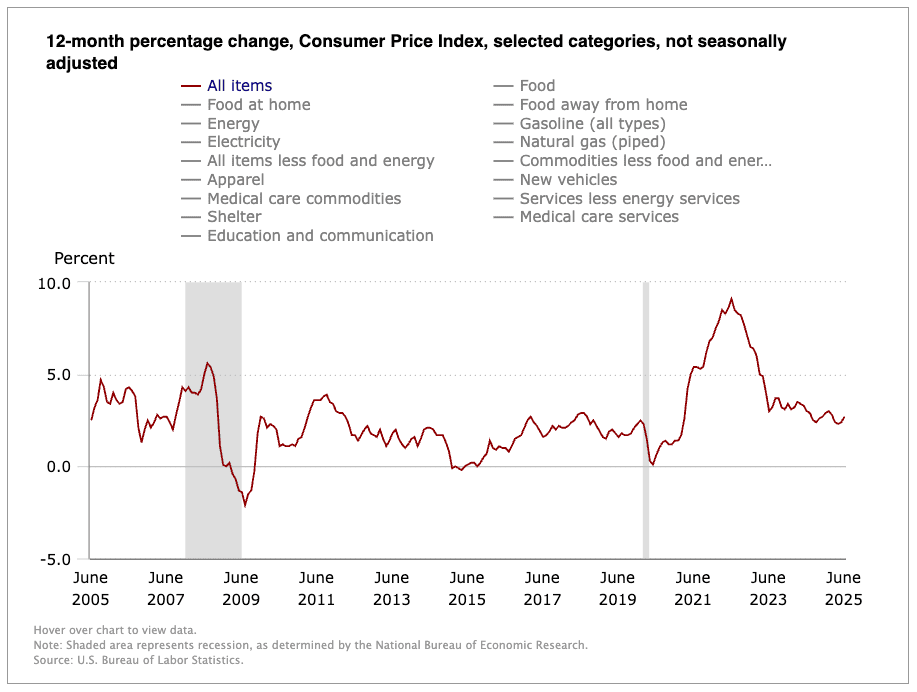

Consumer prices picked up in June, according to the most recent consumer price index (CPI) report, which began to show signs that President Donald Trump’s tariffs were starting to make ripples throughout the U.S. economy.

The U.S. Bureau of Labor Statistics said Tuesday that June’s CPI, which measures the change in prices on a variety of consumer goods and services, rose by a seasonally adjusted 0.3% month-over-month—in line with consensus expectations and higher than May, which saw consumer prices increase by 0.1%.

On a year-over-year basis, consumer prices were up 2.7%, faster than June’s 12-month rate of 2.4% and also in line with economists’ predictions.

“Core” CPI, which excludes food and energy costs (which are more volatile than the other costs tracked by the Labor Department) came in 0.2% higher, just a smidge below estimates for 0.3% growth, but higher than May’s 0.2% expansion. Year-over-year, core CPI grew 2.9%, in line with estimates and higher than last month’s YoY reading of 2.8%.

Following May’s CPI report, economists and analysts said that although tariffs hadn’t yet bled into the CPI report, that it was just a matter of time. A month later, they’re starting to see the impacts of import taxes, though those impacts so far appear to be moderate.

“While today’s CPI release showed some early signs of tariff impact, on the whole underlying inflation remained muted,” says Kay Haigh, global co-head of Fixed Income and Liquidity Solutions in Goldman Sachs Asset Management. “Price pressures, however, are expected to strengthen over the summer, and the July and August CPI reports will be important hurdles to clear. For the time being the Fed remains in wait and see mode. Should underlying inflation, however, continue to prove benign the path remains open to a resumption of the Fed’s easing cycle in the autumn.”

A quick look at June’s key CPI figures:

- MoM CPI: +0.3% (estimate: +0.3%)

- YoY CPI: +2.7% (estimate: +2.7%)

- MoM Core CPI: +0.2% (estimate: +0.3%)

- YoY Core CPI: +2.9% (estimate: +2.9%)

Among the most noteworthy cost increases in June were energy (+0.9% MoM after falling 1.0% in May), electricity (+1.0%), medical care services (+0.6%), and apparel (+0.4%). But one of the biggest signs of tariff impact came from household furnishings and operations, which rose 1.0% MoM in June and 3.3% YoY.

Our Guide to the New Senior Tax Deduction

“Prices for home furnishings increased the most in any month since January 2022, indicating some tariff costs are being passed through in certain categories of goods,” says Andrew Hollenhorst, Chief U.S. Economist at Citi Research. “It may be that different categories of goods see staggered price increases, with apparel prices rising later this summer.

Used cars and trucks (-0.7%) and new vehicles (-0.3%) were the only major categories showing declines.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

“Residual seasonality likely played a role in pushing used car prices down,” Hollenhorst says. “Some additional tariff effects in goods prices that are not fully offset by falling car prices should be expected in the next few months. But the early indication is that tariff related inflation will be relatively modest and confined to goods as services prices continue to slow.”

The report kept Wall Street and analysts confident that the benchmark interest rate will remain steady following the Federal Reserve’s rate-setting meeting later this month.

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, shows a 97% chance that the Fed funds rate will remain between 4.25% and 4.50% at the next Federal Open Market Committee (FOMC) meeting, scheduled for July 29-30. Those same futures also predict that the Fed will lower rates by a quarter point in September, but the odds declined after the report, from 59% to 54%; meanwhile, the odds that rates remain steady rose from 37% to 44%.

5 Critical ‘Last-Mile’ Steps Before Retirement

“This is kind of a perfect inflation report for the Fed: just hot enough to justify their policy of holding rates steady, but not reflective of runaway prices,” says Scott Helfstein, Head of Investment Strategy at Global X. “The question now is whether the labor market holds up throughout summer, and it probably will. If we see strong corporate earnings for the second quarter, growth forecasts for the U.S. may be revised higher.”

What the Experts Think About June’s CPI Report

Here, we outline more thoughts from the experts on what last month’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Alan Detmeister, Economist, UBS

“The moderately elevated headline and core CPI seasonally adjusted monthly changes were held down notably by seasonal adjustment factors that are still being pushed around by pandemic swings. If we exclude the pandemic-era years (2020-2022) from the seasonal adjustment calculations, we estimate that the seasonally adjusted monthly core CPI change would have been around 9 [basis points] higher than what was published today.

“Abstracting from the seasonal adjustment issues today’s release showed the not-seasonally adjusted core CPI increase in June was 14 [basis points] above June last year. This is the largest month-over-12-months-prior difference since core CPI inflation peaked in September 2022, and consequently 12-month core inflation saw its largest setup in 33 months.”

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“Toys and appliances may be flashing early warning signs that tariffs are starting to seep into goods prices. Toys are an important bellwether to monitor, as the product group sits at the intersection of high import share and short turnaround time from the docks to shelves. Prices for toys have consistently accelerated over the last three months, up 0.3%, 1.3% and 1.8%, sequentially, indicating tariffs are starting to have an impact. Appliance prices jumped 1.9%, which makes sense when one considers their high steel and aluminum content.”

8 Best-in-Class Bond Funds to Buy

David Russell, Global Head of Market Strategy, TradeStation

“This number relieves worst-case fears about tariffs spiking inflation, but there was some upward pressure in the exposed category of apparel. The tailwind of moderating shelter costs continue to help the Fed, but core CPI is still well above their target. This is good news overall, but it’s not conclusive and may show some risk of tariffs getting passed through. The waiting game continues.”

José Torres, Senior Economist at Interactive Brokers

“Unfortunately, the opportunity to sneak in a rate cut was in the earlier months of this year when inflation was running in the low 2s. This morning’s publication adds credence to the belief that the Federal Reserve should wait and see, especially with the indicator nearing a 3-handle. But we’ve seen tariff-cost worries before, during President Trump 1.0, when the CPI would ascend close to 3% due to economic growth accelerating amidst levy risks, only for it to return to the 2s after some cross-border commerce turbulence, which at the time was focused on Beijing. Indeed, certain quarters between 2017 and 2019 featured GDP advancement figures well north of 4%.

“Much of the price pressures in this report were also due to strong activity, which in itself, can support cost pressures in light of elevated levels of demand that catch businesses by surprise, compelling heavier charges. The momentum is evident when you look at the performance of stocks, which investors just can’t get enough of, as the profitability outlook over the next four years remains buoyant.”

How Does the 4% Rule Work? [And Why Did It Change?]

Chris Schaechtel, Arkansas market president, BOK Financial

“One line item that remains stubbornly high is the rising cost of housing was up 3.8% annualized. The cost of housing remains a challenging problem as the cost of insurance has accelerated in many markets leading the cost to be passed on to either homeowners or landlords. For the average consumer, housing is typically the largest fixed expense each month.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 8 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 9 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)