Pop quiz: How much money do you expect to collect when you start receiving Social Security retirement benefits?

If you’re like the vast majority of people, you don’t know that number off the top of your head. That’s fine—unless you’re budgeting for retirement. At that point, your potential Social Security payment is one of the most critical numbers to build around. This income stream could affect when you choose to retire and how much you contribute to your retirement plans.

This is a complex social safety net—people commonly make mistakes as it pertains to taking Social Security benefits. But at least when it comes to getting a reasonable estimate on your eventual benefits, it’s fairly easy: The Social Security Administration’s Retirement Calculator will do all the pesky math for you!

Today, I’m going to show you how to create a Social Security Administration account and get your estimated monthly retirement benefit. You’ll be able to see approximately how much you could receive not only if you retire when you’re expected (full retirement age), but also if you retire early or delay your payments for a higher benefit. This information will be key to mapping out your retirement strategy.

Featured Financial Products

How to View Your Social Security Benefit Estimates

To find out how much money you’ll get from Social Security, you need to have a “My Social Security” account, which you can create on the Social Security Administration’s website.

Step 1: Visit the SSA MyAccount Page

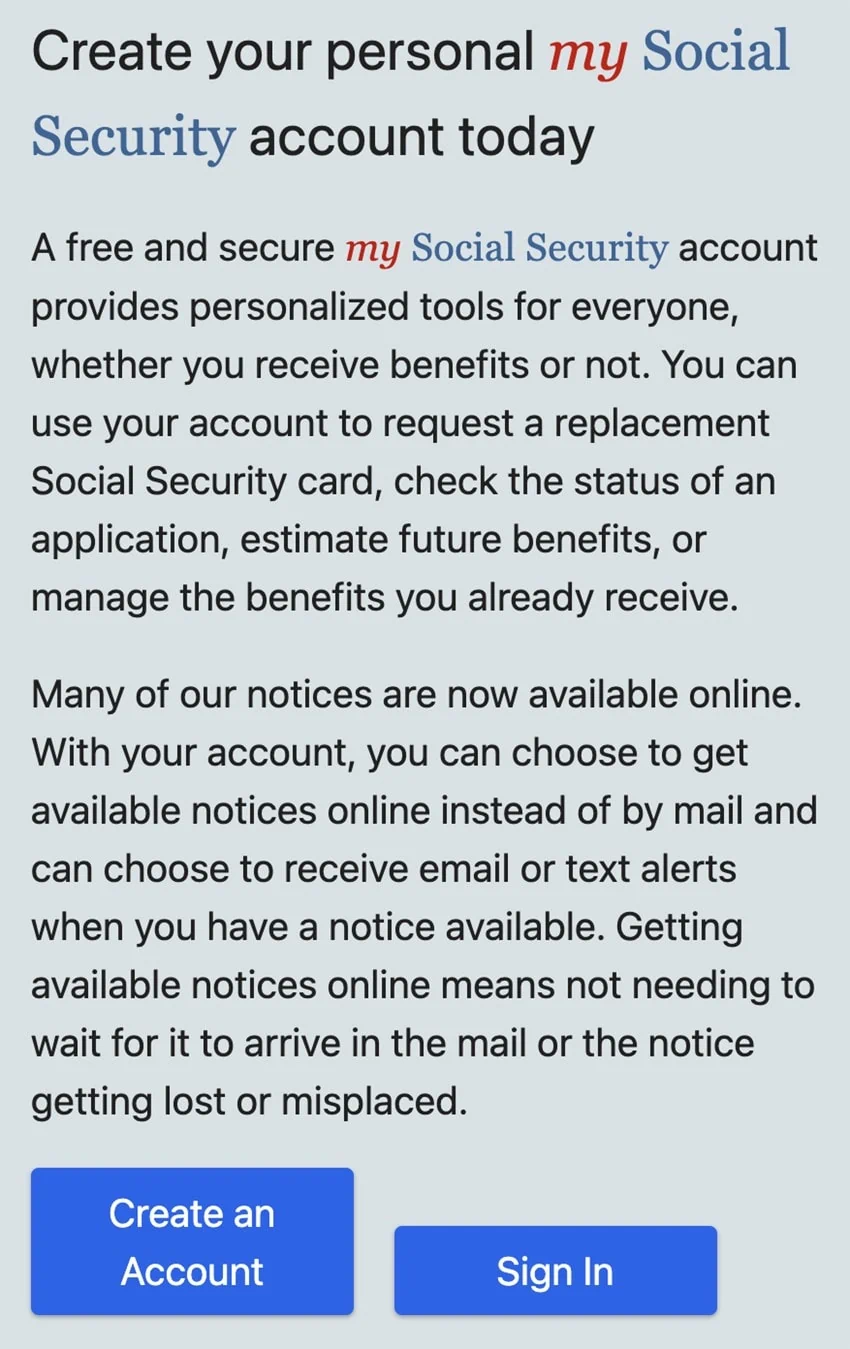

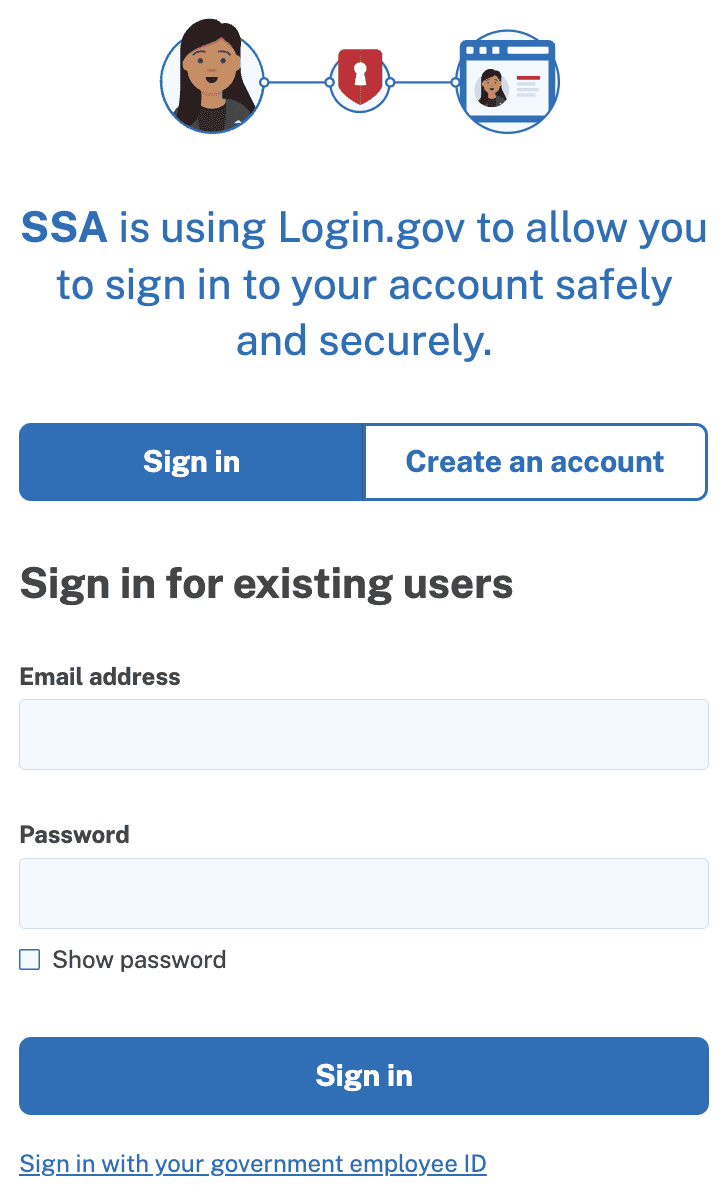

This is pretty straightforward. Navigate to SSA.gov/myaccount, where you’ll see the following:

If you do not already have a My Social Security account, click Create an Account and continue on to Step 2.

If you already have a My Social Security account, click Sign In and continue on to Step 2.

Step 2: Create a Login.gov or ID.me Account

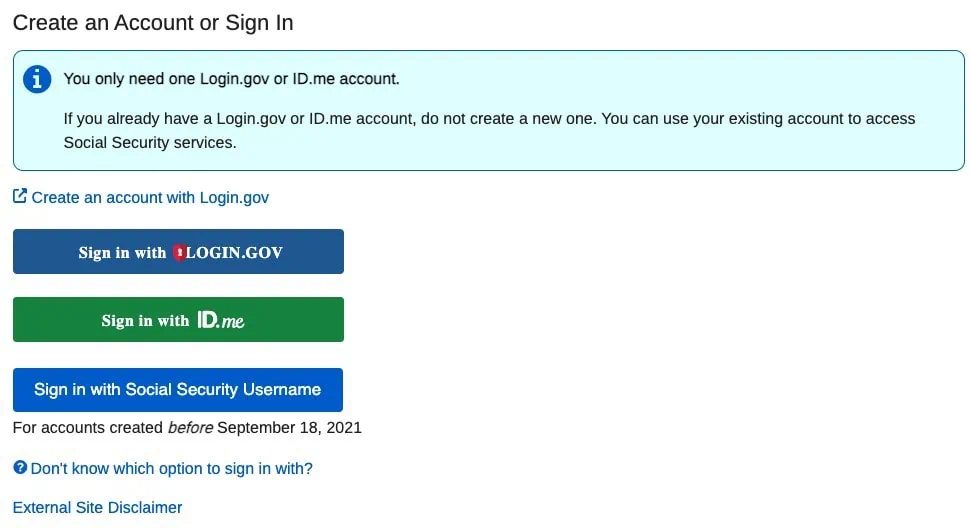

Regardless of whether you clicked Create an Account or Sign In, you will move on to the following page, which asks you to create an account or sign in via one of three options.

The three options presented:

- Login.gov is a secure government-run account for private access to participating U.S. government agencies.

- ID.me is a secure, third-party, single sign-on provider.

- Social Security Username is an option that’s being phased out. So if you currently don’t have a Login.gov or ID.me account, you’ll want to create one.

While both Login.gov and ID.me accounts are secure and acceptable, the subsequent steps will assume use of a Login.gov account, which can be used for governmental purposes only. The steps for continuing through ID.me may be similar, but not identical.

If you already have a Login.gov or ID.me account, click on the appropriate Sign in With box and skip to Step 8.

If you do not have a Login.gov or ID.me account, you must create an account with one or the other. You can follow these instructions to create a Login.gov account, or follow these instructions to create an ID.me account.

Again, we will assume use of a Login.gov account. So click Create an Account With Login.gov and move on to Step 3.

Related: 9 States That Tax Social Security Benefits

Step 3: Answer Whether You Requested an Activation Code

Again, the subsequent steps assume use of a Login.gov account.

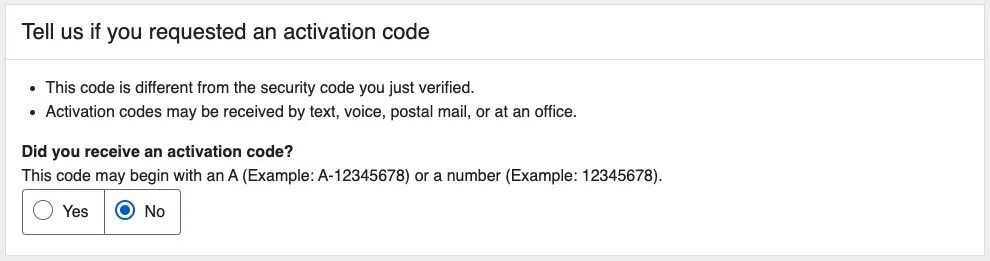

Clicking on Create an Account With Login.gov will send you through a series of pages to create a Login.gov account. Once finished, you should automatically be flowed into the My Social Security account creator, where you will see the following prompt:

If you just signed up for a Login.gov account, you might assume this is asking about the one-time code you received as part of the sign-up process. It is not. Generally speaking, the answer to this question should be no.

Click the “No” box. After your selection, click Next and move on to Step 4.

Related: What Are Social Security Spousal Benefits [And How Do They Work?]

