The average American has extremely limited access to investing knowledge before they hit the workforce. Most K-12 schools don’t teach investing, and what universities do teach it don’t require you to learn it. Most parents aren’t that knowledgeable, either, so they don’t have much wisdom they can pass along.

In other words, having a solid grasp on investing (if it’s not part of your profession) is a fairly rare trait—so much so that people who can intelligently invest are plenty aware that they can do something special. And as a result, they sometimes underestimate their needs for a financial advisor.

Because financial advisors do so much more than help you pick stocks.

Today, I’m going to show you a number of ways in which a financial advisor can make a significant impact on the financial health of even the most experienced investor.

What a Financial Advisor Can Do (That You Might Not Be Able To)

Not only do financial advisors provide a lot more than investment advice, but it’s not even the most requested service from clients!

A Herbers & Company survey showed that among households with more than $250,000 in assets, investment management was only the third-most-in-demand service from financial advisory firms, with roughly half of respondents wanting help in this area.

Nos. 1 and 2? Tax planning and retirement planning, respectively.

Financial advisors provide even more services outside of these three popular asks, too. And I’ll point out: Being able to invest isn’t the same thing as wanting to spend the time necessary to intelligently invest—for many folks, a financial advisor simply frees up time and mental bandwidth that could be otherwise spent on families, friends, and hobbies.

Now, let’s take a look at some of the tasks a financial advisor can handle—even for the most experienced of investors. Note: This isn’t a comprehensive list, but rather a sampling of the most common offerings.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

1. Tax-Loss Harvesting

If you sell an asset in a taxable account for a profit, you generally have to pay capital gains tax. If you sell for a loss, you generate capital losses that can be used to offset capital gains (and in some cases, even your ordinary income).

Maximizing the tax consequences of this relationship is referred to as tax-loss harvesting.

Anyone with a basic understanding of this relationship can do it, so it’s certainly not above an experienced investors’ pay grade. But it’s an additional wrinkle that requires more time on your part—time on top of what you already spend researching investments and making trades.

You’ll also need to mind certain accompanying issues, such as not violating the wash sale rule. And you’ll also have to be aware of situations in which tax-loss harvesting can be inefficient or even backfire, such as in volatile markets or if your tax rate is expected to become higher in the future.

Again, an experienced investor probably could tackle this task. But the question is: Would they want to?

A financial advisor, on the other hand, has all the time in the world—so they can help you with your tax-loss harvesting needs alone, or as part of full management of your portfolio.

2. Access to More Mutual Funds, Better Share Classes

One of the biggest perks of working with a financial advisor is something you almost certainly can’t achieve on your own.

Individual investors (aka retail investors, aka people like you) typically only have access to a mutual fund’s most basic share class—often referred to as “Investor Shares” or “A Shares.” These share classes typically have low minimum initial investments—from anywhere between $0 and $5,000—to make them more accessible to individuals. They’ll also charge an annual expense ratio that comes out of performance, and possibly other fees such as a sales load, which is a one-time cost that comes out of your initial investment.

If you invest individually via a 401(k) or an IRA, you might have access to special shares designed specifically for those kinds of accounts. They might involve slightly lower fees and lower/no sales loads, and in the case of IRA classes, lower investment minimums.

However, financial advisors often have access to certain share classes only available to financial professionals and institutions, and these share classes typically boast much lower costs in exchange for the higher sales volumes that advisors can drive. While these share classes may technically be available to all investors, they often have extremely prohibitive investment minimums in the tens or thousands of dollars, even millions of dollars—unless you invest through an advisor.

Also, some mutual funds will restrict purchases to new investors—for instance, small-cap funds may put a cap on total assets because investing any more money would “move the market” in the shares they want to buy—but still allow purchases to clients through financial advisors and institutions they have existing relationships with.

Related: What’s the Best Tax Bracket for a Roth IRA Conversion?

3. Direct Indexing

Index funds are a powerful investment tool that allow regular Joes and Janes to build diverse portfolios at typically much lower costs than if they bought actively managed funds. Their strategies are often straightforward, tied to a rules-based index that determines what to hold and what to sell.

Best of all? Anyone can buy them. If you have a 401(k), an IRA, a taxable brokerage account—just about any kind of investment account—you almost certainly have access to a few index funds.

But no matter how experienced you are, it’d be mighty difficult to take advantage of direct indexing all by your lonesome.

With direct indexing, a person invests in all the individual securities that make up a chosen index, often in the exact same weights—but it allows for variance. For instance, you can choose to buy more or less of certain stocks compared to the index, or exclude some stocks entirely.

Why would you do direct indexing? It provides a more customized portfolio and gives you a lot more control over your taxes, among other things.

But there are downsides. It’s extremely time-consuming to execute on your own, for one—so much so that it would be almost impossible for an average investor to tackle. It also requires you to adhere to a number of rules. These are two headaches that a financial advisor can easily alleviate.

Related: 7 Best Value Stocks for 2025 [Smart Picks to Buy]

4. Keeping Your Emotions in Check

I hope your eyes didn’t roll at this one, because it’s true: One of the most important things a financial advisor provides is a calm hand and peace of mind.

Extremely skilled and knowledgeable investors can still get emotional, and emotional decisions can bite you in the … well, ROI. That’s true whether we’re talking about a hasty single trade—indeed, I personally know a few savvy individual investors who have told me about their misadventures of impulsively following friends into bad investments—or an overconfident overall assessment of one’s retirement finances during budgeting.

If nothing else, it never hurts to have an objective second opinion, even if you do have your emotions in check. Think about it this way: Doctors don’t treat themselves—they visit other doctors for their medical needs. That’s in part because their specialties might differ, sure, but also because they want objective outside opinions.

In short: No matter how much financial knowledge you have, another perspective can be invaluable.

Related: How Much Does Financial Advice Cost?

5. Charitable Donations

Are you a budding philanthropist? Well, while you might donate money because you care about those charities, there’s nothing wrong with also taking advantage of the related tax benefits.

A financial advisor can provide you with guidance on the best ways to maximize your philanthropic dollars. For instance, they might suggest consolidating multiple years’ worth of donations into a single tax year, or even donate appreciated securities directly to a nonprofit to avoid paying capital gains taxes.

Advisors can set up a donor-advised fund to manage all of your donations in a way that both increases the value of what you donate (by letting donations grow tax-free) and gets you the biggest tax breaks each year. They can also help you establish foundations and grants, as well as create a charitable remainder trust so that even after you pass away, your charitable works will live on.

Related: Federal Tax Brackets and Rates

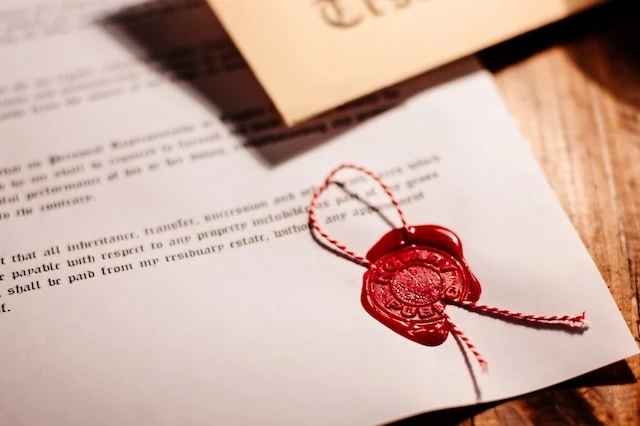

6. Estate Planning

Everyone should have a will to ensure that, after death, their assets are passed along according to their wishes.

But for some people, a will alone won’t cut it—they need estate planning.

Which, by the way: There’s a misconception that estate planning is only for the ultra-wealthy. But in reality, many people outside the high-net-worth set can benefit from this service. A few signs that you might need estate planning include (but aren’t limited to):

- Your estate size exceeds the estate tax exclusion.

- You own a business you want to pass on to a specific person.

- You have philanthropic wishes.

- You fear you might become incapacitated.

- You have a blended family.

While an estate-planning lawyer may be necessary for part of your estate, it’s smart to start your estate planning with a financial advisor. Your advisor can help ensure that your beneficiary designations are properly set up, and that you have any designed life insurance or long-term care coverage policies in place. They can even help with the emotional task of equitably dividing your assets.

Estate planning can be daunting on one’s own. And even if you’re up for the challenge, you might be unaware of everything the process entails.

Related: How Is Retirement Income Taxed?

7. Retirement Planning

Your investment strategy is a crucial part of retirement planning, but it’s not the only part.

Financial advisors can help you set realistic savings goals, determine how much Social Security you should plan to receive (and what to do about spousal benefits), figure out your ideal retirement date, guide you through Medicare and other facets of health care in retirement, and even help you decide whether moving during retirement makes sense.

They can also advise you on managing income streams and help you optimize your retirement accounts (and withdrawal strategies) based on your accounts’ tax characteristics.

I think you get the point: Retirement planning is a lot more than knowing what stocks and bonds to buy.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![Health Care Costs in Retirement [Amounts & Types to Expect] 21 health care costs in retirement](https://youngandtheinvested.com/wp-content/uploads/health-care-costs-in-retirement-600x403.webp)