Effectively managing an investment property goes far beyond collecting the monthly rent check.

Don’t get me wrong: Rent collection is obviously an important piece of being a landlord, but a whole array of other vital tasks happen behind the scenes. As a real estate investor, you must ensure your accounting and bookkeeping are on point, which includes keeping your business banking separate from your personal finances. Otherwise, you could run into issues come tax time and risk getting an expensive slap on the wrist from the IRS.

Many property management software programs can help you streamline these tasks, but these programs can be pricey. Baselane is a noteworthy exception. With this unique platform, you won’t pay an arm and a leg to manage your rental property finances. Plus, it can save you a lot of time and headaches by automating manual tasks.

If you need assistance with managing investment properties, learn about how Baselane works, available plans, features, drawbacks, benefits, and more in our Baselane review.

- Baselane is a complete rental property financial management system.

- Baselane's bank accounts for landlords have no fees and offer high yields on all balances (up to 2.63% APY as of 12/10/2025*). Other features include check writing, same-day ACH payments, and up to $3 million in FDIC insurance.

- Baselane also offers bookkeeping, rent collection, analytics, and more.

- Special Offer ($150 bonus): Earn a $150 bonus after completing four steps with your Baselane Banking account. (1) Make a deposit of greater than $500 into a Baselane banking account within 30 days. (2) Maintain that average balance for 60 days. (3) Make more than $1,500 worth of mortgage payments within 90 days. (4) Collect more than $1,500 of rent via Baselane into Baselane Banking within 90 days.

- Free high-yield bank account

- Free online rent collection

- Same-day ACH payments

- Check writing

- Up to $3 million in FDIC insurance

- 50 states lease creation and e-sign

- Provides Zillow-sourced market values automatically

- No rental property listing capabilities

- No partial rent payment options

Related: 6 Ways to Invest in Apartment Buildings [w/Minimal Effort!]

Baselane Overview

Baselane is a comprehensive financial platform for independent real estate investors. It’s designed to make the process of managing your properties easier, whether you have one apartment or several multifamily investments.

Baselane streamlines tasks such as rent collection and bookkeeping, and it helps you keep your business finances organized and separated from your personal bank account.

Real estate investors growing their portfolios can also benefit from Baselane’s marketplace add-ons, which include lines of credit, loans, and business insurance products powered by third-party partners LendFlow, Simplist, and Obie, respectively. And Baselane now offers its own tenant screening suite, including income verification with actual bank transaction data, ID verification, criminal report, full Equifax credit report, and more

However, Baselane doesn’t just offer features for landlords and real estate investors—it also aims to simplify certain processes for your renters.

Renters can use Baselane to manage rental payments, track their payment history and deposit information, and view their lease details all in one place. The platform lets users set up one-time or automated payments, and they can choose to pay rent via ACH transfer, debit card, or credit card. Your tenants can also get renters insurance through Baselane partner Sure.

Baselane Plans & Pricing

The Baselane platform currently offers one plan, which includes free rent collection, bookkeeping, and banking services. (Yes, we said free!) Here’s a look at the services included in its plan.

| Plan | Monthly Fee | Features Offered Under Plan |

|---|---|---|

| Baselane | N/A | Baselane Banking - Unlimited accounts, partitioned by unit - Dedicated accounts by property - Virtual accounts to separate security deposits, savings, and more - Virtual cards - Spend control - Competitive interest rate on deposits Rent Collection - Collect recurring rent payments - Automated late fee settings - Tenant payments via ACH, credit or debit card Bookkeeping - Integration with Baselane Banking or your existing bank accounts - Automated transaction importing - Tag income and expenses by property and Schedule E category - Many more features |

Given that it’s free, you might be wondering what the catch is or how Baselane makes money, which are both valid questions. To answer the former, there’s no catch. You seriously won’t pay any fees on this platform, which is a major perk.

But Baselane is a business, and like every business, it needs to make money to continue operating. Instead of charging fees, Baselane makes money through its affiliate partner business services, as well as receiving a portion of the interest earned through client banking accounts and a portion of the 2.99% service fee on renters’ credit card payments made through the platform. It also gets a small percentage of applicable merchant fees when you use your Baselane Visa debit card.

Baselane Features

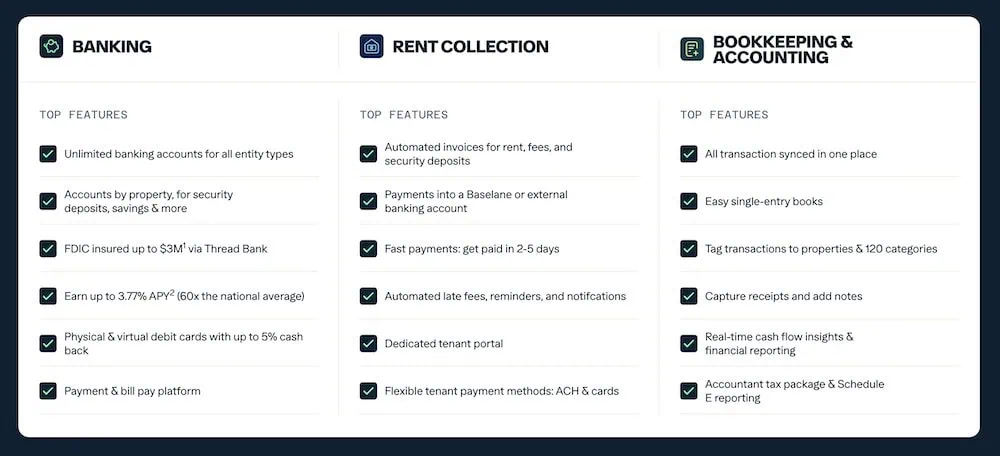

Baselane offers a wide range of no-cost features, many of which you can see above. But here are the features I view as the most important:

Real Estate-Focused Bank Account

Landlords can use Baselane to open a real estate-focused bank account or dedicated accounts for different properties. These accounts can let you view things like security deposits, rental payment history, and past and projected cash flow at a glance. Account holders can also earn interest on their balances.

You can go online and have Baselane fill out, print, and mail checks out. However, if you prefer to work with paper checks yourself, you can order paper checkbooks (each of which includes 80 high-security checks) directly from Baselane.

Related: Best Income-Generating Assets [Best Assets to Invest in for Cash Flow]

Dedicated Accounts by Property and for Security Deposits

Having dedicated accounts makes it simpler to determine which of your properties are running smoothly and which need some attention. This would be much more difficult to parse out with a traditional business bank account where everything is lumped together.

Related: How to Open an Escrow Account to Hold Security Deposits

Unlimited Digital Debit Cards

Baselane offers unlimited digital debit cards, which lets you separate your spending for different properties if you choose. You can set spend controls from your account and easily lock debit cards if one is ever lost or stolen.

Related: Best Debit Cards for Teens

Competitive APY

High-yield checking accounts in this space are almost unheard of. Despite this, you can earn a high yield on your Baselane banking account balance, including security deposits.

Real Estate Accounting Software

Sometimes a traditional spreadsheet just doesn’t cut it. If that’s the case, Baselane offers access to real estate accounting software to help keep your finances on track. Landlords can easily categorize transactions; track and analyze real-time cash flow; and generate income, expense, and tax reports. And if you’re migrating from another accounting program, Baselane’s CSV Import feature lets you plug accounting data from elsewhere directly into Baselane with just a few clicks.

Tax Schedule E Automation

Baselane also simplifies the process of filling out your Schedule E forms when you’re filing taxes. The software auto-generates Schedule E reports with just one click, and it can help accurately populate your tax forms to save you time and help maximize deductions.

