Consumer prices rose a little more than expected in September, but Wall Street’s immediate consensus was that inflation didn’t get hot enough to warrant another “jumbo” cut to the Federal Reserve’s benchmark interest rate at the central bank’s November meeting.

The U.S. Bureau of Labor Statistics said on Thursday that September’s consumer price index (CPI), which measures the change in prices on a variety of consumer goods and services, was 0.2% higher compared to August on a seasonally adjusted basis. That was just ahead of the 0.1% uptick expected by Dow Jones-polled economists, though it was on par with August’s CPI reading.

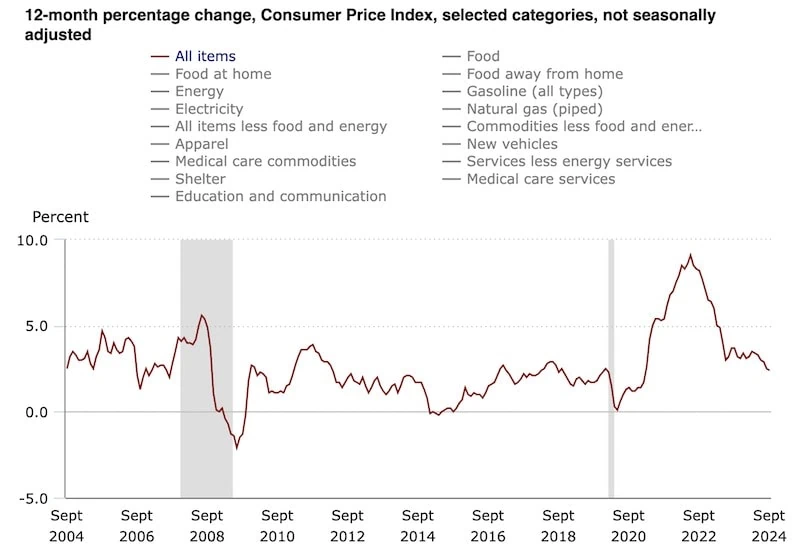

Year-over-year, September’s CPI was up 2.4%, also slightly ahead of estimates for a 2.3% print.

“Core” CPI—a measurement that backs out food and energy costs, which are more volatile than the other costs tracked by the Labor Department—was also hotter than economists expected. September’s core CPI rose 0.3% month-over-month, versus estimates for 0.2%.

Related: 6 HSA Money Mistakes to Avoid

“Today’s CPI number maybe wasn’t as important as the surprisingly strong unemployment data we got last week, but given the current uncertainty of the Fed’s future path of interest rate cuts, it did take on heightened importance,” says John Kerschner, Head of US Securitised Products at Janus Henderson Investors.

Here’s a quick look at September’s key CPI figures:

- MoM CPI: +0.2% (estimate: +0.1%)

- YoY CPI: +2.4% (estimate: +2.3%)

- MoM Core CPI: +0.3% (estimate: +0.2%)

- YoY Core CPI: +3.3% (estimate: +3.2%)

The biggest contributors to September’s inflation included a 1.4% jump in transportation services prices, a 1.1% rise in apparel costs, and a 0.7% increase in medical care services prices.

There were few sources of relief. The greatest came from energy (-1.9% month-over-month in September), thanks to a 6.0% drop in fuel oil, and a 4.1% drop in all types of gasoline. The only other downturn in prices came from medical care commodities (-0.7%).

“The silver lining for today’s CPI print was the deceleration in shelter inflation, which comprises over 40% of the core inflation basket,” says Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas at BlackRock. “Owners equivalent rent as well as Rent of Shelter decelerated from previous month, a decline long expected by the market.

Related: 13 Baby Boomer Retirement Statistics You Should Know

“However, this month’s data also showed that goods inflation returned in September after several months in disinflationary territory which we had long believed was unsustainable. While shelter slowed down, several other services components such as medical care and transportation care services moved higher this month, which led the Fed’s favored measure, ‘super core’ inflation, to trend higher to 0.4% from 0.3% last month and 0.2% in July.”

