When I worked as a financial analyst at a major corporation, my work routinely required me to create models for business transactions, financial scenarios, and program cost-effectiveness assessments. Many inputs went into these models, such as cash flow implications and cost recovery structure. For the latter, we used a MACRS depreciation table for calculating tax depreciation (MACRS stands for “Modified Accelerated Cost Recovery System”).

Many businesses use MACRS depreciation to model how property will depreciate over time. And since they rely on policy certainty to make long-term investment decisions, knowing MACRS depreciation has been in place since 1986 gives many business leaders confidence that it will continue to provide a reliable source for timing depreciation expense from a tax perspective.

However, if you’ve landed on this article, I’m guessing it’s because you need a little help understanding how MACRS depreciation works or how to use a MACRS depreciation table—and I think I can help.

So, let’s dive in and explore MACRS depreciation together. We’ll cover its use, key concepts and terms, and the important components of a MACRS depreciation table. Then, as a bonus, I’ll show you how to get a handy MACRS depreciation calculator for free, which will make your life much easier if you’re calculating depreciation frequently.

Table of Contents

Featured Financial Products

What Is Depreciation?

Before getting into the details of MACRS depreciation and the MACRS depreciation tables, it’s probably a good idea to go over some depreciation basics.

Depreciation is an annual allowance given to a trade or business for exhaustion, wear and tear, and normal obsolescence of property. You can depreciate most types of tangible property, such as buildings, machinery, vehicles, furniture, and equipment—but not land. This includes appreciating assets, like rental property.

Certain intangible property, such as patents, copyrights, and computer software, qualify for depreciation, too. However, MACRS isn’t used to depreciate intangible property. Instead, the straight-line method, or in some cases the income forecast method, is used to depreciate intangible assets.

A depreciation allowance also counts as an income tax deduction. However, in order for a taxpayer to claim a depreciation deduction, the following requirements must be met:

- The taxpayer must own the depreciated property.

- The taxpayer must use the property in a trade or business that seeks to produce income.

- The property must have a determinable useful life of one year or more.

If the depreciable property is used for both personal and business purposes, the tax deduction can only be based on the property’s business use.

Straight-Line Depreciation

I mentioned the straight-line method of depreciation above. MACRS is an alternative to straight-line depreciation. However, as you’ll see in a minute, MACRS also incorporates straight-line depreciation under certain circumstances. That’s why fully understanding MACRS depreciation requires a basic understanding of straight-line depreciation.

With the straight-line depreciation method, a property’s cost recovery is spread out evenly over its useful life. Straight-line depreciation also factors in a piece of property’s salvage value, which is the estimated amount an owner would receive when selling the property at the end of its useful life. The salvage value is subtracted from the property’s basis.

Example: Straight-line depreciation

Let’s look at a simple example to see how straight-line depreciation works.

Assume you purchase a piece of equipment for your business for $12,000. The equipment has an expected useful life of 10 years. The salvage value is estimated at $2,000.

Under the straight-line depreciation method, you can claim $1,000 of depreciation for 10 years.

($12,000 cost – $2,000 salvage value) ÷ 10 years = $1,000

After 10 years, the equipment will only have $2,000 in salvage value and otherwise be fully depreciated. At that point, no more depreciation deductions are allowed.

Related: What Tax Bracket Are You In?

What Is MACRS Depreciation?

MACRS is a cost recovery method used since 1986 for most types of depreciable property. However, you generally can’t use MACRS to depreciate:

- Property you placed in service before 1987

- Certain property owned or used in 1986

- Intangible property

- Films, videotapes, and recordings

- Certain corporate or partnership property acquired in a nontaxable transfer

- Property you elect to exclude from MACRS

MACRS generally benefits taxpayers, because it accelerates cost recovery benefits.

From a high-level view, MACRS depreciation really isn’t terribly complicated. When a taxpayer purchases property for a business (e.g., equipment, machinery, computer software, buildings, etc.), the total cost typically can’t be written off all at once in the first year the property is placed into service (absent special treatment like bonus depreciation or Section 179 expensing).

Instead, with MACRS depreciation, the property’s cost is recovered through tax deductions over a period of time defined by the property’s specified useful life (i.e., the number of years in which it’s expected to last). Depending on the type of property, the useful life can range from 3 to 50 years.

When compared to the straight-line method of depreciating property, MACRS depreciation allows a taxpayer to take a larger tax deduction in the early years of an asset’s life and smaller deductions in the later years. This, of course, reduces taxable income early in the asset’s life but increases it down the road.

In the end, though, MACRS results in the same net depreciation as you would receive under the straight-line method. However, the taxpayer benefits from MACRS depreciation by having a lower net present value for their tax burden.

Related: Form 8594, Asset Acquisition Form: Explained!

Placed In Service Date for MACRS Purposes

Before jumping into calculating your depreciation deduction using the MACRS depreciation tables, let’s look at some important concepts and components of MACRS depreciation—starting with a property’s placed in service date.

You can start depreciating property when it’s placed in service for use in a trade or business or for the production of income. Property is placed in service for MACRS purposes on the date it’s ready and available for a specific use. So, the date you actually start using the property isn’t necessarily the placed in service date.

If property held for personal use is later converted to business use or for the production of income, then the conversion date is the placed in service date for MACRS depreciation.

Related: §1231, 1245 and 1250: Property Used in a Trade or Business

Basis of Property for MACRS Depreciation

You must also know the property’s basis for depreciation to calculate your depreciation deduction using MACRS.

Generally speaking, a property’s basis for MACRS purposes is equal to the amount paid for the property, plus other costs related to the property’s acquisition (e.g., taxes, legal fees, shipping costs, installation fees, etc.). However, if applicable, you must also subtract any tax credits or deductions allocable to the property (e.g., a Section 179 expense deduction, bonus depreciation deduction, credit for employer-provided childcare facilities, etc.)

For example, suppose you purchased an office building to be used in your business for $500,000. You also paid an additional $50,000 for legal fees, mortgage recording costs, and other acquisition-related expenses. For your first year of ownership, you also claimed a $8,000 tax deduction for the removal of barriers to the disabled and the elderly. The property’s basis for MACRS depreciation is $542,000 ($500,000 + $50,000 – $8,000).

YATI Tip: An asset’s basis for capital gains tax purposes is typically different from its basis for MACRS depreciation. For instance, the basis for tax purposes must be reduced by the depreciation allowed (or allowable) for any previous year, even if a depreciation deduction wasn’t claimed by the taxpayer for that particular year.

Related: Which Type of Real Estate Investment is Right for You?

Featured Financial Products

MACRS Depreciation Systems

Drilling down a bit further, we can see that MACRS is split into two different depreciation systems: the general depreciation system (GDS) and the alternative depreciation system (ADS). These two “sub-systems” apply different methods and recovery periods to calculate depreciation deductions.

Most types of property qualify for GDS treatment, while the ADS only applies to:

- Nonresidential real property, residential rental property, or improvement property held by certain real estate businesses

- Property held by certain farming businesses with a recovery period of at least 10 years

- Property used predominantly in farming and placed in service in a year during which an election not to apply the uniform capitalization rules to certain farming costs is in effect

- Property used for tax-exempt purposes (including tax-exempt bond-financed property)

- Property imported from a foreign country that maintains trade restrictions or engages in other discriminatory acts

- Tangible property used predominantly outside the U.S.

- “Listed property” (i.e., property used for transportation, entertainment, recreation, or amusement) that’s used 50% or less in a business during the year

A business can also opt to use the ADS for all property in a property class that’s placed in service during the year. However, an election for residential rental property or nonresidential real property can be made on a property-by-property basis. Once an election to use the ADS is made, it can’t be changed.

Related: How to Give Stocks as a Gift in a Tax-Efficient Way

MACRS Depreciation Methods

Next, let’s take a quick look at the three MACRS depreciation methods: the 200% declining balance method, 150% declining balance method, and straight-line method.

As shown in the following table, the method used depends on the depreciation system and the type of property being depreciated.

| Method | Type of Property |

|---|---|

| GDS Using 200% Declining Balance Method | • Nonfarm 3-, 5-, 7-, and 10-year property • Farm 3-, 5-, 7-, and 10-year property placed in service after 2017, in tax years ending after 2017 |

| GDS Using 150% Declining Balance Method | • Farm 3-, 5-, 7-, or 10-year property placed in service before 2018 • All 15- and 20-year property • Nonfarm 3-, 5-, 7-, or 10-year property • Farm 3-, 5-, 7-, or 10-year property placed in service after 2017 |

| GDS Using Straight-Line Method | • Nonresidential real property • Residential rental property • Trees or vines bearing fruits or nuts • Water utility property • All 3-, 5-, 7-, 10-, 15-, and 20-year property • Property for which you elected Tax Code Section 168(k)(4) for a tax year beginning before January 1, 2018 • Qualified improvement property placed in service after 2017 |

| ADS Using Straight-Line Method | All property depreciated using the ADS |

You might have noticed that some property can be depreciated using more than one method. That’s because you can elect to use a different method for certain types of property. The election is irrevocable, though.

An election generally must be made by the due date of your tax return (including any tax filing extensions) for the year the property is placed in service. However, if you filed a timely tax return for the year but neglected to make the election, you can still change methods by filing an amended tax return within six months of the original return’s due date (not including extensions).

In addition, if you use a different method for one item in a property class, you must use the same method for all property in that class placed in service during the year of the election. However, you can elect different depreciation methods on a property-by-property basis for nonresidential real property and residential rental property.

Related: 30 Tax Statistics and Facts That Might Surprise You

Benefits of 200% and 150% Declining Balance Methods

When compared to the straight-line method (discussed earlier), the 200% and 150% declining balance methods accelerate depreciation. In other words, they result in greater depreciation expense deductions early in the property’s useful life and smaller deductions in the later years.

With the 200% declining balance method, depreciation is taken at twice the rate you would see under the straight-line method. It’s one and a half times faster with the 150% declining balance method.

The “declining balance” aspect of the 200% and 150% methods basically means that depreciation is calculated each year based on the property’s depreciable basis at the beginning of the accounting period. So, any depreciation taken in previous years is subtracted from the property’s value before applying the higher rate of depreciation.

Plus, when the annual depreciation under the 200% or 150% declining balance becomes less than the annual depreciation under the straight-line method, companies usually switch to the straight-line method for the rest of the property’s useful life. This change is also built into the MACRS depreciation tables.

However, in the end, the total depreciation taken is the same between the three methods. It’s just a matter of how early the bulk of the property’s basis is recovered.

Example: 200% declining balance method

To understand this better, let’s look at an example of how the 200% declining balance method works.

Assume a manufacturer purchases a piece of equipment worth $10,000 on the first day of the year. The manufacturer expects no salvage value at the end of the equipment’s useful life in five years.

Under the straight-line method, the annual depreciation would be $2,000 (20% x $10,000). However, under the 200% declining balance method, depreciation for the first year would double to $4,000 (40% x $10,000).

In the second year, the amount of depreciation under the straight-line method would again be $2,000. Under the 200% declining balance method, it would be $2,400 (40% of the $6,000 remaining depreciable basis).

In the third year, the straight-line method once again results in $2,000 of depreciation, while the 200% declining balance method yields $1,440 of depreciation (40% of the $3,600 remaining depreciable basis).

Related: What is the Cash Surrender Value of a Life Insurance Policy?

Featured Financial Products

MACRS Conventions

For calculating the tax deduction to take under the MACRS depreciation formula, it’s also important to understand the different timing conventions used when placing property into service. These conventions help determine the portion of the year to depreciate property in both the year the property is placed in service and the year it is taken out of service.

There are three MACRS conventions: the mid-month convention, mid-quarter convention, and half-year convention.

MACRS Mid-Month Convention

This convention is only used for real property (e.g., nonresidential real property and residential rental property).

When using the mid-month convention, a taxpayer takes half a month of depreciation in the month the property is placed in service and half a month of depreciation in the month the property is removed from service.

MACRS Mid-Quarter Convention

If you’re depreciating personal property (i.e., not real property for which the mid-month convention applies), use the mid-quarter convention if the total MACRS property you place in service in the last quarter of the year is more than 40% of all MACRS property you place in service during the entire year. Don’t count property for which the mid-month convention applies, property placed in service and disposed of in the same year, or property depreciated under a method other than MACRS.

With the mid-quarter convention, you take 1½ months of depreciation in the quarter the property is placed in service and 1½ months of depreciation in the quarter the property is taken out of service.

MACRS Half-Year Convention

Use the half-year convention if neither the mid-month convention nor mid-quarter convention applies.

As you might have guessed, that means you claim six months of depreciation in the year the property is placed in service and six months of depreciation in the year you remove the property from service.

Related: Investing in Startup Companies [Ground-Floor Investments]

MACRS Property Classes and Recovery Periods

The final two MACRS components I’ll cover before turning to calculating depreciation are property classes and recovery periods.

Property class is simply a category of property. There are nine basic property classes for the GDS; however, property classes aren’t really used for the ADS.

A property’s recovery period is the number of years it takes to recover its cost or other basis through depreciation. A property’s recovery period can be different under the GDS and the ADS.

The nine GDS property classes, a few common examples of the type of property included in each class, and the corresponding recovery period for each class are in the following table (exceptions to the general recovery period might apply).

| Property Class | Property Examples | GDS Recovery Period |

|---|---|---|

| 3-Year Property | • Tractor units for over-the-road use • Race horses over 2 years old when placed in service • Other horses (other than a race horse) over 12 years old when placed in service; certain rent-to-own property | 3 Years |

| 5-Year Property | • Cars, taxis, buses, and trucks • Office machines (e.g., computers, calculators, and copiers) • Property used in research and experimentation; breeding cattle and dairy cattle • Appliances, carpets, furniture, etc., used in a residential rental real estate activity • Certain equipment used for farming | 5 Years |

| 7-Year Property | • Office furniture and fixtures (e.g., desks, files, and safes) • Grain bins, cotton ginning assets, or fences used for farming • Railroad track • Any property that doesn’t have a class life and hasn’t been designated as being in any other class | 7 Years |

| 10-Year Property | • Vessels, barges, tugs, and similar water transportation equipment • Single-purpose agricultural or horticultural structures • Trees or vines bearing fruits or nuts | 10 Years |

| 15-Year Property | • Certain improvements made directly to land or added to it (e.g., shrubbery, fences, roads, sidewalks, and bridges) • Retail motor fuels outlets (e.g., convenience stores) • Municipal wastewater treatment plants • Certain natural gas distribution lines | 15 Years |

| 20-Year Property | • Farm buildings (other than single-purpose agricultural or horticultural structures) • Municipal sewers not classified as 25-year property • Initial clearing and grading land improvements for electric utility transmission and distribution plants | 20 Years |

| 25-Year Property | Water utility property that’s either: • An integral part of the gathering, treatment, or commercial distribution of water that otherwise would be 20-year property • Municipal sewers other than property placed in service under a binding contract in effect at all times since June 9, 1996 | 25 Years |

| Residential Rental Property | Rental buildings or structures (including mobile homes) with at least 80% of its gross rental income from dwelling units | 27.5 Years |

| Nonresidential Real Property | Certain structures (e.g., office buildings, stores, or warehouses) that isn’t residential rental property or property with a class life of less than 27.5 years | 39 Years |

As noted, determining the recovery period under the ADS is a bit different. Instead of utilizing property classes, recovery periods for ADS purposes are assigned on a property-by-property basis. Plus, recovery periods are often longer under the ADS than they are under the GDS.

