Millions of American parents use 529 plans to save for their children’s education. And why not? These college savings plans come with valuable tax benefits that are hard to pass up. You might get a sweet state income tax deduction when you put money into a 529 plan, and money in your account will grow tax-free … as long as it’s eventually used for qualified education expenses.

But what if money withdrawn from a 529 plan isn’t used for qualified expenses? Not only will you have to pay federal income taxes on those funds (and possibly state taxes too), but you’ll also be hit with an additional 10% penalty. Ouch!

So, it’s extremely important that you only spend 529 plan funds on qualified education expenses if you want to avoid the tax and penalty. To stay out of trouble, you have to know what those expenses are—and that’s where the information below will help.

We’ll go through all the 529 qualified expenses so you know exactly what’s covered (and what isn’t). Some of the items on the list might surprise you. You can use 529 plan funds for much more than just college tuition and fees. On the other hand, there are also some educational expenses you’d think would be covered, but actually aren’t 529 qualified expenses. You need to know what those expenses are, too.

Related: Education Tax Credits and Deductions for 2023

What Is a 529 Plan and How Does It Work?

Before jumping in on what’s considered a 529 qualified expense, let’s briefly go over some basic information about 529 plans (formally known as “qualified tuition programs”).

These plans are used to save for a designated beneficiary’s educational expenses. You can only have one beneficiary for each 529 plan account, so parents with more than one child will need to open a separate account for each kid.

There are actually two types of 529 plans: investment plans and prepaid tuition plans. With an investment plan, cash contributions into your account are invested and grow tax-free as long as you use the money for eligible education expenses. With a prepaid tuition plan, you pay tuition and fees at the current rate for college expenses to be incurred years in the future.

Our discussion will focus on investment plans, since they are by far the most popular type of 529 plan.

YATI Tip: Until 2026, if you have a loss on your investment in a 529 plan account, you can’t claim the loss on your federal income tax return. Even then, you can only have a loss when you drain the account and the total amount withdrawn is less than the total amount of contributions to the account.

Related: Best Financial Gifts for Babies, Kids & Grandkids

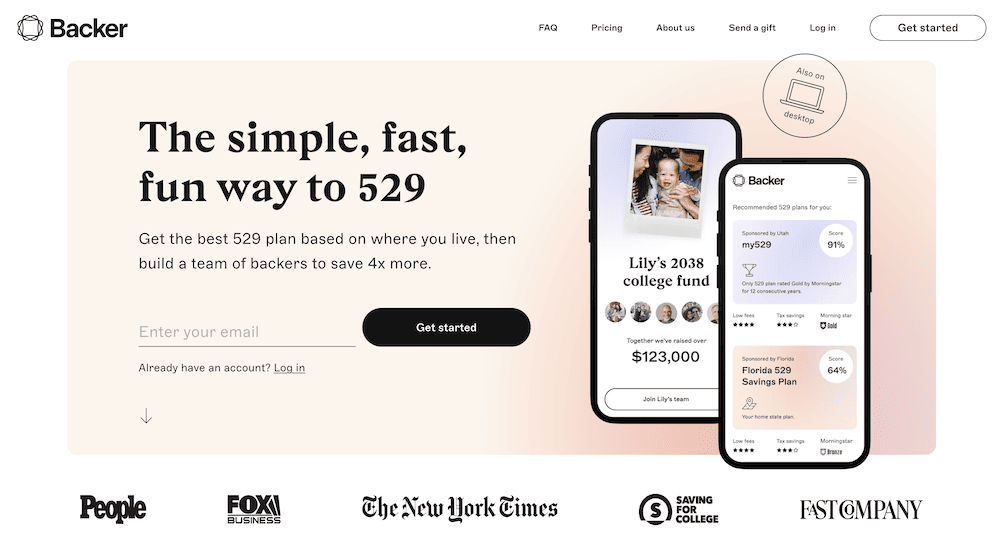

529 Plans From Backer

- Available: Sign up here

- Price: Flat fee of $1.99 per contribution

Consider Backer if you’re looking for a great 529 plan. They offer a hassle-free 529 savings plan that makes it easy for your family and friends to play a role in saving for your child’s education. They’ve helped families save more than $30 million toward college in just minutes.

You can use the 529 plan to put your child on track to afford college; all while remaining invested in an asset class that will grow over time.

Backer allows you to invest in a portfolio of low-cost index funds that track major indexes of large company stocks (S&P 500), small-cap stocks (Russell 2000) international company shares (MSCI EAFE Index), and U.S. government bonds (Barclays Aggregate Bond Index).

- Backer allows you to invest your educational savings tax-free in a 529 plan and also allows for family and friends to help you to save more.

- Use low-cost index funds to invest in different asset classes, including stocks and bonds.

Related: Best Alternatives to 529 Plans [Other College Savings Options]

Federal Income Tax Treatment of 529 Plans

There are no federal tax breaks when you put money in a 529 plan. However, that money grows tax-free, and there’s no federal income tax when you withdraw funds from a 529 plan if the money is used for qualified expenses.

