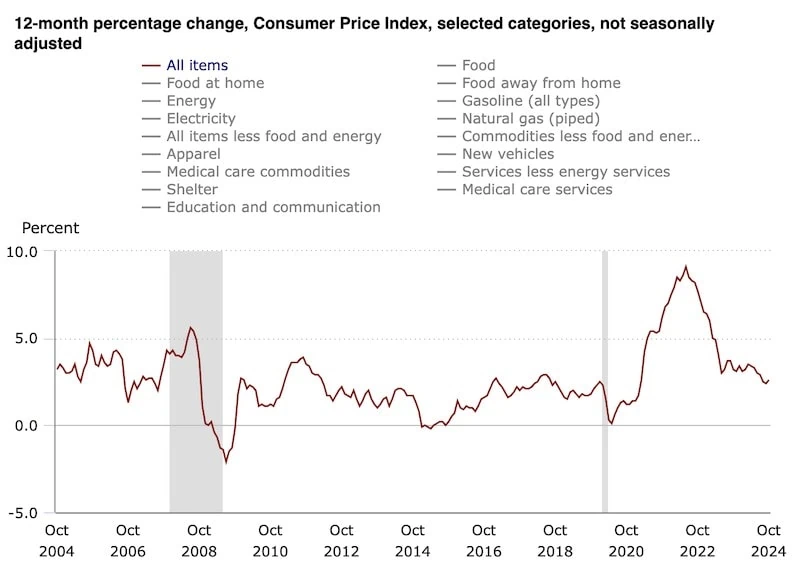

October’s consumer prices were a touch higher than the previous month, but came in both tame and as expected, doing little to shift expectations for a quarter-point rate cut from December’s Federal Open Market Committee (FOMC) meeting.

The U.S. Bureau of Labor Statistics said Wednesday that October’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, was 2.6% higher year-over-year, a slightly faster pace than September’s 2.4% print but right on par with Dow Jones-polled economists’ expectations.

Month-over-month, the 0.2% growth in consumer prices was both the same as it was in September, and also in line with estimates.

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—was also perfectly in line with economists’ expectations. October’s CPI rose 3.3% YoY and 0.3% MoM.

Related: A Quick Guide to Open Enrollment [Don’t Fumble Your Benefits]

Here’s a quick look at October’s key CPI figures:

- MoM CPI: +0.2% (estimate: +0.2%)

- YoY CPI: +2.6% (estimate: +2.6%)

- MoM Core CPI: +0.3% (estimate: +0.3%)

- YoY Core CPI: +3.3% (estimate: +3.3%)

“Bang in-line core inflation leaves the Fed on track to cut rates in December,” says Lindsay Rosner, head of multi sector fixed income investing at Goldman Sachs Asset Management. “After a run of unseasonably hot autumn data, today’s number cools fears of an imminent slowdown in the pace of rate cuts. Still, with uncertainty over fiscal and trade policies high there is a risk that the Fed may opt to slow the pace of easing as the New Year chill sets in.”

Most categories saw growth in prices compared to September, though the biggest leaps were in used cars and trucks (+2.7% month-over-month in October) and electricity (+1.2%).

Related: Q3 Economic Growth Continues at Brisk Pace

But Americans did get relief in fuel oil (-4.6%) and gasoline (-0.9%), as well as apparel (-1.5%).

Core services inflation remained plenty sticky, however. “[Shelter prices are] still higher than what we want to see, leaving more room for improvement,” says Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas at BlackRoc, noting that owners’ equivalent rent grew 0.4% MoM, rent of primary residence was up 0.3%, and lodging away from home was 0.4% higher.

However, “it is also important to recall that the Fed’s target is on PCE inflation, and it is showing a promising story,” Chaudhuri says. “Three-month annualized core PCE [personal consumption expenditures] is running at 2.3% YoY, around the Fed’s 2% target.”

Following Wednesday’s inflation print, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, indicated a 79% chance of a 25-basis-point reduction at the December FOMC meeting, up from 59% yesterday. (A basis point is one one-hundredth of a percentage point.)

But Josh Jamner, Investment Strategy Analyst at ClearBridge Investments, says that “data releases before then (including next month’s CPI) should have a greater impact on the Fed’s decision. With inflation holding steady, the market narrative should not see a significant shift as a result of today’s data.”

Related: 10 Ways Seniors Can Avoid “Medical Gaslighting”

What the Experts Think About October’s CPI Report

Here, we outline more thoughts from the experts on what October’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Scott Helfstein, Head of Investment Strategy, Global X ETFs

“The drivers in year-over-year inflation are pretty straightforward and have been pretty consistent. Shelter, electricity, transportation services, food away from home, and medical care continue to keep consumer prices growth above the Fed target. The service economy in the U.S. has been an important driver of economic strength as manufacturing has sputtered a bit. This could balance out in 2025 with a new administration and new policy priorities.

“The re-acceleration in inflation may cause some indigestion for the market as inflation comes back into focus with the possibility of higher tariffs in the next administration, but this is probably not sufficient to alter the Fed course on interest rates in the next meeting. We still expect a 25-basis-point cut in December, but the pace of cuts may be slow in 2025.”

Jason Pride, Chief of Investment Strategy & Research, Glenmede

“Stickier services inflation right now is a nuisance for the Fed, like it’s stepped in gum along its rate cut path. The Fed wants to avoid the mistakes of the past by prematurely easing and risking a second wave of inflation, so we’d expect the FOMC to take this risk seriously. This doesn’t take a rate cut off the table for December, but it’s certainly not a slam dunk. Until then, the FOMC will receive one more CPI report before its December session, which should provide further clarity on the general direction of inflation.”

Sonu Varghese, Global Macro Strategist at Carson Group

Related: What Is the Government Pension Offset [And How Does It Work]?

![7 Best Growth Stocks to Buy for 2026 [Find Your Edge] 6 best growth stocks to buy 2025](https://youngandtheinvested.com/wp-content/uploads/best-growth-stocks-to-buy-2025-600x403.webp)