Examples of ADS recovery periods for certain types of property are included in the table below (again, exceptions might apply).

| Property | ADS Recovery Period |

|---|---|

| Rent-to-Own Property | 4 Years |

| Cars and Light-Duty Trucks | 5 Years |

| Computers and Peripheral Equipment | 5 Years |

| Personal Property With No Class Life | 12 Years |

| Single-Purpose Agricultural and Horticultural Structures | 15 Years |

| Trees and Vines Bearing Fruits or Nuts | 20 Years |

| Initial Clearing and Grading Land Improvements For Gas Utility Property | 20 Years |

| Initial Clearing And Grading Land Improvements For Electric Utility Transmission And Distribution Plants | 25 Years |

| Residential Rental Property | 30 Years |

| Nonresidential Real Property | 40 Years |

| Railroad Grading and Tunnel Bores | 50 Years |

See Appendix B in IRS Publication 946 for other types of property not included in the examples above.

Related: Best SEP IRAs

How Is MACRS Depreciation Calculated?

Believe it or not, now comes the easy part! After becoming familiar with the MACRS concepts and components discussed above, you should have no problem finding and using the right MACRS depreciation table to calculate the amount of depreciation to deduct each year.

Start with the MACRS Depreciation Table Guide below, which will point you to the proper MACRS table (shown in the last column). You’ll need to know the proper MACRS system, depreciation method, recovery period, convention, class, and month or quarter the property is placed in service.

As noted in the guide itself, use Chart 2 (at the bottom of the table) to find the depreciation table for residential rental and nonresidential real property. Use Chart 1 (at the top of the table) for all other types of property.

Links to the appropriate MACRS depreciation table are included in the guide, but you can also find them at the bottom of this article.

| MACRS Depreciation Table Guide | ||||||

|---|---|---|---|---|---|---|

| Chart 1. Use this chart to find the correct depreciation table to use for any property other than residential rental and nonresidential real property. Use Chart 2 for residential rental and nonresidential real property. | ||||||

| MACRS System | Depreciation Method | Recovery Period | Convention | Class | Month or Quarter Placed in Service | Table |

| GDS | 200% | GDS/3, 5, 7, 10 | Half-Year | 3, 5, 7, 10 | Any | A-1 |

| GDS | 200% | GDS/3, 5, 7, 10 | Mid-Quarter | 3, 5, 7, 10 | 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr | A-2 A-3 A-4 A-5 |

| GDS | 150% | GDS/3, 5, 7, 10 | Half-Year | 3, 5, 7, 10 | Any | A-14 |

| GDS | 150% | GDS/3, 5, 7, 10 | Mid-Quarter | 3, 5, 7, 10 | 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr | A-15 A-16 A-17 A-18 |

| GDS | 150% | GDS/15, 20 | Half-Year | 15 & 20 | Any | A-1 |

| GDS | 150% | GDS/15, 20 | Mid-Quarter | 15 & 20 | 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr | A-2 A-3 A-4 A-5 |

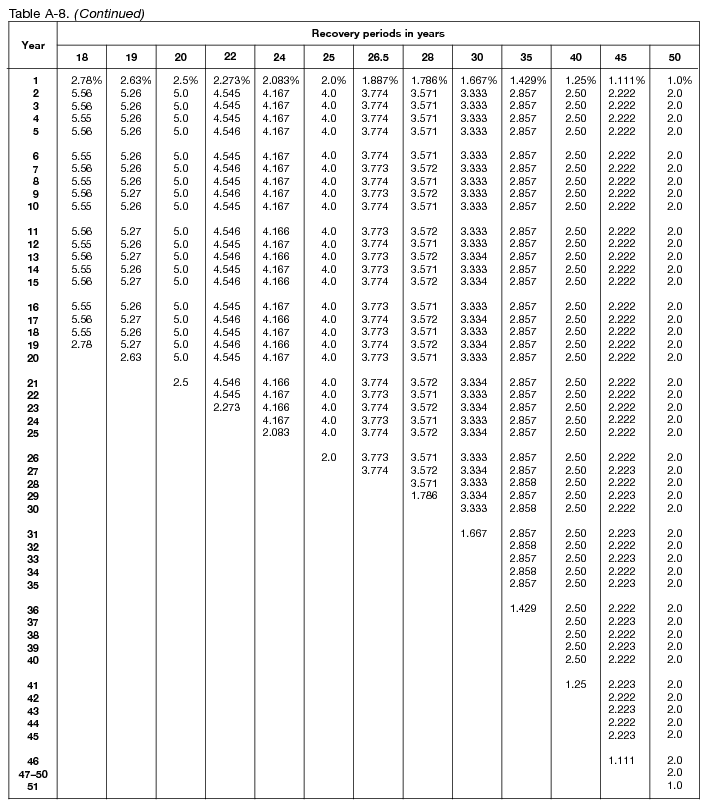

| GDS ADS | Straight-Line | GDS ADS | Half-Year | Any | Any | A-8 |

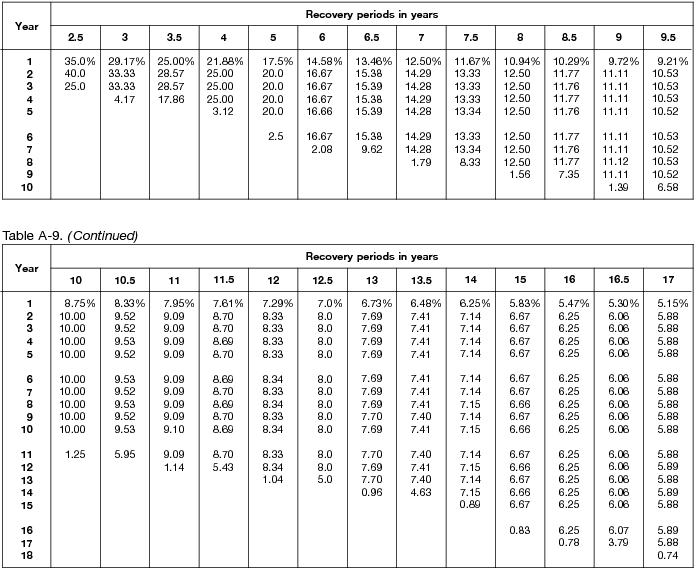

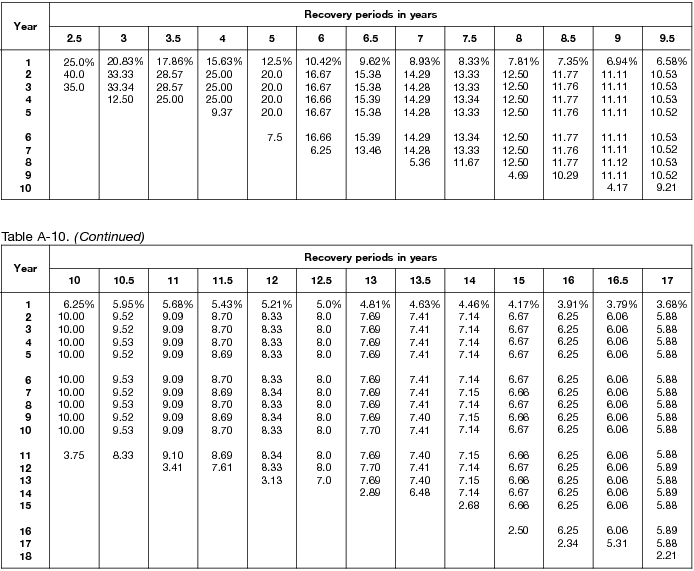

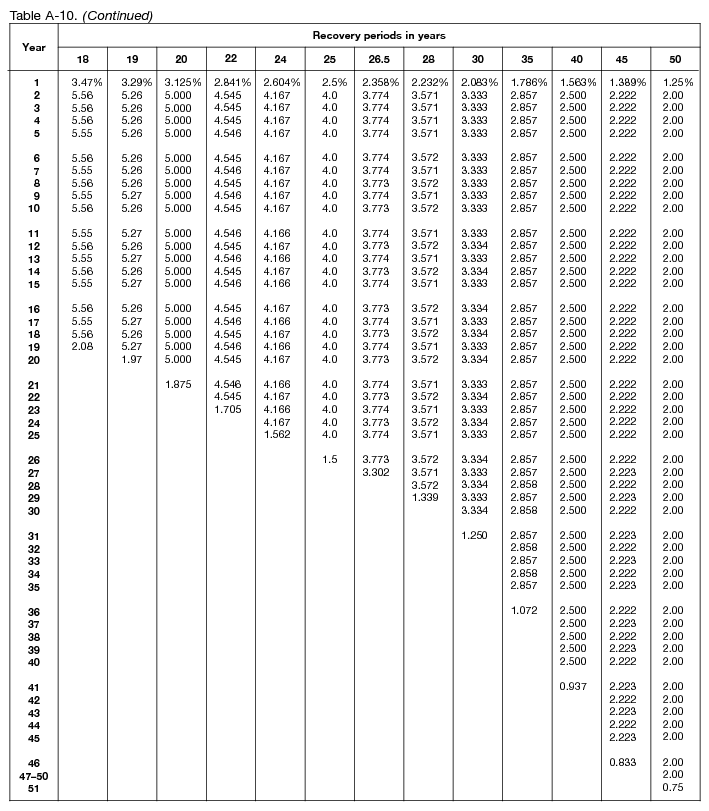

| GDS ADS | Straight-Line | GDS ADS | Mid-Quarter | Any | 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr | A-9 A-10 A-11 A-12 |

| ADS | 150% | ADS | Half-Year | Any | Any | A-14 |

| ADS | 150% | ADS | Mid-Quarter | Any | 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr | A-15 A-16 A-17 A-18 |

| Chart 2. Use this chart to find the correct depreciation table to use for residential rental and nonresidential real property. Use Chart 1 for all other property. | ||||||

| MACRS System | Depreciation Method | Recovery Period | Convention | Class | Month or Quarter Placed in Service | Table |

| GDS | SL | GDS/27.5 | Mid-Month | Residential Rental Property | Any | A-6 |

| GDS | SL SL | GDS/31.5 GDS/39 | Mid-Month | Nonresidential Real Property | Any | A-7 A-7a |

| ADS | SL | ADS/30 | Mid-Month | Residential Rental Property | Any | A-13 |

| SL | ADS/40 | Mid-Month | Residential Rental Property and Nonresidential Real Property | Any | A-13a | |

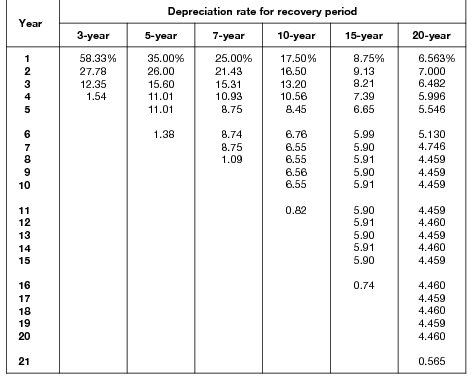

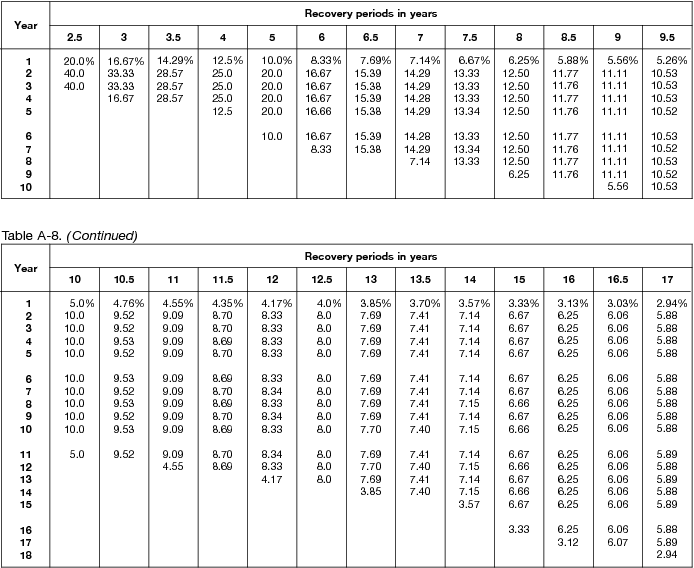

Once you locate the correct MACRS table, find the appropriate recovery period (running across the top of the table) for the property being depreciated. In that column, you’ll see the depreciation percentage for each year of depreciation.

For the first year of depreciation, multiply the property’s basis by the first percentage on the list to determine the depreciation deduction for that year. For the second year, multiply the basis by the second percentage on the list, and so on for each additional year for which depreciation is allowed.

Use Form 4562 to claim your depreciation tax deduction when it’s time to file your tax return for the year.

Example: Calculating MACRS Depreciation

Let’s go through a simple example to illustrate the process.

Assume you purchase office furniture for your business. It’s delivered and placed in service on February 15, 2023. The furniture is used only for business purposes, and you don’t place any other property in service for the year.

The cost of the furniture, plus sales tax and delivery charges, equals $8,000. You don’t claim any tax deductions or credits for the furniture, so your basis for depreciation is $8,000.

The property doesn’t qualify for ADS treatment, so the proper MACRS system is the GDS. Under the GDS, office furniture qualifies as 7-year property (with a recovery period of seven years).

Since furniture is personal property (as opposed to real property), and it wasn’t placed in service during the last quarter of the year, the half-year convention must be used.

For the depreciation method, you select the 200% declining balance method.

Based on all this information, you determine that Table A-1 (below) is the proper MACRS depreciation table to use for the office furniture.

Based on the percentages in Table A-1 for 7-year property, you can depreciate the office furniture and claim depreciation tax deductions as follows.

| Year | Basis | Percentage | Deduction |

|---|---|---|---|

| 2023 | $8,000 | 14.29% | $1,143 |

| 2024 | $8,000 | 24.49% | $1,959 |

| 2025 | $8,000 | 17.49% | $1,399 |

| 2026 | $8,000 | 12.49% | $999 |

| 2027 | $8,000 | 8.93% | $714 |

| 2028 | $8,000 | 8.92% | $714 |

| 2029 | $8,000 | 8.93% | $714 |

| 2030 | $8,000 | 4.46% | $357 |

Note the lower MACRS depreciation amounts for 2023 and 2030. That’s the result of using the MACRS half-year convention, which only allows depreciation for half of the first and last year of depreciation.

Related: 30 Machine Learning Statistics + Trends

Featured Financial Products

Free MACRS Depreciation Calculator (Excel)

Whether you need to understand rental property depreciation, short-lived depreciable assets, or depreciation of property in other areas, I have a free Depreciation Calculator that can handle your needs. Because depreciation is an expense useful for lowering your taxable income, it’s best to plan how depreciation will look over the useful life of an asset.

My depreciation calculator includes both MACRS depreciation calculations and straight-line book depreciation calculations. Additionally, I included a row capturing the temporary timing differences between MACRS and book depreciation, which will eventually reverse as time passes.

The calculator offers two different views (on different tabs), depending on your needs:

- MACRS Depreciation – All Useful Lives. This tab allows for you to input your single asset’s value and see how the depreciation would work from a tax and straight-line book perspective for nearly every major useful life. This is a useful view to see how depreciation expense changes with the useful life of an asset.

- MACRS Depreciation – Multiple Assets. This tab provides more functionality in the event you’re making investments across multiple years and will have these assets go into service at different points. If you know the planned sequence of when these assets will become eligible for MACRS and book depreciation, you can input those values into the Annual Capital Additions cells at the top of the page (highlighted in yellow). From there, you’ll need to select the desired MACRS and book depreciable lives from the drop down lists in the box to the left. The depreciation spreadsheet will handle the rest, even showing the temporary timing difference at the bottom of the page.

Below, you can see a screenshot of what my Depreciation Calculator looks like. Give it a try—for Free!

MACRS Depreciation Tables

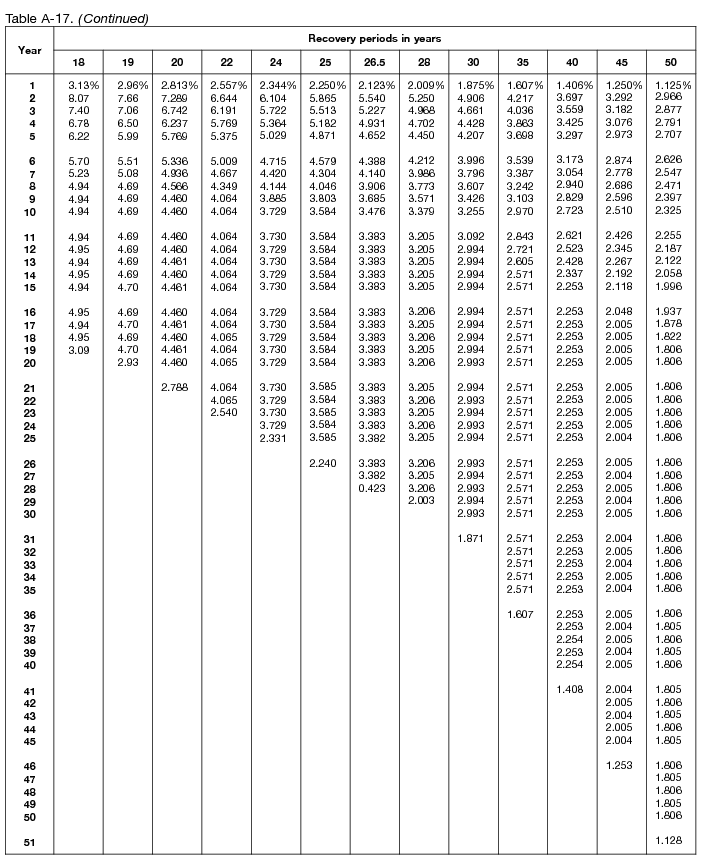

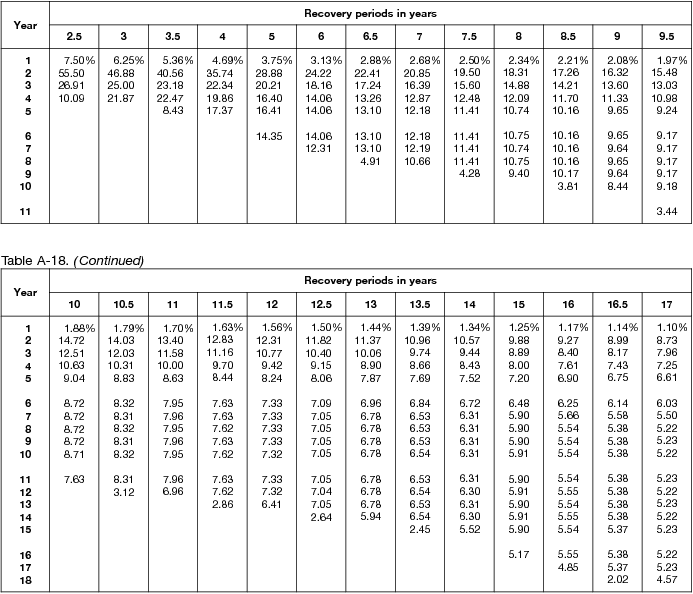

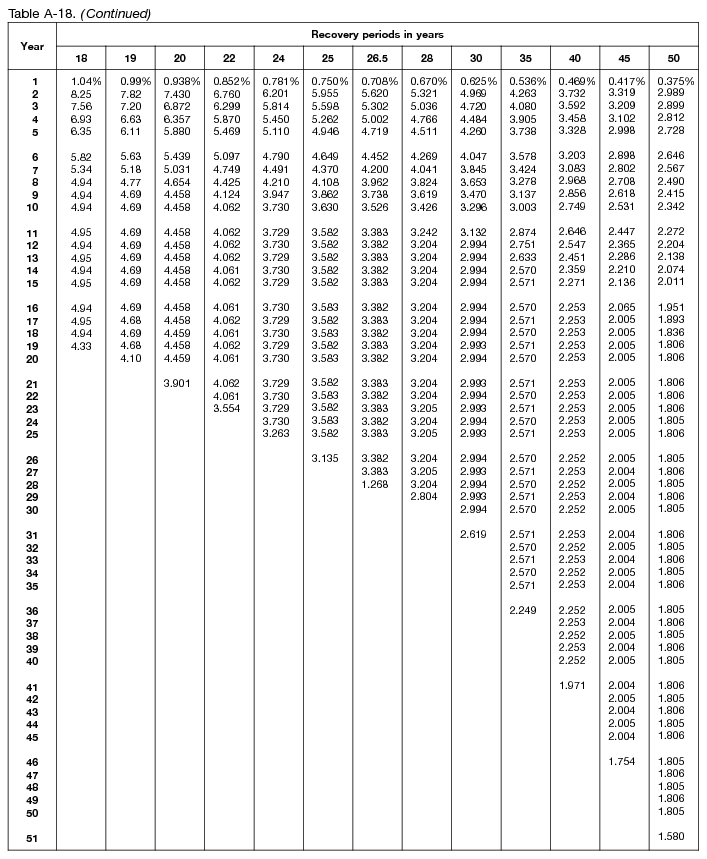

As promised, here are the MACRS depreciation tables referenced in the MACRS Depreciation Table Guide provided above.

Table A-1: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Half-Year Convention

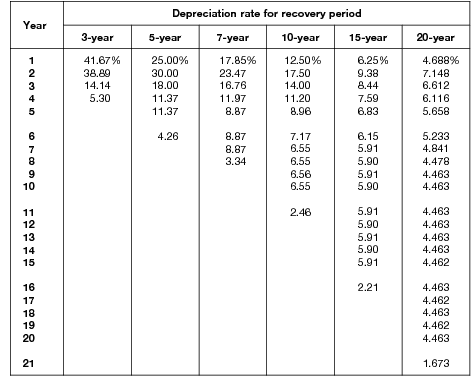

Table A-2: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Mid-Quarter Convention; Placed in Service in First Quarter

Table A-3: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Mid-Quarter Convention; Placed in Service in Second Quarter

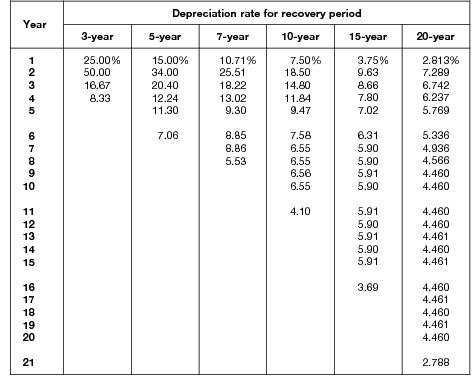

Table A-4: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Mid-Quarter Convention; Placed in Service in Third Quarter

Table A-5: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Mid-Quarter Convention; Placed in Service in Fourth Quarter

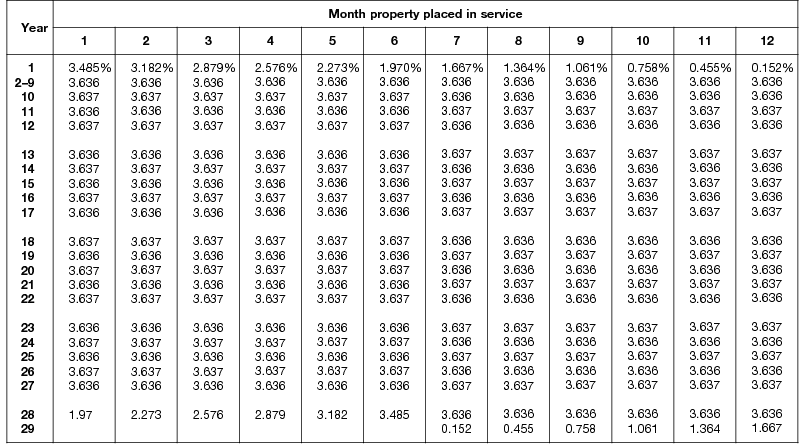

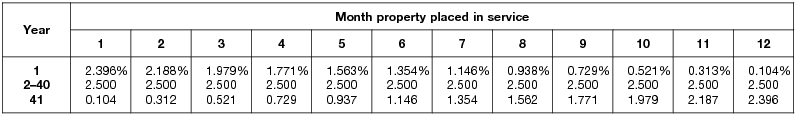

Table A-6: Residential Rental Property; Mid-Month Convention; Straight Line—27.5 Years

Table A-7: Nonresidential Real Property; Mid-Month Convention; Straight Line—31.5 Years

Table A-7a: Nonresidential Real Property; Mid-Month Convention; Straight Line—39 Years

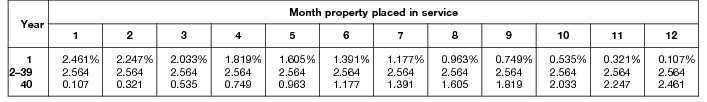

Table A-8: Straight Line Method; Half-Year Convention

Table A-9: Straight Line Method; Mid-Quarter Convention; Placed in Service in First Quarter

Table A-10: Straight Line Method; Mid-Quarter Convention; Placed in Service in Second Quarter

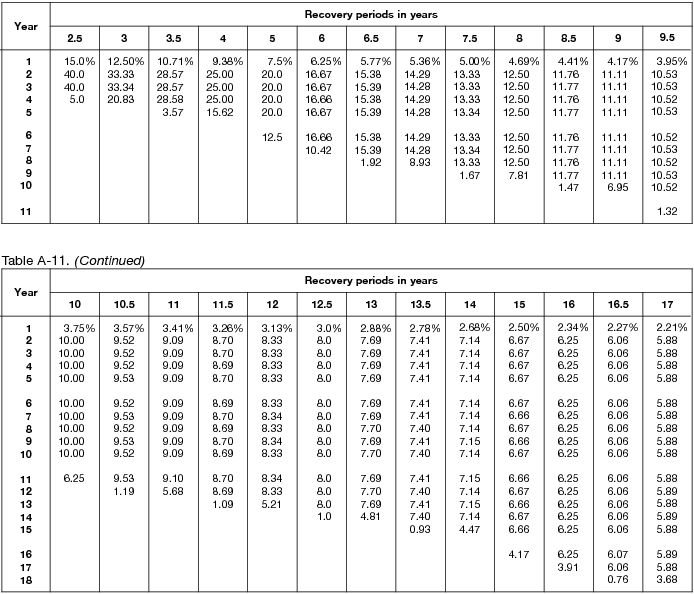

Table A-11: Straight Line Method; Mid-Quarter Convention; Placed in Service in Third Quarter

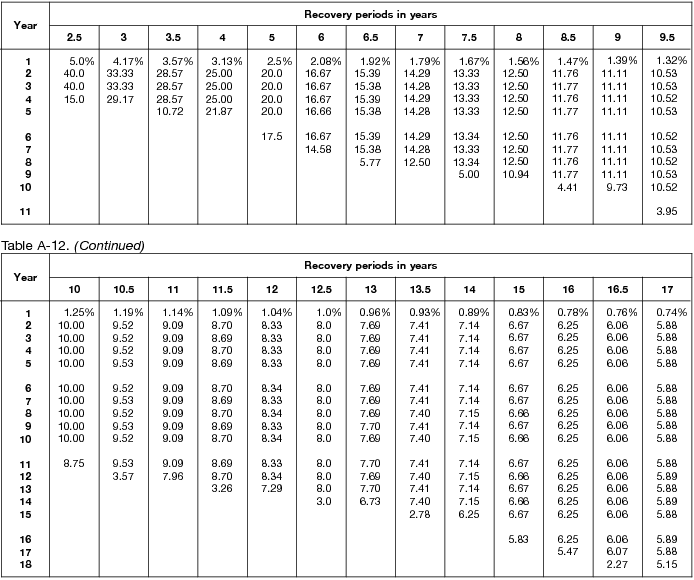

Table A-12: Straight Line Method; Mid-Quarter Convention; Placed in Service in Fourth Quarter

