Consumer prices rose at a slower-than-expected rate for a third consecutive month in what is likely the last consumer price index (CPI) report before tariffs are more fully folded into the economic picture.

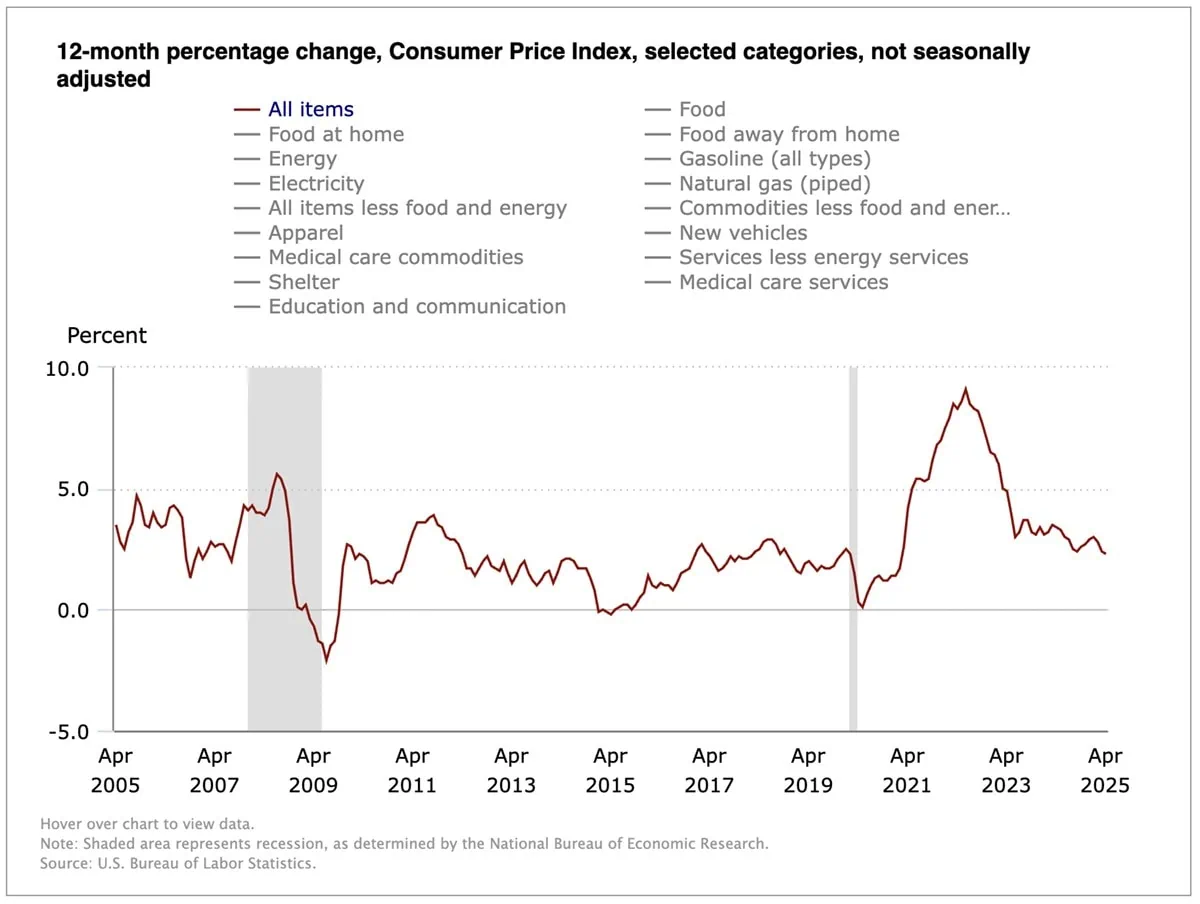

The U.S. Bureau of Labor Statistics said Tuesday that April’s CPI, which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.2% month-over-month, in line with economists’ expectations and up from March’s 0.1% decline. On a year-over-year basis, prices rose by 2.3%, which slid under estimates for 2.4% and was the slowest such growth since February 2021.

Meanwhile, “core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—grew by just 0.2% month-over-month to fall under estimates for 0.3%. On a year-over-year basis, core CPI was in line with projections for a 2.8% increase.

However, much like in March’s CPI report, analysts were largely looking ahead to data prints that will more fully include President Donald Trump’s tariffs, which should be more meaningful to the Federal Reserve and its stance on interest rates.

8 Best-in-Class Bond Funds to Buy

“Like March’s reading, inflation came out like a lamb in April,” says John Kerschner, Head of U.S. Securitized Products & Portfolio Manager at Janus Henderson. “Unfortunately, given the overarching tariff situation, this was probably one of the least important CPI prints since the inflation spike of 2022. Inflation from the new tariffs announced on Liberation Day will not likely show up until at least next month or perhaps even June’s readings. Thus, the market will wait with bated breath for those readings to make a determination of where we actually stand on tariff-induced rising prices.”

A quick look at April’s key CPI figures:

- MoM CPI: +0.2% (estimate: +0.2%)

- YoY CPI: +2.3% (estimate: +2.4%)

- MoM Core CPI: +0.2% (estimate: +0.3%)

- YoY Core CPI: +2.8% (estimate: +2.8%)

Among the drivers of April’s inflation was shelter, which grew 0.3% month-over-month and 4.0% year-over-year. Electricity costs were up 0.8% MoM, and food away from home and medical care commodity prices grew by 0.4%.

Fuel oil retreated by 1.3%, while prices for food at home declined by 0.4%.

“The inflation report had a familiar ring, with housing costs again pushing prices higher. This continues to be a core problem,” says Scott Helfstein, Head of Investment Strategy, Global X. “Meanwhile, energy was also a driver of higher prices with natural gas and electricity costs offsetting the lower oil prices which have been a priority for the administration. The rest of goods and services were mixed across products and services.”

The 7 Best Gold ETFs You Can Buy

“Goods prices accelerated modestly, but it is still too early to see substantial impact from tariffs, while services prices remain firmer but are not worryingly elevated,” adds Josh Jamner, Investment Strategy Analyst at ClearBridge Investments. “So-called ‘supercore’ inflation—services ex-energy, rent, and owners equivalent rent—advanced 0.2% for the month in a sign that underlying inflation trends remain tame.”

Following Tuesday’s report, the broad consensus was that the Fed will likely continue to keep its hands off its benchmark interest rate, at least in June.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

“The April CPI report probably does not change the Fed’s calculus on the path of rate cuts all that much,” says Jason Pride, Chief of Investment Strategy and Research at Glenmede. “The relative health of the labor market affords it the ability to take a patient approach as the effects of tariffs begin to work their way through the economy. The base case is around three rate cuts in the back half of 2025.”

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, now indicates a 92% chance that the central bank will keep its current Fed funds rate range between 4.25% and 4.50% at the next Federal Open Market Committee (FOMC) meeting, scheduled for June 17-18.

What the Experts Think About April’s CPI Report

Here, we outline more thoughts from the experts on what April’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“This CPI print might be one of the last readings before we see the impact of tariffs bleed into the report. Although tariffs on China have been negotiated down to 30% from 145% for the next 90 days, the effective tariff rate remains significantly higher than where we started the year. This suggests that future CPI prints could reflect increased costs due to these tariffs, potentially leading to higher inflation rates.

“The temporary reduction in tariffs on China, the deal with the U.K., and the potential for further negotiation with other countries may provide some relief, but we continue to see inflation remaining elevated in the medium term.”

Are Financial Advisors Only for Inexperienced Investors?

Alexandra Wilson-Elizondo, global co-head and co-chief investment officer of Multi-Asset Solutions, Goldman Sachs Asset Management

“The wide range of estimates coming into today’s CPI report underscores the difficulty for market participants to size the significant uncertainty facing both corporations and consumers.

“The final CPI figure of 2.3% YoY is likely a welcome reprieve for the Fed; however, the larger tariff-related price adjustments are likely to come over the next few months. Consequently, we still anticipate them remaining on the sidelines in the near term and for markets to be trading with negotiation and reconciliation headlines.”

David Russell, Global Head of Market Strategy, TradeStation

“Inflation was slowing before the tariffs were announced, and the economy continues to benefit from that trend. It suggests there’s still time to avoid significant upward pressure in prices and increases the urgency of reaching trade agreements soon.

“While the Fed has maintained a cautious tone, today’s data incrementally nudges them back toward a potential rate cut this summer.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 8 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 9 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)