Are you literally counting down the days until your retirement? Do you have a retirement date circled in your calendar—and is that date sometime in the next year or so?

If so, congratulations! You’ve worked hard for years and deserve to enjoy the fruits of that labor. But planning for this monumental life shift isn’t just about marking days off of a calendar. It’s about making strategic, impactful decisions that will shape your future. Don’t treat this time as a passive waiting game, but as active preparation for the next chapter of your life.

If I were setting my sights on retiring this year, there are five critical steps I’d tackle first to ensure a smooth and secure transition. By checking off these priorities, you can enter retirement better prepared and with greater peace of mind.

Your Immediate Must-Dos for Retirement

Are you ready for your quickly approaching retirement? Well, before you collect your gold watch or pop the retirement party champagne, you should get on top of a few high-priority tasks.

If you’re planning to retire this year, make sure you’ve addressed the following steps.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

1. Know When You’re Applying for Medicare

Most retirees use Medicare to help pay for their health care expenses. But you can’t just sign up for Medicare whenever you want.

There are three types of enrollment periods, which are as follows:

- Initial Enrollment Period

- Special Enrollment Periods

- General Enrollment Periods

Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) is when you first qualify to sign up for Part A and Part B. The IEP lasts for seven months and revolves around your 65th birthday. It usually includes the following:

- The three months before the month in which you turn 65

- The month in which you turn 65

- Three months after the month in which you turn 65

For example, if your birthday was May 12, your IEP would start Feb. 1 of the year you turn 65 and end Aug. 31.

It works slightly differently if your birthday is on the first of the month, however—you still have a seven-month IEP, but the timing is shifted. In this situation, your IEP starts four months before your birthday and ends two months after your birth month. For instance, if your birthday is May 1, your IEP would start Jan. 1 and end July 31.

General Enrollment Period (GEP)

If you don’t sign up during your IEP, and you don’t qualify for a Special Enrollment Period (more on that in a moment), you’ll need to sign up through the General Enrollment Period (GEP).

The GEP runs from Jan. 1 through March 31 of each year.

If you sign up during a GEP without qualifying for a Special Enrollment Period, you could be assessed a monthly late enrollment penalty.

Special Enrollment Periods (SEPs)

Certain situations will trigger a Special Enrollment Period (SEP), which allows you to sign up for Premium-Part A and Part B without paying a late enrollment penalty.

All SEPs are temporary; the length of time it lasts depends on the qualifying event, but it’s frequently between six and 12 months.

If you miss that window, you have to wait until the next GEP (which might result in paying a monthly late enrollment penalty).

2. Prepare for Social Security Taxes

If you were a W-2 employee during your working years, your employer withheld taxes for you. As a retiree, however, you’ll need to plan for (and withhold money for) taxes on your own.

First, figure out whether you make enough money where you’ll even need to pay taxes. If your sole income as a retiree is Social Security, those benefits generally won’t be subject to federal income tax—thus, your adjusted gross income (AGI) will be zero, thus you don’t have to file a federal income tax return. (However, you still can.) But if you have taxable income from elsewhere—such as retirement accounts, life insurance, an annuity, even a job—you might have to pay taxes on your Social Security benefits and other income.

Once you start receiving Social Security benefits, you’ll get a statement each January stating the benefits you received the previous year. To calculate your taxes, the IRS looks at your provisional income (aka “combined income”), which is your AGI added to nontaxable interest and half of your Social Security benefits from the year, minus any deductions and exclusions.

Your provisional income determines what percentage of your benefits are taxable. A quick guide:

- Under $25,000 (single) or $32,000 (filing jointly): Social Security benefits are not taxed.

- Between $25,000 and $34,000 (single) or $32,000 and $44,000 (filing jointly): Up to 50% of Social Security benefits can be taxed.

- Over $34,000 (single) or over $44,000 (filing jointly): Up to 85% of Social Security benefits can be taxed.

Want a shortcut? This IRS tool can help you determine whether any of your Social Security benefits, as well as your spouse’s if filing jointly, are taxable.

If you’ll need to pay federal Social Security taxes, you can be proactive and withhold taxes from your Social Security payments by filling out Form W-4V and choosing one of the following withholding rates:

- 7%

- 10%

- 12%

- 22%

Whether you pay Social Security taxes at the state level depends on where you live. While most states no longer do, there are still some states that tax Social Security benefits.

Related: 12 Income Sources That Don’t Affect Your Social Security Benefits

3. Be Aware of Current Market Conditions

Market volatility can take a bite out of anyone’s returns, no matter how skilled an investor you are. And while virtually any expert would tell everyday buy-and-hold investors to stick to their guns and ignore market volatility in the decades leading up to retirement, current market conditions are a very real concern if you plan to retire within the next year.

You’ll need to see how vulnerable you are to sequence-of-returns risk: the risk of experiencing poor market performance just before or in the early years of retirement. Significant downturns during this time can result in nest eggs becoming depleted earlier than expected. (A retirement buckets strategy may help reduce your sequence-of-returns risk.)

If the market has been significantly lower in the period leading up to your retirement, and/or if you’re pessimistic about the market as you’re about to retire, you might need to make some changes. That might mean adjusting your withdrawal rate lower during your initial year of retirement, or operating under a more conservative budget. Or if the market has plunged very deeply, you might even need to consider postponing your retirement.

Related: How Long Will My Savings Last in Retirement? 4 Withdrawal Strategies

4. Determine Whether You Want to Roll Over Your 401(k)

401(k)s are ubiquitous at this point, so there’s a good chance you have one. If so, when you retire, you’ll need to decide whether to leave your 401(k) funds where they are, or roll over your 401(k) into an individual retirement account (IRA).

If you have a 401(k) balance under $7,000, you might not have a choice. Many (but not all) employers’ 401(k) plans have provisions in which former employees’ accounts automatically will be rolled over into an IRA if they leave with a balance of less than $7,000. Also, in some cases, accounts with less than $1,000 may be cashed out; your workplace would send you a check for the balance minus any taxes and/or applicable early withdrawal penalties.

If you have a 401(k) balance over $7,000, you basically have two options:

First, you can leave your 401(k) as is. And it might be advantageous to do so—large-employer 401(k) plans have very low costs, and most plans’ investment options will include at least a few funds that are attractive to investors in retirement. While you can no longer contribute to your 401(k) once you leave, you can still manage your investments. Additionally, you might be able to take early withdrawals without the hefty penalty via the Rule of 55 or Rule 72(t).

Alternatively, you can roll your 401(k) into another account (typically a traditional IRA). IRAs typically offer a far wider array of investment options—such as stocks, exchange-traded funds (ETFs), individual bonds, and options—than 401(k)s, which usually only offer mutual funds. If you have multiple 401(k)s, you could simplify your finances by consolidating them into a single IRA. Also, once you reach age 70 ½, IRAs give you the option of making charitable IRA rollovers or qualified charitable distributions.

Related: Rule of 55 vs Rule 72(t): What’s the Difference?

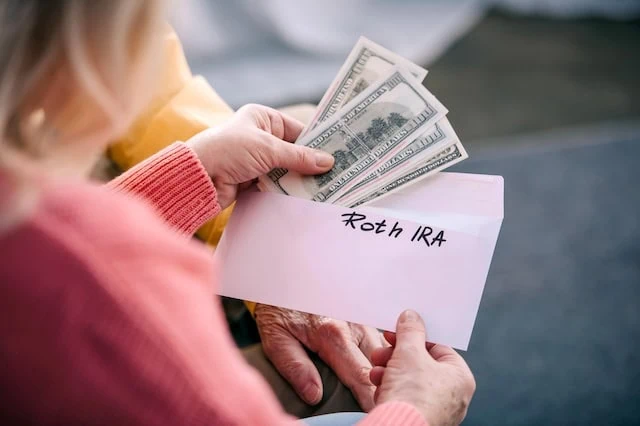

5. Determine Whether You Want to Do a Roth Conversion

A 401(k) rollover involves transferring money from one tax-deferred account to another. It’s simple, it’s straightforward, and it shouldn’t have tax consequences.

A Roth conversion is a transfer from a tax-deferred retirement account (like a traditional 401(k) or IRA) into a tax-exempt Roth retirement account (usually a Roth IRA). And it has considerable benefits, but considerable drawbacks, too.

A Roth conversion puts a portion of your money into a tax-exempt account, which means once you withdraw those funds from your Roth account, you won’t be taxed on those withdrawals. It’s a great way to diversify your tax treatment if you already have a traditional IRA. And Roth accounts aren’t subject to required minimum distributions (RMDs).

However, you will face tax consequences in the year of the conversion—a potentially hefty tax bill on any converted funds. You can’t withdraw any converted money for five years without penalty. And you can’t undo a Roth conversion, so you can’t change your mind after the fact.

There are income limitations, too, based on your modified adjusted gross income (MAGI). However, if you earn more than the annual MAGI limit, that’s OK—you still might be able to execute a backdoor Roth conversion. In a backdoor Roth conversion, you simultaneously make nondeductible contributions to a traditional IRA then complete a Roth conversion soon after.

How do you know if a Roth conversion is a smart strategy for you? To start, the best tax brackets for Roth conversions are generally lower ones. However, your current financial situation, market conditions, how a conversion may affect your heirs, and much more goes into this decision.

Timing matters, too. If you’re retiring very late in the year, you will have collected income from your job throughout the year, which could put you in a higher tax bracket. It may be more advantageous to do this in January or February after you retire, as your income likely will be lower during your first full year as a retiree.

As you can tell, this is a complex process—one with a lot of conditions to consider—so your best move is to discuss your options with a financial advisor.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![How Much to Save for Retirement by Age Group [Get on Track] 17 how much to save for retirement by age group](https://youngandtheinvested.com/wp-content/uploads/how-much-to-save-for-retirement-by-age-group-600x403.webp)