Layoffs are typically a sudden and dramatic shock to a household’s financial situation. In most cases, the loss of a primary job means the loss of at least a significant chunk of a household’s income, if not all of it.

Which means that very shortly after you lose your job, you need to get to work rearranging your financial life.

Today, I’m going to review what should be your top budgeting priorities after a layoff.

Which of the following steps you’ll need to adopt will depend on your personal financial situation. It’s unlikely you’ll need to execute on every one of these actions, but it’s possible you’ll need to put several of them to work.

Featured Financial Products

Budget Adjustments to Make After a Layoff

Before we get into the budgeting changes you’ll need to make after a layoff, it bears saying that if you don’t already have a budget, you need to create one. You can check out our budget directions and template to get started.

If you already have a budget, it’s time to get out the red pen, because you’ll almost certainly need to make changes.

The following suggestions are in no particular order. Some of them are simply executed and relatively painless, though a couple are more complex and risky in nature. Don’t execute on any of these blindly—first, evaluate your financial situation to ensure they even make sense for you.

1. Stop Overpaying Debt / Switch to Monthly Minimums

Some people overpay on student loans, auto loans, and even mortgages to get them paid down early. Between reducing how much interest you’ll pay overall, and the sheer mental satisfaction of eliminating your debt more quickly, this can be a great decision for both your finances and your state of mind.

Regardless, it’s a luxury—and if you’ve just lost a major source of income, it’s a luxury you can no longer afford.

Set these types of bills to the monthly minimum payments to free up extra cash. You can always increase your payment amounts later once you’ve found a job and have reclaimed your financial security.

2. Talk to Your Credit Card Company

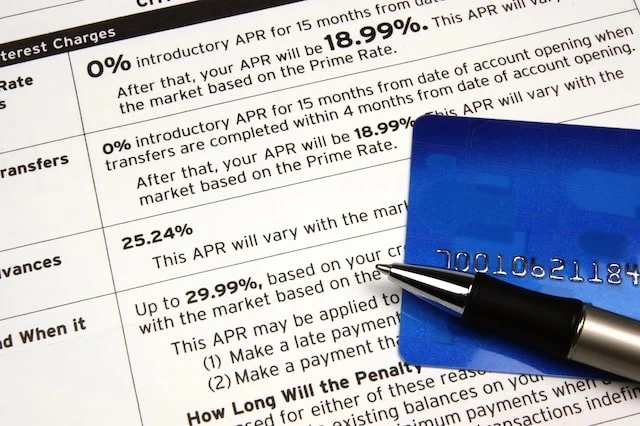

It’s one thing to only pay the minimum on loans with interest rates likely in the single digits. But credit cards, and their often 20%-plus annual percentage rates (APRs), are a different story. Even a little bit of credit card debt can result in you paying an extravagant amount of interest if you only pay the minimum. And after a layoff, you might need to rely more heavily on your credit card.

Reach out to your credit card company. Card issuers will sometimes offer temporary flexibility after a layoff, in the form of waiving late fees, reducing your APR and/or minimum payments, and/or extending your due dates.

Your luck likely will be better if you have a long history of on-time payments with the card provider.

Alternatively, you could execute a credit card balance transfer from a card with a high APR to one that offers a 0% balance transfer. Balance transfer credit cards will often provide interest-free introductory periods of six to 18 months, and occasionally even longer than that.

You would still have to make the minimum payment each month to retain the 0% interest rate, and the action could result in a hard credit pull. But it could save you a great deal of money until you have a new income source.

Related: What Is the Rule of 55 for 401(k) Withdrawals?

3. Ask About Debt Repayment Plans

If you have some form of debt that you don’t believe you can repay at current levels while laid off, you should reach out to your lender about a debt repayment plan.

Debt repayment plans generally ease your debt burden, albeit temporarily, though they differ from one lender to the next, and they sometimes differ by type of debt.

For instance, federal student loans often offer the ability to participate in income-driven repayment (IDR)—a recalculation of your monthly payment that factors in income and family size. Firms that service private student loans are generally far less flexible, typically providing only very short-term relief.

Have a mortgage? You might be able to get a forbearance, which temporarily reduces or pauses your payments. But you’ll want to contact your service provider right away—some servicers require you to request forbearance within a set amount of time after your layoff.

No matter what type of debt repayment plan you arrange, any money you owe won’t disappear. But temporary relief might give you enough breathing room until you find a new job—and that’s a lot better than nothing.

Related: Tax Implications of Getting Laid Off

4. Consider a HELOC

A home equity line of credit (HELOC) is an open-ended line of credit that lets you borrow money against the available equity in your home.

Your equity is the value of your home minus how much you still owe on your mortgage. For instance, if your home is valued at $750,000 and you have $500,000 left on your mortgage, your available equity to borrow against would be $250,000.

Once you enter the repayment period, you have a predetermined schedule for repaying the balance—usually 10 to 20 years. The average interest rate for a HELOC is about 8% right now, and it’s usually variable, so that number will change over time. Still, that’s substantially lower than the average credit card interest rate, which currently sits at 24%, making HELOCs an appealing option for covering your basic expenses.

Importantly: You don’t actually have to use a HELOC—and interest typically only accrues on whatever balance you spend. So you could secure the line of credit as a backup plan in anticipation of a layoff but never end up using it.

HELOCs do have a massive pitfall, however: If you don’t make your payments, you risk losing your home. So you should only consider a HELOC if you’re highly confident you can make all of your loan payments on time.

Featured Financial Products

5. Call 211

Many people know what you get if you dial 911 or 411, but another three-digit number happens to be very useful in this particular situation: 211.

You can call 211 in 50 states, the District of Columbia, and Puerto Rico, or visit the website 211.org, to be connected to useful resources. 211 has staff and volunteers available every day, 24/7, to direct you to assistance for needs such as paying bills, securing food for your family, or addressing your mental health after a layoff. Eligibility for these resources will vary; you must call to find out. And every call is confidential.

Another useful resource is USA.gov’s benefit finder tool, which can help you find programs to keep you on your feet.

Related: What Should I Do After a Layoff?

6. Reduce Discretionary Expenditures

It goes without saying that right after a layoff, it’s essential to either review your budget or, if you don’t have one, create one. (Check out our budget directions and template.)

From there, you’ll want to determine which expenditures can’t go (necessary expenses) and which can (discretionary expenses).

Among the most common discretionary expenses:

- Digital subscriptions

- Memberships

- Eating at restaurants

- Food delivery

- Vacations

- Entertainment expenses (movie/theater/sports tickets)

- Nonreplacement clothing

When it comes to necessary expenditures, there’s not much you can do to reduce those, but you do have a few options. For instance, you could try to use less electricity to bring down your power bill, switch to a lower-tier phone/internet plan, and be more cost-conscious when shopping for groceries. But ultimately, each of these categories will have a bottom line you can’t drop below.

Related: Should You Tap Into Retirement Savings After a Layoff?

7. Look for Short-Term Income Streams

You can only push off debt and cut expenses so much. But a budget is more than expenses—it’s also income, which is why you’re looking for another full-time job in the first place.

But until you land a new role, you should look for other ways to prop up the income side of your ledger. The two most impactful things you can do are:

- Apply for unemployment insurance benefits. Every state administers their own unemployment insurance program within Federal guidelines. As such, benefit amounts and length of benefits vary by state. To apply, contact the State Unemployment Insurance agency for the state where you worked.

- Start a side hustle. You might drive for Uber or Lyft a couple of nights per week or sell unwanted items on eBay or Mercari. If you’re fortunate, you might even find a short-term gig related to your work, such as consulting.

No matter what, the more income you bring in, the less you’ll have to worry about making cuts and/or depleting your emergency fund.

Related: What Is Rule 72(t) for Penalty-Free Retirement Account Withdrawals?

![What Is a Bare-Bones Budget [And How Do I Create One]? 19 budgeting piggy bank tight clamp bare-bones 1200](https://youngandtheinvested.com/wp-content/uploads/budgeting-piggy-bank-tight-clamp-bare-bones-1200-600x403.webp)

![What Is the 50/30/20 Budget Rule [And Is it Impractical]? 20 50 30 20 budget rule pie chart etf index 1200](https://youngandtheinvested.com/wp-content/uploads/50-30-20-budget-rule-pie-chart-etf-index-1200-600x403.webp)