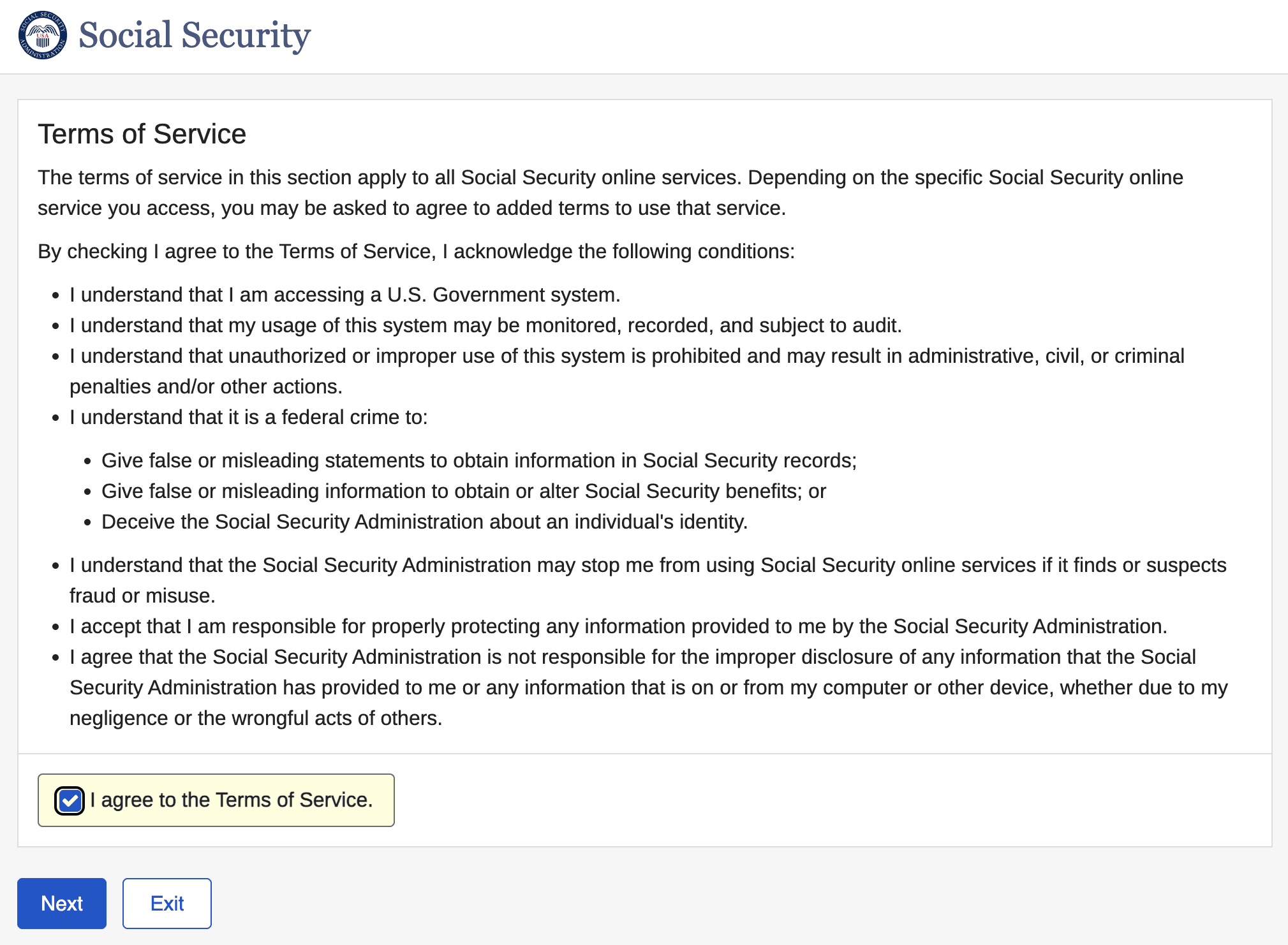

Step 4: Read + Agree to Terms of Service

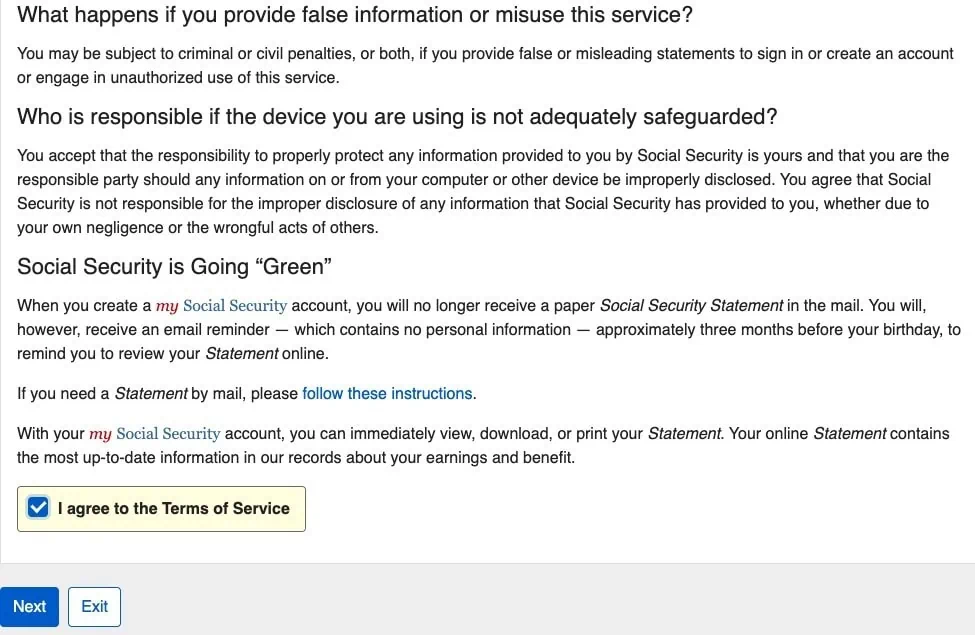

Carefully review the terms of service. As you scroll down the page, the bottom of it should look like this:

Assuming you agree to the terms, check the “I agree to the Terms of Service” box, then click Next and move on to Step 5.

