If you know someone who has been wearing a smile for most of the year, chances are they own a gold exchange-traded fund (ETF).

2025 isn’t over, but it’s setting up to be a good year for stock investors. And considering that’s something we wouldn’t have felt comfortable saying as recently as the spring (when we nearly fell into a bear market), it’s safe to say most of us will take it.

But anyone holding onto gold has to be nothing short of ecstatic.

The yellow metal has gone virtually parabolic in 2025, clearing the $3,000 mark first, then eventually the $4,000 level, amid a more than 55% gain since Jan. 1. That puts it ahead of every major investment we can think of: bonds, real estate, even Bitcoin. That has translated into big gains for numerous gold ETFs, whether they hold the metal directly or find other ways to leverage gold to deliver performance.

I can’t tell you whether gold’s spectacular 2025 will continue into 2026. But if you’re optimistic about the precious metal, I can show you some of the top ways to invest in gold through a brokerage, IRA, and other self-directed investment accounts. Read on as I introduce you to the best gold ETFs on the market right now.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Why Do People Invest in Gold?

Gold is widely considered to be among the market’s top safety plays—so much so that the perception of what it can do is actually wider than what hard data actually says it can do.

The metal is said to provide low correlation to stocks, and indeed it does! In fact, it has an average correlation of zero over the past 50 years. That’s why some advisors will recommend investors have a small allocation to the metal (or commodities broadly, including some gold exposure), often at just 5% of the portfolio, and usually no more than 10%.

However, low correlation to stocks isn’t the same thing as low volatility—gold can move briskly, for better or worse. And that volatility actually dispels another popular notion about gold: that it’s a reliable hedge against inflation. More recently, yes, gold has helped investors during times of rapidly rising prices, but a look farther back shows you can’t necessarily count on that relationship to continue.

“In the recent 20-year period, gold generally outperformed inflation and was thus a good hedge. But in the 20 years before, gold underperformed inflation and so was a poor hedge,” Campbell Harvey, PhD Partner, Senior Advisor and Director of Research at Research Affiliates, says in a recent research paper. “This is exactly what we would expect when an asset with 15% volatility is used to hedge an asset with less than 2% volatility. It is an unreliable hedge.”

At the very least, though, gold is a pretty reliable source of defense in downturns. Upon looking at gold’s performance during 11 major stock market drawdowns, Research Affiliates found that “the price of gold went up in eight of the 11 S&P 500 drawdowns. In the remaining three, the price fell but the drop was far smaller than the S&P 500’s. Thus, gold provided some diversification benefit and could indeed be a valuable hedge against stock market volatility in the current environment.”

Harvey added that gold performed similarly well during recessions, producing gains in three of the four recessions in which the S&P 500 declined.

Why Should I Buy Gold ETFs Instead of Gold?

One argument for holding physical gold is pretty much a catastrophic-case scenario: The global economy falls apart and paper money no longer means anything, but having gold coins and bullion will allow you to continue buying and trading for whatever it is you need.

But to be blunt: That’s not an investment case. That’s a hedge against the apocalypse. If we’re at the point where we’re exchanging gold bits and otherwise bartering for goods and services, it’s safe to say you won’t be worried about your 401(k) anymore.

If we’re talking about a normal-case scenario where you plan on making it to retirement without being bitten by a zombie, investing in physical gold is mighty inconvenient. You have to have physical gold transported to you, you have to safely store it (and you’ll likely want to insure it), and should you want to sell it, you’ll have to find a buyer and arrange for transportation to the seller.

Or you could just buy gold ETFs, which allow you to get either direct or indirect exposure to the metal as easily as buying a single stock.

Your call.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

The Best Gold ETFs to Buy Now

If you’re convinced that ETFs are an ideal way to buy gold, the next thing to do is pick one.

The world of gold-related ETFs is relatively tight, at just a few dozen products. Still, some are better than similarly built rivals, while others provide a type of gold exposure that other funds simply don’t.

I’ll look at several of these funds and explain what exactly makes them worthy of your consideration.

