the time frame, and the stocks being evaluated, dividends have made up between roughly 35% and 50% of stock-market returns.

Ideally, though, a company doesn’t just pay a dividend—it increases how much it pays over time. That’s not just because it’d be nice to earn more money as the years roll on. It’s also because continuously raising a dividend helps at least maintain that dividend’s worth against inflation, if not outpace it. If a company pays $1 per share for 20 years, that purchasing power will look a lot better in Year 1 than it does in Year 20.

Many companies are aware of this, and make it a point to increase their dividends regularly—typically once a year, usually revolving around one of their quarterly earnings reports.

Enter the Dividend Aristocrats.

The Dividend Aristocrats: Wall Street’s Generous Royal Family

The S&P 500 Dividend Aristocrats are a group of S&P 500 companies that have increased the total sum of dividends they’ve paid on an annual basis for at least 25 consecutive years.

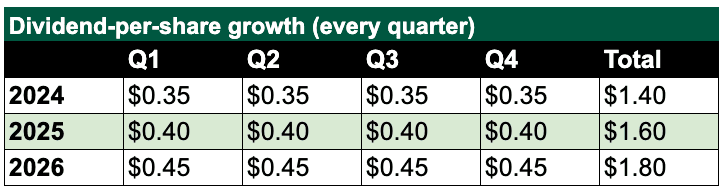

Typically, that looks exactly like what you’d think it would look like:

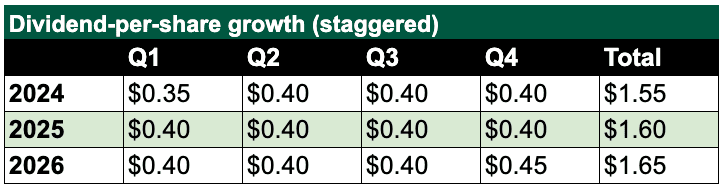

However, on occasion, companies can fall on hard times, during which raising the dividend like normal would be financially imprudent. When that happens, sometimes companies will stagger out their dividend growth in a way where the quarterly payout doesn’t actually rise in a given year, but the annual payout still technically improves:

Regardless, elevating the amount of cash you pay to investors every single year, for at least a quarter century, is an impressive feat, especially given that the past 25 years have seen:

- The dot-com bubble burst

- The Great Financial Crisis/Great Recession

- The COVID crash

- The 2022 bear market

A lot of companies lowered or suspended their dividends over this time, but not the Aristocrats.

However, the idea of “Dividend Aristocrats” extends far past just the S&P 500.

For instance, S&P Dow Jones Indices, which is responsible for the S&P 500 Dividend Aristocrats (and the S&P 500, for that matter), also has a laundry list of other Aristocrat indexes that focus on specific factors and even geographies. You can check out the full list here, but some of those indexes include:

- S&P 500 Dividend Aristocrats

- S&P 500 Dividend Aristocrats Monthly Rebalance Index

- S&P 500 ESG Dividend Aristocrats Index

- S&P 500 Sector-Neutral Dividend Aristocrats Index

- S&P MidCap 400 Dividend Aristocrats

- S&P High Yield Dividend Aristocrats

- S&P Dividend Monarchs Index

- S&P TSX Canadian Dividend Aristocrats

- S&P UK High Yield Dividend Aristocrats

- S&P Europe 350 Dividend Aristocrats

- S&P Global Dividend Aristocrats

- S&P International Dividend Aristocrats Index

Not to mention, there are other sets of dividend growers that exist outside of S&P’s indexes.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

An Investment Strategist’s Take on the Dividend Aristocrats

The Dividend Aristocrats aren’t just an exclusive club—they’re a stable club with precious little turnover. However, early each year, if any companies qualify, they’re added to the list. And as it turns out, 2025 will enjoyed a bumper crop of new Aristocrats, with three companies joining the club starting on Feb. 3.

And we’ve decided to use this occasion to provide more insights into the Aristocrats.

This week, we talked to Simeon Hyman, global investment strategist at ProShares—whose fund lineup includes the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), as well as a number of other Aristocrat ETFs—about the new additions, as well as the broader appeal of Dividend Aristocrats, both from an evergreen perspective as well as what they offer today.

Young and the Invested: First, let’s start out with the big reveal: Who are those new S&P 500 Aristocrats?

Simeon Hyman: Factset (FDS), Erie Indemnity (ERIE), and Eversource Energy (ES).

Factset is a particularly cool story because, over that 25 years, they returned quadruple the S&P 500, and [return on equity] was double the S&P 500. Everybody uses Factset if they’re an investment banker or an investment manager. Everybody uses them.

Young and the Invested: Inclusion implies a company has reached their 25th consecutive year of increases on an annual basis. So basically, when a company starts out in the Aristocrats, it’s sitting at 25 consecutive years of dividend growth, right?

Hyman: This is about 98% true.

The Aristocrats also have an index committee. Every once in a while, a company will pay a special dividend [a one-time dividend that’s outside of their regular dividends], and the committee would have to decide whether the special dividend counted toward the consecutive increases or not.

And then occasionally you’ll get a situation with spinoffs. For instance, Kenvue (KVUE) had Johnson & Johnson’s historical growth attributed to them, so that’s why they’re in.

