A Wednesday report from the Commerce Department showed that U.S. gross domestic product declined for the first time in three years. However, economists and market strategists had mixed reactions to the underlying data, which showed that despite self-inflicted wounds and a mild economic contraction, some parts of the economy remained resilient.

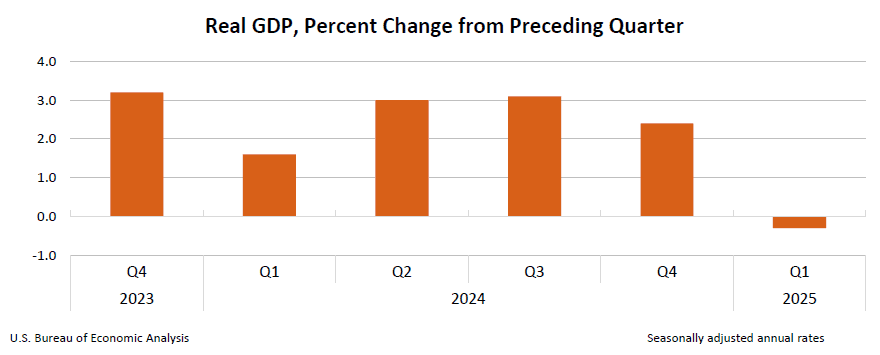

The Commerce Department’s Bureau of Economic Analysis (BEA) said that in its advance estimate for the first quarter, GDP across the first three months of 2025 contracted at a seasonally adjusted 0.3% annualized pace. While economists were largely expecting a weak Q1 print, it still was a surprise loss versus estimates for GDP growth of 0.4%, as well as a sharp drop from Q4 2024’s 2.4% expansion.

The reading also marked America’s first quarter of economic contraction since the first quarter of 2022.

The decline in GDP follows months of sharp trade policy shifts, most notably President Donald Trump’s implementation of tariffs on imported goods from most of the world.

“If you were looking for a playbook on how to slow a healthy economy, this seems like a good example,” says Scott Helfstein, Global X’s Head of Investment Strategy. “The continual sequence of policy reversals has led to very high levels of uncertainty for businesses and investors. This report should be a canary in the coal mine for the new administration, but perhaps their willingness to inflict economic pain in pursuit of the long-term goals was underestimated.”

7 Low- and Minimum-Volatility ETFs for Peace of Mind

Notably, companies rushed to bring in goods before Trump’s tariffs went into effect earlier this month, sparking a 41.3% jump in imports during the first quarter.

“The surge in imports puts an asterisk on today’s negative first-quarter GDP release but also shows how dramatically government policy expectations can drive real-world business decisions,” says Peter Graf, Chief Investment Officer at Nikko Asset Management Americas. “Companies got ahead of possible tariffs by building inventories just as they are now likely getting ahead of a possible policy-driven recession by reducing hiring and investment.”

But Graf says the unexpectedly sharp rise in prices meant that nominal growth stayed close to the pace of previous quarters.

“With few signs of a slowdown in core activity or price growth, this report is unlikely to motivate the Trump administration to accelerate de-escalation, or to give the Fed pause about keeping rate cuts paused,” he says.

Indeed, following Wednesday’s GDP report, the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions, indicated a 94%-plus chance that America’s central bank would keep its current target rate of 4.25%-4.50% in place.

“Below the headlines, the GDP report confirms what we are seeing in corporate earnings,” Helfstein adds. “The first quarter was actually decent. There was healthy revenue growth, and the impact of tariffs was relatively modest. But investors should prep for softening in economic and corporate fundamentals over the next couple of quarters.”

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Consumer spending decelerated to 1.8% in Q1, which was its slowest reading since Q2 2023, but it wasn’t as bad as feared. Expansion was seen in both goods and services, led by health care, housing, utilities, and nondurable goods.

The personal consumption expenditures (PCE) price index was up sharply, too, increasing 3.6% in Q1 vs. 2.4% in Q4 2024. “Core” PCE, which excludes the impacts of food and energy, and which the Fed favors, was up 3.5%.

“Beneath the noise, the core fundamentals of the U.S. economy actually appear relatively solid,” says Michael Reynolds, Vice President, Investment Strategy at Glenmede. “A ‘core’ GDP focused on private activity in consumer spending, business fixed investment and home building grew 2.8% on a quarter-over-quarter annualized basis in Q1, accelerating from Q4’s 2.3% pace. Consumer spending remained more resilient than expected, though there were signs of caution on the margin as households pulled back on big-ticket expenses like motor vehicles.”

Do These 7 Bear Market Tips Hold Up to Scrutiny?

Several economists noted that Q1’s report told us little that we didn’t already know, and because of its timeline failed to reflect much of the damage that could be caused by policies implemented last quarter.

“There’s little fundamental implication for the economic outlook from this report,” says Michael Gapen, Chief U.S. Economist at Morgan Stanley. “Demand was strong—but only before the shocks from tariffs, government layoffs, ongoing slowing in immigration, and other new policies that are likely to affect growth in Q2. We continue to expect a surge in inflation, slowing in employment growth but little rise in the unemployment rate, and a sharp slowing in real spending,”

And despite some encouraging underlying data, Q1’s GDP print further raised worries about the potential for a U.S. recession.

Two consecutive quarters of economic contraction is the unofficial benchmark for a recession. Ultimately, though, the official call goes to the National Bureau of Economic Research, which has a vaguer definition. Most notably, the NBER did not confirm the U.S. was in recession during 2022 even though data at the time indicated economic contraction in Q1 and Q2 2022 … a better call in hindsight, as a later update to the data showed that the economy marginally improved in Q2 2022.

“Investors should keep a close eye on how consumers alter their spending patterns as the impact of tariffs starts to flow-through to retail prices,” Reynolds says. “Whether they continue to consume through higher prices (as they did in 2022) or pull back on spending will be a key determinant of the fate of the ongoing U.S. economic expansion. The impact of tariffs should, at minimum, lead to a notable economic slowdown and runs the risk of creating a near-term recession.”

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

![The 10 Best ETFs for Beginners [2026] 10 a hand taking a slice of a pie chart.](https://youngandtheinvested.com/wp-content/uploads/pie-chart-index-fund-etf-wooden-table-1200-600x403.webp)