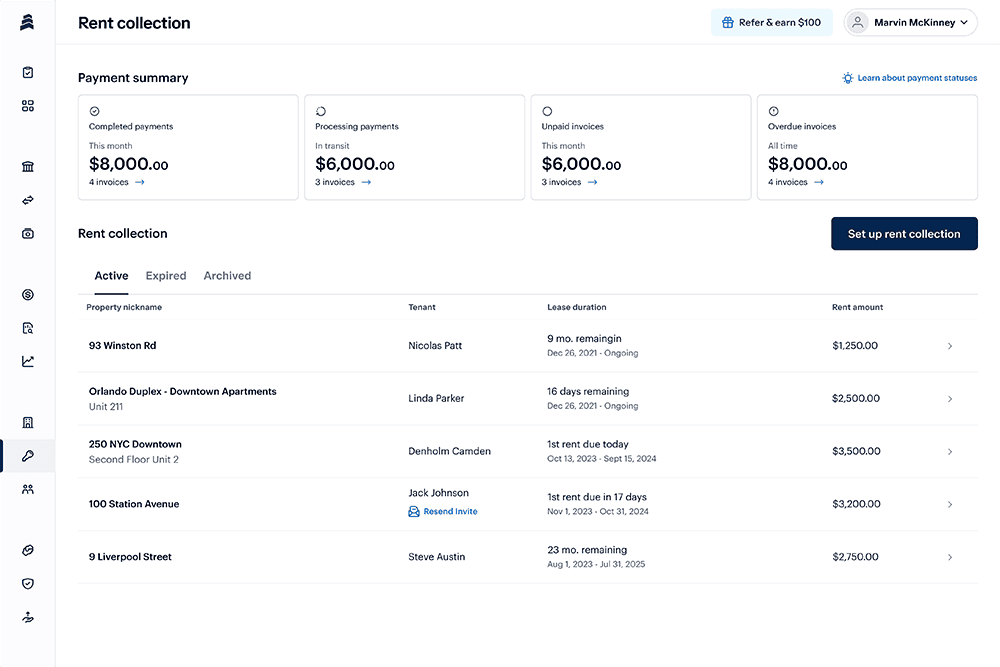

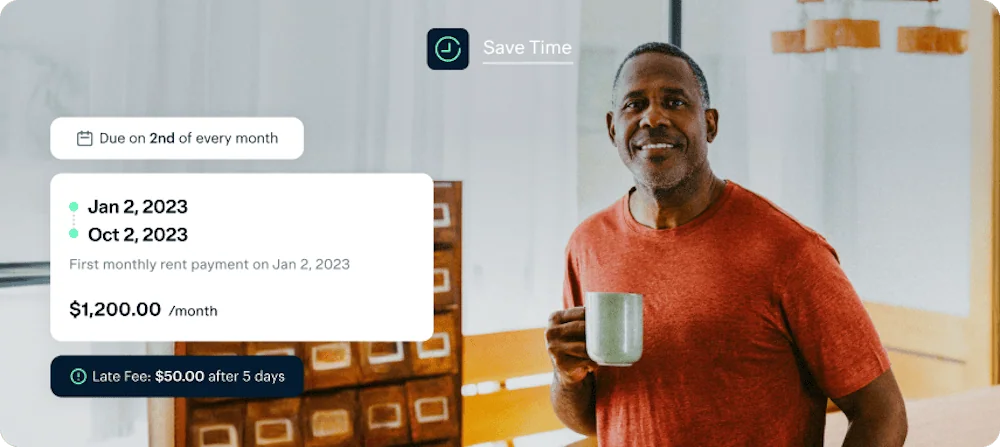

Rent Collection (Via ACH or Card)

You can also automate your rent collection through the platform, provided that your renters have signed up for Baselane too. Tenants can pay rent via ACH, debit or credit card, and rent payments are automatically deposited into your Baselane banking account or an external account of your choosing.

Related: Best Online Rent Payment Systems

Reporting and Analytics

Want insight into your projected cash flow? Income and expense reports for different properties? Simplified tax reports? This platform can help with all these things, providing deeper insight into your full portfolio and individual properties.

Free Rental Applications and E-Sign for Landlords and Tenants

Baselane makes it easy to get started with new tenants with free customizable lease agreements you can print out or share with your tenant for e-signature. Customizable lease agreements are available for each U.S. state.

Related Services Marketplace (Add-Ons)

If you need business insurance or financing to grow your portfolio, Baselane also has a marketplace of products and services, including the following.

Insurance

Baselane partners with Obie to offer affordable landlord insurance, which includes coverage for your rental and other structures on that property, as well as liability and loss of rent insurance. Coverage starts at just $8 per month.

Loans

Eligible borrowers can also access loans and lines of credit through Baselane partners Simplist and LendFlow. Whether you want to improve an existing property or purchase a new one, this platform’s got you covered.

Tenant Screening

Baselane now offers its own suite of tenant screening services, which is free for landlords (prospective tenants are charged during their rental application process). Screening includes income verification with actual bank transaction data, daily updated housing court records to identify eviction histories, ID verification with live selfie photos, a criminal report that checks national and local databases, and a full Equifax credit report with payment history and balance across credit accounts.

Basic reporting is included in every screening ($24.99); eviction reports ($10), criminal reporting ($5) and income verification report ($5) require add-on fees.

Limited Liability Company (LLC) Formation Service

Investors seeking legal services, such as LLC formation, or help with eviction notices, lease agreements, rental applications, or rent increase notices, can also access RocketLawyer through the Baselane marketplace.

Baselane’s Ease of Use

Overall, Baselane offers an easy-to-use platform with all the features real estate investors need for effective rental property management. And the products and services it doesn’t offer directly are likely available through its marketplace partners. Baselane is fully integrated, meaning you won’t have to manually input financial information from its rent collection tool to your banking account or bookkeeping features, which is a huge time-saver.

Users praise Baselane’s intuitive platform, though some mention its desktop dashboard offers more services than its mobile app. That said, this issue isn’t unique to the Baselane mobile app—many mobile apps offer more limited features.

Related: Best Property Management Software

Baselane Pros

- Real Estate-Focused Financial Solution for Independent Landlords: While other platforms offer general business accounting and payment services, Baselane is a rarity in that it’s a real estate-focused platform designed to help independent landlords and tenants with rental property management.

- End-to-End Financial System: It’s also an end-to-end financial system that lets you track everything from new lease agreements and security deposits to ongoing rental payments and projected cash flow analytics.

- 100% Free, No Hidden Fees: Besides being incredibly useful, Baselane is also free. There are no hidden fees or minimum balance requirements to worry about.

- Tenant Screening: Baselane also provides tenant screening services, including identity verification, credit reports, criminal and eviction reports, income verification, and updated housing court records. Screening results typically show up within minutes.

- Unlimited Accounts: Unlike traditional business banking accounts, Baselane offers as many accounts as you need, partitioned by unit.

- Individual Unit Finances, Progress Reports, And Tax Reporting: By assigning each individual unit its own Baselane banking account, you can easily separate and track rental property performance and address any issues that arise quickly.

- Auto-Tagging Expenses on Digital Debit Cards: Baselane’s auto-tagging feature makes categorizing purchases made with your Baselane Visa debit card simple. Automatic transaction tagging will help keep your finances organized and simplify things at tax time.

- Free E-Lease and E-Signing: You can download and customize lease templates in Baselane, opting to print them out or send them to your tenants to e-sign. Users get up to three free leases.

- Competitive APY: Baselane’s high-interest checking accounts come with a competitive APY. In addition to a generous APY, you can also get up to 5% back on your Baselane debit card purchases when you shop at home improvement stores, and 1% back on all other purchases.

Baselane Cons

- No In-App Communication Features Currently Available: While we’ve spoken to Baselane about their plans to launch this feature in the future, at this time no functionality exists for landlords to communicate with tenants through the platform.

- No Advertising or Rental Listing Functionality: You can’t advertise rental listings through Baselane, so you’ll have to do so elsewhere. While it would be great if advertising rental properties were free through Baselane, having this feature as an add-on through a partner in the Baselane marketplace may help close this gap.

- No Network of Third-Party Property Managers + Service Providers: Likewise, there’s currently no network of rental property managers and service providers to help with upkeep in the Baselane marketplace. Adding a property management provider network could be a huge value-add for landlords and real estate investors seeking assistance with managing and maintaining their investment properties. Providers like Hemlane specialize in this area of property management.

- No Partial Rent Payment Option: Tenants can’t make partial rent payments through Baselane’s rent collection service at this time. This flexibility would be useful in case something unexpected happens and a tenant needs to pay a portion of their rent.

- No Maintenance Request Management: Tenants can’t send maintenance requests through Baselane, so you’ll need to track those through another platform. Maintenance requests can get unwieldy with multiple properties, so being able to track those through your Baselane account would be a convenient time-saver.

Who Is Baselane Best For?

If you’re a real estate investor seeking help managing your rental properties, but you aren’t interested in paying a hefty sum for that assistance, Baselane could be a good solution. You’ll get banking, bookkeeping, and online rent collection under one umbrella, without the hassle of an extra monthly cost.

Both new and experienced real estate investors could benefit from Baselane’s financial tools, which can keep your money organized and make tax season much simpler. That said, it is likely a better solution for newer investors with smaller residential portfolios. Those with large portfolios that include commercial real estate will likely want to look elsewhere for a solution with more robust features and tools.

Baselane Review: Conclusion

Baselane fares pretty well on consumer review sites like Trustpilot. Trustpilot users give Baselane 4.2 out of 5 stars, or a rating of “great,” across 33 reviews. Satisfied reviewers mention that the platform is easy-to-use and its customer service team is helpful. But some customers report problems with account closures and long timelines to receive funds.

To sum up our Baselane review, we’d recommend this platform for newer independent landlords and real estate investors looking to streamline their finances. While the platform has some kinks to work out and certain property owners have expressed some concerns on third-party review sites, its features and tools are worth a look. The company also seems to be working on new features, which could help improve its platform even further.

Baselane Disclaimer

¹ Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure/ and a list of program banks at https://thread.bank/program-banks/. Please contact customerservice@thread.bank with questions regarding the sweep program. Pass-through insurance coverage is subject to conditions.

² The Annual Percentage Yield (APY) on your Savings Account is accurate as of 10/29/2025. Total balances across Checking Accounts and Savings Accounts are used to calculate APY tier, but only money in Savings Accounts is eligible for interest. Total balances less than $10,000 earn up to 1.69% APY for Savings Accounts. Total balances between $10,000 and $24,999 earn up to 2.39% for Savings Accounts. Total Balances between $25,000 and $49,999 earn up to 2.71% APY for Savings Accounts. Total balances of $50,000 or more earn 2.93% APY for Savings Account. Rates are variable and are subject to change after account opening. An APY bonus is applied to accounts that collect rent via Baselane banking within the prior calendar month. Review the Baselane Business Deposit Account Agreement for more information.