Private credit funds are a high-risk, high-reward asset class that have been growing in popularity since the global financial crisis. Many investors use private credit to diversify their portfolios because it’s largely uncorrelated to the broad financial markets.

According to Morgan Stanley’s estimates, the private debt market was estimated to be about $1.4 trillion at the start of 2023. By 2027, the bank expects private debt to balloon to $2.3 trillion.

This raises a natural question: Should you have private debt in your investment portfolio?

To determine whether private debt might be a smart strategic addition to your investment portfolio, you first need to understand what private debt is (it goes by many names), its advantages and disadvantages as an investment, and which investors qualify to participate in it.

Keep reading as I break down these issues, talk about the top private credit funds, discuss the easiest way for you to get started in private debt, and more.

What Is Private Debt?

Private debt (also known as “private credit” or “direct lending”) is a capital investment to acquire private companies’ debt. It falls within the category of alternative debt or alternative credit.

For example, private debt is issued when a privately owned company gets a business loan or when someone borrows money from a friend to start a new business.

Individuals and startups typically take on private debt when they can’t access public credit markets by issuing bonds.

Private debt frequently takes the form of credit card debt, business loans, private corporate bonds, or personal loans, but there are other types, too.

Private debt isn’t traded on open markets. There are several strata of private debt, such as senior debt, subordinated, and mezzanine debt. These designations determine which lenders get repaid first in the event that the borrower can’t meet all of its obligations or declares bankruptcy.

Private debt is different from private equity. Private equity sponsors raise capital from investors and create funds that purchase ownership stakes in companies that are not publicly traded on the stock market. Their goal is to increase the value of the portfolio of companies the fund owns and then sell its stakes in those companies at a higher price than the fund paid. In contrast, private debt funds lend to privately owned companies that need capital in exchange for regular interest payments.

Related: 10 Investments that Earn a Great Return [10% or More]

How Is Private Debt Different From Public Debt?

There are many advantages to investing in private debt over public debt. With private debt, investors gain access to unique markets and smaller issuers not available to traditional investors.

Through private debt funds, you have the power to invest in industries you may not otherwise be able to, including borrowers that might be more reliable credit risks than large companies.

Investors can also exert direct influence over the borrowers during the negotiation and structuring of the debt. In private debt deals, borrowers work more directly with lenders because the debt deals aren’t syndicated among many creditors. So, if there are specific requirements you need met, you can voice that need and see what’s necessary to get a deal done.

Nearly all private debt issues are secured, meaning that the borrower pledges some type of asset as collateral in case it defaults, whereas most public debt is unsecured. Having the debt secured reduces investors’ risk and incentivizes the borrower to make its debt payments on time. The debt being secured also means recovery rates on private debt are better than those on public debt in cases where the borrower can’t repay everything it owes to its lenders.

Covenants, which are requirements imposed on borrowers for the duration of a transaction, are still popular with private debt, as well. These can provide additional protections to the lender, but they can also increase the chance of a default if they strain the borrower’s finances. For example, an investor might require a startup to which it is lending to maintain a minimum cash balance, or it may prohibit the borrower from entering into any acquisitions or mergers.

However, there are a couple of downsides to private debt when contrasted with public debt. Private debt is less liquid because it doesn’t trade on public markets the way corporate bonds do. Lenders generally intend to hold the debt until maturity.

There is also less overall transparency. Private debt doesn’t receive multiple agency ratings like public bonds do, though S&P Global Ratings does provide credit estimates for almost 1,400 private debt market issuers.

Finally, private debt borrowers tend to have weaker credit profiles than the companies that can tap the bond markets for capital, which may result in more defaults.

Related: 17 Best Income-Generating Assets [Invest in Cash Flow]

What Types of Private Credit Exist?

Private credit is an umbrella term describing forms of credit that don’t trade on public financial markets. There are many types of private credit, such as:

- Private debt funds (in which the money to be lent is raised from investors)

- Collateralized loan obligations, or CLOs (a single security backed by loans to multiple middle-market companies and larger businesses)

- Distressed debt financing (a loan to a business near or in bankruptcy)

- Mezzanine debt (when a borrower issues additional debt that is subordinate to its original debt)

- Specialty finance (loans made outside the traditional banking system)

- Business development companies, or BDCs (closed-end funds that invest in privately owned small and midsize companies)

- Infrastructure debt (when finance companies back projects or assets providing essential services)

The risk and reward levels, the amount of possible negotiation, and other details vary by private credit type. Direct lenders should carefully choose which type of private credit they want as part of their investment portfolios.

Why Invest in the Private Debt Asset Class?

According to Forbes, private debt is currently the third-largest alternative asset class. It’s easy to see the appeal—and why institutional investors are allocating more of their portfolios to these investments.

This asset class has a low correlation to public markets, so it can be excellent for portfolio diversification. Investment vehicles that target private debt also tend to offer higher yields in exchange for less liquidity. And most importantly, returns on private debt have a strong track record. The SEC’s Asset Management Advisory Committee has stated, “private debt funds appear to outperform comparable public debt indices over most comparison periods … with the outperformance more significant over longer durations.”

Portfolios that rely on private credit as part of a broader set of investment strategies can benefit from both regular interest income (great for fixed income investing) and capital appreciation.

In addition to potentially lucrative returns, you have access to small and midsize companies to which banks won’t lend substantial amounts of money. Some of these companies are in markets that can be challenging to otherwise gain access to, such as renewable energy.

Many private credit funds are also backed by floating-rate loans, which can help protect investors against rising interest rates.

Finally, private debt can be much easier to manage than private equity funds.

Remember: There is risk involved with any investments, so carefully scrutinize the capital structure of debt securities before purchasing any of them.

Best Private Credit Funds

1. Goldman Sachs Asset Management (West Street Strategic Solutions Fund I, L.P.)

You’ve likely already heard of Goldman Sachs Asset Management (GSAM), as it is one of the leading asset managers worldwide. The group was founded in 1869 and has more than $2 trillion in assets under its supervision.

West Street Strategic Solutions Fund I, L.P. is its flagship alternative investing vehicle. It’s focused on direct origination of credit and structured equity opportunities. The fund initially planned to raise $10 billion but upped that figure due to strong demand from investors.

2. Intermediate Capital Group (ICG Europe Fund VIII SCSp)

The Intermediate Capital Group (ICG) is a global alternative asset manager headquartered in London. It focuses on supplying capital to aid companies growing through private and public markets. ICG has $82 billion in total assets under management.

The ICG Europe Fund VIII SCSp is a debt-related private equity investment. It raised about $8.5 billion from investors in 2022.

3. AMP Capital (AMP Capital Infrastructure Debt Fund V)

AMP Capital was established in 1849 and is headquartered in Sydney, Australia. The company invests with over 250 investment professionals in 17 locations around the world. AMP Capital has more than 190 billion AUD (about $121 billion) under management.

The AMP Capital Infrastructure Debt Fund V is multi-regional and focuses on infrastructure debt. It was purchased by Ares Capital Management in late 2021.

4. Apollo Global Management (Apollo Hybrid Value Fund II)

Apollo Global Management was founded in 1990 and is headquartered in New York City. It’s a global alternative investment management firm. With $617 billion in assets under management, it’s one of the largest asset managers.

The Apollo Hybrid Value Fund II is Apollo’s second flagship fund. The fund aims to provide companies with flexible equity and debt capital solutions. It raised $4.6 billion.

5. Carlyle (Carlyle Credit Opportunities Fund II)

Carlyle, founded in Washington, D.C., in 1987, now has 29 offices around the world and $385 billion in assets under management. Its second fund targeting opportunities in private debt, the Carlyle Credit Opportunities Fund II, raised $4.6 billion last year to lend to firms across media, entertainment, real estate, software and technology, financial and business services, and aerospace.

Other Ways to Invest in Private Debt

Even if you are an accredited investor and you’ve decided that private debt is right for your portfolio, it can be difficult to gain access to the sorts of funds described above. After hitting their fundraising targets, they typically close to new investors. Plus, you might not want to commit to the hefty minimum investment many of these funds require.

Luckily, there’s a way to access opportunities in the private debt space on a rolling basis, and often at a much lower minimum cost of entry than most funds charge.

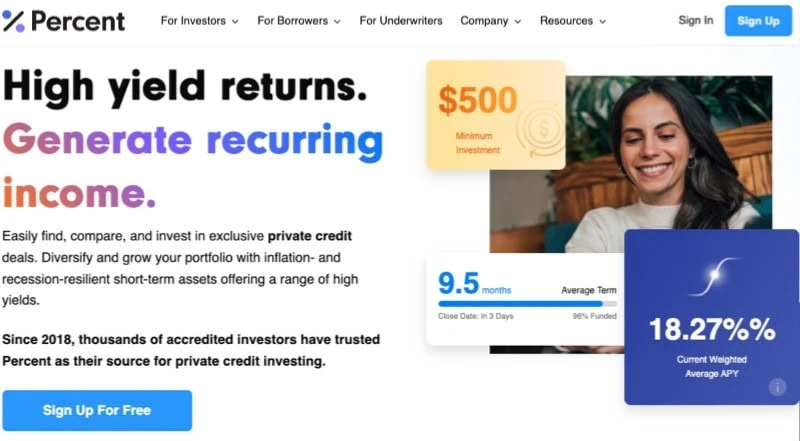

Percent (Private Credit Investments)

- Minimum Investment to Start: $500

- Type of Investor: Accredited investors only

Percent is an investment platform designed for accredited investors who are interested in accessing private credit (non-bank lending).

You can diversify your portfolio with investments such as …

- small business lending in Latin America

- U.S. litigation finance

- Canadian residential mortgages

- merchant cash advances

Percent has built a way for retail accredited investors to access a wide range of private credit opportunities with a clear view into their performance through its innovative tools and comprehensive market data. That allows investors to make better-informed decisions, source and compare opportunities, and monitor performance with ease.

This platform also provides access to an alternative investment that’s a little more liquid than other alts, with some debt investments only lasting nine months, with liquidity available after the very first month in some cases.

The service targets annualized returns on unsecured notes between 12% to 18% on average and up to 20%. And while investment minimums vary, many Percent opportunities require only $500 to invest.

If you’re interested, visit Percent’s site to learn more or open an account.

- Access for accredited investors to private credit markets, which historically have been limited to institutional investors

- Shorter-term investments, with many durations between 9 months to several years, and liquidity available after the first month, if the borrower provides this option

- Lower minimums (most deals requiring only $500 to invest)

- Diversification, with access to small business lending in Latin America, U.S. litigation finance, Canadian residential mortgages, merchant cash advances, and more

- Uncorrelated returns with the stock market and a potential hedge on stock market volatility

- Greater liquidity than many alternative investments

- Low investment minimums

- Low stock market correlations

- Only accessible to accredited investors

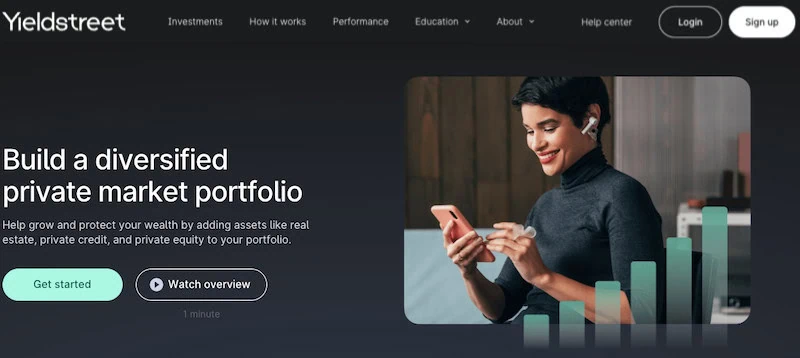

Yieldstreet (Private Credit + More)

- Available: Sign up here

- Minimum initial investment: $10,000

Yieldstreet is an alternative investment platform that provides you with income-generating opportunities. These investment options come backed by collateral, typically have low stock market correlation, and span various asset classes, including:

- Private credit

- Art finance

- Real estate

- Commercial finance

- Legal finance

- And more

Yieldstreet, which has been in business since 2015, has returned more than $2.2 billion to its investors since its founding.

Yieldstreet currently boasts a net annualized return (measured by internal rate of return, or IRR) of 9.6% across all its investments since inception. But that’s an average: Historically, annual returns range anywhere from 3% to 18%, depending on the goal-based strategy. Yieldstreet offers predefined payment schedules (e.g., monthly or quarterly payments), and they may pay principal and interest upon the occurrence of certain events, such as settlement within a legal finance investment.

The durations of investment opportunities range from three months to seven years. Investment minimums start as low as $10,000, but can go well into mid-five digits.

Yieldstreet technically is open to all investors, as non-accredited and accredited investors alike can participate in the Yieldstreet Prism Fund. However, you must be an accredited investor to participate in all other Yieldstreet offerings.

Learn more, and consider accessing these passive income investments, by opening an account today.

- Yieldstreet offers portfolio diversification through building passive income streams with alternative investments

- Typically have low stock market correlation

- Have short durations (6 months to 5 years)

- Low minimums (as low as $2,500)

- Backed by collateral to help protect your principal (over $600m in principal and interest payments returned to investors since 2015)

- Access to several alternative asset classes

- Low stock market correlation

- Low minimums compared to other accredited investment platforms

- Illiquid investments

- Some investments have lost money

- Most investments only available to accredited investors

Related: 15 Best High-Yield Investments [Safe Options Right Now]

Private Credit Investments: FAQs

Is private credit accessible to non-accredited investors?

To qualify as an accredited investor, per SEC Rule 501 of Regulation D, you must meet one (not all) of the following criteria:

- Have a gross income of over $200,000 in each of the last two years (or $300,000 of joint income with a spouse) and expect that income level to continue.

- Have a net worth of over $1 million individually or jointly with your spouse.

- Be an investment professional in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82).

- Be a general partner, director, or executive officer for a company issuing unregistered securities.

The SEC allows businesses to use private credit from non-accredited investors; Rule 504 allows fundraising from non-accredited investors at the federal level. But ask for investment advice from a professional adviser if you need more advice about rules on private credit investing.

Does the Securities and Exchange Commission regulate investment opportunities in the private credit market?

The SEC is responsible for the regulation of securities markets and is meant to protect investors.

Private credit assets aren’t subject to the same level of scrutiny as banks. However, that doesn’t mean the SEC isn’t paying any attention to them at all.

The SEC looks into specific funds within the private debt market when returns seem substantially higher than would normally be expected.

In August 2023, the SEC adopted new rules that require private fund managers to provide more detailed reporting on any potential issues with companies in their portfolios to increase overall transparency.

What is mezzanine debt?

Mezzanine debt offers very high returns in exchange for taking very big risks.

Usually, the capital structure of this debt involves investors receiving a small amount of ownership or an option that lets them later buy equity in the company. This makes mezzanine debt similar to private equity. However, equity investors don’t receive interest payments like debt investors do. There may also be prepayment penalties for borrowers who repay their mezzanine loans ahead of schedule.

Buying this type of debt can be lucrative, but it is also usually an illiquid asset for eight to 10 years.

Borrowers often favor this type of debt because its interest is a tax-deductible expense.

What is distressed debt?

Distressed debt usually comes in the form of bonds and other loans to companies that are either bankrupt or close to bankruptcy. It can also be accessed through mutual funds or the distressed firm directly.

Typically, mid- to large-cap companies are targeted.

Distressed debt is in a more dire state than stressed debt, which is issued by a company that is struggling to meet its obligations but is not on the verge of bankruptcy.

Investors who take on distressed debt are taking on hefty risks, but there is also a chance for a substantial return if the failing company turns itself around and becomes successful.

The negotiations over the terms of this type of debt are essential to the overall outcome and the investor’s potential return.

How do traditional lenders differ from private credit?

There are several differences when borrowers get money directly from an investment firm in the form of a private loan, rather than from a bank.

The private debt market became more popular during the global financial crisis because at that time of market turmoil, traditional lenders didn’t want to extend very risky loans.

From the lender’s perspective, private debt is a wise investment strategy, since private debt funds can bring higher yields compared with traditional, investment-grade debt securities. For this reason, institutional investors are leaning into private credit.

On the downside, private credit is less liquid than other types of investments, so investors need to be very patient and shouldn’t commit funds to acquire debt if they’ll need that money in the near future. Reaping the high potential rewards of investing in private debt requires a long time horizon, and a lot of discipline.

Related: