You worked hard to have a comfortable life and pass on some wealth to your heirs. Unfortunately, if not done strategically, the transition of your wealth could result in a substantial tax burden for whoever inherits it. Don’t let your final gift to your heirs be a tax bomb.

Sure, people typically prefer receiving money with a high tax burden than not receiving the money at all. But suddenly owing more in taxes than you expect can throw off a person’s budget and make organizing their finances more difficult.

This isn’t an inevitable outcome, though. There are several ways to reduce or eliminate your beneficiaries’ tax burden when they gain ownership of your retirement accounts. Let’s review some of the best strategies to avoid giving your heirs an unwelcome tax surprise.

How to Minimize Your Heirs’ Taxes

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 2 grown up children family financial support](https://youngandtheinvested.com/wp-content/uploads/grown-up-children-family-financial-support.webp)

Parenting is a lifelong job—and in at least one way, even longer.

How you handle your IRA will have an impact even after you’ve passed. So you’ll want to make sure to do so in a way in which your children won’t have to pay higher-than-necessary taxes on the assets they inherit.

Even if you don’t have children, you likely want to maximize how much of your life savings your beneficiaries receive, and minimize how much the Internal Revenue Service takes home.

With that said, here are a few strategies that will help you to avoid igniting a tax bomb for your heirs.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

1. Roll Traditional IRA Funds Into a Roth IRA

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 3 roth ira tax income retirement](https://youngandtheinvested.com/wp-content/uploads/roth-ira-tax-income-retirement.webp)

Most people spend their retirement years in a lower tax bracket than during their working years.

But if you pass on your traditional IRA to a beneficiary, they will pay taxes on the inherited account at their own tax rate, not yours. So if you pass assets from your traditional IRA along to a child who earns a high income, that money will be taxed at their potentially higher rate.

They can’t indefinitely spread out those taxes, either. When someone inherits a traditional IRA, they typically (with a few exceptions) must take annual required minimum distributions (RMDs) and must liquidate the account by the end of the 10th year following the original owner’s death. This is often referred to as the “10-year rule.” Though there is one upside: If an heir is under age 59½, the 10% early withdrawal penalty is waived when pulling out funds.

Still, it’s an unnecessary tax implication—one you can prevent by rolling your traditional IRA money into a Roth IRA (referred to as a “Roth conversion“) before you pass away. You’ll have to pay taxes on any converted funds at your ordinary income tax rate, but after that, all withdrawals will be tax-free for both you and your heirs.

A Roth conversion fixes a lot of problems, but there are a few considerations. Among them?

For one, if the Roth account was just opened, both the original account owner and the beneficiary would be subject to the five-year rule (must wait until at least five years after your first contribution to be able to withdraw earnings tax-free). That said, the heir would get credit on whatever the original owner served of that five-year period.

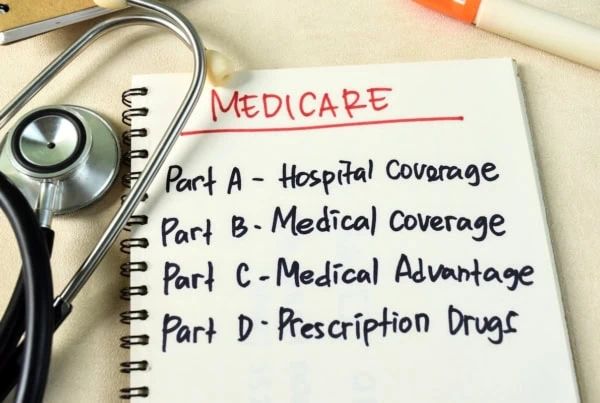

Also, a Roth conversion can impact your Social Security taxes and Medicare premiums, so be careful about the size of a conversion and when you make it.

Related: What Is a Backdoor Roth Conversion? [Retirement Strategy for High-Earners]

2. Don’t Put Your Estate as Your IRA Beneficiary

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 4 reminder social security mistakes](https://youngandtheinvested.com/wp-content/uploads/reminder-social-security-mistakes.webp)

The aforementioned 10-year rule doesn’t apply to estates, which instead must liquidate inherited IRA assets five years after the original owner’s death.

And that can result in a host of issues, including:

- The beneficiary would have to withdraw more across a shorter time frame, which likely would result in even higher income taxes.

- The beneficiary might face increased Medicare charges and greater taxes on their Social Security payments.

- Assets in an estate have very little protection against creditor claims compared to assets left directly to a beneficiary.

Naming your estate as a beneficiary, rather than selecting the actual people yourself, might be easier for you … but it might not be the best solution for your beneficiaries.

Related: How Can I Lower My Taxes in Retirement? 8 Proven Strategies

3. Don’t Divide Accounts Equally to Kids in Different Tax Brackets

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 5 tax brackets taxes irs fixed](https://youngandtheinvested.com/wp-content/uploads/tax-brackets-taxes-irs-fixed.webp)

When your children were little, you may have split up desserts with the utmost care to ensure the portions were exactly equal. And as an adult parent, you still probably do your best to treat your kids equally.

