America’s employment situation was better than expected in June, coming in well ahead of estimates, in sharp contrast to a dour ADP report, and amid other flagging economic data.

The Labor Department reported Thursday that nonfarm payrolls grew by 147,000 in June—well ahead of economists’ estimates for 110,000 jobs, just over May’s 144,000 new payrolls, and also an inch above the 12-month average monthly gain of 146,000. That May figure was 5,000 jobs higher than the initial print last month; April’s total was also revised upward, by 11,000 jobs, for a total of 158,000.

“The June jobs report continues to demonstrate resilience across the labor market, even as certain sectors such as manufacturing continue to lag,” says Joe Gaffoglio, President and CEO at Mutual of America Capital Management. “Still, even with a booming stock market, consumers are signaling a softening economy, as consumer confidence fell for the sixth time in seventh months and discretionary spending saw its steepest monthly decline since February 2023.”

The report, which represented America’s 54th consecutive month of payroll gains, surprised both in contrast with estimates as well as ADP’s monthly national employment report out Wednesday, which showed that U.S. employers lost an estimated 33,000 jobs. However, while the ADP report is often looked at as meaningful from a standpoint of hiring trajectory, its numbers often don’t align with the government’s monthly data.

Dynasty Trusts: A Beginner’s Guide to Passing Down Wealth

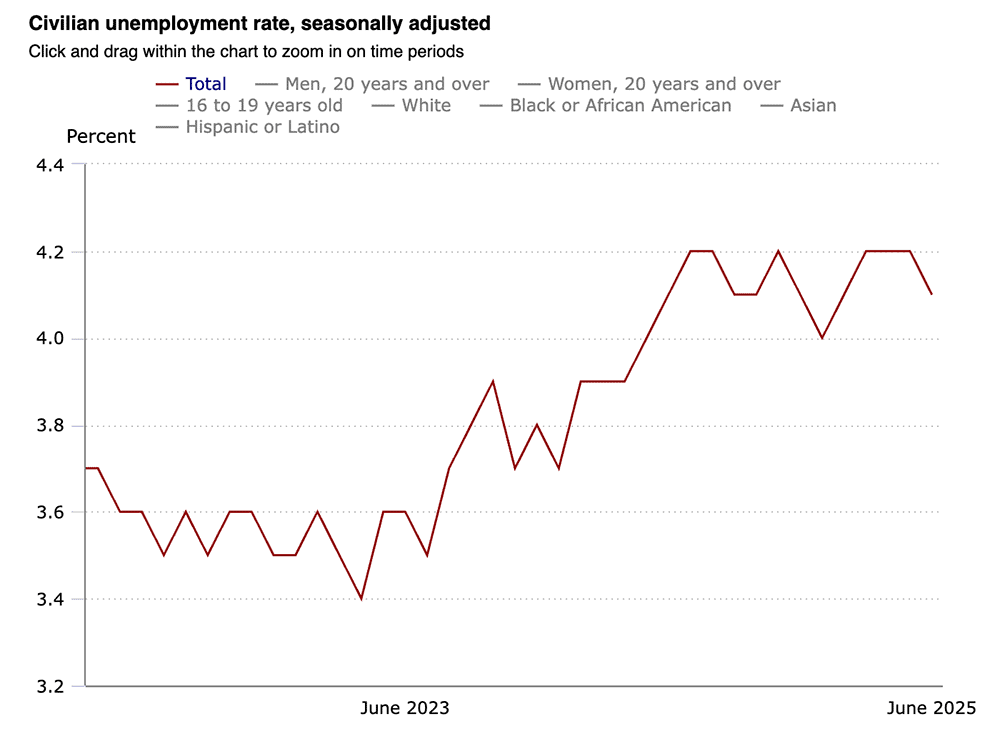

Unemployment ticked down to 4.1%, from 4.2% in May, better than analyst expectations and within the range of 4.0% to 4.2% that has held since last year.

Coming in below forecasts was the June hourly earnings figure, which grew by 0.2% month-over-month, to $36.30. Economists were looking for 0.3% growth in wages. Over the past year, average hourly earnings have grown by 3.7%.

Here’s a brief look at the June jobs report’s most pertinent details:

- June payrolls: +147,000 MoM (estimate: +110,000)

- June unemployment: 4.1% (estimate: 4.3%)

- June hourly earnings: +0.2% MoM (estimate: +0.3%)

- May payrolls (revised): +144,000 (+139,000 previously)

- April payrolls (revised): +158,000 (+147,000 previously)

Government employment showed a surprising 73,000 payrolls gained in June, lifted primarily by 47,000 state government jobs, which themselves were primarily educational (+40,000); federal government payrolls declined by 7,000 and are off by 69,000 since January.