In addition, even if a 529 plan is used to pay for a student’s education, the student or the student’s parents can still claim the American Opportunity tax credit or the Lifetime Learning credit. However, the same expenses can’t be used for both benefits.

Taxes and Penalties for Use of Funds for a Non-Qualified Expense

As already noted, a 10% penalty applies if money taken out of a 529 plan is used for a non-qualified expense. In addition, any earnings withdrawn from the account are taxed at the same federal tax rates as wages, tips, taxable Social Security benefits, and other “ordinary” income.

However, the penalty doesn’t apply if a 529 account’s beneficiary:

- Dies

- Becomes disabled

- Attends a U.S. military academy

- Earns tax-free scholarships or fellowship grants

- Receives veterans’ educational assistance, employer-provided educational assistance, or any other tax-free payments as educational assistance

The penalty is also waived if 529 plan funds are included in income only because qualified education expenses were taken into account in determining the American Opportunity tax credit or Lifetime Learning tax credit.

If a beneficiary receives money from both a 529 plan and a Coverdell ESA in the same year, and the total of the distributions is more than the beneficiary’s qualified education expenses, the expenses must be allocated between the 529 plan and Coverdell ESA distributions for purposes of determining the tax on earnings.

State Income Tax Treatment of 529 Plans

Most states offer a tax deduction or credit for contributing to a 529 plan. However, you usually have to contribute to the 529 plan set up by your state to qualify for a state tax break (although a few states let you put money in any 529 plan). Only a handful of states with an income tax don’t offer any state tax benefits for 529 plan contributions.

Unfortunately, though, you might not get a state tax break for the full amount of your contributions to a 529 plan. Some states limit how much qualifies for their tax deduction or credit.

Most states will also tax 529 funds used for non-qualified expenses. State tax penalties may also apply.

Check with the state tax agency where you live to see how your state treats contributions to and non-qualified withdrawals from 529 plans.

How Does a 529 Plan Affect Financial Aid?

A 529 plan can affect your child’s financial aid, but the impact is typically minimal.

A student’s financial aid eligibility is generally based on his or her Student Aid Index (SAI). A higher SAI typically means less aid is available. Students are expected to use a higher percentage of their assets to pay for college (20%) than what their parents are expected to pay (up to 5.64%). So, it’s better to have income and assets assigned to the parents rather than to the student.

If held by either the student or the student’s parents, 529 accounts are treated as parental assets on the FAFSA form. That’s a good thing. Plus, withdrawals from the student- or parent-held accounts don’t impact financial aid at all if the funds are used for qualified education expenses.

If a 529 account is opened by someone other than the student or the student’s parents (e.g., a grandparent or other relative), the account isn’t reported on the FAFSA form. However, withdrawals from the account will be treated as untaxed income for the student, which has a negative impact for financial aid purposes. For this reason, it’s often better for a 529 account to be in a parent’s name.

Related: Best Investments for Grandchildren: Ways to Save & Invest

529 Plan Investment Options

When you open a 529 account, you’ll likely be able to choose from a list of investment options. However, your choices are generally more limited with a 529 plan than with some other brokerage accounts.

Many 529 plans offer an age-based investment option that automatically takes a more conservative approach as your child’s college enrollment gets closer, similar to target-date funds people use for retirement.

Account maintenance fees for 529 accounts also vary, so be sure to shop around.

529 Plan Qualified Education Expenses

Let’s now look at which educational costs are considered qualified education expenses for 529 plan purposes. Again, if you withdraw money from a 529 plan to pay for qualified expenses, there’s no tax or penalty on those funds.

Qualified education expenses must be paid to an eligible educational institution. With one notable exception that we’ll discuss in a minute, that generally includes any college, university, vocational school, or other postsecondary educational institution eligible to participate in a federal student aid program administered by the U.S. Department of Education. Graduate school counts, too.

Since 529 plans are generally designed for college savings, most of the 529 qualified expenses fall into the category of “qualified higher education expenses.” These are expenses related to enrollment or attendance at an eligible postsecondary school as described above.

So, without further ado, here’s a rundown of the qualified expenses for which 529 plan funds can be used.

College Tuition and Fees

Tuition and fees are considered qualified expenses for 529 plan purposes if they’re required for enrollment or attendance of the designated beneficiary at an eligible postsecondary school (e.g., at a college, university, graduate school, or vocational school).

Tuition for K-12 Education

Here’s the one exception where qualified education expenses don’t have to be for colleges, universities, or vocational schools. You can use up to $10,000 per year of 529 funds for the account beneficiary’s tuition at a public, private, or religious elementary or secondary school (i.e., kindergarten through grade 12).

YATI Tip: Note that you can only use 529 funds for K-12 tuition … not for fees or for other related expenses.

Room and Board

The cost of room and board is a qualified expense, but only for students who are attending an eligible postsecondary school on at least a half-time basis. This includes off-campus room and board expenses at eligible schools.

There are limits to room and board costs, though. Generally, room and board expenses can’t be higher than the amount shown in the school’s cost of attendance for federal financial aid purposes for a particular academic period and type of living arrangement. If the actual amount charged for room and board is greater than that amount, the larger amount is a qualified higher education expense if the student resided in housing owned or operated by the school.