1. SPDR Gold Shares

- Style: Physical gold

- Assets under management: $136.6 billion

- Expense ratio: 0.40%, or $4.00 per year for every $1,000 invested

The SPDR Gold Shares (GLD), which debuted in November 2004, is the oldest and largest U.S.-traded gold ETF—and a model for most gold ETFs that have been launched since then.

Like so many of its descendants, GLD allows you to own a fractional interest in physical gold bullion, saving you the aforementioned hassles of physical gold ownership. At the fund’s inception, iShares stored that bullion in vaults in London, but has since expanded its storage to New York and Zurich.

And that’s it!

Physical gold ETFs are extremely simple. You buy shares. Shares represent gold stored somewhere. Gold prices go up, shares go up. Gold prices go down, shares go down. Easy peasy.

In truth, only a handful of traits set the dozen or so physical gold ETFs apart. And the two that matter the most are fund expenses and liquidity. SPDR Gold Shares is king of the latter, trading more than 16 million shares daily. Why does that matter? That trading volume tends to produce tighter price spreads, lower transaction costs, and better options markets—three things that traders value.

Per the former, which is something that long-term investors value, GLD is … well, honestly, it’s terrible. It’s one of the most expensive physical gold ETFs at 0.40% in annual fees. GLD has a market-leading $136 billion-plus in assets despite its costs—you can instead chalk that up to its trader-friendliness, 20-plus years of trading history, and unmatched name recognition in the space.

So if you’re a long-term investor, you might want to consider the next fund instead.

Want to learn more about GLD? Check out the SPDR provider site.

Related: 10 Best ETFs to Beat Back a Bear Market

2. iShares Gold Trust Micro

- Style: Physical gold

- Assets under management: $5.5 billion

- Expense ratio: 0.09%, or 90¢ per year for every $1,000 invested

The iShares Gold Trust Micro (IAUM) is—get ready for it!—backed by gold bullion stored in vaults.

It works the same as GLD, the same as its larger sister fund, the iShares Gold Trust (IAU), and the same as most other physical gold ETFs. And in case you’re curious, IAUM’s gold is stashed in London and New York.

At least for right now, IAUM is the best gold ETF for low fees, as it charges a mere 0.09% annually.

Why do I say “for right now”? Generally speaking, virtually every fund is at risk of another fund undercutting it on price—so that risk is rarely worth mentioning. However, in this case, gold ETFs have spent the past few years in an intense fee war that saw smaller operators undercut legacy funds like GLD and IAU, which eventually prompted their providers (State Street Global Advisors and iShares, respectively) to create cheaper versions that could compete on price.

Do I think iShares’ micro gold fund is at immediate risk of another fund beating it on fees? Not really, and even if that does happen, IAUM would still be incredibly cheap. But just given the relatively recent fee actions in the space, it’s fair to say IAUM is at slightly-higher-than-normal risk of that happening.

Lastly, while buy-and-hold investors don’t really need to be concerned with uber-tight price spreads and robust options markets, they do need at least enough liquidity that they can enter and exit positions whenever they please. And while IAUM has less liquidity than GLD, it still trades a very-liquid 2.8 million shares daily.

Want to learn more about IAUM? Check out the iShares provider site.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

3. Franklin Responsibly Sourced Gold ETF

- Style: Physical gold

- Assets under management: $421.5 million

- Expense ratio: 0.15%, or $1.50 per year for every $1,000 invested

While price and liquidity are the most important factors in evaluating a gold ETF, other considerations do exist.

The Franklin Responsibly Sourced Gold ETF (FGDL), for instance, caters to investors who not only want to invest in gold, but also want to make sure that the metal was ethically sourced.

FGDL shares are (quelle surprise!) backed by physical gold. And that gold, stored in London, is “sourced from LBMA accredited refiners that are required to demonstrate their efforts to respect the environment and combat money laundering, terrorist financing and human rights abuses in accordance with the LBMA’s Responsible Gold Guidance.”

This focus on responsible sourcing has done nothing to hinder FGDL’s performance. Indeed, it’s one of the best-performing gold ETFs since inception in June 2022—because of its 0.15% fee, which is among the lowest in the industry.

And in general, most variance in the performance of physical gold ETFs can be explained by differences in fees. IAUM has outperformed the more expensive IAU. And the SPDR Gold MiniShares Trust (GLDM, 0.10% fee) has outdone its pricier sister fund, GLD.

Want to learn more about FGDL? Check out the Franklin Templeton provider site.

Related: Do These 7 Bear Market Tips Hold Up to Scrutiny?

4. iShares MSCI Global Gold Miners ETF

- Style: Gold miners

- Assets under management: $2.6 billion

- Expense ratio: 0.39%, or $3.90 per year for every $1,000 invested

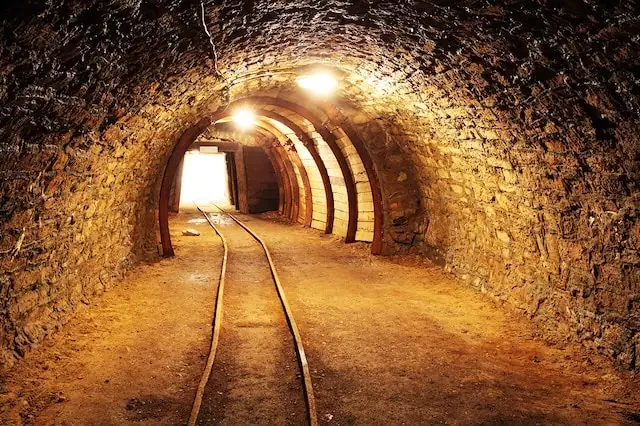

A less direct—but often more powerful—way to profit off the price of gold is to buy gold mining companies.

Your typical gold mining company pulls gold ore from the earth and converts it into doré bars, which are then sent off for further refining. It’s a really straightforward business model in which they try to sell gold for a higher price than what it cost them to extract it.

If a miner spends $1,500 to produce one ounce of gold, and it sells for $2,000 per ounce, great! But if it sells for $1,000 per ounce … well, that’s not so great. So it’s pretty easy to see how changes in the price of gold would directly impact these firms’ bottom lines and, as a result, their stock prices.

It’s also important to understand that gold miners often trade in a more volatile fashion than gold itself. When gold rises, miners tend to rise by a greater degree, and when gold declines, miners tend to decline even faster. Which makes sense, given that publicly traded companies add elements of risk and reward that gold doesn’t possess on its own.

If you appreciate the somewhat leveraged returns gold miners provide, you can buy them via the iShares MSCI Global Gold Miners ETF (RING). This index fund holds a tight grouping of about 45 miners that are primarily (and in some cases entirely) in the business of gold. It’s market capitalization-weighted, too, which means the bigger the company, the more assets are allocated to it. Right now, for instance, mega-miners Newmont (NEM) accounts for a whopping 15% of RING’s assets, Agnico Eagle Mines (AEM) represents another 13%, and the top five holdings cumulatively account for almost half the ETF’s weight.

And unlike a lump of gold, gold miners actually pay dividends—RING pays you a modest 0.7% annually to hold it.

The biggest, most established name in the space is the VanEck Gold Miners ETF (GDX), which commands 10 times the assets RING has collected. But iShares’ fund has outperformed GDX over every meaningful time period, thanks in part to its cheaper expense ratio (0.39% to GDX’s 0.51%).

Want to learn more about RING? Check out the iShares provider site.

Related: 8 Best-in-Class Bond Funds to Buy

5. VanEck Junior Gold Miners ETF

- Style: Junior gold miners

- Assets under management: $8.4 billion

- Expense ratio: 0.51%, or $5.10 per year for every $1,000 invested

VanEck does get the nod when it comes to investing in another type of gold miner: “junior” miners.

“Senior” miners are the aforementioned larger companies that extract gold. But junior miners are focused on an earlier part of the gold-mining process. Specifically, they search for and prove gold deposits, which they usually will sell to more established miners (though some will run operations themselves).

This is yet another step removed from physical gold itself, and it’s also a riskier business that usually involves smaller companies. Thus, junior miners’ stocks tend to move even more drastically than senior miners.

The VanEck Junior Gold Miners ETF (GDXJ) is one of the best ways to invest in the space, but to be clear, it’s not truly a pure-play junior miners fund.