September’s CPI was in particularly close focus as Wall Street searched for signals of the Fed’s next move. The central bank kicked off a rate-cutting cycle last month with a 50-basis-point reduction in the federal funds rate.

Following Thursday’s inflation print, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, indicated an 86% chance of a 25-basis-point reduction at the November Federal Open Market Committee (FOMC) meeting, and just a 14% chance of a 50-bps cut. (A basis point is one one-hundredth of a percentage point.)

“[September’s CPI report] makes it potentially less likely the Fed will introduce another round of jumbo cuts anytime soon,” Global X Portfolio Strategist Ken Tjonasam says. “The Fed has been clear—they’re not backing down until inflation is well under control, and this report reinforces that. Higher inflation means the Fed is likely to stay cautious.”

Related: 8 Special Tax Breaks for Senior Citizens

Jason Pride, Chief of Investment Strategy & Research at Glenmede, echoed that sentiment: “It felt like the jobs report took a 50-bps November cut off the table, but this CPI report kicked it to the curb. There may even be some discussion questioning the necessity of a 25-bps cut in November. However, the Fed will likely proceed with a quarter-percent cut in order to establish a smooth trajectory, in recognition that they are starting from a point that is well above neutral and constrictive for economic growth.”

But he added that the Fed might try to strike a more stable tone than what the data might suggest, and thus “investors should avoid knee-jerk reactions to individual reports and instead take a step back to see the bigger picture, which is an economy with a strong labor market and relative price stability.”

In tandem with the CPI report, the Social Security Administration announced Thursday that the 2025 cost-of-living increase (COLA) would be 2.5%. That marked the lowest increase of Social Security’s COLA, an annual adjustment to the program’s benefits, since 2021 (1.3%).

What the Experts Think About September’s CPI

Here, we outline more thoughts from the experts on what September’s CPI numbers mean for consumers, markets, the Federal Reserve’s future actions, and more:

Whitney Watson, Global Co-Head and Co-CIO of Fixed Income and Liquidity Solutions, Goldman Sachs Asset Management

“The September CPI report came in stronger than expected, with core CPI in particular surprising to the upside. Labor market data, however, remains in the driving seat for the Fed and we see next month’s payrolls release as the more important data point in determining the pace and extent of Fed easing.”

Related: What Is a Backdoor Roth Conversion? [Retirement Strategy for High-Earners]

Sonu Varghese, Global Macro Strategist, Carson Group

“CPI Inflation data was slightly on the hotter side, with commodity prices (outside) energy rising more than expected. The good news is that shelter inflation is pulling back and that’s going to pull inflation lower. The big picture is inflation continues to pull lower, albeit with some bumps along the way.”

Gargi Chaudhuri, Chief Investment and Portfolio Strategist, Americas, BlackRock

“This stickiness in super core inflation but progress on shelter inflation should keep the Federal Reserve on their course of normalizing policy rates gradually. We believe that they will cut by 25 bps in each of the next two meetings for the remainder of the year.”

John Kerschner, Head of US Securitised Products, Janus Henderson Investors

“What did the bond market make of all this? Higher than expected inflation usually means higher rates. Lower increases in housing costs and a weaker job market usually means lower rates. Layered on top of that, the market was still digesting the recent 40bp increase in the U.S. Treasury two-year note. Put all that data in a bowl and mix it up, and you have a U.S. Treasury market from (two-years) to (10-years) that is only slightly higher. This is a sure sign of market confusion or lack of conviction.

“Now the market will wait for a barrage of Fed speakers later today and tomorrow (Cook, Barkin, Williams, Logan, Bowman) and PPI tomorrow to try and decipher just what is going on with this surprisingly strong economy and somewhat torn (FOMC) Federal Reserve Open Market Committee.”

Related: What Is the Government Pension Offset [And How Does It Work]?

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 6 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)