Most of life’s defensive decisions are far from exhilarating. Riding a bike is fun, but wearing a helmet is a necessity. Driving a car can be a rush; buying auto insurance, not so much. And while investing based on assumptions of long-term growth can be full of hope and excitement … most of the best exchange-traded funds (ETFs) to hold in a bear market are downright snoozers.

Still, like helmets and insurance, bear-market ETFs can prevent a lot of headaches.

Why ETFs? Well, broadly speaking, individual stocks and bonds are inherently riskier than investment funds—the risk of one or two securities torpedoing your portfolio is much higher when you only invest in one or two securities as opposed to when you invest in hundreds or even thousands of securities via a single fund. And within the world of funds, ETFs offer a massively wider breadth of tactical options than mutual funds.

That said, just like you wouldn’t buy a helmet just as you hit the pavement or wouldn’t call GEICO once you’ve already been in a crash, you shouldn’t wait until we’re in the midst of a bear market to learn about defensive ETFs and start putting them to work. Now—while we’re currently not in a bear market (that we know of yet!)—is the perfect time to start doing your research.

To get you started, I’d like to introduce you to some of the best bear market ETFs. These funds represent a number of ways to shield against—or even attack!—a bear market, with strategies ranging from simple defensive-sector ETFs to buffer and inverse products.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Bear Markets: Not Fun … But Fortunately, Not All That Frequent, Either

You’ll sometimes hear people toss around the term “bear market” whenever stocks are on the decline. But a bear market is a specific phenomenon—albeit one with different definitions depending on who you talk to.

Virtually everyone will tell you that a bear market—whether in the broader stock market or in any investment, including individual stocks—is a drop of 20% or more from a peak. They also agree that the end of a bear market (and the start of a bull market) is when prices hit their lowest point.

Where they tend to disagree is when the end of a bear market is confirmed. Some would say it’s confirmed once the investment has risen 20% off the bear-market low. However, we follow the view that a bear market ends once the investment rebounds all the way past its previous peak.

Take this moment in time, for instance. The S&P 500’s last high was on Oct. 28, 2025, at 6,890.89. Thus:

- We would officially be in a bear market if the S&P 500 closed at least 20% lower, which would be below 5,512.71.

- If the index fell below that level on, say, Jan. 1, 2026, we would still say the bull market ended (and the bear market began) on Oct. 28; these markets would have been merely confirmed on Jan. 1.

Now, let’s say we do fall into a bear market on Jan. 1, and the low point occurs on Feb. 1, 2026.

- We would officially be in a bull market once the S&P 500 closed back above 6,890.89.

- If the index closed above that level on March 1, 2026, we would still say the bear market ended (and the bull market began) on Feb. 1, 2026; again, these markets would have been merely confirmed on March 1.

Regardless, you’re still dealing with a 20% drop in prices. To put it in dollar terms, we’re talking about taking $100,000 and turning it into $80,000. Not great!

… But Fortunately, Not All That Frequent, Either

Fortunately, as investors, we spend most of our time in the relative warmth of bull markets.

“Bear markets can be painful, but overall, markets are positive a majority of the time,” says Hartford Funds. “Of the last 94 years of market history, bear markets have comprised only about 21.4 of those years. Put another way, stocks have been on the rise 78% of the time.”

And when bull markets last this long … well, they tend to last even longer.

“Going back 50 years, we found five other bull markets that made it this far,” Carson Group Chief Market Strategist Ryan Detrick wrote in October ahead of the current bull market’s three-year anniversary. “You know what happened with those bulls? They all lasted many more years, with the shortest bull market five years, two lasting more than a decade, with an average length of eight years for the five.”

By comparison, the average bear market lasts a little more than a year.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

No Two Bear Markets Are the Same

The reason I’m about to offer up a wide selection of ETF ideas is because there’s no silver-bullet bear market ETF … because no two bear markets are the same.

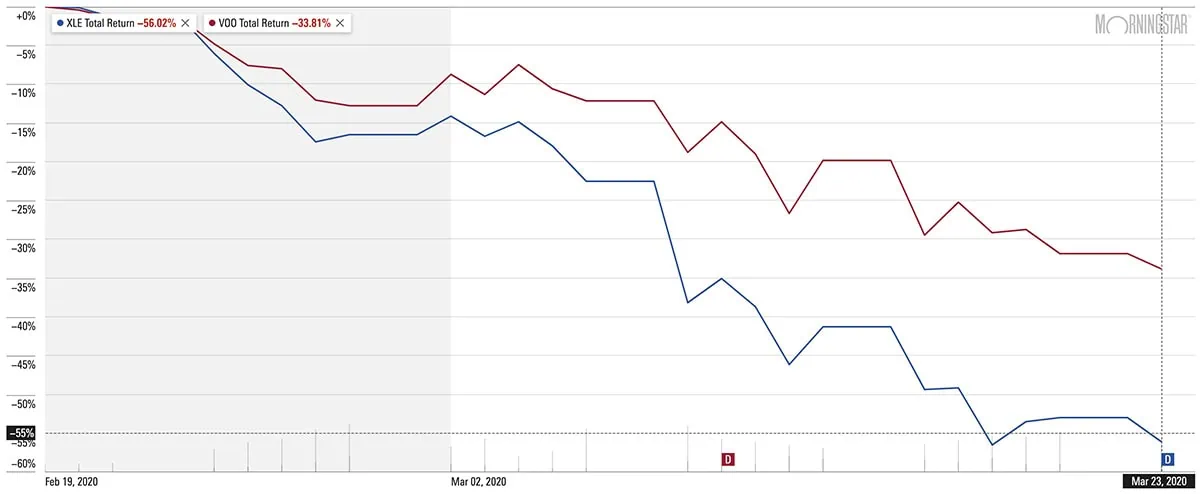

One of the best examples of this lies in the performance of the energy sector during the 2020 and 2022 bear markets.

In 2020, energy commodities crashed amid global travel restrictions, with oil briefly trading at negative prices. Energy stocks—represented here by the Energy Select Sector SPDR Fund (XLE)—lost more than half of their value by the bear market’s nadir, reached on March 23, 2020.

However, 2022 was a completely different story altogether. The post-COVID rebound resulted in high levels of inflation that were exacerbated by Russia’s invasion of Ukraine, which sent energy prices skyward. That forced the Federal Reserve and other central banks to authorize steep interest-rate hikes, which ultimately sent every market sector but one—energy, propped up by high oil, natural gas and other commodity prices—into the red.

Go further back: The 2007-09 bear market was set off by collapse in the financial markets. The dot-com bear market of 2000-02 was triggered by wild overvaluation and speculation in the tech sector.

You get the picture: Each bear market has its own causes and characteristics, so naturally, which investments will protect you the most will vary from one bear market to the next.

Plus, your goals might vary. You might simply want to limit your risk but still be able to participate in most of the upside in case you incorrectly anticipate a bear market. Or you might be more aggressive and want to actually produce positive returns if stocks circle the drain.

For that reason, it’s good to have options—rather than having one go-to fund for a rainy day, it might behoove you to have a handy list of several bear-market ETFs to meet your needs.

1. Invesco S&P 500 Low Volatility ETF

- Style: U.S. low-volatility stock

- Assets under management: $7.3 billion

- Dividend yield: 2.0%

- Expense ratio: 0.25%, or $2.50 per year on every $1,000 invested

High volatility and losses often are discussed in the same breath. That’s because volatility, put very simply, is how much an asset moves up and down—so higher volatility typically includes a higher risk that prices will go down.

Logically, then, investors looking to survive a bear market will often seek out low-volatility investments. Reduced swings during a time in which most stocks are heading lower should theoretically limit downside during a down market.

The Invesco S&P 500 Low Volatility ETF (SPLV) is the biggest low-volatility ETF on the market. This straightforward ETF tracks the S&P 500 Low Volatility Index, which starts with the S&P 500’s components, narrows it down to the hundred components with the lowest realized volatility over the past 12 months, then “weights” each stock based on its lack of volatility. (Weighting refers to the percentage of fund assets invested in something, be it an asset, industry, sector, country, etc.)

Right now, this construction method has built a portfolio that’s high on utilities (23%), financials (16%), and consumer staples (15%). Top individual holdings are who’s who of reliable blue-chip names, including Coca-Cola (KO), Johnson & Johnson (JNJ), and Realty Income (O).

Volatility can be measured by several metrics, but a commonly used one is “beta.” Beta measures a security’s volatility compared to a benchmark—and with stocks, that benchmark is typically the S&P 500. The benchmark will always have a beta of 1. SPLV has a beta of 0.50, implying that the ETF is half as volatile than the broader stock market.

A low beta (or any measure of low volatility) isn’t a guarantee that an asset will outperform during a bear market. For instance, SPLV actually underperformed the S&P 500 by 2 percentage points during 2020’s COVID bear market.

Fortunately, quick crashes tend to be the exception. Invesco’s low-volatility ETF has performed very well during longer periods of market sluggishness. For instance, between June 2015 and May 2016, the SPLV delivered a 9% total return (price plus dividends) while the turbulent S&P 500 was marginally negative. During the 2022 bear market, SPLV only lost 15% compared to 24% for the S&P 500. And it fared well during 2025’s near-bear downturn, off just 6% between Feb. 19 and the market low on April 8, versus a 19% loss for the S&P 500.

Low volatility is a double-edged sword—if stocks are generally heading higher, owning a fund that doesn’t swing as dramatically means you’ll probably leave some gains on the table. Still, SPLV gives you the ability to protect against some downside while still participating in some of the upside of a bull market. That makes it one of the best bear market ETFs for investors who just want to exercise a little caution.

Want to learn more about SPLV? Check out the Invesco provider site.

Related: The 13 Best Mutual Funds You Can Buy

2. iShares MSCI USA Min Vol Factor ETF

- Style: U.S. minimum-volatility stock

- Assets under management: $22.5 billion

- Dividend yield: 1.5%

- Expense ratio: 0.15%, or $1.50 per year on every $1,000 invested

Coming in at roughly three times the size of SPLV is the iShares MSCI USA Min Vol Factor ETF (USMV): a minimum-volatility ETF.

“Wait,” you ask. “What’s the difference between low volatility and minimum volatility?”

Both types of funds try to reduce volatility, but they go about it in two starkly different ways. Low-vol funds simply hold the lowest-volatility stocks within their selection universe. Min-vol funds try to create the lowest-volatility portfolio possible, even if doing so involves owning some volatile stocks. (How would that work? If you own several stocks that are volatile, but whose performances aren’t really correlated with one another, they could balance each other out to an extent, creating a portfolio that overall doesn’t exhibit much volatility.)

The iShares minimum-volatility ETFs start with an MSCI market index. They look at volatility on a single-stock level, but they also analyze correlations between stocks, sectors, and (where applicable) countries. They also constrain sectors and countries to within 5% of their weighting in the index—so, if consumer staples made up 10% of the index, it could make up no more than 15% and no less than 5% of the fund’s holdings. From there, they optimize the portfolio to create a minimum-volatility index.

The iShares MSCI USA Min Vol Factor ETF is, as the name would suggest, focused specifically on U.S. stocks. The sector weightings of this 170-stock portfolio aren’t all that dissimilar from the S&P 500. Technology is best represented, followed by health care and financials. Past that, the ordering differs, but every sector weight is still within just a few percentage points of not just its underlying index (the MSCI USA Index), but the S&P 500, as well.

USMV has earned its assets. The fund delivered positive returns while the S&P 500 was negative in 2018, its 2022 declines were half those of the S&P 500, and from peak to bottom in 2025, its losses were a little less than half the S&P 500’s. Meanwhile, its beta is higher than SPLV, but still low, at 0.60.

Want to learn more about USMV? Check out the iShares provider site.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Related: The 10 Best Index Funds You Can Buy

3. iShares Core High Dividend ETF

- Style: U.S. high-dividend stock

- Assets under management: $11.3 billion

- Dividend yield: 3.2%

- Expense ratio: 0.08%, or 80¢ per year on every $1,000 invested

Another way of approaching the potential for a decline in stock prices is to rely less on stock prices for your returns.

Dividend stocks provide not just capital appreciation (stock price goes up) but also dividend income. High-yield dividend stocks deliver a much more substantial amount of income, so they don’t need as much in the way of price returns to produce a reasonable total return.

Better still? Many dividend stocks belong to sectors whose businesses are considered more defensive than cyclical, which means they might be less likely to decline in a bear market in the first place.

Enter the iShares Core High Dividend ETF (HDV). This dirt-cheap fund tracks the Morningstar Dividend Yield Focus Index, made up of 75 large- and mid-cap stocks that have been screened for company quality and financial health. Thus, these companies are believed to have the ability to sustain above-average dividend payments.

The portfolio is heavily tilted toward traditionally defensive sectors—namely consumer staples (25%), health care (21%), and utilities (9%). But it also currently allocates 20% of its assets to the energy sector, where stocks such as Exxon Mobil (XOM) and Chevron (CVX) pay well-above average dividends.

This blend of defensive businesses and yield has produced a mighty durable bear-market ETF. The S&P 500 lost nearly a quarter of its value during the 2022 bear market; HDV lost just 5%. iShares’ fund lost only about half as much as the S&P during the near-bear we suffered across the last few months of 2018. And it lost just 8% between February and April.

And while reducing volatility isn’t explicitly the point of HDV, it’s usually calm nonetheless. Currently, the ETF boasts a low beta of just 0.51.

Want to learn more about HDV? Check out the iShares provider site.

4. Franklin International Low Volatility High Dividend ETF

- Style: International low-volatility dividend stock

- Assets under management: $3.4 billion

- Dividend yield: 3.6%

- Expense ratio: 0.40%, or $4.00 per year on every $1,000 invested

The Franklin International Low Volatility High Dividend ETF (LVHI) helps us cover our bases on a couple of fronts: It helps us target lower volatility in the international portion of your portfolio, and it demonstrates how dividends can be helpful in providing stability.

Here’s how LVHI builds its 175-stock portfolio:

The fund starts by reviewing the MSCI World ex-US IMI Index, which is made up of more than 3,000 stocks of all sizes across numerous countries. It uses a proprietary screen to identify “profitable companies that have the potential to pay relatively high sustainable dividend yields.” It then scores those dividend stocks based on price and earnings volatility; higher-scoring stocks get larger weightings.

But there are constraints. Every quarter, the fund rebalances so that no stock accounts for more than 2.5% of assets, no sector accounts for more than 25% (except real estate investment trusts [REITs], which can’t exceed 15%), no country accounts for more than 15% of assets, and no individual geographic region exceeds 50%.

For instance, right now, Canada is the greatest country weight at 16%, followed by the U.K. and Japan, each of which accounts for at least 10% of assets. Financials are the largest sector allocation at 25%, followed by energy (16%) and industrials (11%). Top holdings include the likes of Italian bank Intesa Sanpaolo Group (ISNPY), British energy giant Shell (SHEL), and oil-and-natural-gas firm Canadian Natural Resources (CNQ).

A reliance on international large caps results in a fine yield of 3.6%, which is more than triple what the S&P 500 offers at present. Those dividends represent returns that are largely separated from price—even if the stocks themselves don’t perform well, those dividends can help make up for at least some of that shortfall.

Franklin’s low-vol international fund isn’t terribly old, having hit the market in 2016. But it has performed well so far, outdoing 85% of its large-cap foreign-stock peers over the past five years, including a positive return in 2022 when competitors in its category were down 9% on average, and roughly half the losses of the S&P 500 during 2025’s downturn.

Want to learn more about LVHI? Check out the Franklin Templeton provider site.

Related: The 8 Best Dividend ETFs [Get Income + Diversify]

5. Consumer Staples Select Sector SPDR Fund

- Style: U.S. sector (consumer staples)

- Assets under management: $15.6 billion

- Dividend yield: 2.8%

- Expense ratio: 0.08%, or 80¢ per year on every $1,000 invested

We often slice and dice stocks into various categories—say, value vs. growth, or large/mid-/small caps. Well, another way we divvy up the market is into cyclical and defensive. Cyclical stocks have a tendency to rise and fall based on the economic cycle, whereas defensive stocks are more capable of maintaining their value regardless of what the economy is doing.

One great example of the latter? Consumer staples.

The phrase I use to define consumer staples is “any goods you need to buy regularly and somewhat frequently.” Food. Beverages. Household goods and personal products such as toilet paper and toothpaste. These are all things you’re going to have to buy no matter what the economy looks like. That stands in contrast with consumer cyclical, which includes “any goods you need to buy, but irregularly and less frequently (a car, shoes, clothes), or goods you want to buy (video games, food eaten at restaurants).” If the economy goes in the tank, you’ll likely slow or pause your purchases of these goods.

The only confusing exceptions within consumer staples are alcohol and tobacco, which you could argue aren’t exactly “needs,” to which I would counter-argue that you’ve clearly never waited tables before. But I digress …

The Consumer Staples Select Sector SPDR Fund (XLP) owns all of the consumer staples stocks within the S&P 500. At the moment, that includes 37 stocks such as warehouse retailer and hot dog hero Costco Wholesale (COST), consumer goods multinational Procter & Gamble (PG), and tobacco giant Philip Morris International (PM).

XLP, like many other funds, is market cap-weighted, which means the larger the company, the larger the position. For instance, Costco is weighted at nearly 10%, while the much more diminutive Brown-Forman (BF.B) accounts for just 0.3% of assets.

The defensive nature of these businesses also lends itself to high and reliable dividends, leading to a fund yield of 2.8% that’s more than double the S&P 500 right now.

This combination of recession-resistant businesses and high yield has made the XLP a great bear-market ETF for investors who want to limit losses. During the 2007-09 Great Recession bear market, consumer staples declined only half as much as the market. In 2015, XLP outperformed the S&P 7% to 1.3%. During the 2022 bear market, this sector fund lost just 10% to the S&P 500’s 25%. And in 2025’s downturn, XLP lost just 6% between February’s high and April’s low.

Want to learn more about XLP? Check out the State Street Investment Management provider site.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

6. Health Care Select Sector SPDR Fund

- Style: U.S. sector (health care)

- Assets under management: $36.5 billion

- Dividend yield: 1.7%

- Expense ratio: 0.08%, or 80¢ per year on every $1,000 invested

Health care is simultaneously a defensive sector and a source of pretty sizable growth.

If you have to pinch pennies, you might stop going to restaurants and purchasing movie tickets, but you’re not going to suddenly stop taking your prescriptions or avoid the hospital if you have a broken arm. You just don’t have a choice in the matter.

At the same time, American spending on healthcare isn’t just even year-in and year-out—it has been rocketing higher for decades. U.S. health spending was $1.4 trillion in 2000, according to nonprofit health organization KFF; by 2023, that number had more than tripled to $4.9 trillion.

That has made the Health Care Select Sector SPDR Fund (XLV) a great anytime fund that can both hold its own in bear markets and run when Wall Street gets bullish.

XLV operates similar to its sister fund, XLP: It holds all 60 S&P 500 health care stocks, which include pharmaceutical names such as Eli Lilly (LLY) and Merck (MRK), medical device firms such as Thermo Fisher Scientific (TMO), managed care providers such as UnitedHealth Group (UNH), and companies across a few other health industries.

This health care fund suffered less than half the market’s losses during the 2022 bear dive, and outperformed the S&P 500 significantly during the Great Recession, 2018 near-bear, 2020 COVID bear market, and 2025’s deep correction. It historically has been among the most productive of the defensive sectors across all market cycles, too, though recent fears over Medicare, Medicaid, and other health care policies have eaten away at that advantage.

Want to learn more about XLV? Check out the State Street Investment Management provider site.

7. JPMorgan Limited Duration Bond ETF

- Style: Short-term bond

- Assets under management: $3.0 billion

- SEC yield: 4.4%*

- Expense ratio: 0.24%**, or $2.40 per year on every $1,000 invested

Of course, if you’re convinced the stock market is in for a particularly rough run, you might not want to be in stocks at all, defensive or not.

Fortunately, you have options.

One of the more common defenses against a downturn in equities is the relative safety of bonds. Historically, bonds haven’t held a candle to stocks when it comes to their returns across all economic cycles. However, bonds are far more stable, with most of their returns coming in the form of interest income—and those traits begin to look a lot more appealing when stocks are dropping like rocks.

The JPMorgan Limited Duration Bond ETF (JPLD) is one of the best options within the world of bond funds, for several reasons.

For one, short-term bonds are considered safer than longer-dated bonds. That’s because the less time a bond has remaining before it matures, the likelier it is that the bond will be repaid. And JPLD’s management team—Michael Sais, Robert Manning, Sajjad Hussain, and Cary Fitzgerald—have built a 600-bond portfolio with an average life to maturity of less than three years. This results in a low duration (a measurement of a bond’s risk) of 1.9 years, which effectively implies that for every 1-percentage-point increase in interest rates, JPLD would suffer a short-term loss of just 1.9%.

Second, management isn’t limited to any one type of bond—they can hold a variety of different debt products to maximize results in any environment. Right now, JPLD has a 28% weight in agency mortgage-backed securities (MBSes), 25% in asset-backed securities (ABSes), 18% in Treasuries, and 14% in commercial mortgage-backed securities (CMBSes); the rest of the portfolio’s assets are spread among non-agency MBSes, collateralized loan obligations (CLOs), money market funds, and other credit. That translates into a 4.4% yield right now despite the short-term nature of its holdings.

Also, while the Federal Reserve has begun lowering its benchmark interest rate during the second half of 2025 (which is considered generally positive for the price of existing bonds), that might not impact all bonds equally. Long-term rates have remained high amid worries about both inflation and the budget reconciliation bill adding to the deficit and might not be affected much by a reduction in the federal funds rate, which is an overnight lending rate used by banks. But the Fed’s rate likely will have more of an impact on the shorter-term debt held by funds like JPLD.

Lastly, JPLD is run by skilled managers.

“Comanagers Michael Sais and Bob Manning average more than three decades of experience managing mortgage-backed securities,” says Paul Olmstead, an analyst at Morningstar, which gives JPLD a Gold Medalist rating. “The luxury of a deep supporting cast of securitized managers and research analysts make this team stand out as one of the strongest in the short-term bond Morningstar Category.”

JPLD has only traded since 2023, but it was converted from a mutual fund, so it does have a long track record—and a darn good one at that. It ranks among the top 15% of category funds over the trailing 15 years, and it has beaten its benchmark index over every meaningful time period.

Moreover, it suffered minimal losses during the Great Recession, COVID, and 2022 bear markets. Better still, it actually produced small gains during the near-bear of 2018, and did so again between the February 2025 highs and April lows.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

** 0.33% gross expense ratio is reduced with a 9-basis-point fee waiver until at least July 31, 2026.

Want to learn more about JPLD? Check out the JPMorgan Asset Management provider site.

Related: 7 Best Value Stocks for 2025 [Smart Picks to Buy]

8. iShares Gold Trust Micro ETF

- Style: Commodity (Gold)

- Assets under management: $5.4 billion

- Dividend yield: N/A

- Expense ratio: 0.09%, or 90¢ per year on every $1,000 invested

Some experts recommend investing in commodities generally during a flight to safety, but specifically, gold is the first-to-mind metal for fending off bear markets.

You’ll occasionally hear extreme-case scenarios for gold, where global economies collapse and paper money becomes meaningless, forcing humanity to turn toward something tangible (gold!) as currency. Whether that will actually play out is an open question—virtually all post-apocalyptic sci-fi movies would disagree—and if there is an apocalypse, you probably won’t be thinking about your retirement account anymore.

But there are real-world cases for gold being used as a bear-market hedge. Gold is uncorrelated to the stock market, which basically means that gold moves differently than stocks because it’s either not affected by the same market forces, or it’s affected differently by those market forces. That’s why some advisors will suggest at least a small allocation to gold.

It’s hard to argue with the track record, too. During just about every major downturn of the past two decades, gold has shown up to play:

- Great Recession: Gold +25%, S&P 500 -57%

- Black Monday (2011): Gold +2%, S&P 500 -7%

- 2018 near-bear market: Gold +5%, S&P 500 -19%

- 2020 bear market: Gold -5%, S&P 500 -34%

- 2022 bear market: Gold -9%, S&P 500 -25%

- 2025 downturn (Feb. 19-April 8): Gold +2%, S&P 500 -19%

Buying physical gold is pretty impractical for most folks, unfortunately. When you purchase gold bullion (bars, coins, ingots), you have to pay for physical delivery, figure out where to store them (which often involves buying a good safe), pay for insurance, and then—if you want to cash in on some of your investment—find someone to buy your gold and deal with the transportation on that end.

If you’re merely investing and not planning for a zombie apocalypse, you’re better off buying gold ETFs.

Most gold ETFs work the same way: Shares reflect real, physical gold that the fund company has stored away in one or more vaults. That’s it. Past that, all that really matters is expenses and liquidity needs.

True traders might want to consider funds like the SPDR Gold Trust (GLD) and the iShares Gold Trust (IAU), which have extremely high trading volumes, ensuring traders can easily find buyers and sellers and make transactions quickly at their desired price. But the average investor who might hold gold for months, if not years, is better off favoring low expenses, and on that front, iShares Gold Trust Micro ETF (IAUM) takes the taco.

The iShares Gold Trust Micro ETF is named as such because each share represents a smaller portion of gold than its sister fund, IAU. And it’s the product of several years of fee wars within the gold ETF space. Newcomers launched fresh funds with lower costs than established fund providers, forcing those providers to come down on the fees of existing funds before ultimately launching low-cost versions of their cornerstone products. At 0.09% in annual expenses, IAUM is not only far cheaper than IAU (0.25%)—it’s the cheapest gold ETF on the market.

At least for now.

Want to learn more about IAUM? Check out the iShares provider site.

Related: The 9 Best ETFs for Beginners

9. ProShares Short S&P500 ETF

- Style: Inverse stock

- Assets under management: $1.2 billion

- Dividend yield: 5.1%

- Expense ratio: 0.89%, or $8.90 per year on every $1,000 invested

All of the aforementioned funds dance around bear markets.

The ProShares Short S&P500 ETF (SH) uses them to its advantage.

The view from 10,000 feet is that when the S&P 500 goes down, SH goes up. How it does that is fairly complex—rather than simply holding stocks, bonds, or physical assets like the aforementioned ETFs, this fund needs to use a series of futures, swaps, and Treasury bills to create the inverse performance of the S&P 500. I normally say that investors should “look under the hood” before they buy an ETF, but in this case, knowing what the ProShares Short S&P500 ETF holds isn’t helpful in understanding the fund.

What is helpful is understanding how SH behaves.

SH provides the inverse daily return of the S&P 500. This means if the S&P 500 declines by 1% on Monday, this ETF will gain 1% on Monday (minus expenses, of course). But because this only occurs on a daily basis, that doesn’t mean if the S&P 500 declines by 10% in a year, SH will gain 10% in a year. That’s in large part because of how returns compound over time, which is easiest to demonstrate with a table.

| S&P 500 | Difference from $100 | SH | Difference from $100 | |

|---|---|---|---|---|

| Starting value | $100.00 | $0.00 | $100.00 | $0.00 |

| S&P 500 +2% | $102.00 | $2.00 | $98.00 | -$2.00 |

| S&P 500 +2% | $104.04 | $4.04 | $96.04 | -$3.96 |

| S&P 500 +2% | $106.12 | $6.12 | $94.12 | -$5.88 |

| S&P 500 -5% | $100.81 | $0.81 | $98.83 | -$1.17 |

This example doesn’t even account for fees, which are much higher in SH than they are for your average S&P 500 index fund. Not to mention, if the market goes up, you’re not participating in any upside whatsoever—SH will lose money.

I’m not building a case against SH—far from it. I’m simply explaining the risks, which are important to know before you dive into any fund.

But this fund can do quite well for itself. From Feb. 19 through April 8, it generated a positive 23% total return. In fact, SH not only has a permanent place in my annual best ETFs roundup, but I’ve owned it before, and I actually owned it for a large part of 2025’s downturn (though I have since sold off my position).

While this ProShares ETF might not provide perfect negative-1-for-1 performance, it comes pretty darn close—certainly close enough to make it useful if you’re anticipating a significant downturn. It’s also a safer hedge than leveraged funds that provide -2x or even -3x the market’s performance, which can get out of hand in a hurry. And it’s a better alternative than jettisoning stocks you already own, which can not only result in taxable events if done outside of tax-advantaged retirement plans, but (in the event you’re selling dividend stocks you’ve owned for a while) can snuff out attractive yields on cost.

One last important note: SH isn’t meant to be held forever. Funds like this are tactical in nature—you hold it for as long as you find it useful, but once you think the tide is going to turn, get out. Leaving it in your portfolio in perpetuity will provide an unnecessary drag as long as stocks go up in the long term.

Want to learn more about SH? Check out the ProShares provider site.

Related: 7 Best Fidelity ETFs for 2025 [Invest Tactically]

10. AdvisorShares Ranger Equity Bear ETF

- Style: Inverse stock

- Assets under management: $58.3 million

- Dividend yield: 7.7%

- Expense ratio: 3.80%, or $38 per year on every $1,000 invested

While the AdvisorShares Ranger Equity Bear ETF (HDGE) is classified as an inverse stock fund, it works nothing like the aforementioned ProShares fund.

HDGE is an actively managed fund, for one. And rather than using a variety of instruments to create the inverse performance of an index, management straight-up bets against individual securities through short selling—borrowing shares which are then sold, then eventually rebought to close out the trade.

Managers John Del Vecchio and Brad Lamensdorf attempt to identify companies with “low earnings quality or aggressive accounting which may be intended on the part of company management to mask operational deterioration and bolster the reported earnings per share over a short time period.” However, they will also try to identify “earnings-driven events that may act as a catalyst to the price decline of a security, such as downwards earnings revisions or reduced forward guidance.”

HDGE also is unlike the S&P 500 in that the fund doesn’t just bet against the S&P 500, but stocks of all sizes: While large caps are most prominent at about 45% of assets, mid-caps still make up a significant 33%, followed by small caps and cash. And at the moment, consumer discretionary, technology, and financial stocks are its largest sector bets by weight.

The one similarity it shares with SH is performance, with both funds producing gains that were similar to or even greater than the extent of the S&P 500’s losses during the 2018, 2020, 2022, and 2025 downturns. That’s impressive, especially considering that performance includes HDGE’s sky-high 3.8% expense ratio.

Want to learn more about HDGE? Check out the AdvisorShares provider site.

Kyle Woodley was long XLP and XLV as of this writing.

![9 Best Schwab ETFs to Buy [Build Your Core for Cheap] 33 best schwab etfs to buy](https://youngandtheinvested.com/wp-content/uploads/best-schwab-etfs-to-buy-600x403.webp)