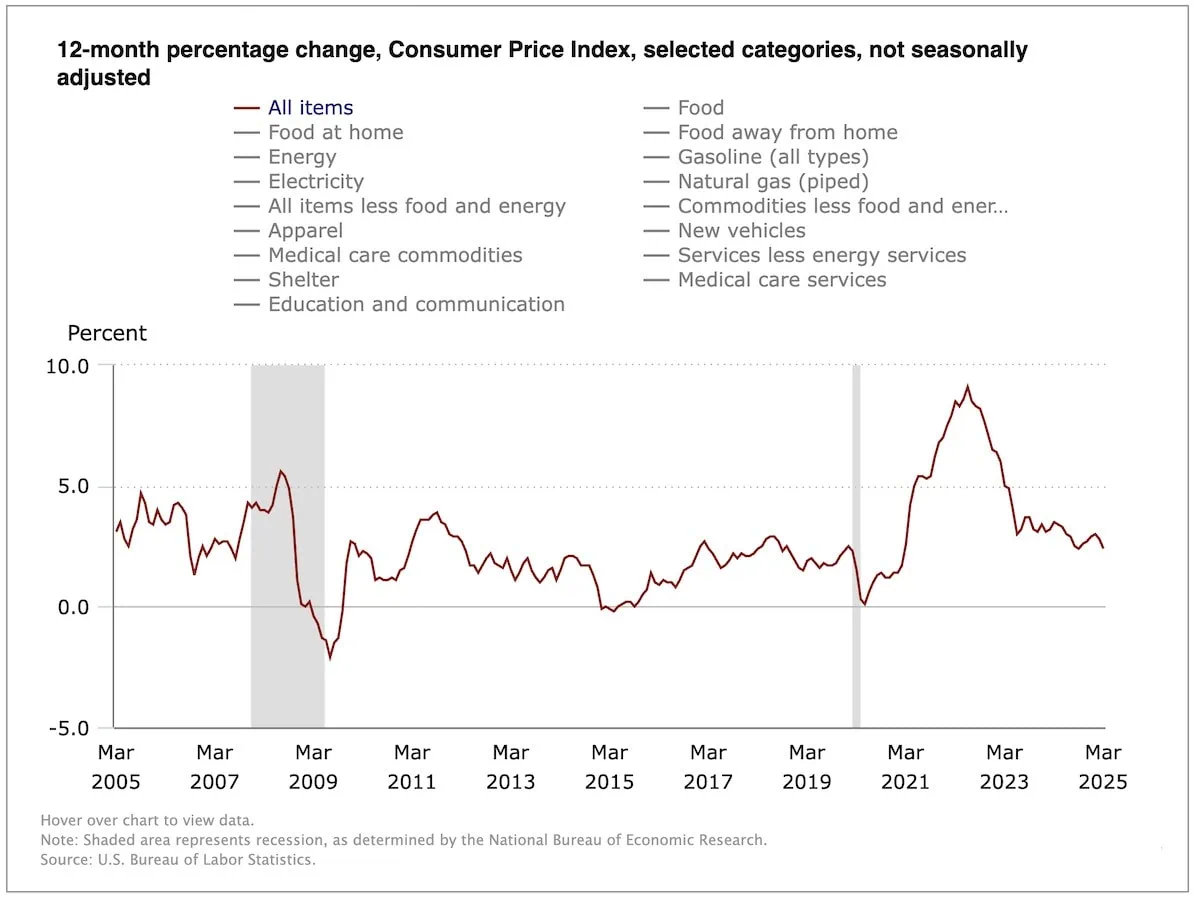

Consumer prices increased more slowly than expected in March, the second straight month of less-than-anticipated prints. However, analysts already had their eyes set on future reports amid a dramatically changing tariff backdrop.

The U.S. Bureau of Labor Statistics said Thursday that March’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, actually declined 0.1% month-over-month. That was an improvement from both February’s 0.2% rise in prices, as well as analysts’ expectations for 0.1% growth.

Year-over-year, headline inflation of 2.4% was below estimates for 2.5%.

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—grew by just 0.1% month-over-month, good for the lowest reading in four years and below the 0.3% expected. On a year-over-year basis, core CPI was 2.8% higher, below 3.0% expected.

However, March’s inflation print barely registered for many analysts, who instead were focused on how President Donald Trump’s tariffs would impact future reports.

Do These 7 Bear Market Tips Hold Up to Scrutiny?

“Today’s inflation data seemed encouraging, but it was backward-looking,” says David Russell, Global Head of Market Strategy at TradeStation, an online brokerage firm. “Wall Street will probably focus on the pressure of tariffs going forward. We face much higher duties on China, which provides a large number of ordinary consumer goods. Auto prices are unlikely to keep falling either.”

“This report could be like reading an old newspaper from a different reality.”