If you do not agree to the terms, or if at any point throughout the process you have an issue, reach out to Social Security directly at 1-800-772-1213. The line is staffed between 8 a.m. and 7 p.m. local time, Monday through Friday.

Related: How to Maximize Social Security Spousal Benefits

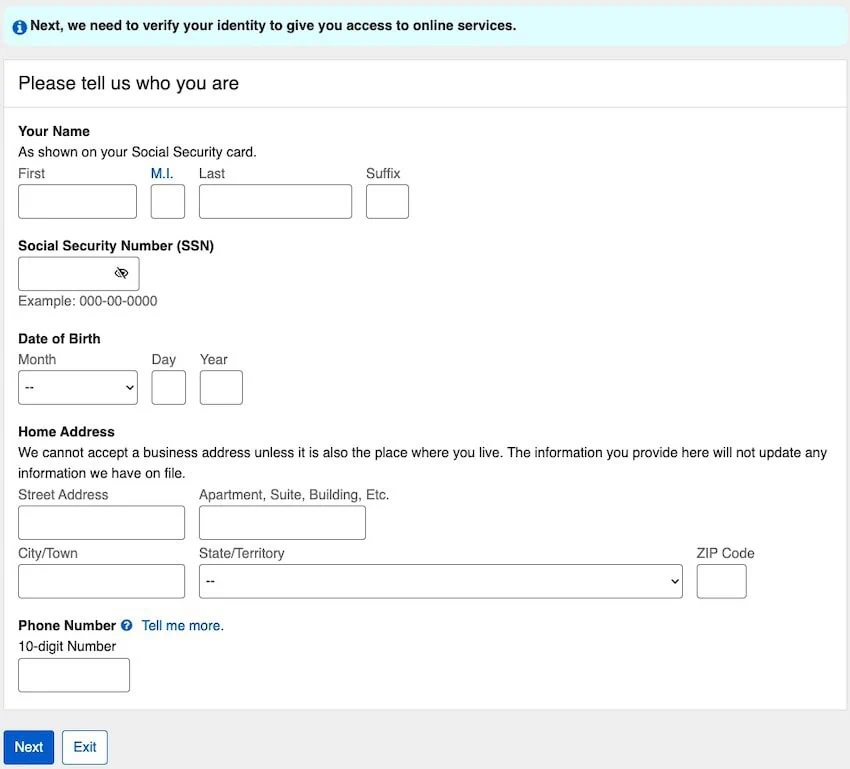

Step 5: Verify Your Identity

You will be directed to the following form:

Enter the requested information. Click Next and move on to Step 6.

