Table of Contents

What is Renters Insurance and How Does it Work?

Let’s imagine a dire situation: you’re renting a condo or apartment and your electric stove short-circuits, causing a fire. The flames take most of your personal property with them and you’re left with mostly-charred remains. In this case, those contents wouldn’t be covered by a landlord insurance policy. The only way to recoup these losses you’ve experienced is through carrying a renters insurance policy. The same is true of theft or another catastrophe. The landlord policy held by the unit owner may protect the building you live in, but this landlord insurance will not replace your personal possessions or pay for your temporary living expenses as the building is repaired. In fact, the only reliable way to protect yourself financially against disasters such as these is to buy a renters insurance policy. Renters insurance, sometimes also referred to as tenants insurance, includes three basic types of protection in a standard policy:- Personal Possessions Coverage

- Liability Coverage

- Additional Living Expenses (Temporary Rehousing)

How Much is Renters Insurance Per Month for an Apartment?

Given the low cost of a renters insurance policy, sometimes under $10/month, it makes sense to carry coverage. For $7/month, my wife and I carry:- $100,000 of personal liability coverage (per occurrence)

- $15,000 of personal property coverage

- $3,000 for loss of use of our primary residence

- $1,000 for medical payments made to others (per person)

- Standard Policy coverages

- Policy deductibles for coverages

- Total standard policy premium

- Additional coverages under the policy above the standard policy

- Additional coverages you can add through an insurance endorsement or rider

1. Personal Possessions Renters Insurance Coverage

Under a standard renters insurance policy, you will receive loss protection against events such as:- Fire

- Smoke

- Vandalism

- Windstorm

- Theft

- Explosion

- Lightning

- Water

- Other disasters specified in the policy and relevant to your geographic area (though, flood and earthquakes are not covered loss events)

- Furniture

- Clothing

- Electronics

- Appliances (if you own them)

- Kitchen utensils and equipment

- Linens and sheets

- Bikes

2. Liability Coverage

Most renters insurance policies come with standard liability protection coverage which cover against legal actions stemming from bodily injury or property damage you or your kin may cause to others on-site. By extension, this also covers against any damage which may be caused by a pet. For example, if you decide to attend a neighbor’s housewarming party and your dog decides to ruin the event by relieving himself on the expensive rug, you’ll have coverage against that incident. Were it your own rug being soiled, you wouldn’t be protected under this liability coverage. Spike should have known better in both instances, but you’re only covered in one scenario. The liability portion of a renters insurance policy provides coverage for both:- the cost of defending you in court, and

- any awards made by the court, up to the policy limit.

Umbrella (Excess Liability) Insurance

As a supplemental level of liability coverage, you can also buy an Umbrella or Excess Liability policy, which provides both higher coverage limits and broader coverage. Generally, these policies can run in the low hundreds of dollars for an added $1 million of liability protection. Of note for an umbrella policy, if you opt not to carry renters insurance and instead feel comfortable only carrying umbrella coverage, the insurance company will likely not cover the first $100,000 (renters insurance liability coverage) and only pick up from after that point ($100,001+). The renters insurance policy acts as the base line coverage and absence of this coverage does not then automatically default to the umbrella policy. Recently, my wife and I bought a new vehicle and added it to our Liberty Mutual auto insurance policy. Because my wife and I could fear our liability coverage on the policy might not be sufficient for our needs ($500,000), we decided it would be in our best interest to purchase an additional $1,000,000 of liability coverage under an umbrella policy. Making this decision would cover us against more now that we have more to lose with a baby in the picture. The simple addition only cost a few hundred dollars extra because it came bundled with several other coverages we carry. The one kicker came when I also needed to have it cover against any potential liability stemming from my condo rented out in New Orleans. This triggered a $125 premium. Regardless, we carry the reasonably-priced umbrella insurance policy on top of our other coverages for the added peace of mind in case the existing liability coverages proved insufficient. As mentioned above, there are multiple carriers who provide umbrella coverage, and quite often they can bundle with existing policies and potentially result in a bundle discount. Related: Are Life Insurance Proceeds Taxable? The Complete Guide3. Additional Living Expenses Coverage

An often forgotten component of your renters insurance policy is the additional living expenses coverage (ALE). This coverage works by covering the cost of incidental housing costs incurred as a result of losing your primary covered residence under the renters insurance policy. For example, if your apartment complex burns down and you’re no longer able to live there, while you find alternative accommodations and live somewhere else, your ALE will cover hotel bills, temporary rentals, restaurant meals and other incidental expenses incurred while your home is being rebuilt. Policies will generally reimburse you for the difference between your additional living expenses incurred as a result of this circumstance and your normal living expenses.Two Types of Renters Insurance Policies Exist

Before buying your renters insurance from a recommended provider below, be sure to understand the two types of renters insurance policies that exist.- Actual Cash Value – This type of policy pays to replace your possessions minus any related depreciation up to the policy limit

- Replacement Cost – This renters insurance policy type pays you for the actual cost of replacing your lost possessions without consideration for depreciation, up to the policy limit. In general, because you’re receiving a larger payout for this added reimbursement, you will tend to pay more for Replacement Cost renters insurance policies.

Is Renters Insurance Really Necessary?

Some people enjoy risk and can tolerate loss. While I’ll admit to having some risk tolerance, for the low cost of renters insurance, I find the added $5-7/month as a pleasant peace of mind. However, in our case, it was a requirement of living in our apartment. Regardless, I still think the small expense would have fit into our personal budget plan and more than offset any expense should a claim be made against the policy.Does Each Person Need Renters Insurance in an Apartment?

Generally, yes, assuming the tenants aren’t related. If unrelated, each roommate should purchase separate renters insurance policies, unless they are listed on the policy.How have Renters Insurance Costs Trended?

Compared to homeowners insurance costs, renters insurance premiums haven’t moved in the last decade since the Great Recession according to data from the Insurance Information Institute. In fact, as you can see below, the average premium for a renters insurance policy has remained essentially flat, going from $182 in 2007 to $185 in 2016.| Year | Homeowners (1) | % Change | Renters (2) | % Change |

|---|---|---|---|---|

| 2007 | $822 | 2.2% | $182 | (3.7%) |

| 2008 | 830 | 1.0 | 182 | <0.1 |

| 2009 | 880 | 6.0 | 184 | 1.1 |

| 2010 | 909 | 3.3 | 185 | 0.5 |

| 2011 | 979 | 7.7 | 187 | 1.1 |

| 2012 | 1,034 | 5.6 | 187 | <0.1 |

| 2013 | 1,096 | 6.0 | 188 | 0.5 |

| 2014 | 1,132 | 3.3 | 190 | 1.1 |

| 2015 | 1,173 | 3.6 | 188 | (1.1) |

| 2016 | 1,192 | 1.6 | 185 | (1.6) |

| (1) Based on the HO-3 homeowner package policy for owner-occupied dwellings, 1 to 4 family units. Provides all risks coverage (except those specifically excluded in the policy) on buildings and broad named-peril coverage on personal property, and is the most common package written. | ||||

| (2) Based on the HO-4 renters insurance policy for tenants. Includes broad named-peril coverage for the personal property of tenants. | ||||

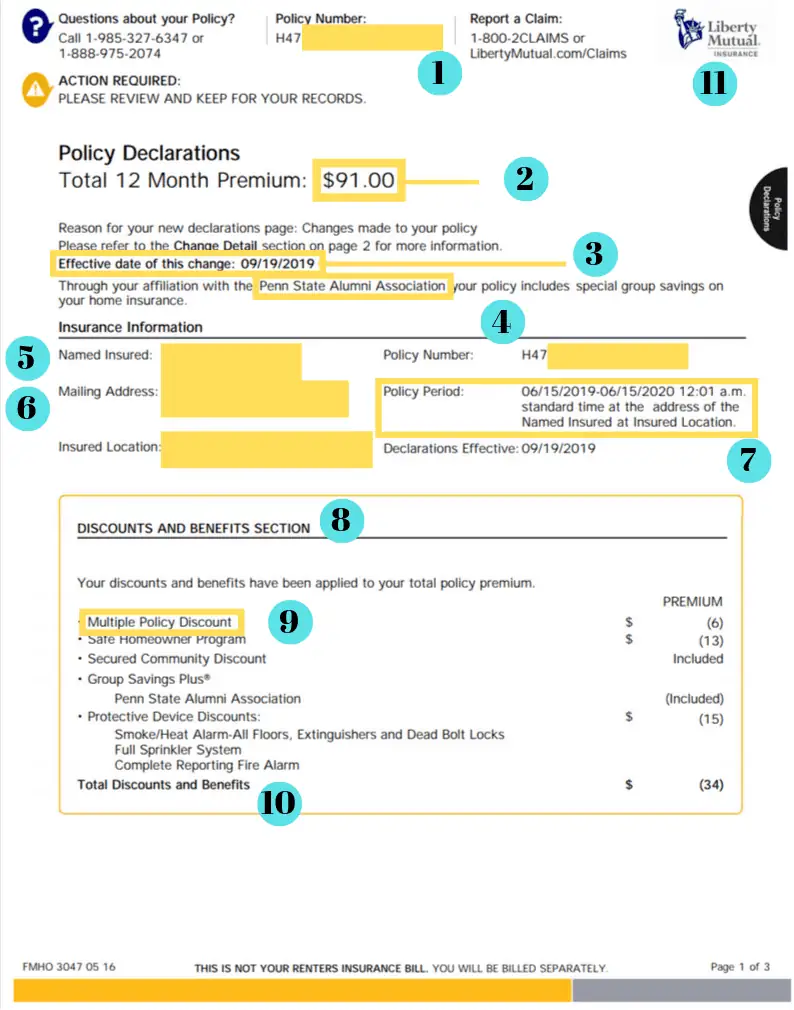

To review these renters insurance declaration pages, the items numbered above include:

To review these renters insurance declaration pages, the items numbered above include: