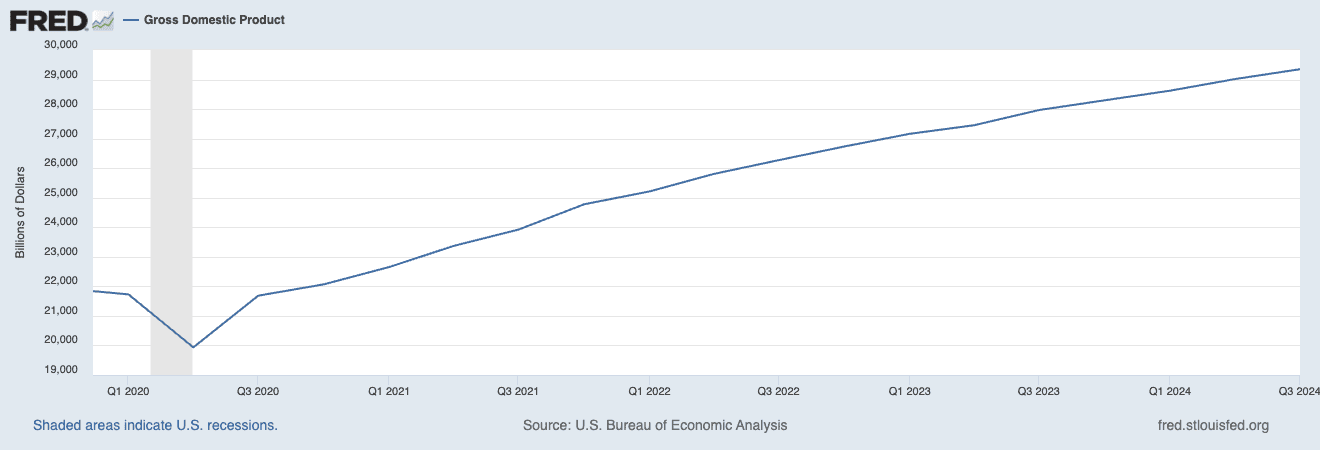

Economists and market strategists were encouraged by data from the Commerce Department out Thursday, which showed that U.S. gross domestic product (GDP) for the third quarter of 2024 split expectations but continued at a robust clip, signaling a 10th straight month of economic expansion and continued momentum heading into the end of the year.

The Commerce Department’s Bureau of Economic Analysis (BEA) said that GDP, factoring in both seasonality and inflation, expanded at a seasonally adjusted 2.8% annualized pace across the third three months of 2024. That came in behind Bloomberg-surveyed economists’ expectations of 3.1%, and slightly behind Q2’s revised rate of 3.0%, but came out ahead of some individual estimates.

“The GDP report today was a modest positive surprise in that growth exceeded estimates and prices advanced less than anticipated,” says Matt Peron, Global Head of Solutions at Janus Henderson Investors. “On its own, this was a market-friendly report, confirming the notion that economic growth is not slowing rapidly and price pressures remained contained. This notion is also supported by a strong ADP payroll report earlier.”

The Personal Consumption Expenditures (PCE) index rose just 1.5%, which was a much bigger difference from Q2’s 2.5%. However, “core” PCE, which backs out food and energy (a pair of more volatile factors), improved by a more encouraging 2.2%.

15 Best Investing Research & Stock Analysis Websites

“The consumer came to the rescue, with consumption growing at the fastest rate in over a year,” says Scott Helfstein, Head of Investment Strategy at Global X. “This could help drive a manufacturing recovery in the fourth quarter, which would get the economy firing on all cylinders as services remain reasonably strong.”

Nondurable goods, motor vehicles and parts, health care services, and food services and accommodations were the greatest drivers of consumer spending during Q3.

Sonu Varghese, Global Macro Strategist at Carson Group, notes that business investment remains strong. Specifically, equipment spending spiked by 11%, “which bodes well for productivity.”

Disposable personal income improved by 3.1% in Q3, to $166 billion, while real disposable personal income was up 1.6%; both figures were slower than their growth in the second quarter. The personal savings rate also slowed, to 4.8% in Q3, from a revised 5.2% for the second quarter.

10 Worst 401(k) Money Mistakes to Avoid

The Q3 GDP report also carried some evidence that companies are being influenced by the upcoming election.

“Perhaps some businesses have been accelerating imports ahead of threatened tariffs. Imports were up 11.2%, which is the highest rate of growth since the supply chain backlogs began to clear in early 2022,” says Mike Reynolds, Vice President of Investment Strategy at Glenmede. “In addition, fixed investment in both residential and nonresidential structures stalled as some businesses have balked at election uncertainty, particularly given the stark difference between the major candidates on key economic policies.”

For now, America’s recovery out of the depths of COVID and sky-high interest rates continues apace, and continues to remain a standard among developed nations.

“Over the past three quarters, the economy has consistently demonstrated a pattern of growth that meets expectations. This trend is encouraging, suggesting that despite the inflationary pressures of the past year, the economy is continuing to grow and exhibits signs of strength,” says Steve Rick, Chief Economist at TruStage. “Recent forecasts by the International Monetary Fund (IMF) indicated that the United States continues to lead the global economy and further reinforced this outlook by upgrading predictions for next quarter. As evident in the Q3 GDP data, we expect the economy to maintain its strength as we head into the end of the year.”

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 7 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 8 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)