Vanguard has changed retirement saving as we know it in many ways. But one of the lasting legacies that strikes truest with the average American is just how inexpensive they’ve made it to invest.

Under visionary founder Jack Bogle, Vanguard created the concept of the index fund—a product that by its nature allows for lower costs. Thirty years later, expenses have plummeted lower on funds across the board—though Vanguard remains a favorite in most types of retirement plans, including the ubiquitous 401(k).

Indeed, you’re likely to find a wealth of Vanguard options in your 401(k) and other retirement plans. And given that they’re typically competitive on both price and performance, they should be among the first funds you look at.

Today, I’m going to introduce you to a number of Vanguard retirement-focused mutual funds you’re likely to find in your 401(k) plan. To be clear: Your plan might not hold one, some, or all of these—if they don’t, you can always ask your plan sponsor to include them. You can also consider holding them in other tax-advantaged accounts, such as an IRA or HSA.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

What Should You Want in a Retirement Fund?

When you invest your retirement savings in an account like a 401(k), you’ll want to keep a few things in mind.

Costs are first and foremost. Let’s say you pay $5 in expenses for every $100 a mutual fund earned you. That’s $5 that wouldn’t grow and compound for you over time. So if all else is equal, the lower the cost, the better. But occasionally, a fund justifies its higher fees. No worries in that department: The best Vanguard retirement funds’ fees typically sit near or at the bottom of their category.

Income matters, too. You probably want your retirement portfolio to produce at least some regular income—in the form of both bond interest and dividend income. Stock prices can suffer during nasty corrections and bear markets, but income-generating funds can help provide for your living expenses without forcing you to sell at an inopportune time. How much income your account should produce depends on your own circumstances. For instance, older investors tend to be more concerned with income while younger investors focus more on growth.

Don’t forget taxes. A taxable account (like a standard brokerage account) is better suited to take advantage of certain tax-advantaged investments, such as municipal bonds. For tax-advantaged accounts, such as 401(k)s, some of the best investments include bond funds (where the interest income won’t be taxed) and actively managed stock funds (where the capital gains distributions from heavy trading, aka “turnover,” won’t be taxed).

Diversification matters (in more than one way). You’ve probably heard that your portfolio should be “diversified,” which means holding a variety of investments, whether that’s holding multiple assets (stocks, bonds, alternative investments), but that could also mean holding, say, stocks from different countries, or stocks from different sectors. And investment funds, which can own any number of stocks, bonds, or other holdings all at once, can help you achieve that diversification. But every fund has its own level of built-in diversification. Some funds hold dozens of stocks while others hold thousands. Some funds invest heavily in their biggest stocks while others spread their assets out more evenly. So always consider how diversified a fund really is, as well as whether that level of diversification suits your needs.

What Types of Funds Are Available in 401(k) Plans?

Virtually every 401(k) plan is limited to mutual funds. While a handful of plans might offer exchange-traded funds (ETFs), they’re typically limited to mutual funds—and a handful, at that. Rather than a self-directed account, where you have your pick of virtually the entire mutual fund universe, 401(k)s only let you invest in, say, 10, 15, or 20 mutual funds, each of which cover a specific investing style.

Would it be nice to invest in ETFs, which typically offer lower costs? Sure. But mutual funds have certain qualities more befitting a 401(k).

For one, mutual funds don’t trade all day on an exchange, which discourages long-term investors from panic-selling during a particularly bad day in the market. They also allow for fractional share ownership, which is important given that 401(k) plan investors are typically allocating a fixed amount of money to their account every paycheck.

Also, rather than a self-directed account, where you have your pick of virtually the entire mutual fund universe, 401(k)s usually only let you select from between 10 and 20 mutual funds. Fortunately, each fund tends to cover a specific investing style, meaning you should be able to address most of your core needs with the options made available to you.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

What Is a Mutual Fund?

A mutual fund is an investment company that pools money from many investors to buy stocks, bonds or other securities. The investors get the benefits of professional management and certain economies of scale. A pool of potentially millions or even billions of dollars is large enough to diversify and might have access to investments that would be impractical for an individual investor to own.

