Inflation worries were re-ignited after consumer prices rose faster than expected in January, with Wall Street experts expecting caution from the Federal Reserve while keeping a wary eye on further tariff action from Washington.

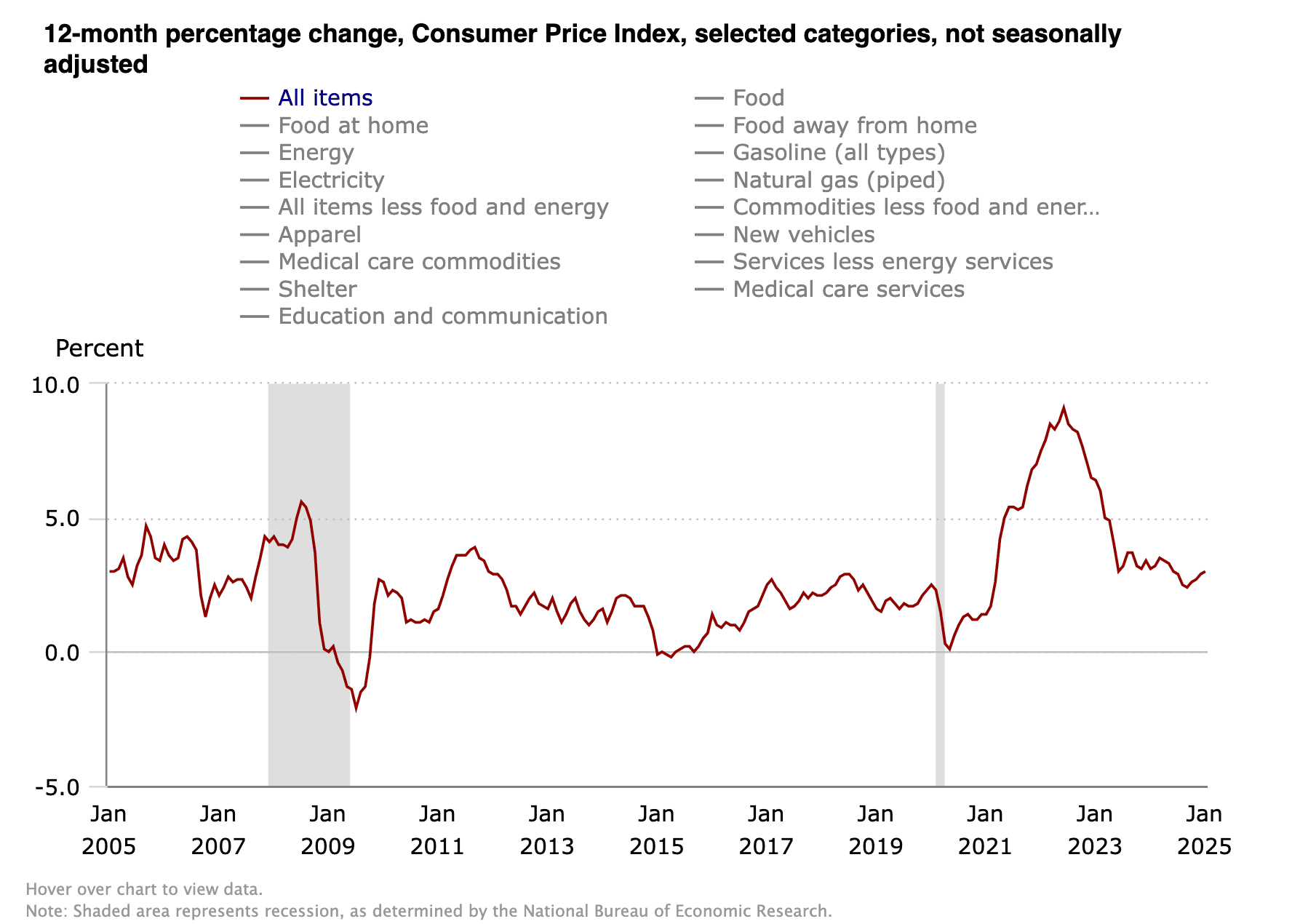

The U.S. Bureau of Labor Statistics said Wednesday that January’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, was 3.0% higher year-over-year—higher than the 2.9% that Dow Jones-polled economists’ expectations and faster than December’s headline number (also 2.9%).

Month-over-month, the 0.5% growth in consumer prices was well ahead of estimates for 0.3% and December’s 0.4% reading.

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—also came in hot, at 0.4% month-over-month and 3.3% year-over-year.

The 10 Best Index Funds You Can Buy

Here’s a quick look at January’s key CPI figures:

- MoM CPI: +0.5% (estimate: +0.3%)

- YoY CPI: +3.0% (estimate: +2.9%)

- MoM Core CPI: +0.4% (estimate: +0.3%)

- YoY Core CPI: +3.3% (estimate: +3.1%)

“No matter how you slice the data, the January CPI print marks an unwelcome re-acceleration in prices to start off 2025,” says Jason Pride, Chief of Investment Strategy and Research at Glenmede. “Even many of the major sub-classes such as core goods, shelter and services ex-shelter were within the 0.4%-0.5% range, suggesting that inflation was broad-based in January and not just driven by a handful of outliers.”

Categories showing the most inflation in January included fuel oil (+6.2%), transportation services (+1.8% month-over-month), utility gas service (+1.8%), and gasoline (+1.8%).

Americans only saw relief in one category: apparel, where costs were down 1.4% month-over-month.

The 13 Best Mutual Funds You Can Buy

The report largely set expectations for a continued pause in the Fed’s benchmark interest rate, which would include inaction at the next Federal Open Market Committee (FOMC) meeting, set for March 18-19.

“Today’s stronger-than-expected CPI release is likely to further cement the FOMC’s cautious approach to easing,” says Whitney Watson, global co-head and co-chief investment officer of Fixed Income and Liquidity Solutions within Goldman Sachs Asset Management. “A resilient labor market also provides scope for patience. We think the Fed is likely to remain in ‘wait-and-see mode’ for the time being and anticipate the Fed staying on hold at next month’s meeting.”

Indeed, following Wednesday’s inflation print, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, indicated a 97.5% chance that the Federal Reserve would sit on its current target rate of 4.25%-4.50%.

“The bottom line is clear: The Fed should not be cutting,” says Dan Siluk, Head of Global Short Duration and Liquidity & Portfolio Manager at Janus Henderson. “No matter which way the Fed chooses to slice-and-dice the data—headline, core, supercore—all came in higher than expectations. Both three-month and six-month annualized reads are also moving higher.

“While early-year CPI reads are notorious for seasonality and distortions, the labor market is clearly stable and economic conditions don’t warrant easier conditions. All signs suggest that the neutral interest rate should be higher.”

The unexpectedly swift rise in consumer prices also put more scrutiny on President Donald Trump’s push to levy high taxes on foreign imports.

“Inflation acceleration is more concerning than usual right now, particularly as economists ponder the impact of impending tariffs,” Pride says. “Rising prices already appear to be a headwind, and the prospect of new trade barriers have the potential to further fuel inflationary pressures by increasing costs for businesses and consumers.

“Some of the duties on China and steel/aluminum products are unlikely to have a material impact on inflation in their current form. However, tariffs targeting Canada, Mexico, and universal tariffs pose a much greater risk of price increases due to the higher difficulty of avoidance.”

What the Experts Think About January’s CPI Report

Here, we outline more thoughts from the experts on what January’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Steve Wyett, Chief Investment Strategist, BOK Financial

“This will leave a mark. After this morning’s CPI report, which was hot on both headline and core, whatever level of confidence the Fed had of inflation getting back to their 2% target, had to be reduced. From an equity market standpoint, whatever level of valuation support came from an outlook for lower rates, sooner rather than later, must be reconsidered.”

“The sheer amount and materiality of the policy changes in motion, and the enormous implementation risks they pose, mean the Fed has no better idea than the rest of us what the ultimate outcome will be for growth and inflation. We remain more optimistic than pessimistic but making significant calls one way or the other in this environment feels speculative in nature.”

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“At first glance, January’s hot inflation report may seem like a sign that we are returning to a stronger inflation environment. But it’s important to remember that January often reflects annual resets in price that companies pass through to consumers (e.g. things like your annual streaming subscription). Therefore, it is hard to determine if this is one-time noise or a reflection of a higher inflationary environment.

January Jobs Report: Weak Hiring in a Messy Data Month

“Looking ahead, we could see one-time price shocks on goods due to tariffs with China and steel & aluminum imports. We have yet to see the degree of those price shocks, as it depends on how much companies decide to pass on higher costs to the consumer. Regardless, near-term inflation expectations have edged higher over the past few weeks, according to consumer and business surveys.”

David Russell, Global Head of Market Strategy, TradeStation

“Inflation has gotten sticky with items like used cars and auto insurance ticking back up. This puts pressure not only on the Fed but also on the White House to tread carefully on tariffs. There was progress on owners’ equivalent rent, but other items are moving the wrong way. Investors may not react too aggressively yet because we get more data before the key dotplot in March. But time could be running out for this bull market if we don’t see progress on inflation soon.”

Scott Helfstein, Head of Investment Strategy, Global X

“Wage inflation has probably not subsided as much as the Fed had hoped and that is driving continued spending. This is the time of year that people expect to get raises and that may contribute to the tick up in prices. Unfortunately, the tick up in inflation comes just alongside a modest decline in consumer and small business sentiment. This is worth paying attention to. Hope for deregulation and lower taxes helped stoke animal spirits. If that optimism cools too quickly, growth might slow as well.

“This is a tough inflation report to get while the White House is looking at further tariffs with consumer inflation expectations jumping higher. While this does not blunt our optimism yet on both the economy and stocks, it does bear watching closely.”

Josh Jamner, Investment Strategy Analyst, ClearBridge Investments

“Today’s hotter print shifts investor expectations for monetary policy, which lends to upward pressure on long-term interest rates and downward pressure on equities. Not all equities are impacted equally, however, with more indebted companies facing headwinds from higher rates while others will ultimately benefit from higher revenues as they are able to charge more for their products. We believe value should outperform growth in such an environment.”

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 7 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 8 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)