Related: What Is the Windfall Elimination Provision? [And How Does It Work?]

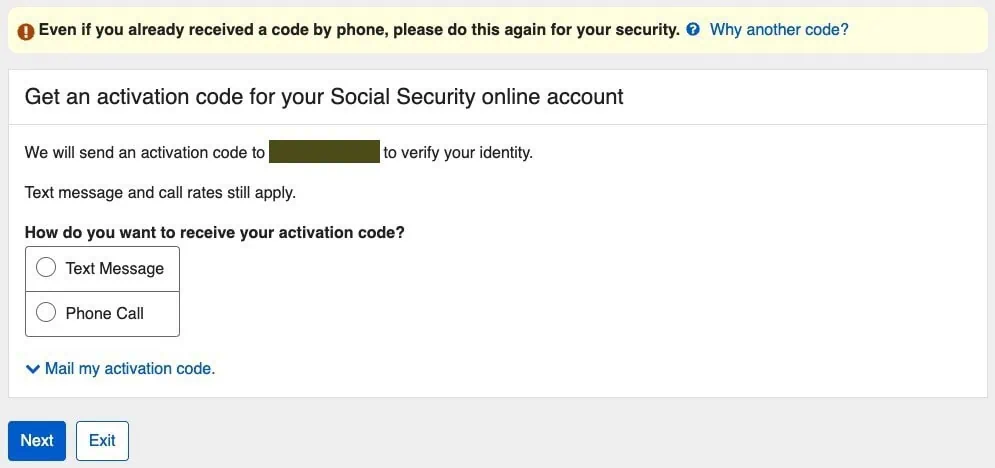

Step 6: Choose How to Receive an Activation Code

You will then be asked to receive an activation code.

Check the box with your preferred method of activation, then click Next. Move on to Step 7.

Related: What Is the Government Pension Offset? [And How Does It Work?]

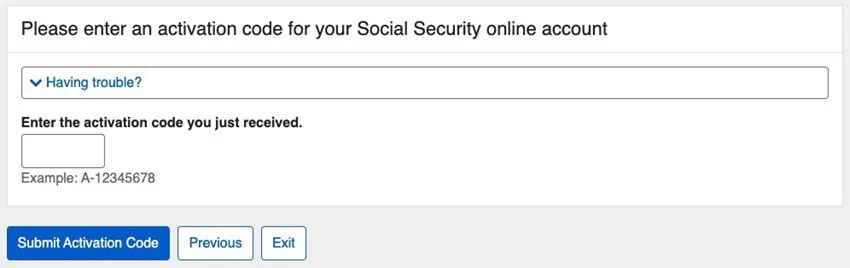

Step 7: Enter Code

You will be prompted to enter the activation code, which will have a letter, a dash, then several numbers.

Enter the activation code into the appropriate field. Click Submit Activation Code. Assuming the code is correct, you will receive one of two messages.

If you did not previously have a Social Security Username, it will look like this:

If you previously had a Social Security Username, it will look like this:

Either way, click Next, and skip to Step 10.

Step 8: Sign In (Already Have Existing Login.gov Account)

When you click Sign in With Login.gov, you will move to the following page:

Fill in your email address and password, then click Sign In and move to Step 9.

Related: RMDs Too High? 6 Ways to Reduce Them at Age 73

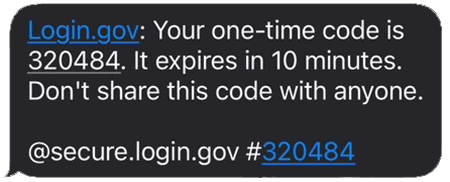

Step 9: Enter Your One-Time Code

The site will send you a one-time code under your preferred method.

The text should look like this:

Enter the code and click Submit, then move on to Step 10.

Step 10: Read + Agree to the Terms of Service

You will be presented with the Terms of Service.

Assuming you agree with the General Terms of Service, check the “I agree to the Terms of Service” box and click Next. Move on to Step 11.

Related: When Should You Take Social Security?