YATI Tip: Check with your school’s financial aid office to verify the announced room and board expenses.

Books, Supplies, and Equipment

Books, supplies, and equipment required for the enrollment or attendance at an eligible postsecondary school are also considered qualified expenses.

Computers, Software, and Internet Access

Computers (including peripheral equipment), software, and internet access used primarily by a student while enrolled at an eligible postsecondary school are also qualified higher education expenses for which 529 plan funds can be used.

However, software designed for sports, games, or hobbies isn’t a qualified expense unless it’s predominantly educational in nature.

Special-Needs Services

Money from a 529 plan can be used to pay for the cost of special-needs services for a special-needs student that are incurred in connection with enrollment or attendance at an eligible postsecondary school.

Apprenticeship Program Costs

The expenses for fees, books, supplies, and equipment required for a 529 plan beneficiary’s participation in an apprenticeship program registered and certified with the U.S. Secretary of Labor are also considered qualified expenses.

Student Loan Repayment

Up to $10,000 of student loan payments owed by a 529 plan beneficiary or the beneficiary’s sibling (including a stepbrother or stepsister) count as qualified higher education expenses. Payments can be of either principal or interest.

The $10,000 cap is a lifetime limit, not an annual one. In addition, for purposes of the cap, a sibling’s student loan repayments that are treated as a qualified expense are taken into account for the sibling, not for the plan beneficiary.

You also can’t claim the student loan interest deduction for any earnings withdrawn from a 529 plan to the extent the earnings are treated as tax-free because they were used to pay interest on student loan debt.

State Conformity With Federal Definition of Qualified Education Expenses

Be careful when you’re working on your state tax return—some states don’t follow the same definition of a “qualified education expense” that’s in the federal tax code.

This is particularly true for the federal provisions allowing 529 plan funds to be used for K-12 tuition, student loan payments, or apprenticeship program expenses.

Again, check the state tax agency where you live for details.

Related: How Much to Save for Your Kid’s College

What’s Not a Qualified Education Expense?

Not all costs related to college, graduate school, or vocational school are qualified higher education expenses.

So, what are some of the non-qualified expenses that people often think (or hope) are 529 qualified expenses? Here are some of the most common expenses college students face that can’t be paid for with 529 funds:

- Application fees

- Health insurance costs

- Transportation costs

- Childcare expenses

- Fitness club membership fees

- Extracurricular activity costs and fees

YATI Tip: If costs are actually part of an eligible school’s regular tuition and fees, then you can pay for them with money taken out of a 529 plan.

4 Things You Can Do With Unused 529 Plan Funds

What if you save too much money for your child’s education in a 529 plan? Do you have to just take your lumps and pay tax and the 10% penalty on the excess funds?

No. Fortunately, there are a number of options available if there’s leftover money in a 529 plan after the beneficiary is done with school.

1. Transfer Funds to a Family Member’s 529 Plan

You can transfer unused 529 plan funds to a family member’s 529 account. For example, the beneficiary’s younger sibling can use the funds for college, a parent can use it for work-related training at a vocational school, or a nephew can use it for private K-12 school tuition.

There are no federal income tax consequences if the beneficiary is changed to a member of the original beneficiary’s family.

2. Transfer Funds to a Family Member’s ABLE Account

Extra 529 plan funds can also be transferred to a family member’s ABLE account, which is a savings account for people with disabilities. However, first make sure the transfer doesn’t exceed the ABLE account’s annual contribution limit.

3. Roll Over 529 Plan Funds to a Roth IRA

Starting in 2024, a beneficiary can transfer up to $35,000 of leftover money in a 529 plan into a Roth IRA in his or her name. Any rollover is subject to annual Roth IRA contribution limits, and the 529 account must have been open for at least 15 years.

YATI Tip: If you’re not sure your child will attend college, you’re getting a late start saving for your child’s college education, you want more investment options, or you want to maximize your child’s financial aid eligibility, you might want to consider using a Roth IRA to save for college instead of or in addition to using a 529 plan. You can even open a custodial Roth IRA for your child.

4. Leave Excess Funds In a 529 Plan for Future Use

Another option is to leave any extra 529 plan funds in the account. The beneficiary might eventually decide to take additional courses, attend graduate school, or even pass the leftover funds on to children of their own.

Related:

![6 Best Seeking Alpha Alternatives [Competitors' Sites to Use] 14 best seeking alpha alternative](https://youngandtheinvested.com/wp-content/uploads/best-seeking-alpha-alternatives.webp)

![7 Best Motley Fool Alternatives [Competitors' Sites to Use] 15 best motley fool alternatives](https://youngandtheinvested.com/wp-content/uploads/best-motley-fool-alternatives-600x403.jpg.webp)

![11 Best Stock Charting Apps [Free + Paid Software] 16 best stock charting apps](https://youngandtheinvested.com/wp-content/uploads/best-stock-charting-apps-600x403.jpg.webp)