GDXJ tracks the MVIS Global Junior Gold Miners Index, which is a modified market-cap-weighted index that includes “companies that invest primarily in gold or silver, generate at least 50% of their revenue from gold or silver mining, or own properties that have the potential to generate at least 50% of their revenue from gold or silver mining when developed.” In other words, while VanEck’s fund does hold true juniors, it also holds “mid-tier” producers such as Alamos Gold (AGI), Coeur Mining (CDE), and Harmony Gold (HMY).

It’s hardly perfect, but it’s still arguably the best way to get diversified exposure to these more minor miners.

Want to learn more about GDXJ? Check out the VanEck provider site.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

6. Invesco DB Precious Metals Fund

- Style: Precious metals futures

- Assets under management: $253.3 million

- Expense ratio: 0.73%, or $7.30 per year for every $1,000 invested

Numerous gold miners don’t mine for gold alone—they might also mine for silver, copper, and other metals. Thus, any gold mining ETF you hold will provide you exposure not just to gold prices, but the prices of other metals, too … even if it’s just incidentally.

But the Invesco DB Precious Metals Fund (DBP) intentionally exposes you to more than just gold.

DBP is an 80/20 split of exposure to gold and silver futures. I say “exposure” because the ETF’s actual holdings are primarily U.S. Treasury securities and money market instruments, which are used as collateral to back their futures positions.

This is a very different critter than a physical gold ETF, and not just because it’s invested in silver. Futures-based commodity funds are simply different than “spot” (physical) funds. Spot funds will always give you performance that’s more closely tied to a commodity’s spot price than futures, which moreso reflect where traders think a commodity will trade in the future. Futures also involve leverage, which can magnify gains and losses alike.

If you prefer the simplicity of spot ETFs that directly track the metal, you’re better off just buying physical gold and silver ETFs. DBP merely represents a different way to add a little diversity to your commodity exposure.

Want to learn more about DBP? Check out the Invesco provider site.

Related: 10 Monthly Dividend Stocks for Frequent, Regular Income

7. WisdomTree Efficient Gold Plus Equity Strategy Fund

- Style: Multi-asset

- Assets under management: $445.7 million

- Expense ratio: 0.20%, or $2.00 per year for every $1,000 invested

The vast majority of investment funds stick to one asset. You’ve got stock funds. You’ve got bond funds. You’ve got commodity funds. You get the point. But there are exceptions: “Allocation” or “balanced” funds, as well as target-date funds (TDFs), enable you to invest in stocks and bonds simultaneously.

Stocks and commodities simultaneously? That’s a far rarer bird.

But that’s exactly what you get from the WisdomTree Efficient Gold Plus Equity Strategy Fund (GDE).

GDE invests $90 of every $100 of assets in large-cap U.S. equities and $10 in short-term collateral. It then layers $90 worth of gold futures on top of that, effectively using a high amount of leverage to achieve 180% total exposure to stocks and gold. If that math doesn’t math in your head, don’t worry. The practical takeaway is that GDE provides roughly 50/50 exposure to stocks and gold.

The equity portfolio holds about 500 large-cap stocks, with the largest weights going to the likes of Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL).

I’d be remiss not to point out that WisdomTree bills this as a way to hedge against inflation, which I mentioned earlier is a potentially overstated quality of gold. But hey—you don’t have to agree with the advertising to want the product. Just look at GDE as a way to get two uncorrelated assets with a single click of the “buy” button.

GDE did a lovely job remaining above water during 2025’s market downturn. But more impressively, it has also beaten the S&P 500 by nearly 160% on a total-return basis (price plus dividends) since inception in March 2022.

Want to learn more about GDE? Check out the WisdomTree provider site.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![9 Best Fidelity ETFs for 2026 [Invest Tactically] 25 best fidelity etfs](https://youngandtheinvested.com/wp-content/uploads/best-fidelity-etfs-600x403.webp)

![7 Best Growth Stocks to Buy for 2026 [Find Your Edge] 26 best growth stocks to buy 2025](https://youngandtheinvested.com/wp-content/uploads/best-growth-stocks-to-buy-2025-600x403.webp)