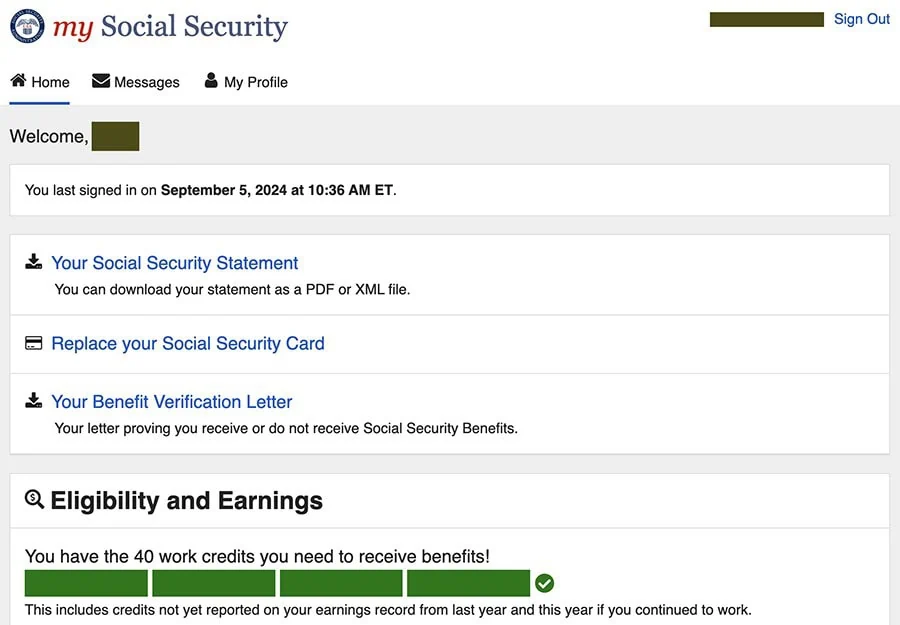

Step 11: Scroll Down to View the Retirement Calculator

Your My Social Security dashboard should look something like this:

Scroll down to the Retirement Calculator, which will look like this:

