BESTOW AT A GLANCE

- Acts as agent for term life insurance online, without need for medical exams nor lab tests.

- Applicants who qualify can gain coverage in as little as 5 minutes.

- Offers term policies (10, 15, 20, 25, 30 year terms)

- Available nationwide, except in New York.

| Item | Description |

|---|---|

| Products offered | Term life insurance. |

| Term options | 10, 15, 20, 25, 30-year |

| Age availability | 18 - 60 |

| Medical exam required? | No. |

| Can be denied for coverage? | Yes. |

| Available in | All states except NY. |

- What is the Cash Surrender Value of a Life Insurance Policy?

- Are Life Insurance Proceeds Taxable? A Complete Guide

- What is Imputed Income for Life Insurance?

Bestow Overview

Bestow commits to employing technology to provide competitive life insurance quotes to its customers. It does so by relying on data and not needing medical examinations (as many life insurance insurers require) in a bid to streamline life insurance approval and underwriting. Bestow started in 2016 when co-founders Jonathan Abelmann and Melbourne O’Banion launched the company in a bid to help address the issue of financial preparedness for families, but without the complex processes often imposed by traditional life insurance companies. To accomplish this feat, Bestow offers to quote life insurance without a medical exam or a complicated underwriting process. On the other hand, for those with more long-term certainty, if you know how much insurance you will need and wish to lock in a low price now, you can choose between 10 to 30 years term life insurance. Not only does Bestow offer unique product flexibility, Bestow also offers an exceptional opportunity to enjoy a convenience-friendly (i.e., from your smartphone) term life insurance without having to take a medical examination.

Bestow’s Financial Picture

Bestow has received notoriety for its streamlined online application that can be completed — and in many cases, approved — within minutes. Financial strength lends itself to the company’s association with North American Company for Life and Health Insurance®, one of the leading U.S. companies for issuing life insurance and annuities. Further, because of this relationship and sound money management skills, they have received an “A+ (Excellent)” rating by A.M. Best, Fitch, and Standard & Poor’s, indicating sound financial health. As a reminder, financial strength should serve as an important determinant when choosing an insurer because it indicates how well an insurer can manage to pay claims made by policyholders. Because these life insurance claims might not occur until decades in the future, this rating serves as an absolute differentiator if all else appears equal for term life insurance policies.

How Much Does Life Insurance By Bestow Cost?

The cost of life insurance depends on various factors. Bestow screens applicants on their age, smoking status (i.e., smoker vs. non-smoker) state of residence, and other details about their medical history and demographic profile. An additional element to consider on determining the premium amount comes from the total amount of coverage you want. Understandably, higher coverage amounts usually cost more even for the healthiest applicants, all things being equal. Because Bestow does not require a medical exam for receiving term life insurance coverage, the company relies on algorithms to determine an applicant’s risk profile before providing an offer for monthly premium payments. Consider the following three examples (data gathered 5/4/2020):

- Healthy 27-year old female who does not smoke would pay just over $8 ($8.17) per month for a 10-year plan with $100,000 in coverage.

- Healthy 32-year old male with $250,000 in 10-year term coverage would stand to pay about $16 ($16.04) per month.

- Healthy 37-year old male who does not smoke and requests a $1,000,000, 20-year policy, faces a monthly cost of $59.16.

How Bestow Works

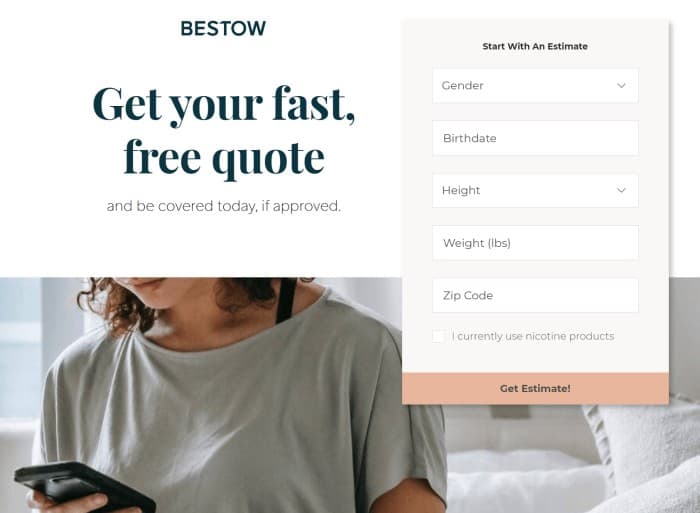

People can apply for life insurance entirely online by answering some simple lifestyle and health questions about themselves. Bestow combines the answers provided in your initial application with big data functionality to assess applicant risk and coverage options instantly. If approved by Bestow’s underwriting process, term life insurance customers can check out with their policy in less than 5 minutes from start to finish. That’s a hard time to beat. Bestow’s digital application enables an entirely online experience, completely different from traditional industry offerings, which usually require paper forms, and meeting with an agent and taking a medical exam. The process can take days or even weeks. Other online life insurance companies may offer an indicative quote online, but then refer applicants to enter a more traditional underwriting application process. Bestow has modernized the process to occur entirely online, for every policy. Period.

Why Bestow?

Bestow serves as an excellent option for individuals aged 18-60 looking for 10, 15, 20, 25 or 30-year term life insurance. In other words, primarily Gen-Zers, Millennials and Gen-Xers looking to provide coverage for dependents easily and quickly. Finally, Bestow shows quality reviews and rating on the Better Business Bureau and strong customer satisfaction ratings. Despite the relative youth of the company, many have awarded the startup company numerous notable accolades. Below comprises the major need-to-know facts about Bestow:

- 100% online application and policy origination process

- No medical exams

- Only sells term life insurance policies (see age and product offering restrictions above)

- Coverage from $50,000 to $1,500,000

- Geared toward Gen-Z, Millennials and Gen-X

- Quotes in seconds, coverage in minutes

BESTOW AT A GLANCE

- Acts as agent for term life insurance online, without need for medical exams nor lab tests.

- Applicants who qualify can gain coverage in as little as 5 minutes.

- Offers term policies (10, 15, 20, 25, 30 year terms)

- Available nationwide, except in New York.

- What is an Insurance Declaration Page? All About the DEC Page

- What are Insurance Riders and Endorsements? What You Need to Know

How Bestow Compares

See how Bestow compares against the other online life insurance agencies in the market. Have a look at each review by clicking on the relevant links below to learn which might lead to your best policy.

Best Online Life Insurance Agencies - 2020

| Bestow | Haven Life | Fabric | Ethos | |

|  |  |  |

|

| Products offered? | Term life insurance only. | Term life insurance only. | Term life insurance and accidental death. | Term life insurance. |

| Term options | 10 and 20 years. | 10, 15, 20 and 30 years. | 10, 15 and 20 years. | 10, 15, 20 and 30 years. |

| Age Availability | For 20-year policies, 21 to 45 (21 to 43 for male tobacco users); for 10-year policies, 21 to 54. | 18 to 64. | 18 to 60. | 18 to 75. |

| Coverage amount available | Up to $1,000,000 for 10- and 20-year terms. | $100,000 up to $3,000,000. | $100,000 up to $5,000,000. | $100,000 up to $1,500,000. |

| Medical exam required? | No. | Depends. A medical exam may not be needed for eligible applicants applying for up to $1,000,000 in coverage. Once an application is submitted, you will find out if a medical exam is needed to finalize your rate. | Depends. May be required if more health information is needed. Better rates possible with medical exam. | Depends. May be required on policies over $1,000,000 or if more health information is needed. |

| Can be declined for coverage? | Yes. | Yes. | Yes. | Yes. |

| Available in | All states except NY. | All states except CA, DE, FL, ND, NY, and SD. | All states except MT, CA*, and NY*. | All states except NY. |

Prices, products offered and coverage terms effective as of publication.