Here’s a quick look at March’s key CPI figures:

- MoM CPI: -0.1% (estimate: +0.1%)

- YoY CPI: +2.4% (estimate: +2.5%)

- MoM Core CPI: +0.1% (estimate: +0.3%)

- YoY Core CPI: +2.8% (estimate: +3.0%)

The sharpest decline was seen in energy (-2.4% month-over-month), where gasoline prices declined 6.3% MoM while fuel oil was down by 4.2%. Transportation services declined a swift 1.4%, medical care commodity costs were down by 1.1%, and used-car prices were off 0.7%.

Is the U.S. Headed for a Recession? 5 GDP Forecasts

We did, however, see sharply higher utility gas service prices (+3.6% MoM), as well as increases in medical care services (+0.5%), food (+0.4%), and apparel (0.4%).

“Inflation on goods decreased in March, but we should not get used to seeing negative numbers for goods inflation if tariffs persist,” says Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas at BlackRock. “Going forward, we do expect more elevated inflation in goods because of tariff policy.”

Chaudhuri adds that “in stocks, we think it makes sense to consider minimum volatility strategies as policy uncertainty persists,” which are among the strategies we suggest in our look at bear market ETFs.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

The broad consensus following Thursday’s report is that the weakness in consumer prices gives the Federal Reserve room to resume cutting its benchmark interest rate.

“This latest inflation reading is the last clear indicator we’ll have before tariffs potentially distort the true underlying inflation rate,” says Matt Stephani, President at Cavanal Hill Investment Management. “From the Federal Reserve’s perspective, the year-over-year core inflation rate, excluding food and energy, at 2.8%, offers some reassurance that the non-tariff economy is both decelerating and moving towards price stability. If the Fed concludes that the current tariff uncertainty is likely to trigger a significant slowdown or recession, this latest CPI reading could provide justification for a rate cut.”

The CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, now indicates a 76% chance that the Fed will keep its current Fed funds rate range between 4.25% and 4.50%, down from nearly 80% a day ago.

“While the Fed is still likely to remain on hold at this month’s meeting, the combination of easing inflationary pressures and rising downside risks to growth suggest that the Fed is moving closer to continuing its easing cycle,” says Kay Haigh, global co-head of Fixed Income and Liquidity Solutions at Goldman Sachs Asset Management.

What the Experts Think About March’s CPI Report

Here, we outline more thoughts from the experts on what March’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Jason Pride, Chief of Investment Strategy and Research, Glenmede

“If we weren’t on the eve of significant tariff impacts, today’s CPI report would be a welcome sign that inflation is moving in the right direction.

“Today’s report is a bit inconsistent with the dramatic rise in consumer inflation expectations. Those expectations can often become a self-fulfilling prophecy – if households believe prices are going higher, in theory they should prioritize purchasing now before prices go up. This effectively accelerates demand and can often bring about the inflation that was expected all along. There are few signs of that right now and, in some sense, it feels as if the opposite may be happening. Core goods prices were down -0.1%, suggesting households may have been pulling back on purchases in the face of economic uncertainty.

Will Tariffs Raise Consumer Prices? 7 CEOs Weigh In

“Even though reciprocal tariffs have been temporarily watered down, the 10% universal tariff that remains in place can still have a material impact on inflation that may start to show up over the next few CPI reports. The universal nature of those tariffs makes them increasingly difficult to avoid until domestic production capacity has time to catch up. The first signs of those impacts may be found in goods with high inventory turnover rates, so product categories such as groceries, cosmetics, seasonal items and auto parts will be important to watch over the next few months.”

Scott Helfstein, Head of Investment Strategy, Global X

“Consumer inflation at 2.4% and nonfarm payrolls at 200,000 last week. In a normal world, the Fed gets to declare victory. We are just not in a normal world. Prices for some items are going up, and that is going to keep the Fed on the sidelines. They are going to wait and see what the implications are.

“Did the new administration blink or are there really 75 countries looking to negotiate? The about-face on tariffs, and the risk of another policy shift, are driving markets, but this comes as the big banks kick off earnings season on Friday. The timing of the relief rally was helpful, but now we get to see what damage has already been done. Expect companies to pull guidance for this year as Delta (DAL) did or widen their guidance ranges.”

Dan Siluk, Head of Global Short Duration & Liquidity and Portfolio Manager, Janus Henderson

“This data suggests a softening in price pressures, despite concerns over potential inflationary impacts from recent tariff implementation and ongoing negotiations by the administration. Key components contributing to the subdued inflation included declines in energy costs, airfares, used cars, and medical care goods, though rents showed some firmness.

13 States That Don’t Tax Retirement Income

“We remain circumspect regarding the current inflation data, as these figures are reflective of a period prior to the implementation of recent tariffs. Therefore, we expect that there could be more volatility from inflation reads in the months ahead, particularly from the (tariff impacted) goods side.”

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“Officials at the Federal Reserve have recently urged caution in adjusting policy too quickly while also acknowledging that the announced tariffs would have stronger effects on growth and inflation than previously thought. Investors now expect between three and four interest rate cuts in 2025, reflecting the potential of slowing U.S. economic growth. For now, the Fed remains committed to their ‘hold steady’ policy stance, as they wait to examine the potential effects of new policies on growth, inflation, and the labor market.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 9 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 10 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)