But when it comes to divvying up traditional IRA funds, equal treatment might seem like the fairest option, but it’s not a terribly strategic choice. The even division would result in any of your children in higher tax brackets absorbing a bigger tax hit than the children in lower tax brackets.

Especially if you have other retirement assets you can pass on to your high-income children, you might want to consider distributing more (or even all!) of your traditional IRA funds to your lower-income children.

A financial advisor can help if you’re struggling with how to divide your assets up in an equitable way.

4. Name Your Spouse as the Beneficiary

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 6 social security benefits spouse senior retirement](https://youngandtheinvested.com/wp-content/uploads/social-security-benefits-spouse-senior-retirement.webp)

Even if your spouse is still alive, you might feel compelled to pass some or all of your traditional IRA assets along to one or more of your children. Maybe that’s because your spouse has plenty of financial resources, and you figure your money eventually would’ve trickled down to your kids anyways.

Still, naming your spouse as your IRA beneficiary offers a lot more options.

A surviving spouse has the option to roll over an inherited IRA into an IRA in their own name, treating the assets as if they were their own. If you’re not yet age 73, it can allow you to delay taking distributions until then, and in general, it can allow you to keep assets growing within a tax-advantaged account for longer.

A child doesn’t have this choice.

There are other perks, too. If your spouse is in a lower tax bracket than your children, that’s less of each withdrawal going to the IRS. Even if you think your spouse has more than enough funds to last for the rest of their life, it’s better to be safe than sorry. You never know when unexpected medical costs in retirement or another emergency might strike. And of course, your spouse can give some of the money they withdraw to your children.

Again, there are potential downsides. If the deceased spouse was taking required minimum distributions (RMDs) but hadn’t taken the full required amount for the year in which they passed away, the surviving spouse would need to withdraw the remaining amount for that year. And taxes would apply.

Related: 7 Retirement Account Withdrawal Mistakes to Avoid

5. Use Up Your Traditional IRA Before Other Sources

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 7 individual retirement account ira 640](https://youngandtheinvested.com/wp-content/uploads/individual-retirement-account-ira-640.jpg)

Do you have both a traditional IRA and a Roth IRA? Consider prioritizing traditional IRA withdrawals, which benefits you and your heirs in a few ways:

- It gives your Roth IRA earnings more time to grow tax-free.

- After you pass, your beneficiary can withdraw both your Roth IRA contributions and earnings tax-free (assuming the account is at least five years old). That’s not the case with a traditional IRA.

- Once you reach a certain age, your traditional IRA requires minimum distributions; your Roth IRA does not.

Related: Federal Tax Brackets and Rates

6. Gift Your Children Money While Alive

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 8 gift cash ribbon estate tax](https://youngandtheinvested.com/wp-content/uploads/gift-cash-ribbon-estate-tax.webp)

Sharing your wealth during your lifetime is becoming more popular. According to the 2024 Schwab High Net Worth Investor Survey, millionaire Millennials and Gen X are more than twice as likely to want to share money with the next generation while they are still alive compared to millionaire Baby Boomers.

And indeed, while they’re still alive, older adults can withdraw money from their traditional IRAs to give financial gifts.

Your kid may be able to use the money for a house down payment, or your grandchild might be able to avoid taking out student loans thanks to a generous gift. In many cases, receiving money at a younger age is more advantageous than receiving it later in life.

However, while this strategy can greatly benefit your children, it might have tax implications for you.

Your children or grandchildren generally don’t have to pay any income tax on money they receive as a gift. You, on the other hand, have to pay taxes on traditional IRA withdrawals in retirement. You’re taxed at your current tax rate. Anyone under age 59½ also has to pay a 10% early withdrawal penalty. And while it’s unlikely that you would exceed the lifetime gift tax exemption, if you did, you might owe even more to Uncle Sam. So only withdraw and gift as much as you can afford.

Related: How Is Retirement Income Taxed?

Do I Need to Name Beneficiaries if I Have a Will?

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 9 inheritance will testament notary public stamp](https://youngandtheinvested.com/wp-content/uploads/inheritance-will-testament-notary-public-stamp.webp)

You should always name beneficiaries for your retirement accounts.

Usually, you name a primary beneficiary and contingent beneficiaries. If your will indicates assets would go to certain beneficiaries, but your retirement accounts name other beneficiaries, the people named in your retirement accounts would be far more likely to actually receive those assets.

This being the case, make sure to review your beneficiaries after major life changes, such as marriage, divorce, or death.

![How to Pass an IRA to Heirs [Without Leaving a Tax Mess] 1 how to pass an IRA to heirs 1200](https://youngandtheinvested.com/wp-content/uploads/how-to-pass-an-IRA-to-heirs-1200-584x389.webp)