Health care continued to a source of strength, adding 39,000 jobs last month, though that figure was slightly below the 12-month average of 43,000.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Job losses were limited elsewhere: Manufacturing lost 7,000 jobs, whosesale trade payrolls were down by 6,600, and the mining and logging industries collectively lost 2,000 jobs.

Market Expects Interest Rates to Stay Put

Wall Street’s hopes that the Federal Reserve might lower its benchmark interest rate at the Federal Open Market Committee meeting, set for July 29-30, took a hit from Thursday’s report.

“While many will not want to believe this solidifies a strong labor market, especially on the backs of a negative ADP print, what this print does solidify is the Fed does not have the data to contemplate a cut in July,” says Lara Castleton, U.S. Head of Portfolio Construction and Strategy at Janus Henderson Investors. “Bond markets are, therefore, repricing yields higher, and investors should continue with the mindset of higher for longer.”

The CME FedWatch Tool, which uses Fed funds futures prices to track the probability of a change to the central bank’s benchmark rate, now shows a 95% chance that the Federal Reserve will keep rates steady this month. That figured jumped from 76% prior to the June payrolls release. However, futures are still pricing in a 97% chance of at least one quarter-point rate cut by year’s end, and a roughly 45% chance that the Fed funds rate will be 50 basis points lower. (A basis point is one one-hundredth of a percentage point.)

What’s the $10,000 SALT Cap [And Will It Change]?

“Today’s stronger jobs report confirms a still-resilient U.S. labor market, defying, at least for now, the signs of weakness seen in some leading indicators,” says Simon Dangoor, head of Fixed Income Macro strategies at Goldman Sachs Asset Management. “The FOMC’s conviction that it should hold its wait-and-see stance while it braces for an acceleration in inflation over the summer will only be strengthened.

But we still see a path to a resumption of the Fed’s easing cycle later in the year should the summer acceleration in inflation prove more modest than expected, or the softening in the labor market exceed the relatively low thresholds implied by the dot plot.”

More Expert Reactions to June’s Jobs Report

Here’s what other strategists, financial managers, and experts had to say about last month’s employment situation:

Jeff Schulze, Head of Economic and Market Strategy, ClearBridge Investments

“The solid June jobs report confirms that the labor market remains resolute and slams the door shut on a July rate cut. Today’s report saw a trifecta of positives that should send the labor bears back into hibernation: a drop in the unemployment rate, a solid beat on headline job creation vs. consensus, and positive revisions to the prior two months. Softer average hourly earnings (wage) gains suggest that a wage-price inflationary spiral shouldn’t be a near-term concern, setting up something resembling a goldilocks scenario.

Thinking of Retiring Within a Year? 5 Signs You’re Not Ready

“Today’s good news should be treated as such by the markets, with equities rising despite the accompanying pickup in interest rates.”

Kevin O’Neil, Associate Portfolio Manager & Senior Research Analyst, Brandywine Global

“The bond market clearly wasn’t expecting such a strong jobs report, including the upward revisions to the previous two months. While easing inflation continues to support the case for Fed rate cuts, a 4.1% unemployment rate significantly reduces the urgency for aggressive action. Notably, the gains came from the government sector, which had seen subdued job growth this year in part due to the administration’s initiatives.

“In terms of bond action, today’s data will likely help reverse some of the yield curve steepening that’s taken place in recent weeks.”

Scott Helfstein, Head of Investment Strategy, Global X

“Why act if you don’t have to? Seems like the Fed gets to take the summer off. This is what achieving the dual mandate, full employment and price stability looks like, even if the White House is nervous. The jobs numbers have now delivered better than expected four months in a row. A good labor market with real wage gains will ultimately drive consumer spending.”

How to Avoid Medicare’s Late Enrollment Penalties

“The only bad news, if there is any, in the job report was the decline in manufacturing jobs. That was offset by hiring in construction. Tariffs are not driving the onshoring of production yet. That is an area worth paying attention to.”

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“It’s difficult to look at today’s jobs report and not come to the conclusion that the U.S. labor market remains tight. However, the data suggest this tightness has not been accompanied by the usual wage squeeze, as average hourly earnings gains were relatively subdued. This will likely be a welcome sign for the Fed, which is watching inflation like a hawk over the summer months.

“The labor force participation rate ticked lower for the second straight month and is now 0.5% lower than its late-2023 peak. This will be an important indicator to monitor over the coming months to decipher if this is just short-term noise or a symptom of something deeper.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)