Here’s an example: An investor wanting to mimic the S&P 500 Index (an index made up of 500 large, U.S.-listed companies) would generally have a hard time buying and managing a portfolio of 500 individual stocks, especially in the exact proportions of the S&P 500 Index. Another example: An investor wanting a diversified bond portfolio might have a hard time building one when individual bond issues can have minimum purchase sizes of thousands (or tens of thousands!) of dollars.

Equity funds or bond funds will generally be a far more practical solution.

To invest in a mutual fund, you’ll need to open an account with the fund sponsor or open a brokerage account with a broker that has a selling agreement in place with the fund sponsor. As a general rule, most large, popular mutual funds will be available at most brokers, so if you open a traditional investment account (like an IRA or brokerage), you’ll have access to most of the mutual funds you’d ever want to invest in.

Related: 7 Best Vanguard Retirement Funds [Start Saving Today]

Why Vanguard Mutual Funds?

Vanguard Group is a leader in investment funds, boasting almost $12 trillion in assets under management.

Part of the allure is that across its 400-plus funds (which include mutual funds and ETFs), Vanguard charges an average expense ratio of just 0.07%, or a mere 70¢ for every $1,000 invested. The average asset-weighted expense ratio for U.S. mutual funds and ETFs is 0.44%, or $4.40 annually for every $1,000 invested.

In other words, Vanguard’s average fee is astoundingly low—even when a Vanguard fund isn’t the absolute cheapest in its category, it’s still going to be one of your most cost-efficient options.

Vanguard also grew into the powerhouse mutual fund company it is today by taking care of its clients and genuinely looking after their interests. Vanguard funds really started and continue to accelerate the trend of fee compression. But it’s not only the best Vanguard retirement funds that benefit. We all collectively pay less in fees and expenses and enjoy better returns because of the index revolution started and led by Vanguard’s founder Jack Bogle.

Related: 6 Best AI ETFs for the Artificial Intelligence Era

The Best Vanguard Retirement Funds for Your 401(k)

With all that out of the way, let’s dig into some of the best Vanguard retirement funds to hold in a 401(k) to consider diving into this year.

These Vanguard retirement funds are ordered by their Morningstar Portfolio Risk Score for the trailing 10-year period. You can get risk scores and other data through Morningstar Investor (which I’ll briefly discuss after I examine these funds).

Here are the risk levels each score range represents:

- 0-23: Conservative

- 24-47: Moderate

- 48-78: Aggressive

- 79-99: Very Aggressive

- 100+: Extreme

Importantly, these scores are a general gauge of risk compared to all other investments. For example, a bond fund with a score of 20 might be considered a conservative strategy overall, but it could simultaneously be riskier than a number of other bond funds.

1. Vanguard Federal Money Market Fund

- Style: Money market

- Management: Active

- Assets under management: $371.8 billion*

- 7-day SEC yield: 3.7%**

- Expense ratio: 0.11%, or $1.10 per year for every $1,000 invested

- Morningstar Portfolio Risk Score: N/A

Vanguard Federal Money Market Fund (VMFXX) is one of the very best Vanguard retirement funds for investors looking to generate income with less risk than not just stocks but most bonds. This defensive income fund consists entirely of U.S. Treasury bills and other U.S. government obligations and repurchase agreements.

Money market funds provide investors with a relatively safe place to store their money while collecting a decent yield. (At least for now.) They’re somewhat unique among mutual funds in that money market funds specifically target a net asset value of $1 per share. Any earnings that cause the net asset value to go higher than $1 get distributed as dividends. This means that, unless you reinvest your dividends, the value of your money market mutual fund will not grow over time. Because of how they’re structured, they have essentially no interest-rate or duration risk whatsoever.

Thus, while VMFXX doesn’t have a listed Morningstar Portfolio Risk Score, it’s fair to assume that this is one of the most conservative Vanguard funds you can own.

Just remember: Money market funds’ yields are highly sensitive to Federal Reserve policy moves. A few years ago, money market funds in general offered virtually nothing in yield. Then, after the most aggressive string of rate hikes in history, Vanguard Federal Money Market became a legitimate income fund. However, more recently, the Federal Reserve reduced its benchmark rate in 2024 and 2025, cutting back VMFXX’s headline yield somewhat. Still, today’s yield, which is well north of 3%, remains competitive.

As far as taxes are concerned: Money market funds are effectively bond funds, with interest income the predominant source of returns. Interest income is taxed as ordinary income—if you’re in the 37% tax bracket, then you’re losing 37% of your bond interest to taxes—making bond funds (and money market funds) extremely tax-inefficient. Put differently: It makes sense to hold bond and money market funds in a 401(k), IRA, HSA, or other tax-advantaged account.

If the Fed cuts even more deeply into rates, you might want to re-evaluate your options. But until then, the Vanguard Federal Money Market Fund remains one of the very best Vanguard 401(k) funds for its low risk and competitive yield.

* Many Vanguard funds have multiple share classes, including ETFs. Listed net assets for Vanguard funds in this story refer to assets under management across all of a given fund’s share classes.

** 7-day SEC yield reflects the interest earned across the most recent seven-day period. This is a standard measure for money market funds.

Want to learn more about VMFXX? Check out the Vanguard provider site.

Related: 9 Best Fidelity Index Funds to Buy

2. Vanguard Total Bond Market Index Fund Admiral Shares

- Style: Intermediate-term core bond

- Management: Index

- Assets under management: $383.6 billion

- SEC yield: 4.1%*

- Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 16 (Conservative)

Bond funds play an important role in lowering volatility and providing regular income. Within Vanguard’s roster of debt-focused products, Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX) stands out as one of the best Vanguard retirement funds for its combination of competitive yield and rock-bottom fees. Indeed, with an expense ratio of just 0.04%, it’s all but free to own.

Buying VBTLX invests you in a massive portfolio of some 11,500 bonds. About half of assets are Treasury or agency debt backed by the U.S. government. A quarter is invested in corporate bonds, and another 20% is used to own government mortgage-backed securities (MBSes). The remaining sliver is spread across foreign bonds, commercial mortgage-backed securities (CMBSes), asset-backed securities (ABSes), and other debt.

One of the most critical metrics to consider when considering bond funds is duration, which is a measure of interest-rate sensitivity. As an example, a bond with a duration of two years would see its price rise by 2% if interest rates fell by 1% (or conversely, would see its price fall by 2% if interest rates rose by 1%). The actual calculation of duration is fairly complex; it’s the weighted average of the bond’s cash flows. But the key takeaway is that, all else equal, the longer a bond’s time to maturity, the higher its duration—and thus the higher the interest-rate risk.

The Vanguard Total Bond Market Index Fund, with a duration of 5.8 years, has moderate interest-rate risk. So while investors are collecting a 4%-plus yield for now, VBTLX could struggle somewhat if the Fed cuts deeply into its target rate.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Want to learn more about VBTLX? Check out the Vanguard provider site.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Related: 10 Best Fidelity Funds to Buy

3. Vanguard Wellington Fund Investor Shares

- Style: Moderate allocation

- Management: Active

- Assets under management: $122.3 billion

- Dividend yield: 2.1%

- Expense ratio: 0.25%, or $2.50 per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 46 (Moderate)

You can think of the Vanguard Wellington Fund Investor Shares (VWELX) as a “portfolio in a can.”

Stock funds allow you to own hundreds or thousands of individual stocks. Bond funds allow you to own hundreds or thousands of bonds. But funds like VWELX—known as “allocation” or “balanced” funds—provide you with exposure to both assets within a single ticker, virtually acting like an entire self-contained portfolio.

Vanguard Wellington, which came to life in 1929, is a moderate allocation fund that invests roughly two-thirds of its assets in stocks, and the other third in bonds. The stock portion of the portfolio currently holds about 80 predominantly large-cap stocks* with a median market cap of around $310 billion—a “who’s who” of mega-cap blue-chip firms such as Microsoft (MSFT) and Apple (AAPL), with a little exposure to international names such as UBS Group (UBS) and British American Tobacco (BTI).

The bond portfolio is much more broadly diversified, at nearly 1,500 investment-grade issues. The majority of debt assets (roughly two-thirds) is invested in corporate bonds. Another 25% is dedicated to Treasuries and agency bonds. And the rest is peppered across MBSes, foreign sovereign bonds, and other debt.

