They tell you to enjoy the little things in retirement. They’re right, of course, but sometimes retirees have to shell out money for the big things: a new home, a new car, a home improvement, you name it.

And that means at some point, you’re going to have to rely on your credit score.

“I’ll have saved up a lot of cash!” you say. “My credit isn’t everything.” If you think that, you’re not alone. In a 2023 survey conducted by OnePoll on behalf of FormFree, just 28% of respondents said they strongly agree that their credit score accurately represents their financial situation.

That might be true. But accurate measurement or not, credit scores are mighty important to most lenders. That’s the case, to at least some extent, whether you’re 28 and paying off a batch of student loans, a car note, and a mortgage, or you’re 68 with a paid-off house, a fully owned car, and no major debt of which to speak.

So now that you know your credit score can still be relevant in retirement, what should you do about it? Today, I’ll show you some of the reasons retirees often still need good credit, explain why some retirees’ credit scores drop after they quit the workforce, and explain how to keep your credit score elevated even after you call it a career.

Understanding Your Credit Score

When people talk about their credit score, they’re typically referring to their FICO score. FICO uses information from a person’s credit reports—built by the three major credit bureaus, Equifax, Experian, and TransUnion—to calculate this score. The score ranges from 300 to 850; the higher the score, the more your creditworthiness.

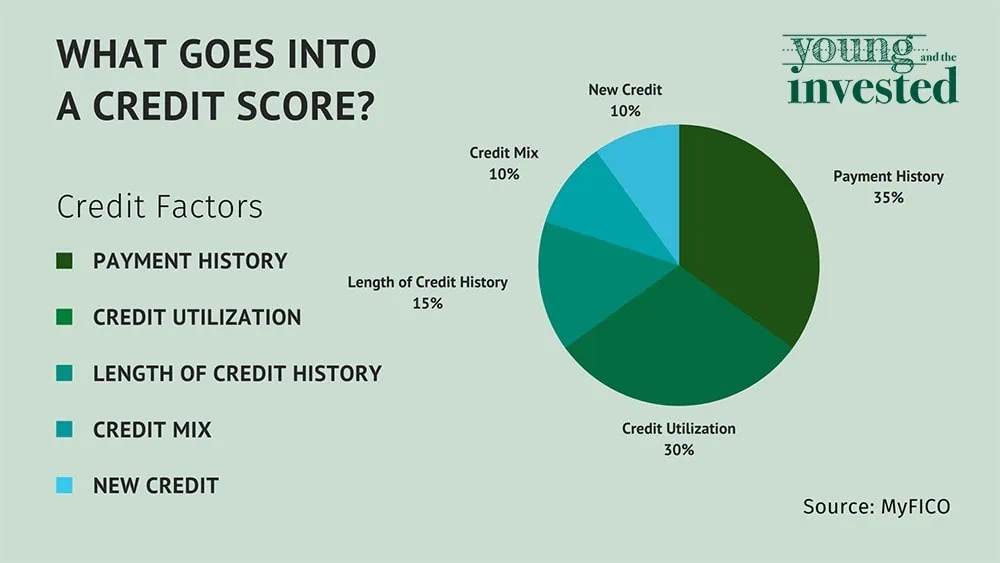

FICO scores are calculated using the following five categories:

- Payment history (35%): Your record of paying past credit accounts (and importantly, paying them on time).

- Amounts owed / Credit utilization (30%): How much you owe compared to your available credit. In general, the more you owe, the more it weighs on this criteria.

- Length of credit history (15%): Predominantly how long your credit accounts have been open, but also how long it has been since you’ve used certain accounts.

- New credit (10%): New credit means new risk, so if you’ve opened several new accounts recently, that will weigh on this factor.

- Credit mix (10%): The types of credit accounts you hold—credit cards, installment loans, mortgages, etc. You don’t necessarily have to have one of every type of credit to satisfy this factor.

Why Your Credit Score Might Go Down in Retirement

Retirement doesn’t directly affect your credit score—credit score agencies don’t receive a notification that you’re retired and suddenly knock you down a few pegs.

However, some of the actions that retirees take can negatively affect their scores:

- Let’s say you don’t plan to shop as much in retirement, so you close out a credit card you never use. It’s a reasonable choice. But if that card had a high credit limit, it could affect your credit utilization because you now have less available credit. (Example: You have a $3,000 balance and $6,000 limit on Card A. You have a $0 balance and $6,000 limit on Card B. Currently, your total credit balances are $3,000 versus $12,000 in capacity. After closing Card B, your balances are $3,000 versus $6,000 in capacity.)

- Closing out a very old credit card could also shorten the average age of your accounts. Paying off your only remaining installment loan—say, an auto loan—could make your credit mix less diverse.

- Your spending could increase in retirement, too. Using your credit card for every vacation expense (unless you pay it off immediately) could increase your utilization and hurt your score.

- Also, people have lower incomes during retirement than they had during their working years, which will in turn weigh on their debt-to-income ratio. (No, FICO doesn’t use debt-to-income in determining its score, but lenders use it to decide whether to lend to you.)

And while a lower credit score in retirement won’t necessarily cripple you financially, it can have an effect on your finances. Let’s go over some of the main reasons you’ll still need a decent credit score as you age.

Reasons Retirees Might Need Good Credit

Whenever financial needs arise, you want to be quickly approved for whatever you need—that’s true whether you’re in retirement or not.

Unfortunately, in a 2022 LendingTree survey, 21% of Baby Boomer respondents said their credit scores had prevented them from obtaining a financial product for which they applied over the prior year—better than the average across all generations (42%), but still worrying for more than one-fifth of American’s near- and current retirees.

If you still need a little motivation to maintain a high credit score, check out some of the most common reasons you might need good credit in retirement.

1. Buying a Home

Two out of every five non-retired investors say they plan on moving to a different city or region once they retire, according to the Advisor Authority survey from the Nationwide Retirement Institute.

Jobs can tie people to a certain location—and retirement often releases people from those shackles. And there are many reasons that retirees might want to use that newfound freedom to buy a home, whether that’s somewhere far away or somewhere nearby.

You might want a larger home to make room for a caregiver to move in. If you live in a larger and/or older home, you might want a smaller and/or newer house with less maintenance. You might want to move closer to family and friends, or to a more desirable climate.

You might not even need a new primary residence. Maybe you have the means and want to buy a small vacation home or help your adult children secure a new house.

According to a 2023 Joint Center for Housing Studies of Harvard University report, of the older adults who bought a new home between 2016 to 2021, only slightly more than half bought it outright. And even if you could cover the cost by selling your home or drawing from your retirement savings, that might not be the best idea for your specific financial situation.

In other words: It’s possible that your days of paying a mortgage aren’t over, which means you’ll still need good credit to secure housing.

Related: How Long Will My Savings Last in Retirement? 4 Withdrawal Strategies

2. Refinancing a Home

Maybe you’re certain (or almost certain) you’ll never need to buy a new home.

But what if you want to refinance your current mortgage?

According to data from the U.S. Census Bureau analyzed by LendingTree, more than 10 million American homeowners age 65 and older are currently paying off mortgages. Across the country’s largest 50 metro areas, 19% of homeowners age 65+ still have a mortgage.

Refinancing a mortgage requires a decent credit score, too. Borrowers with higher credit scores also tend to get offered lower refinance interest rates, so you’ll want want to aim higher than the minimum score.

Related: Best Target Date Funds: Vanguard vs. Schwab vs. Fidelity

3. Apartments or Assisted Living Facilities

Landlords routinely run credit checks on prospective tenants to assess the likelihood they’ll pay rent on time. Thus, poor credit makes it more challenging to get a lease application approved.

While some people might think it’s silly to switch from owning a home to renting an apartment, there are some significant benefits. Older adults can skip out on the hassle of home and yard maintenance. When downsizing, finding an apartment might be easier than securing a new house. Apartments also make sense for seniors who plan to spend much of their time traveling.

And again, seniors might want to help their younger relatives—in this case, by co-signing for, say, a child or grandchild who is still building up a credit history.

This dynamic isn’t limited to apartments—you also might need good credit to get your application approved for an assisted living facility. More than 800,000 Americans live in assisted living facilities. And while you might not intend to reside in one of these facilities, it’s impossible to know what your future physical and mental health will look like. It’s better to be prepared for the possibility rather than be denied a spot because of a low credit score.

Related: How to Max Out Your 401(k) + Other Retirement Accounts

4. Utilities

If you move, you’ll have to make new arrangements with the local utility companies.

Utility companies send you a bill each month based on how much water, electricity, etc., you use, which in a way is extending credit until you pay. So even if you’re able to buy a home in cash, you still might need a decent credit history to start up utility service.

These companies usually check your credit history to determine how likely it is that you’ll pay on time. A poor credit history can make it more difficult to get these services. The company might have you pay a deposit or ask for a letter of guarantee from another person who’s willing to pay your bills if you fall behind.

Related: How to Start a Retirement Plan [Build Your Retirement Savings]

5. Getting a New Credit Card

In 2023, 91% of adults age 60 or older had a credit card. So while you might reduce your credit card count in retirement, the stats say you’ll almost certainly keep at least one or a couple cards in your wallet.

And it’s possible you might open a new one.

According to a 2024 Forbes Advisor survey, the main motivator for credit card usage among Baby Boomers is earning credit card rewards. If a new rewards card comes out, or your favorite shop starts offering a store card, that might entice you to arm yourself with more plastic. Those who plan to travel extensively in retirement might finally take the plunge and get a hotel or airline rewards cards.

Also, it’s possible that if you forget about an older card for long enough, the account will be closed due to inactivity. If so, you’ll want the ability to open another card with a good limit.

The better your credit score, the better your chances.

Related: How Much to Save for Retirement by Age Group [Get on Track]

6. Auto Loan or Lease

You never know what could happen to your car. You could get into an accident, it could run into mechanical issues, or Mother Nature could simply decide to toss a tree branch onto the hood. For whatever reason, you might find yourself needing to take out an auto loan or car lease in retirement—which will require someone to look at your credit score.

While older adults have far less auto debt than younger generations, it’s not nothing. Based on New York Fed Consumer Credit Panel and Equifax data, in the first quarter of 2024, people in their 50s borrowed around $37.0 billion, and those in their 60s borrowed about $21.9 billion.

Even if you pay for a car in full, you’ll need to pay for auto insurance. While younger drivers are typically more accident-prone, drivers over 74 years old tend to pay higher car insurance rates. As one’s credit score can have a significant effect on car insurance costs, retirees will want to keep up their scores to keep insurance prices down.

Related: When Should You Take Social Security?

7. Personal Loans

According to Federal Reserve data analyzed by MarketWatch, more than one-third of adults between the ages of 65 to 74 held installment-loan debt in 2022. That covers a wide variety of debt, including mortgages, auto loans, student loans … and personal loans.

You can use a personal loan for any number of reasons. You might need to fund a home improvement project, unexpected vehicle repairs, the purchase of a new major appliance, or debt consolidation.

When deciding whether to approve a personal loan, most lenders consider your income, debt-to-income ratio, collateral … and your credit score and history.

In fact, your credit score is one of the most important factors. The minimum score required varies by lender, but according to myFICO (the official consumer division of FICO), the minimum is often around 670, the baseline for “Good” under the FICO system. To get more ideal terms, you’ll want a score of at least 740, or “Very Good.”

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

How to Maintain a High Credit Score in Retirement

How you keep a good credit score during retirement is largely the same as how you maintain good credit during your working years. Pay your bills on time. Keep a low credit card balance. Limit the number of new accounts you open. And check your credit report regularly for errors.

One change seniors are often tempted to make in retirement is to close old credit card accounts. And in some cases, even when they don’t purposely close accounts, inactivity leads to account closures anyways.

This isn’t to say not to close accounts if you don’t want them open, but be aware that cutting up your credit cards can affect you in a few ways:

- If it’s a card you had for a long time, closing it could shorten your credit history.

- If you close a card with no balance, you could negatively affect your credit utilization ratio (as you’re bringing down your available credit but not lowering your actual overall debt).

- If you have only one credit card and close it, you might eliminate your only type of revolving credit, which would weigh on the “credit mix” part of your score.

If you use a card infrequently, but don’t want to close it out or let it close from inactivity, consider setting it to pay one of your recurring bills, then set up auto-pay to ensure the credit card bill is always paid on time.

Related: