Many Americans aren’t putting enough money into savings.

According to 2022 Federal Reserve data, 37% of Americans don’t have the liquid assets available to cover an emergency expense of only $400. But our savings woes aren’t just short-term in nature: The U.S. Department of Labor found that only half of Americans have calculated how much they’ll need to save for retirement.

In some cases, Americans simply don’t have the capacity to save—their income is only enough to make ends meet, and sometimes, it’s not even enough for that. But some Americans do have the financial means to save; they just need a little discipline and a plan that works for them.

A reverse budget strategy can make it easier to save and invest. So, read on as I explain what reverse budgeting is, how it works, the pros and cons of this budgeting strategy, and more. My goal is to help you decide if this budgeting style might work for you and, if so, how to get started.

Featured Financial Products

How Does Traditional Budgeting Work?

Traditional budgeting focuses on expenses and allocating your income to various expense categories. This strategy has you look at how you spent money the previous month or year to help you determine how much money goes into each category. In other words, it looks at past spending to plan for future spending.

For example, you might look back at bank account statements and calculate how much you usually spend each month dining out. If you need to “tighten” your budget, you would then think of ways to reduce that cost, such as going out less frequently. If you spent $100 on DoorDash last month, you could decide to dine in and save that money instead.

“What about saving?” Well, with traditional budgeting, saving comes last. Once you’ve budgeted for your essential and discretionary spending, whatever is left over is what you’re able to save. Because of that, tightening a traditional budget often starts with reducing/killing saving before ever touching discretionary funds.

If you’re looking for a free Excel monthly budget template, sign up in the box below:

What Is Reverse Budgeting?

Reverse budgeting differs based on how it treats saving. It uses a “pay yourself first” method when it comes to your financial obligations, demanding that you save before setting aside money for non-essential monthly expenses.

What Does It Mean to Pay Yourself First?

Paying yourself first means that you prioritize saving and investing goals over recreational spending. But technically, you don’t pay yourself first.

First, like with a traditional budget, you calculate your essential expenses and subtract that from your net income. You then determine the savings contributions you’ll make. Whatever’s left after essential spending and saving can be used for recreational spending.

Much of this can be done automatically to help you stay on track to reach your financial goals.

Related: 7 Best Wealth + Net Worth Tracker Apps [View All Your Assets]

How Does the ‘Pay Yourself First’ Budgeting Strategy Work?

It’s not difficult to create a ‘Pay Yourself First’ budget. Follow the steps below to create a reverse budget.

#1: Calculate Your Essential Expenses

Some expenses—such as rent, utilities, car insurance, and more—are unavoidable. You need to spend on those items. And depending on the cost of living in your city, these everyday expenses can vary greatly.

Pretend you’re a single person and your monthly salary (after taxes and paycheck deductions) is $4,500. Your monthly essential expenses add up to about $3,250. That leaves $1,250 for your savings goals and recreational spending habits.

#2: Decide How Much to Pay Yourself

Once you know how much money you’ll have left after accounting for living expenses, you can choose how much to pay yourself.

“How much should I pay myself first each month?” I wish I had a simple answer for you, but sadly, this isn’t a one-size-fits-all solution. The amount depends on your financial situation and the ambitiousness of your financial goals.

For simplicity’s sake, let’s say your reverse budgeting plan is to allocate half of non-essential money toward your personal finance goals. That means the first $625 goes into your savings, then the remaining $625 is for discretionary spending (“fun money”).

#3: Create Savings Goals

I suggest you establish savings goals for numerous time horizons.

The first goal you should set is building an emergency fund (if you don’t already have one). A good rule of thumb is to have three to six months’ worth of living expenses set aside in case of emergencies.

Past that, establish short-, medium-, and long-term savings goals. Here are a few examples:

- A short-term savings goal might be to save enough for a vacation next year.

- A medium-term savings goal might be to save for a home down payment in three years.

- And the most common long-term savings goal is retirement.

The number of savings goals in a reverse budgeting plan will vary by person, and so will the amount allocated to each goal.

Don’t feel like you have to fund every goal at once—or even equally. Your savings should work for you, not the other way around. You can fund goals at different rates according to your priorities at any given time.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

#4: Adjust as Necessary

Be flexible and reassess your budget when needed.

It will take some trial and error to find the right amount of money to set aside. Also, life changes. You might get a promotion that increases your monthly income, you might face unanticipated expenses, or you might have to change your priorities.

Your budget doesn’t have to be rigid; it can be malleable. If your current reverse budget isn’t working for you, change it into one that will.

One thing that helps: Having separate checking and savings accounts, or having a financial app with separate spending and saving buckets:

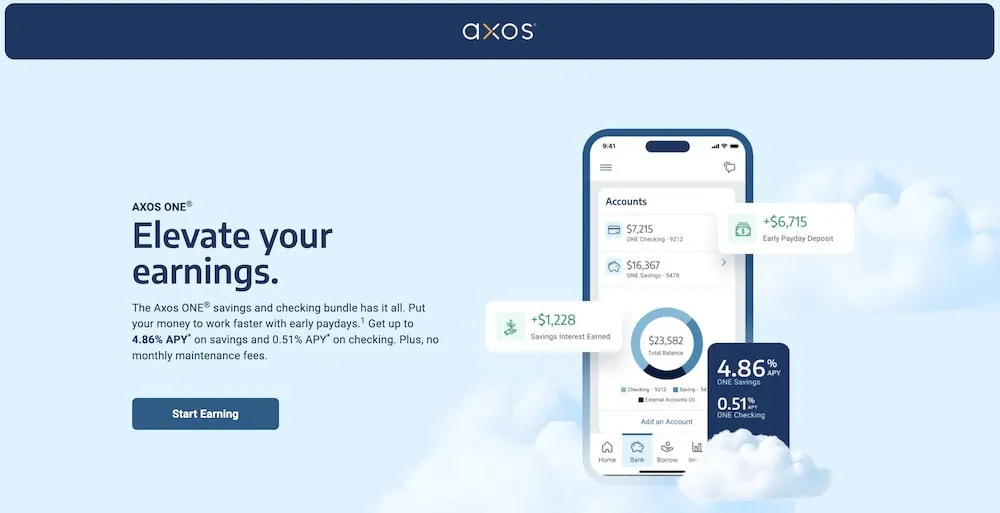

Earn a High Yield and Pay No Monthly Maintenance Fees With Axos ONE

- Available: Sign up here

- Platforms: Web, mobile (iOS, Android)

Axos Bank is an online-only bank that offers a potent high-yield checking and high-yield savings account bundle called Axos ONE. The competitive APYs on both accounts, when combined with the zero monthly maintenance fees, make this account pairing a highly desirable combination to hold your cash.

Additionally, the bank has access to over 95,000 ATMs nationwide with withdrawal fee-reimbursement, no overdraft fees, and no minimum account balances.

Check out the Axos ONE checking and savings bundle to earn more, for less, on your money.

- Axos ONE is a bundled high-yield checking and savings product offering early paydays and competitive APY rates

- Savings Account: 4.86% APY*

- Checking Account: 0.51% APY*

- Age requirement: 18 or older

- Minimum deposit: None

- Minimum balance required: None

- Fee-free ATM Network: 95,000+ locations

- No monthly fees

- High APY for checking

- Mobile app

- Online bill pay

- Spend tracking

- Unlimited ATM reimbursements

- No physical branches

Related: 11 Best Free Investing Apps [Invest for Free]

What Does a Pay Yourself First Budget Look Like?

Your “pay yourself first” budget might look similar to the chart above. After your core expenses, you put money toward your savings goals before any other money gets spent. While your actual numbers will look different, the principle remains the same: Essentials and savings are prioritized before everything else.

Where Can You Save Money Using a Reverse Budget?

While your everyday money can remain in your checking account, money for savings should go elsewhere so you can earn more in interest and make your money work for you.

Different types of accounts pair well with different savings goals.

Savings Accounts

While an emergency fund isn’t as fun to save for as a vacation or wedding, it’s far more important. Without a fully funded emergency fund, you may have to go into debt to pay for unexpected expenses or even essential expenses if you lose your job unexpectedly. Rather than paying back debt, plus interest, it’s better to use emergency fund money. So, start funding your emergency account now, if you don’t already have one.

Rather than a traditional savings account, it’s preferable to use a high-yield savings account for your short-term savings. A high-yield savings account is a popular place to store one’s emergency fund because, in addition to earning interest, your money is liquid and thus can be accessed immediately in the event of an emergency.

|

Primary Rating:

4.4

|

Primary Rating:

4.1

|

|

Free (no monthly maintenance fees).

|

Free (no monthly maintenance fees).

|

Related: 15 Best High-Yield Investments [Safe Options Right Now]

Investment Accounts

While you don’t want to use an investment account to store short-term savings, it’s an excellent place for long-term savings. Strategically invested, money has the potential to grow far more than money in savings accounts. It’s possible to lose money in the stock market, but you can mitigate your risk by choosing safer investments and being prepared to wait out volatility.

Related: 11 Best Investment Accounts [Types for Beginners to Use]

Retirement Accounts

Contributing to an employer-sponsored retirement account, such as a 401(k), is one of the easiest ways to pay yourself first. Your retirement contributions can be automatically deducted from your paychecks. Always contribute at least up to any employer match as that is free money. You can also set up recurring bank transfers from your bank account to an IRA or other personal retirement account if you don’t have access to a 401(k) or want to maximize your retirement savings.

Related: How to Max Out Your 401(k) + Other Retirement Accounts

Education Accounts

Any parent anticipating their child might want to attend college should consider opening an education account, such as a 529 plan. Higher education is expensive, so you want to start these accounts as early as possible.

Related: 7 Best Alternatives to 529 Plans [Other College Savings Options]

Is Pay Yourself First Budgeting Right for You?

For many people, paying yourself first works well as a budgeting strategy. It’s a relatively simple method, and it’s easily adjusted to meet your needs. However, for some people—like those with a variable income—reverse budgeting just might not cut it.

To decide whether this strategy is right for you, I suggest giving it at least a few months. One month is simply too short a time to evaluate this type of budgeting.

Featured Financial Products

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Related:

![Should You Max Out Your 401(k) Each Year? [Yes...and No] 19 should you max out your 401k each year or invest elsewhere](https://youngandtheinvested.com/wp-content/uploads/should-you-max-out-your-401k-each-year-or-invest-elsewhere-600x403.webp)