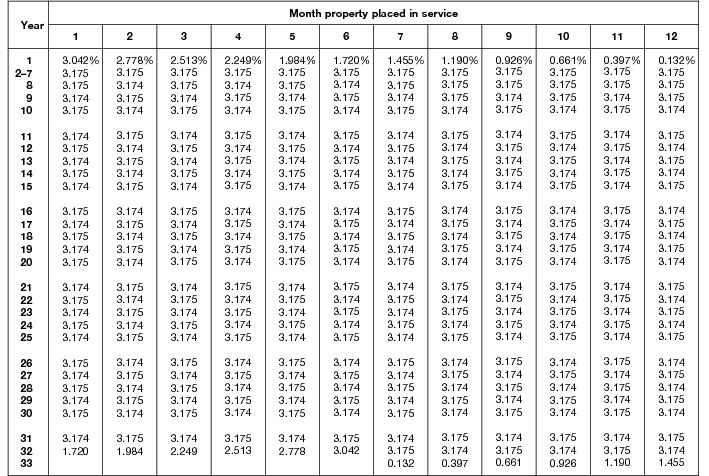

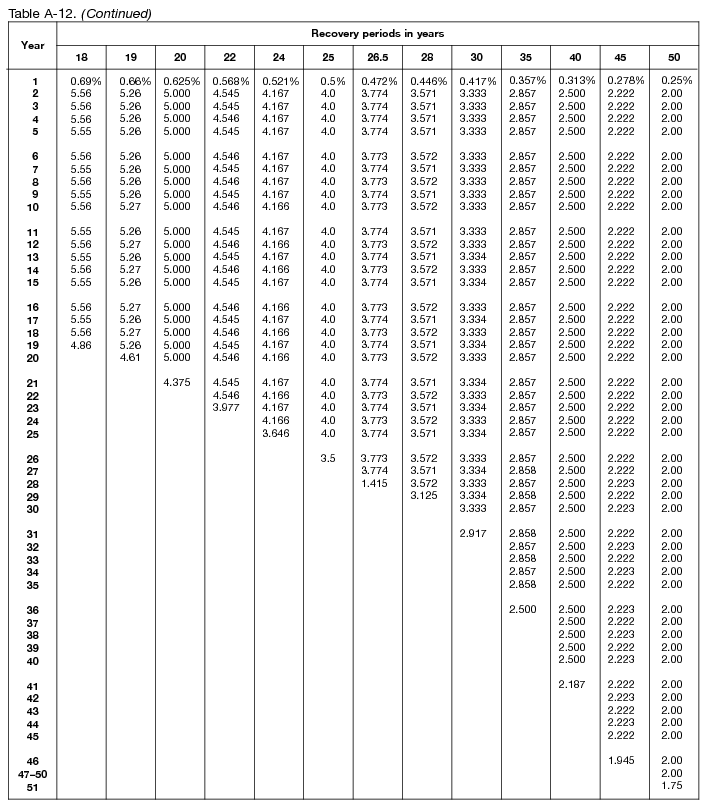

Table A-13: Residential Rental Property Placed in Service After 2017; Straight Line—30 Years; Mid-Month Convention

Table A-13a: Straight Line—40 Years; Mid-Month Convention

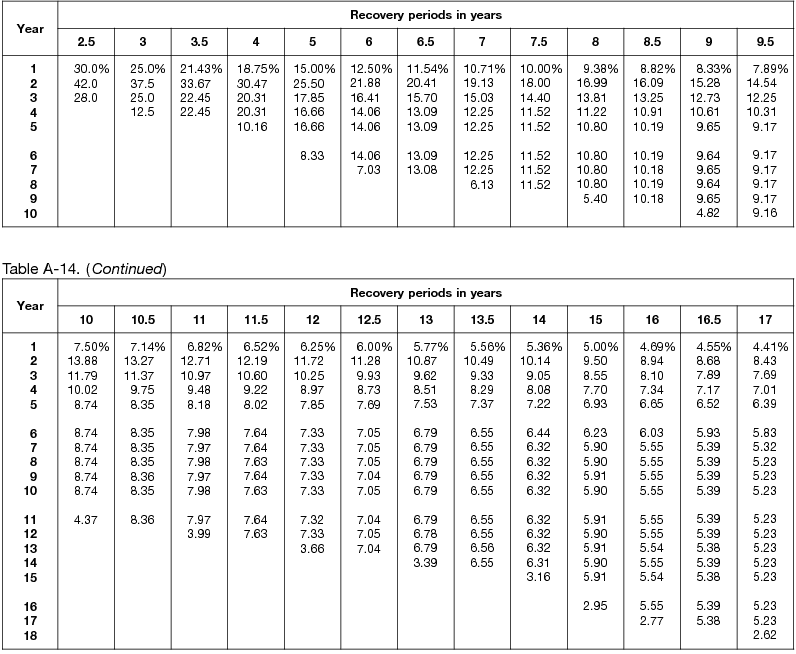

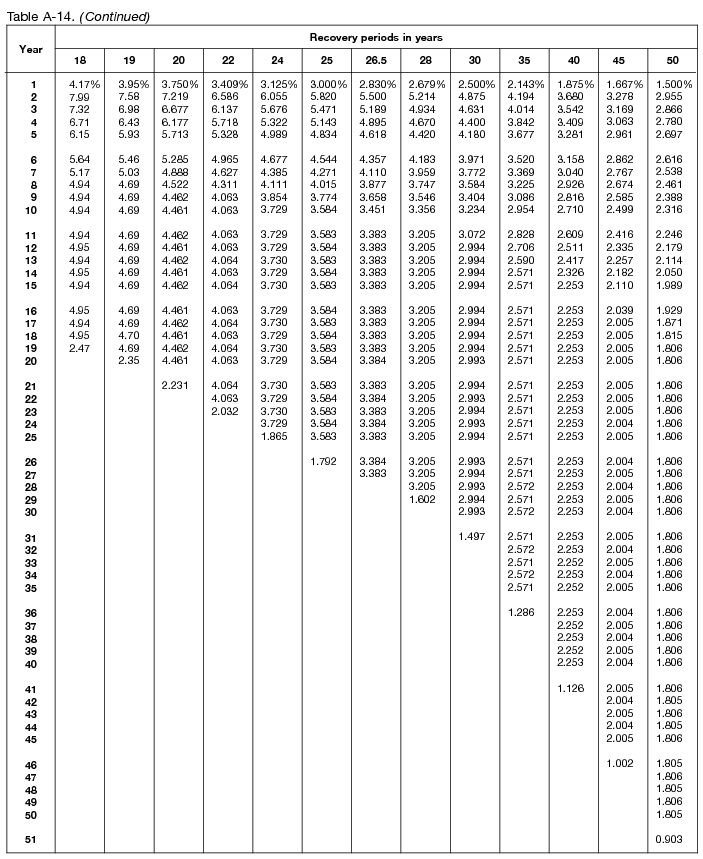

Table A-14: 150% Declining Balance Method; Half-Year Convention

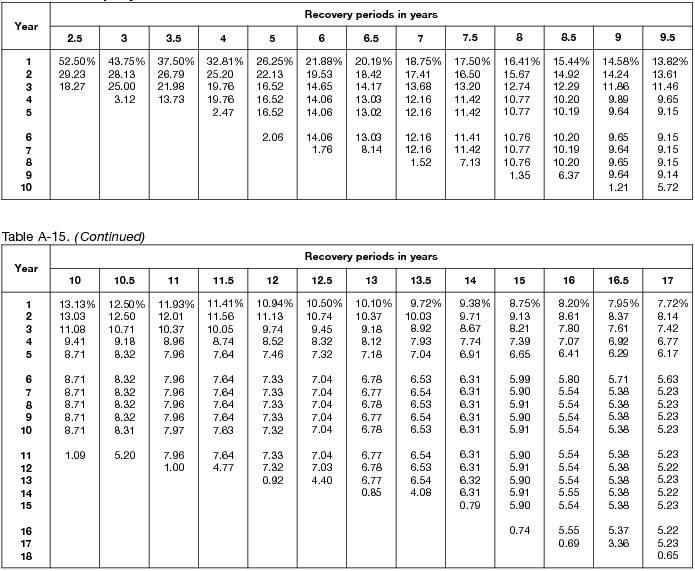

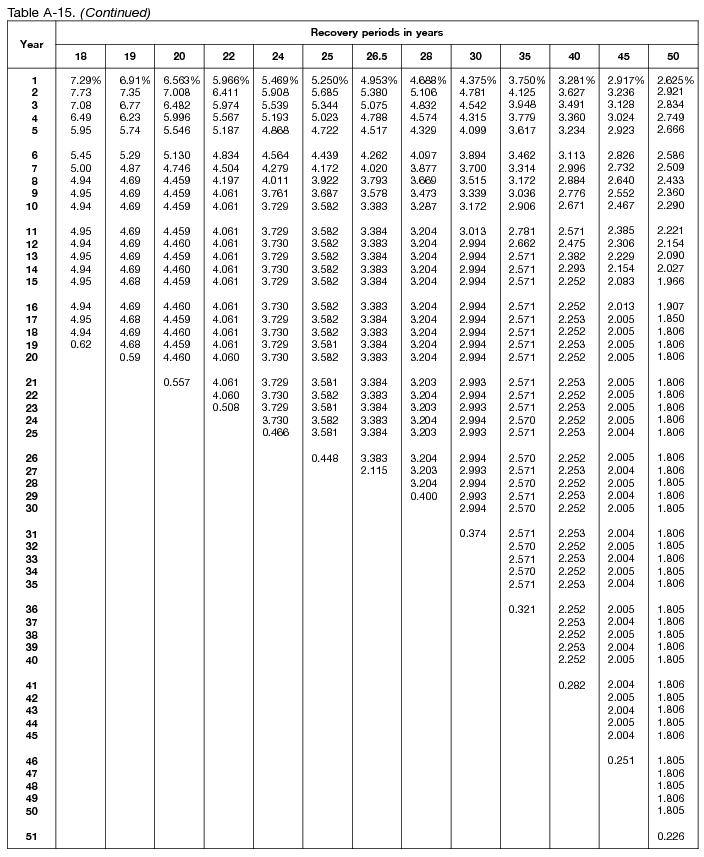

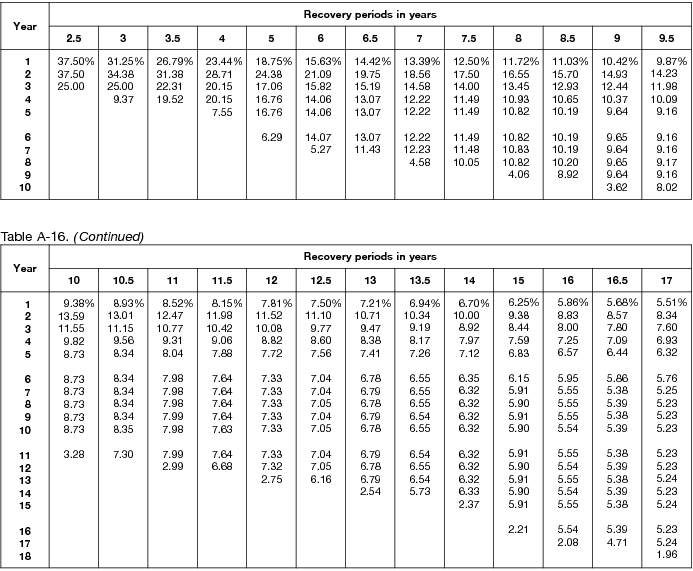

Table A-15: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in First Quarter

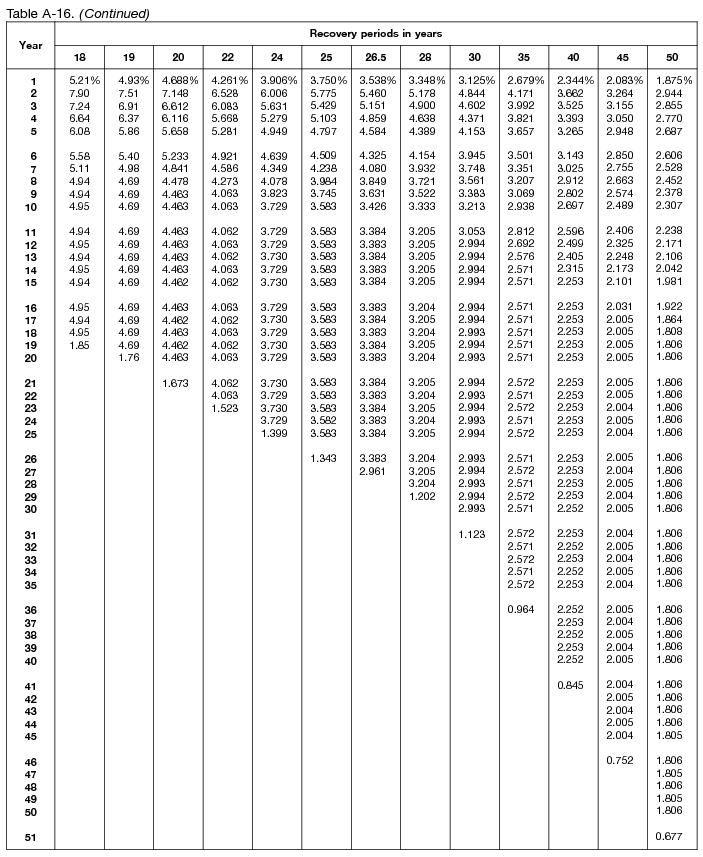

Table A-16: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in Second Quarter

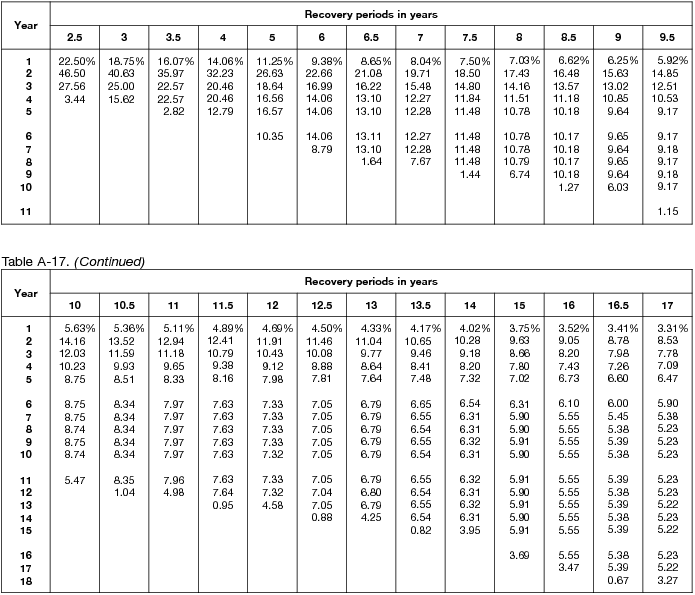

Table A-17: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in Third Quarter

Table A-18: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in Fourth Quarter

Related:

![What’s Your Capital Gains Tax Rate? [2025 + 2026] 90 whats your capital gains tax rate](https://youngandtheinvested.com/wp-content/uploads/whats-your-capital-gains-tax-rate-600x403.webp)