Editor’s note: Kenvue was Johnson & Johnson’s (JNJ) consumer health unit. It was added to the Aristocrats on Aug. 25, 2023, just days after J&J officially spun it off into a separate publicly traded company.

Young and the Invested: The reconstitution takes place early each year, but let’s say a company cuts their dividend, say, in March, does the index committee get together and say “We’re cutting the company early, we’re not waiting until reconstitution”?

Hyman: In the early days of the index, that was not true, you’d only be out once a year. But a few years ago, the committee did alter the rules to take out a constituent midyear if they cut midyear, really just for hygiene purposes. And it’s good. You don’t want anybody lingering in there.

Editor’s note: Most recently, 3M (MMM) was removed from the S&P 500 Dividend Aristocrats Index in May 2024, shortly after it reduced its dividend by roughly 54%.

Young and the Invested: Backing out to the Dividend Aristocrats as a whole: Why should your average investor be interested in the Aristocrats?

Hyman: From an evergreen standpoint, companies that consistently grow their dividends are demonstrating quality.

You can’t manufacture a dividend out of thin air. These companies have to be generating consistent earnings, consistent cash flow, have appropriate levels of leverage … and that comes through in spades. If you look at the Aristocrats, you’ll see things like better return on assets (RoA) compared to the S&P 500, and a whole host of other measures.

Not to mention, the dividends, which historically have grown substantially faster than the dividend of the S&P 500, and that’s the quintessential inflation hedge.

That’s the evergreen story. The story right now is that the Aristocrats are on sale.

The S&P 500, driven by the tremendous performance of the very narrow tech- and Magnificent Seven-driven market, is trading at 25 times earnings, and NOBL is trading at 20. It’s very rare to see these high-quality stocks on sale, so it really is a bit of a catalyst.

Young and the Invested: A popular call entering the year was to buy the equal-weight S&P 500 to avoid exposure to many of the S&P 500’s largest stocks, which also happen to be many of those overpriced technology companies.

We have a simple quote regarding NOBL: “Equal weight is not enough.”

NOBL is equally weighted, but it’s equally weighted high-quality dividend growers. To get back to that quality observation, if you look at RoA, when you equal-weight the S&P 500, you substantially degrade the return on assets versus the market cap-weighted S&P 500. But NOBL’s RoA is notably better than both.

And if you want to avoid big companies, we also have the ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL).

Young and the Invested Tip: Would you prefer to instantly diversify by holding numerous dividend stocks through one single fund? NOBL is among our favorite dividend ETFs.

I have a colleague who, in these instances, likes to share the following analogy: “A Swiss Army knife has a stinky knife and a stinky screwdriver. But sometimes you really want a good knife and a good screwdriver.”

If you’re worried about market capitalization and looking for a solution, first of all, NOBL is a great choice—again, equal weight is not enough—but to the second point, buy some mid-caps. It’s much more powerful over time, and going the dividend-growth route with mid-caps is an awesome way to keep up the quality that is often degraded when you go down in market-cap size.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Young and the Invested: Why is dividend growth such an important metric of quality?

Hyman: People will conflate the action of a stock buyback and a dividend increase, and they’ll think, “Well, it’s the same thing: It’s just money going back to shareholders.”

Look, there’s nothing wrong with buybacks. It’s a lot better than squandering the money on chandeliers and private jets.

But if you think about the signal, which is critically important, a company that does a buyback is telling you they had a good year last year—a company that increases the dividend is telling you they have great confidence about next year.

That’s another element of dividend growth that’s often overlooked—it’s almost like an earnings surprise. When a company increases their dividend, it’s telling you they’re perhaps a little bit more bullish on their future.

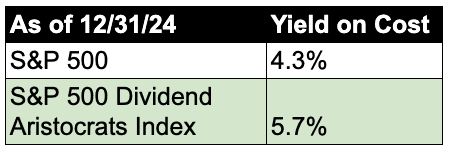

YATI: An important concept in dividend growth is showing “yield on cost.” That is, not the headline yield you see when you look up the ticker, the yield you’re getting today, but the yield you’re actually collecting based on when you originally bought it. How do the Aristocrats stand up on that front?

Hyman: It’s one of our favorite illustrations.

The dividends of NOBL have grown substantially faster than the S&P 500. The yield on cost is a big story, and it’s totally applicable to NOBL.

The table below shows yield on cost for NOBL versus the S&P 500 since NOBL’s inception in October 2013:

Young and the Invested: One thing I noticed is that ProShares doesn’t have any products connected to the S&P High Yield Dividend Aristocrats. Any thoughts on that?

Hyman: You’ve got high dividend yield and dividend growth: Those are the two basic piles of dividend strategies.

High-yield strategies are kind of in the value bucket, and they can be a little interest-rate-sensitive. Why? Well, as I like to say:

“What is a stock that doesn’t grow? It’s a bond!”

A bond has a fixed coupon, so it’s exposed to inflation. So sometimes, you’ll see that high-yielding strategies like utilities become almost bond surrogates in equity form. The High Yield Aristocrats are sort of betwixt and between because they screen for years of dividend growth but then it weights by dividend yield, so it’s neither fish nor fowl—it’s more like halfway between high yield and dividend growth.