Vanguard Wellington’s name refers to its manager: Wellington Management, an investment management company with nearly a century of operational experience. And this one-stop shop for your large-cap stock and bond needs charges just 0.25% in annual expenses—very inexpensive for the skilled management and strong performance track record you’re getting in return. It’s also an excellent 401(k) recommendation for a pair of reasons:

- It’s among the most common Vanguard funds you’ll find in 401(k) plans.

- Turnover (how much the fund tends to buy and sell holdings) is on the elevated side, with about 60% of the portfolio turning over every year, so it generates some capital gains distributions. It also produces a decent chunk of interest income from its bond portfolio. A 401(k) can help you avoid both sets of tax consequences.

Just make sure you’re considering your own investment needs with this fund. If you don’t want a third of your portfolio to be in bonds, you’ll want to put additional money into individual stocks, equity funds, and/or alternative investments.

* There are different ways to define “cap” levels. We’re adhering to Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Want to learn more about VWELX? Check out the Vanguard provider site.

4. Vanguard Target Retirement Funds

- Style: Target-date

- Management: Active

- Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 20-62 (Conservative to Aggressive)

The only way in which allocation funds fall short of truly being a self-contained portfolio is that their mix of assets always remains the same. That’s great if that’s the particular allocation you need at a given moment in your life. But one of the greatest challenges in retirement planning is getting the asset allocation right: that is, having an asset class mix that is appropriate for an investor at your age and stage of life. An ideal portfolio for a 20-year-old is likely going to be very different from that of a 40-year-old, and both those portfolios will be different from what’s ideal for a 60-year-old.

This is where Vanguard Target Retirement Funds can really add value.

Target-date funds (TDFs)—also called life-cycle funds—are basically allocation funds that change their asset allocation over time. TDFs start out invested heavily in stocks, but as they approach their target retirement date, they slowly reduce their stock exposure and replace it with bond exposure, following a glide path along the way.

The target retirement dates are intended to be estimates; they don’t have to be super precise. Generally, most mutual fund families will create target-date funds in five-year increments (say, 2030, 2035, 2040, etc.).

And given the hyper-specific focus on retirement, target-date funds tend to be a mainstay of 401(k) plans.

Vanguard Target Retirement Funds hold varying blends of both U.S. and international stocks of various sizes, as well as U.S. and international bonds. Their target dates currently span from 2020 through 2070; the series also includes Vanguard Target Retirement Income Fund (VTINX), which is designed for investors who are in retirement.

This TDF lineup is unsurprisingly dirt-cheap, at just 0.08% annually, and the entire series earns a respectable Silver Medalist rating from Morningstar.

Want to learn more about Vanguard Target Retirement Funds? Check out the Vanguard provider site.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

5. Vanguard International Core Stock Fund Investor Shares

- Style: International large-cap stock

- Management: Active

- Assets under management: $6.7 billion

- Dividend yield: 1.3%

- Expense ratio: 0.48%, or $4.80 per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 70 (Aggressive)

U.S. markets have long been among the most productive in the world, and if you believe in the American economy’s ability to keep growing, that should remain the case. Still, America’s stock markets do catch the occasional cold, and that’s why most experts will tell you it’s worth having at least some exposure to international stocks.

You can do that via funds such as the Vanguard International Core Stock Fund Investor Shares (VWICX).

VWICX, which is run by Wellington Management’s F. Halsey Morris and Anna Lunden, currently own 95 companies that have been selected from a universe of 350 to 400 equities from around the globe (excluding the U.S.). Morris and Lunden favor firms from more established nations—companies from developed markets such as Japan and the U.K. make up 75% of assets—but they also hold stocks from emerging markets such as China, India, and Taiwan.

The managers blend growth and value styles, but they generally lean heavily on large-cap stocks; VWICX’s median market cap is close to $70 billion. In other words, this is a predominantly blue-chip portfolio, one that includes multinationals such as Taiwan Semiconductor (TSM), China internet giant Alibaba (BABA), and British oil-and-gas giant Shell (SHEL).

Also, as is common with developed-country funds, VWICX’s yield is higher than comparable U.S. funds.

Vanguard International Core Stock Fund also does more trading than any other fund on this list, with turnover sitting around almost 90% right now—which means most of the portfolio turns over each year. As that can result in capital gains distributions, VWICX is a great Vanguard retirement fund for a 401(k), but a little less so for taxable accounts.

Want to learn more about VWICX? Check out the Vanguard provider site.

Related: The 12 Best Vanguard ETFs to Buy [Build a Low-Cost Portfolio]

6. Vanguard 500 Index Fund Admiral Shares

- Style: U.S. large-cap stock

- Management: Index

- Assets under management: $1.5 trillion

- Dividend yield: 1.1%

- Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 76 (Aggressive)

If we’re talking about tax consequences alone, a taxable account is much better positioned to take advantage of an index fund’s tax efficiency than a tax-advantaged account. However, given that a 401(k) is often an investor’s primary (and sometimes only) investing account, and given that performance is the ultimate goal, an S&P 500 index fund absolutely belongs in any 401(k).

Why? Well, the S&P 500 is hard to beat. According to S&P Dow Jones Indices, by midyear 2025, “In our largest and most closely watched comparison, 54% of actively managed large-cap U.S. equity funds underperformed the S&P 500.” So, a little fewer than half of managers outdid the benchmark. The problem? Historically speaking, that’s good. Over the trailing 10 years, only 14% of large-cap managers beat the S&P 500, and that drops to just 12% for the trailing 15 years.

If the pros can’t beat it, we might as well join it.

The Vanguard 500 Index Fund Admiral Shares (VFIAX), by virtue of tracking the S&P 500, holds shares of 500 large U.S. companies. But it doesn’t hold them equally. The S&P 500 is “market-cap weighted,” which means the larger the company, the more weight the stock has in the index (and thus the more impact it has on returns). Thus, right now, VFIAX dedicates the largest portions of its assets to companies like Nvidia (NVDA), Apple, and Microsoft, whose market caps are measured in trillions of dollars. It’s also considered to be a “blend” fund, which means it has relatively even exposure to value stocks and growth stocks.

Turnover tends to be low, as only a handful of stocks enter or leave the index in any given year. So it typically makes little to no capital gains distributions. This makes VFIAX an extremely tax-efficient option for taxable accounts. But again, if you primarily invest through your 401(k) plan, and your goal is simply to maximize performance, there’s no good reason not to hold VFIAX in your 401(k).

VFIAX is Vanguard’s oldest index strategy, and it remains one of the very best Vanguard retirement funds—for 401(k)s or wherever else you can stash it.

Want to learn more about VFIAX? Check out the Vanguard provider site.

Related: 7 Best Vanguard Dividend Funds [Low-Cost Income]

7. Vanguard Explorer Fund Investor Shares

- Style: U.S. small-cap growth stock

- Management: Active

- Assets under management: $20.7 billion

- Dividend yield: 0.4%

- Expense ratio: 0.44%, or $4.40 per year for every $1,000 invested

- Morningstar Portfolio Risk Score: 89 (Very Aggressive)

Retirement savers with a high risk tolerance who want to try to turbocharge their returns might consider Vanguard Explorer Fund Investor Shares (VEXPX), which invests in predominantly American small- and midsized stocks with growth potential.

The actively managed VEXPX owns about 730 stocks with an average market cap of $7.7 billion—well within the traditional mid-cap range ($2 billion to $10 billion), though the majority of its holdings fall into the small- ($500 million to $2 billion) and micro-cap ($500 million or less) ranges. Holdings include the likes of insurance software company Guidewire Software (GWRE) and investment bank Houlihan Lokey (HLI).

While larger companies also have the potential for outsized growth, smaller companies, as a group, tend to be more explosive—for better or worse. They benefit from investing’s rule of large numbers (effectively, doubling your revenues from $1 million to $2 million is a lot easier than doing so from $1 billion to $2 billion). And when institutional investors become interested in these stocks, large influxes of new investment money can send their stocks skyward.

But they’re riskier. Smaller firms have fewer and narrow revenue streams, meaning if a core product line struggles, it can more easily lead to stock turbulence and losses. They also have less access to capital than larger companies, so if times get tight, it’s harder for them to survive.

Funds like VEXPX help defray that risk by allowing you to buy many smaller companies at once, so one stock’s failure doesn’t torpedo your portfolio’s worth. That risk is further reduced by Explorer’s management style—holdings are selected by five different investment advisors that manage independent subportfolios, allowing them to use their specialities to generate outsized returns while preventing any one manager’s strategy from upending the entire fund’s performance.

Turnover is elevated, too, at about 35%, but you can snuff out that liability by holding VEXPX in a 401(k) or other tax-advantaged account.

Want to learn more about VEXPX? Check out the Vanguard provider site.

Track Your Portfolio With Empower

- Available: Sign up here

- Price: Tools: Free. Wealth Management: Starts at 0.89% of assets annually.*

Empower is one of our top-rated financial services firms for people of any income level thanks to the quality and breadth of its offerings:

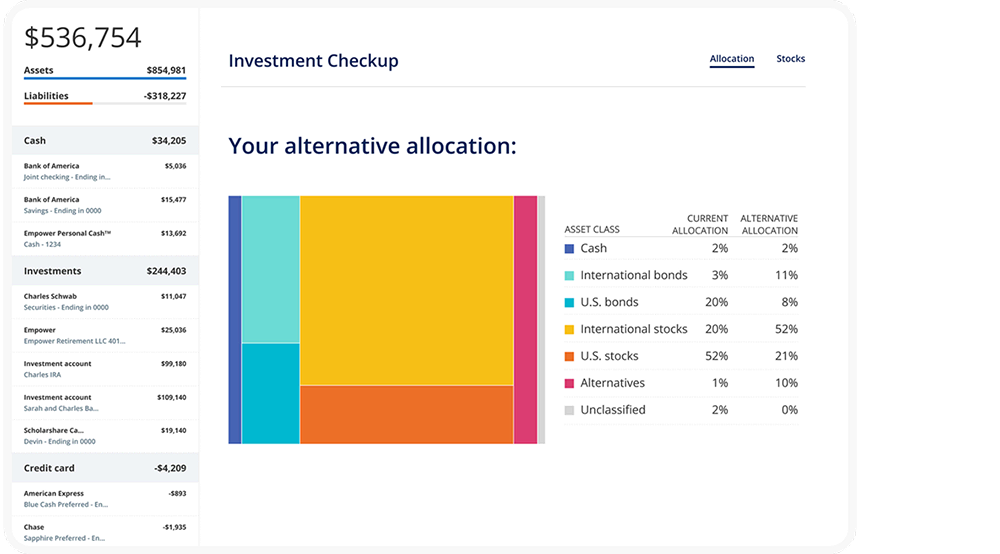

- Free financial tools: Empower’s free Personal Dashboard includes a host of useful tools, including a savings planner, retirement planner, financial calculators, and even a cost planner for your children’s education. But the tool that sets Empower apart is its Investment Checkup tool, which assesses portfolio risk, analyzes past performance, provides a target allocation for your portfolio, and lets you compare your portfolio to the S&P 500 and Empower’s “Smart Weighting” Recommendation.

- Fee-based wealth management services: Empower also offers several suites of advisory services depending on your investible assets. People with as little as $100,000 can get unlimited financial advice and retirement planning and a professionally managed portfolio. Clients with higher assets can access more services, including dedicated financial advisors, specialists in areas such as real estate and stock options, and even access to private equity.

Use our exclusive link to sign up for the Empower Personal Dashboard, whether that’s for the free tools or the advisory services. If you have $100,000 or more in investible assets, you’ll also be able to schedule a free initial 30-minute financial consultation with an Empower professional.

- Empower offers both a free set of portfolio, net worth, and cash flow tracking tools, as well as paid asset management service.

- Link Empower to your bank and investing accounts, credit cards, and more to see a single view of useful information and data, including your net worth.

- Empower Advisory Group offers a comprehensive wealth management service known as Personal Strategy. This managed account solution provides clients with discretionary investment management, personalized portfolio construction, and access to financial planning support. Accounts investing $100k to $250k receive unlimited advice and retirement planning help from financial advisors, as well as a professionally managed ETF portfolio with reviews upon request. Higher asset tiers offer access to dedicated advisors, estate planning, and tax specialists, plus additional investment options like access to private equity.**

- Special offer: If you have $100k+ in investible assets, sign up with our link to schedule a free initial 30-minute financial consultation with an Empower professional.

- Free portfolio tracker (Dashboard)

- Free net worth, cash flow, and investment reporting tools (Dashboard)

- Tax-loss harvesting (Personal Strategy)

- Dividend reinvestment (Personal Strategy)

- Automatic rebalancing (Personal Strategy)

- Low investment expense ratios (Personal Strategy)

- High number of investment accounts supported (Personal Strategy)

- High $100k minimum for investment management (Personal Strategy)

- Moderately high investment management fee (0.89% AUM) compared to other online advisors (Personal Strategy)

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial and a discount on your first year’s subscription when you use our exclusive link.

- Morningstar Investor offers expert research, investing analysis, and advisor-grade portfolio management tools that are tailor-made for buy-and-hold investors.

- Morningstar is one of the most prized sources of mutual fund and exchange-traded fund (ETF) data in the world.

- How does your portfolio stack up? Put it through Morningstar's Portfolio X-Ray, which will provide insights such as whether you have too many overlapping holdings or whether you're paying too much in fees.

- Special Offer 1: Click our sign-up link to receive $50 off your first year of Morningstar Investor. (Annual plan only.)

- Special Offer 2: Students receive one year of Morningstar Investor access for just $25!

- Special Offer 3: Teachers receive a 60% discount on Morningstar Investor access.

- Top-flight fund research and analysis

- Portfolio management tool

- Powerful screener

- Watchlists

- Tailored news and commentary

- Below-average charting

- High monthly billing rate

Related: 9 Best Schwab Funds You Can Buy: Low Fees, Low Minimums

Vanguard Retirement Funds for 401(k)s: Frequently Asked Questions (FAQs)

What is the minimum investment amount on Vanguard mutual funds?

Vanguard funds are known for being shareholder-friendly. It blazed new trails with the index fund, and Vanguard has done more than any other investment firm to keep costs to a minimum for investors.

There is one hitch. Many of Vanguard’s cheapest funds in terms of fees have initial investment minimums of around $3,000—and some can be even more.

But if you’re investing through a 401(k), don’t sweat it.

Funds don’t have minimum investment requirements when you buy them through a 401(k) plan. When you invest in a 401(k), you decide what percentage of your total contribution you want to allocate to each fund, and every time contributions are taken from your paycheck, the appropriate amount is parceled out.

However, if you’re considering investing in a Vanguard fund outside of a 401(k), note that many Vanguard index funds are also available as ETFs. Most brokers will allow you to buy as little as one share, and some even allow for fractional shares. And if you use a commission-free brokerage, you can buy those ETFs without incurring additional fees. ETF prices vary, of course, but many cost less than $100, and they rarely exceed $500 per share.

Related: 7 Best T. Rowe Price Funds to Buy and Hold

What are index funds?

There are two kinds of funds: actively managed funds and index funds.

With an actively managed fund, one or more managers are in charge of selecting all of the fund’s holdings. They’ll likely have a specific strategy to adhere to, and they’ll be tasked with beating a benchmark index, but they’ll be given a lot of discretion about how to achieve that. These managers will identify opportunities, conduct research, and ultimately buy and sell a fund’s stocks, bonds, commodities, and so on.

An index fund, on the other hand, is effectively run by algorithm. The fund will attempt to track an index, which is just a group of assets that are selected by a series of rules. The S&P 500 and Dow Jones Industrial Average? Those are indexes with their own selection rules. Index funds that track these indexes will generally hold the same stocks, in the same proportions, giving you equal exposure and performance (minus fees) to those indexes.

If you guessed that it’s more expensive to pay a conference room full of fund managers than it is a computer that tracks an index, you’d be right. That’s why actively managed funds tend to cost much more in fees than index funds.

And that’s why ETFs are generally cheaper. Most (but not all) mutual funds are actively managed, while most (but not all) ETFs are index funds.

Why does a fund’s expense ratio matter so much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Related: 10 Monthly Dividend Stocks for Frequent, Regular Income

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio] 32 best Vanguard ETFs](https://youngandtheinvested.com/wp-content/uploads/best-vanguard-etfs-600x403.webp)

![15 Best Investing Research & Stock Analysis Websites [2026] 33 best stock investment research software and websites](https://youngandtheinvested.com/wp-content/uploads/investment-research-software-and-websites.webp)