E*Trade is one of America’s most popular stock trading apps for retail investors, boasting millions of client accounts and hundreds of billions of dollars in client assets.

But the question remains: Is E*Trade the right app for you?

E*Trade, which was acquired by Morgan Stanley in 2020 but still operates under the name from its 1982 founding, offers traditional brokerage accounts, retirement accounts, automated investment management, and even checking and high-yield savings accounts. The focus of this article is E*Trade’s trading platforms.

In this E*Trade review, I’ll discuss the trading platforms E*trade offers, the most impressive features, how it could improve, and who is the best fit for an E*Trade account.

Our E*Trade Review

E*Trade isn’t just one of the most-used brokerages in the U.S. It also ranks among our best investment apps and platforms,

Why? Well, today, I’ll cover some of the most important aspects of trading on E*Trade, starting with a short list of critical features and information, then a closer look at some of the brokerage’s most important elements.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

What Investments Can You Trade on E*Trade?

First, let’s start out with a quick list of what you can (and can’t) trade on E*Trade.

| Investment | Investment | ||

|---|---|---|---|

| Individual stocks | ✅ | Cryptocurrency* | ❌ |

| Individual bonds | ✅ | Foreign exchange | ❌ |

| Exchange-traded funds (ETFs) | ✅ | ||

| Mutual funds | ✅ | ||

| Options | ✅ | ||

| Futures | ✅ | ||

| Micro futures | ✅ | ||

| Futures options | ✅ | ||

| Initial public offerings (IPOs) | ✅ | ||

| Certificates of deposit (CDs) | ✅ | ||

| * You can't invest in crypto directly, but you can trade Bitcoin futures. | |||

Not exactly great for crypto and forex lovers. But as a whole, that’s still one of the best selections of available investments among all major brokers, behind only super-powered trading platforms such as TradeStation and Interactive Brokers.

I’ll also point out that while initial public offerings are available on E*Trade, not all investors will qualify.

One shortcoming that doesn’t show up in our investment selection list, but that we still do consider when formulating a brokerage rating, is fractional shares. While E*Trade technically allows for fractional shares, it does so only through dividend reinvestment plans (DRIPs) or robo-advisory portfolios. But you can’t trade fractional shares normally like you can with brokerages such as Robinhood or Webull.

From a commission standpoint, E*Trade offers zero-commission stock, ETF, and options trading. (Options still incur a 50- to 65-cent contract fee, however.) It also has a leg up on some platforms by offering $0-commission mutual fund trading, not to mention commission-free trading on U.S. Treasuries and new bond issues.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

What Types of Trading Platforms Does E*Trade Offer?

E*Trade has two platforms, both of which are free, and both of which have web and mobile versions.

E*Trade

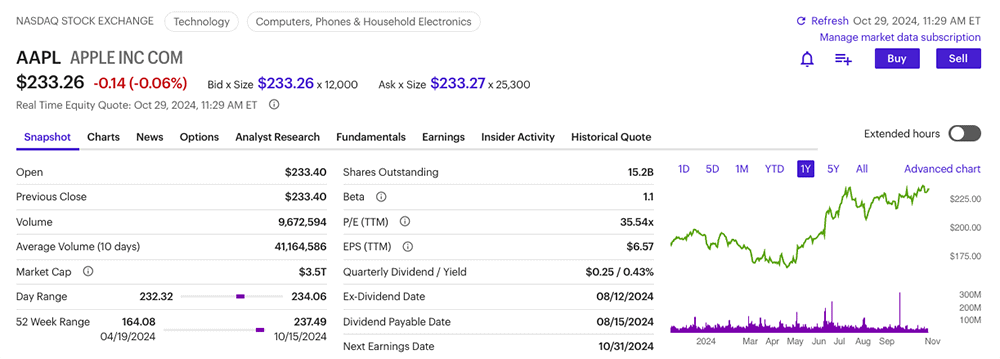

The “basic” E*Trade web platform might be more suitable for beginning-to-intermediate traders and investors, but that doesn’t mean it’s short on features.

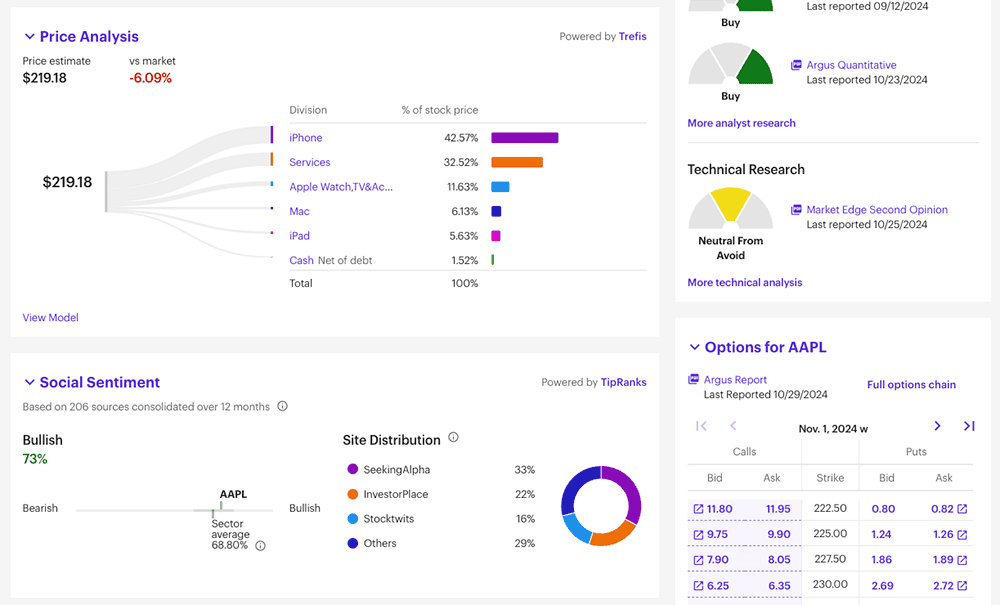

E*Trade’s main web platform includes everything you need to keep up to date on your portfolio, including real-time quotes, charts, market commentary, and stock news. The latter includes free access to Thomson Reuters, Bloomberg TV, and TipRanks research.

How important the news features are really depends on how “plugged in” you want to be. I can tell you, as an investment editor of more than 10 years, I love every one of these features. You’re probably familiar with Reuters and Bloomberg TV, but if you haven’t heard of TipRanks, it’s a useful stock data tool that allows you to tap Wall Street analyst research.

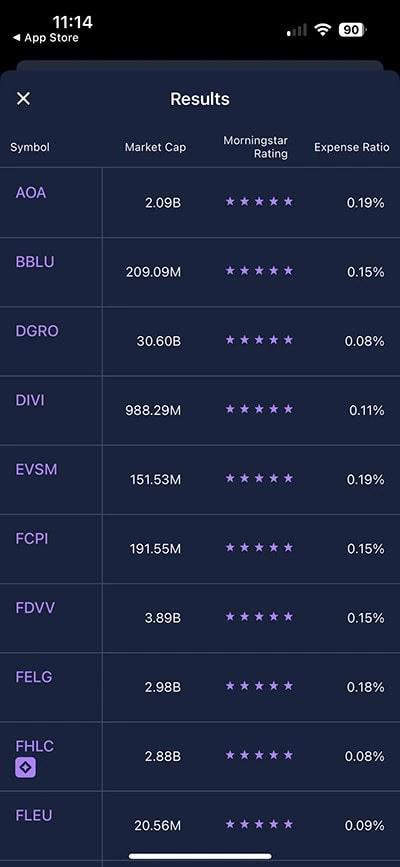

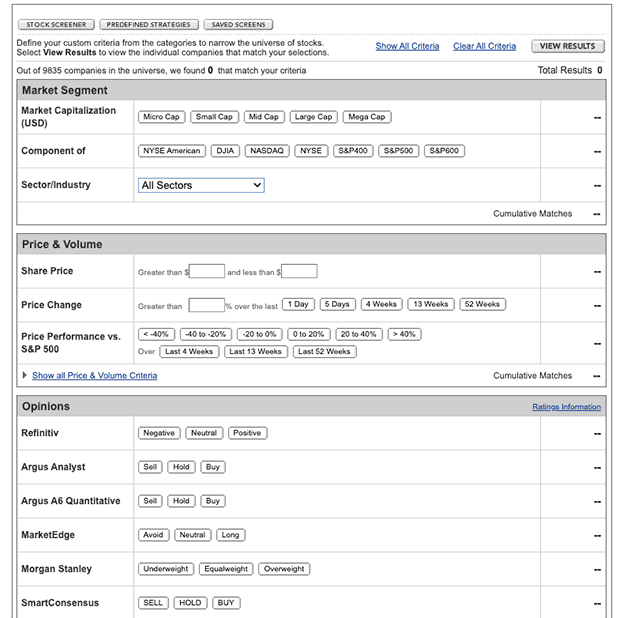

Past that, E*Trade features plenty of fantastic tools of its own, including stock, mutual fund, bond, and ETF screeners; trade optimizers; backtesters; and more.

E*Trade also touts its educational resources, which includes articles, videos, and classes, as well as monthly webinars and live events. But we will note that its educational content is difficult to sort through.

A lesser-touted feature, but one worth noting, is that you can conduct quite a bit of personal finance through the E*Trade mobile app, including check deposits, money transfers, and bill pay. That is, of course, if you sign up for at least one of varying accounts (CD, checking, saving) with Morgan Stanley Private Bank.

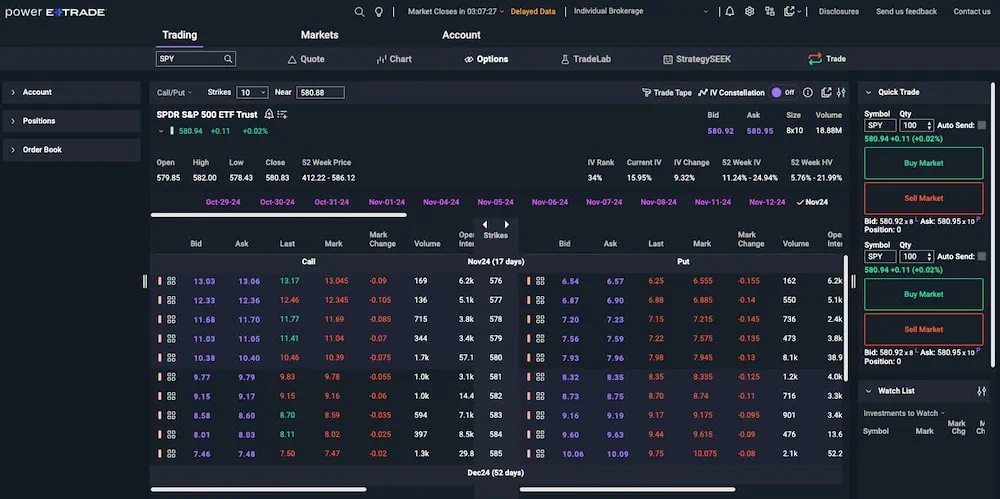

Power E*Trade

Power E*Trade is geared toward intermediate-to-advanced traders. This version allows you to conduct much deeper and more thorough analysis thanks to features such as:

- Advanced charting that includes intraday and historical options; more than 145 studies; over 100 drawing tools; and the ability to automatically identify technical patterns

- Snapshot Analysis, which lays out risk-reward probabilities in your options trading

- Powerful stock and trade scanner; use preset filters or customize as you wish

- Paper trading to test out strategies without putting your money at risk

- Ability to design exit strategies

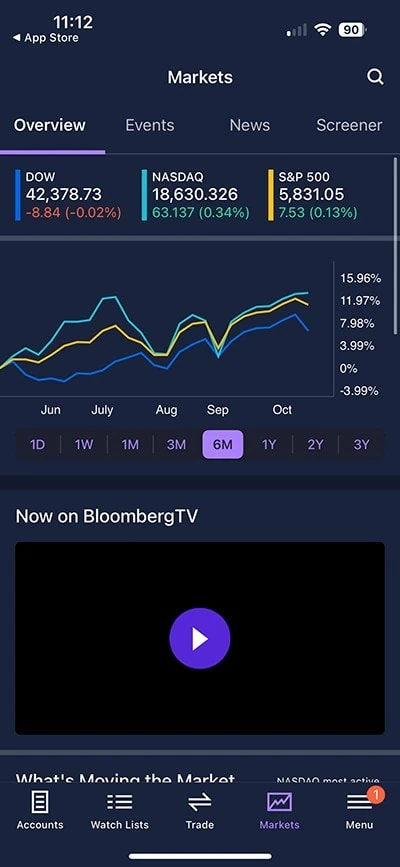

Like with the Power E*Trade web platform, the Power E*Trade app is a more powerful version of its basic counterpart. This app allows you to use preset scans, work with interactive charts, place complex options trades, and more.

E*Trade User Experience

I and my fellow reviewers don’t have any major complaints about the E*Trade user experience. That in and of itself is high praise.

E*Trade has built inherent, easy-to-navigate interfaces for any type of experience—desktop, web, and mobile—for both less experienced (E*Trade) and more experienced (Power E*Trade) investors and traders. If you’re looking for a simple, uncluttered interface, you can have it. If you need to pack your screen with data and charts, you can do that.

Power E*Trade, as a platform, was especially impressive because of the relative ease with which you could find and access its various features. Of course, even if you disagree, you can customize your interface—a table-stakes feature for high-end trading platforms, but worth noting that it’s an option.

We would give the edge to E*Trade’s mobile platform over desktop/web. It’s not through any fault of the keyboard-and-mouse experience, but just plain ol’ excellence of its mobile design. E*Trade’s mobile apps are smooth and intuitive without feeling overly simplified or childish like some other apps with more spartan designs.

And I’d be remiss if I didn’t point out that you can use E*Trade on the Apple Watch.

Like with many watch apps, this is more about “cool” or “neat” than real utility. Still, you can use your watch to look at your portfolio, track performance, and receive notifications. It’s not much, but it’s more than other brokerages offer!

Core Portfolios: E*Trade’s Robo-Advisory Product

E*Trade also offers an automated investing platform, called Core Portfolios, where you can let E*Trade manage as little as $500.

Answer a few questions about yourself, your goals, and your risk tolerance, then E*Trade will provide you with a suggested portfolio that you can either accept or personalize more before putting it to work. From there, E*Trade will automatically invest funds for you and manage the portfolio.

Fees are 0.30% annually, or $30 on every $10,000 invested.

Retirement Tools: An Under-Discussed Edge

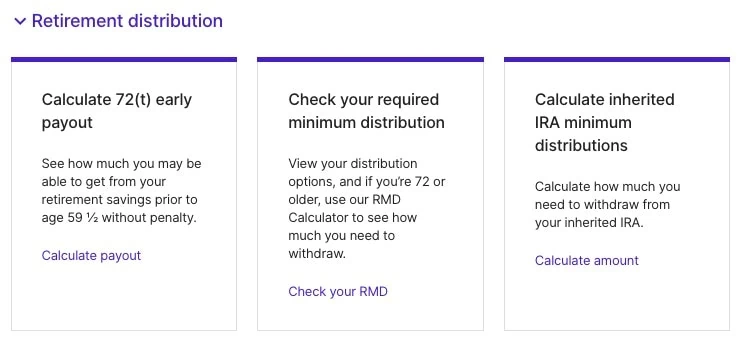

It’s a boring little section that most users might gloss over or ignore, but E*Trade’s “Planning” section reveals a number of really useful tools, including:

- IRA Selector (Helps you decide whether a traditional or Roth IRA is better for your situation)

- A guide to inherited IRAs

- 401(k) rollover guide

- Small business retirement plan comparisons

- 72(t) calculator (Helps you understand how much you can withdraw penalty-free from a 401(k), IRA, etc.)

- Required minimum distribution (RMD) checker

- Inherited IRA minimum distribution checker

- Net unrealized appreciation (NUA) calculator

These tools are useful to everyone, from novice investors just getting started, to longtime retirement planners getting ready to pull the trigger on their post-career lives.

Related: What Is a Backdoor Roth Conversion? [Retirement Strategy for High-Earners]

What We Like About E*Trade

E*Trade offers a wide range of investment choices. While $0 commissions for stocks and ETFs are becoming more mainstream, it’s still uncommon to offer commission-free mutual fund trading, which makes E*Trade stand out from its many competitors.

It seems that no matter what device you use E*Trade on, or whether you opt for the regular or Power experience, the user experience is quick and clean. There are ample tools and features if you want them—but if you don’t, you can buy, sell, and get out without tripping over anything.

What E*Trade Could Do Better

To be crystal-clear, I have no problem with the web screener above—in financial data, archaic often runs parallel to powerful—but it’s one of E*Trade’s few interfaces that feel a little bit behind the times.

Other concerns? E*Trade is filled with educational content, it’s worth noting that the content is difficult to sort through. Additionally, many customers also complain about E*Trade’s customer service. While you can contact customer service representatives over the phone or through physical “snail mail,” the website doesn’t offer an email or live chat option.

Who Is E*Trade Best For?

E*Trade is an absolute best fit for intermediate investors, given its mix of simple UX but abundant features, great usability on any device, and the optionality of the regular or Power E*Trade platforms.

Beginner investors might have a slightly easier time with apps like Robinhood or eToro that feature incredibly basic, big-buttoned interfaces. But it would be worth considering E*Trade anyways just because there’s a lot more brokerage to grow into—from both an asset and feature standpoint.

It’s a solid choice for options traders, too. E*Trade allows traders to explore advanced options strategies, use options chains to compare ETF and stock options trades they’re considering, and test strategies before trading. If you’re an active trader, you’ll enjoy E*Trade’s volume discounts. And if you’re a novice options trader, E*Trade’s educational library is more helpful than most.

Click the button below to learn more or sign up today.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, Treasuries, and new-issue bonds. (Options have a 65¢ contract fee, or 50¢ at certain volume thresholds.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- Commission-free mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

Related: 15 Best Investing Research & Stock Analysis Websites