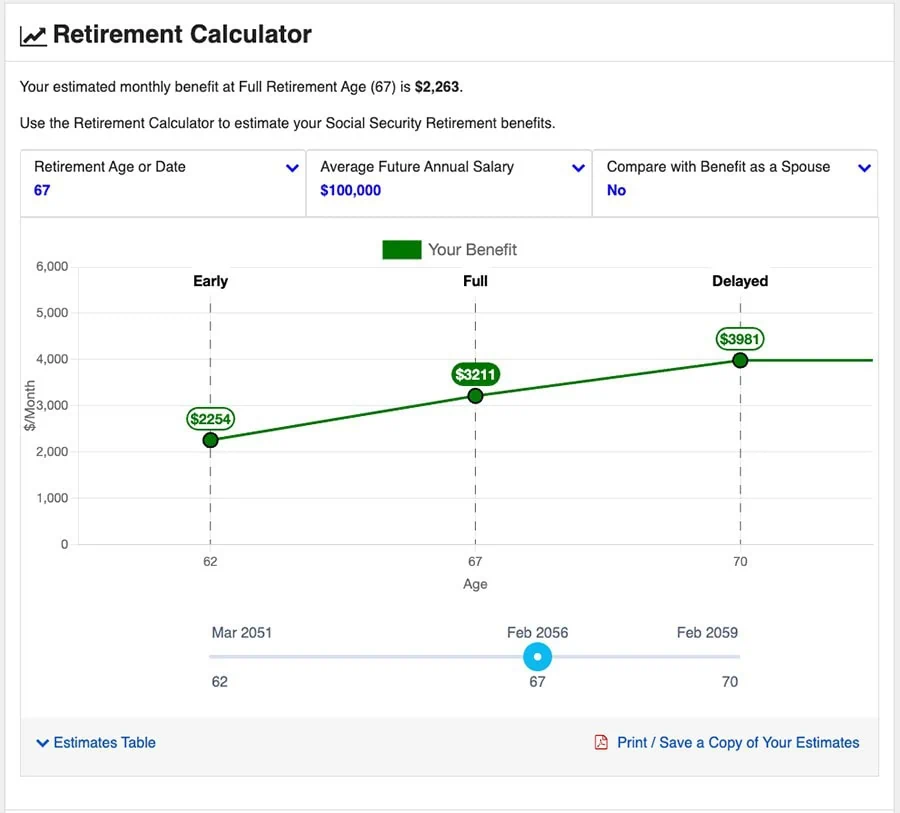

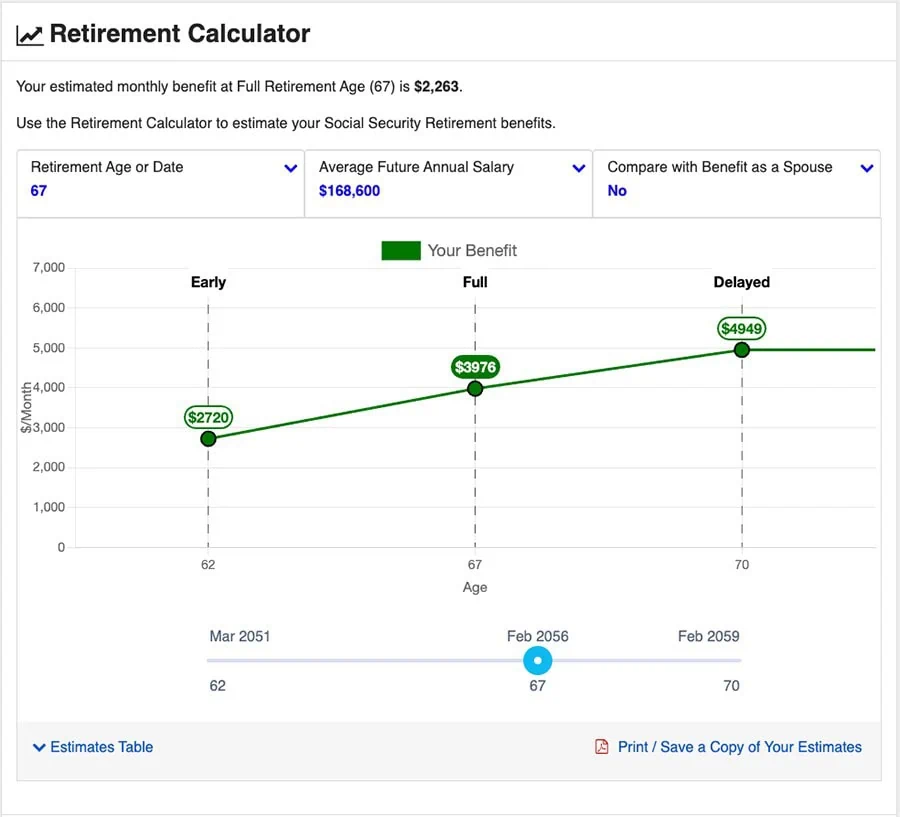

The Retirement Calculator will show your estimated Social Security retirement benefits if you retire early (age 62 is the minimum), your full retirement age (birth year-dependent), or if you delay payments (amount maxes out at age 70). You can play with the average future annual salary amount to see your best- and worst-case scenarios.

Note: Every year, the government determines a limit on the amount of one’s earnings that can be taxed for Social Security. The 2025 limit is set at $176,100. Any salary you enter in excess of the Social Security income tax limit won’t increase your benefit amount any further.

Once you are finished looking at your Social Security benefits, log out using the “Sign Out” button on the upper-right corner of the page.

Conclusion

Your My Social Security account can be used for more than just looking at the Retirement Calculator. You can get your Social Security statements, replace your Social Security card, access and print out your Benefit Verification Letter, review your eligibility and full earnings record, and more.

However, the Retirement Calculator is a particularly important tool in helping you plan for retirement. So as soon as you’re serious about drawing up a retirement game plan, be sure to include the calculator’s estimate for the payments you can expect once you begin collecting benefits.

Featured Financial Products

Related:

![Should You Max Out Your 401(k) Each Year? [Yes...and No] 35 should you max out your 401k each year or invest elsewhere](https://youngandtheinvested.com/wp-content/uploads/should-you-max-out-your-401k-each-year-or-invest-elsewhere-600x403.webp)