Consumer prices rose more slowly than expected in February, providing at least a brief sigh of relief from Wall Street and giving the Federal Reserve some flexibility to resume its rate-cutting cycle eventually, though escalating tariffs remained a significant asterisk on results.

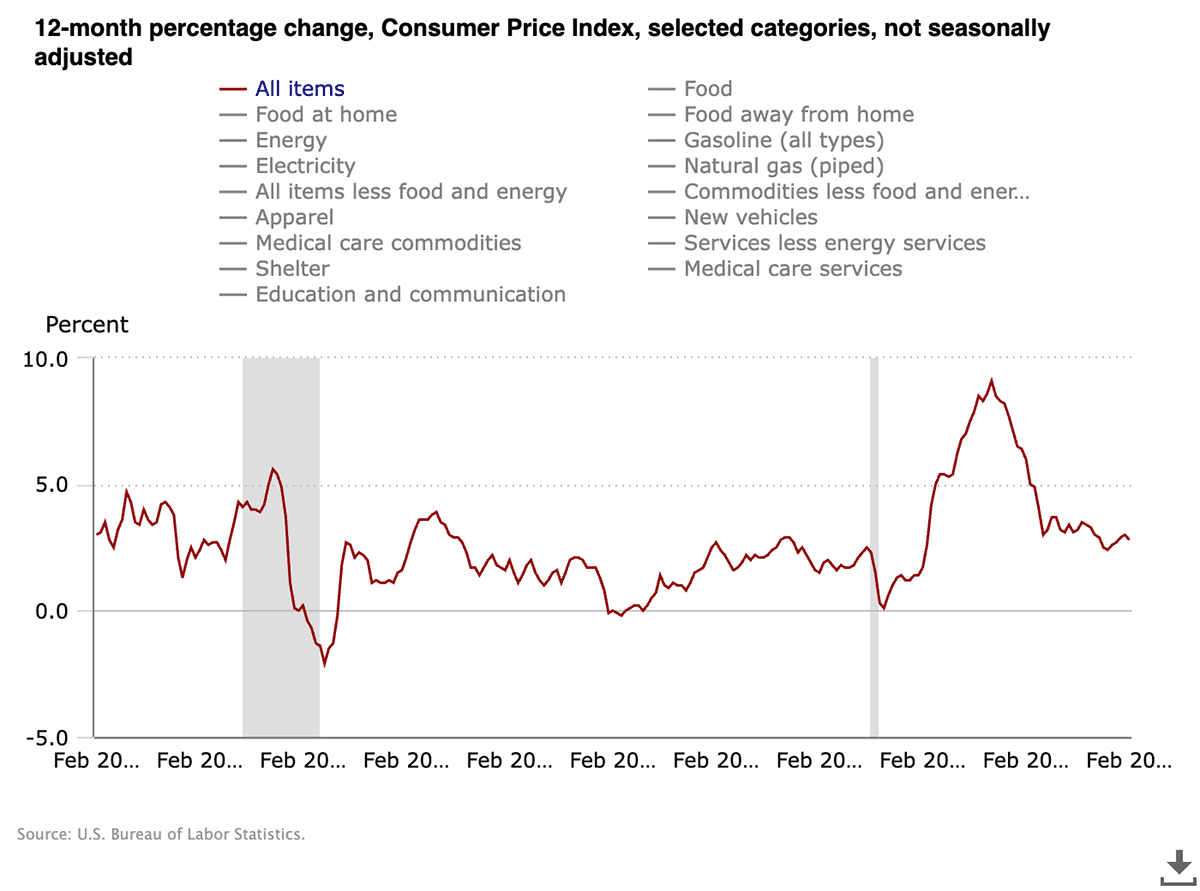

The U.S. Bureau of Labor Statistics said Wednesday that February’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, was 2.8% higher year-over-year—a tenth of a point lower than what Dow Jones-polled economists expected, and slower than January’s headline number (3.0%).

CPI grew 0.2% on a month-over-month basis, also coming in under expectations for 0.3%, and well under January’s 0.5% print.

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—flew in under estimates, too, rising 3.1% year-over-year and 0.2% month-over-month.

10 Best ETFs to Beat Back a Bear Market

Here’s a quick look at February’s key CPI figures:

- MoM CPI: +0.2% (estimate: +0.3%)

- YoY CPI: +2.8% (estimate: +2.9%)

- MoM Core CPI: +0.2% (estimate: +0.3%)

- YoY Core CPI: +3.1% (estimate: +3.2%)

“The February CPI release showed further signs of progress on underlying inflation, with the pace of price increases moderating after January’s strong release,” says Kay Haigh, global co-head of Fixed Income and Liquidity Solutions at Goldman Sachs Asset Management. “While the Fed is still likely to remain on hold at this month’s meeting, the combination of easing inflationary pressures and rising downside risks to growth suggest that the Fed is moving closer to continuing its easing cycle.”

Despite the soft inflation reading, very few categories actually saw costs decline. Gasoline was down 1.0% month-over-month, transportation services were off 0.8%, and new vehicles were a touch lower at 0.1%.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

But price growth was limited in most categories; utility gas service (+2.5% MoM) and electricity (+1.0%) experienced the greatest price increases.

“Goods inflation remained in positive territory with core goods up 0.22% month-over-month, mainly due to: (1) the fading effect of wildfires pushing car prices, (2) a rebound in apparel inflation, (3) acceleration in other goods such as tobacco, perhaps still reflecting some residual seasonality,” says Michael Gapen, Chief U.S. Economist at Morgan Stanley. “Core services inflation decelerated to 0.252% as airfare fell 4.0% and [owners’ equivalent rent] slowed by 5 bps to 0.28%.”

The broad consensus following Wednesday’s report is that the slowdown in consumer prices gives the Federal Reserve some room to begin resuming its rate-cutting cycle, though likely not immediately, as the central bank will likely want to see the effects of President Donald Trump’s latest round of tariffs on future data.

“If inflation trends remain subdued, it may give the Fed cover to cut rates up to two to three times in 2025 to cushion an economy dealing with volatile terms of trade,” says Jason Pride, Chief of Investment Strategy and Research at Glenmede. “A cut at the March meeting is unlikely, as the Fed likely wants to see further inflation improvement and perhaps gauge the outcome of scheduled tariff increases over the next few weeks.”

13 States That Don’t Tax Retirement Income

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, indicates a 99% chance that rates will stay at the Federal Reserve’s current target range of 4.25% to 4.50%. Indeed, tariff fears still appear to be the predominant pressure on Fed-rate handicapping, as the projected chances of a quarter-point rate cut have dropped by about 5 percentage points from a week ago.

“This CPI number is encouraging but does not factor in the new round of tariffs,” adds Scott Helfstein, Global X’s Head of Investment Strategy. “That might begin showing up next month, but the lag could be longer. We expect interest volatility to remain elevated as markets await the impact. We still believe the next Fed rate move is lower, but it is hard to have high confidence with the impact of tariffs still uncertain.

What the Experts Think About February’s CPI Report

Here, we outline more thoughts from the experts on what February’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Jeff Schulze, Head of Economic and Market Strategy at ClearBridge Investments

“The pace of inflation slowed from January’s red-hot pace, which was pushed higher due to the ‘January effect.’ Core goods prices firmed, which is likely related to the 10% tariffs on Chinese goods that went into effect in early February, with prices for key import categories such as household furnishings and apparel moving firmly into positive territory last month. Further strength in goods could be forthcoming as tariffs on Chinese imports went up by an additional 10% earlier this month.

February Jobs Report: Payrolls Growth, Unemployment Worse Than Expected

“Today’s inflation release is unambiguously positive for risk assets as there is greater confidence that inflation is not re-accelerating like January’s data showed, which gives policymakers a bit of breathing room and should allow the Fed to loosen policy should signs of labor market weakness emerge. However, the Fed will also need to see that inflation expectations are recovering from their recent rise before cutting rates, as a de-anchoring of inflation expectations is what keeps most central bankers up at night, given the challenge it represents to restoring price stability in the future.

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“Housing costs softened in February, continuing the progress from the past several months. Rent prices rose 0.28% month-over-month, a downtick from the +0.31% growth previously. Housing inflation is historically the ‘stickiest’ component of inflation, meaning it takes longer to buck price trends. The recent trend in housing prices keeps us optimistic on the future trajectory of inflation.

“Looking ahead, we could see one-time price shocks on goods due to tariffs on our trading partners. Near-term inflation expectations have edged higher, according to consumer and business surveys.”

John Kerschner, Head of U.S. Securitised Products, Portfolio Manager, Janus Henderson

“One of the main factors helping inflation coming in below expectations were airline fares, which were down 4%. This after several airlines, including Delta (DAL), were on the tape this week talking about a recent slump in airline travel and thereby lower earnings ahead. This is but one indicator that the resilient consumer is finally running out of steam.

Will Tariffs Raise Consumer Prices? 7 CEOs Weigh In

“However, what is most surprising this morning is that the bond market actually sold off on these numbers. This is most likely a correction to the large rally in bonds (rates going down) since the end of February, bringing the 10-year U.S. Treasury down about 20 basis points. Equities, on the other hand, after a horrendous beginning of the week, are rallying this morning.”

David Russell, Global Head of Market Strategy, TradeStation

“The White House and the Fed are breathing a sigh of relief because tariffs didn’t filter through to consumer prices. A June cut is still on the table because inflation continues to moderate, especially the key shelter category.

“This is a positive for investors because a huge amount of negativity is priced into stocks. For the first time in several weeks, we might get a break in the streak of frightening news. The other shoe didn’t drop, and that could be good news for Wall Street. Next week’s Fed meeting got a little less worrisome.”

Steve Wyett, Chief Investment Strategist, BOK Financial

“The CPI report this morning, with headline and core coming in a touch lower at 0.2%, reflects an economy where inflation was continuing to moderate towards the Fed’s 2% target. Absent the presence of tariffs and other policy changes we would be talking about the Fed being able to look at lowering rates at their upcoming March meeting.

“Because of those other factors however, this report will not be enough to push the Fed to act, and we must acknowledge that some of the data within the CPI report is not so favorable based on how it flows into the Fed’s preferred PCE measure of inflation. This should give us some sort of welcome reprieve in the equity markets.”

![The 10 Best ETFs for Beginners [2026] 8 a hand taking a slice of a pie chart.](https://youngandtheinvested.com/wp-content/uploads/pie-chart-index-fund-etf-wooden-table-1200-600x403.webp)