If you’re seeking out the market’s best dividend stocks for 2026, I have a suggestion:

Seek out the best stocks that also pay dividends.

I know it sounds like I said the same thing twice, but look again: The emphasis matters. Sometimes, people seek out dividend stocks with a focus on yield first, then quality second. That can work out, but it can also flame out spectacularly. After all, if a high payout is built on a shaky foundation, you might not receive that payout in perpetuity, and if that happens … well, it’s hard to imagine you’d love the stock you’re left with.

Instead, I suggest you initially target high quality, for two reasons: 1.) It gives you a better chance of buying durable dividends that will keep delivering a steady (and even growing) stream of income over time, and 2.) it gives you a better chance of buying companies whose sales and profits will continue to improve, resulting in higher share prices over time, too.

Today, I’m going to look at some of the best dividend stocks for 2026, as viewed through a high-quality lens. But don’t worry: Yield hasn’t been forgotten completely. Indeed, every stock here pays more than the market, and a majority pay double that or more.

Disclaimer: This article does not constitute individualized investment advice. Securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Featured Financial Products

Why Dividend Stocks?

Dividend stocks can do wonders for the long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return—even when share prices aren’t cooperating.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

Related: Direct Indexing: A (Tax-) Smarter Way to Index Your Investments

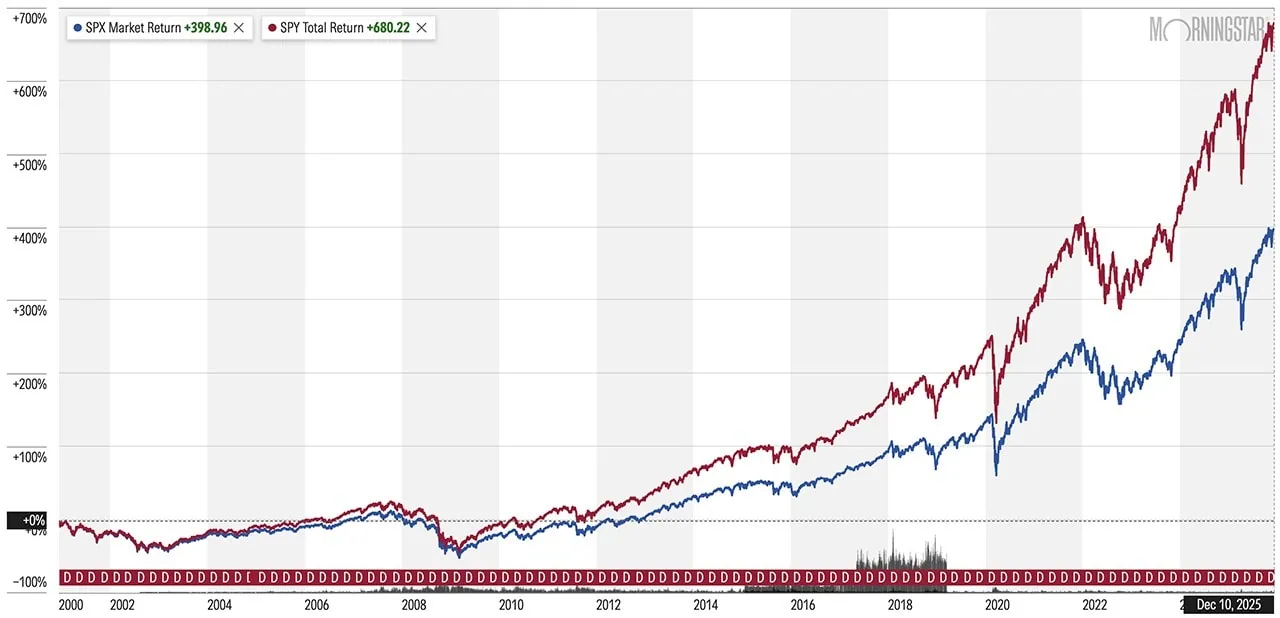

Here’s a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years:

Now look at how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance):

The price return is right around 400%. The total return (price plus dividends) is 680%!

Just like price return on stocks can be improved upon with dividends, though, a stock that pays dividends but doesn’t go anywhere isn’t exactly ideal, either. Thus, the best dividend stocks will provide both a steady baseline of income and provide you with the potential for meaningful price upside.

Dividend Yields (And Dividend Safety)

Dividend yield is a simple calculation—annual dividend / price x 100—that can mean a world of difference for investors, especially those reliant on income.

But dividend yield isn’t everything. Sometimes, stocks with high yields can look more attractive, but they’re actually flashing a warning signal that the dividend isn’t sustainable. You see, a company can get a very high annual dividend yield in two very different ways: the dividend growing very rapidly, or the share price falling very quickly.

For example, Alpha Corp., which trades for $100 per share, pays a 75¢-per-share quarterly dividend, or $3 across the whole year. It yields 3.0%. In a month, however, it yields 6.0%. Here are two ways that could have happened:

- Alpha Corp. doubled its dividend to $1.50 per share quarterly, good for a $6-per-share annual dividend. The share price stays the same. ($6 / $100 x 100 = 6.0%)

- Alpha Corp. kept its dividend at 75¢ quarterly ($3 annually), but its share price plunged in half to $50 per share. ($3 / $50 x 100 = 6.0%)

In one of those scenarios, Alpha Corp. has a very safe dividend. In the other one, Alpha’s dividend could be ready to implode.

So, if you’re sniffing out the best dividend stocks to buy for 2026, make sure you’re not just looking at yield, but also gauging a dividend’s safety. Among other things, you’ll want to look at payout ratio, which determines what percentage of a company’s profits, distributable cash flow, and other financial metrics (depending on the type of stock) are being used to finance the dividend. Generally speaking, the lower the payout ratio, the more sustainable the payout.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

How We Chose the Best Dividend Stocks to Buy for 2026

Before I started this article, I was video calling a colleague and joked, in a pseudo-philosophical voice, “What is a good dividend stock, anyways?”

But I was only partly kidding. What’s ideal to one investor might not fit the bill for another. Ultimately, though, I coalesced around safe dividends, with some capacity to grow, sporting above-average yields, paid by larger (and thus likelier to be more stable) companies. Specifically, they have to …

- Be in the S&P 500.

- Have a yield greater than 1.5%, to ensure they’re better than the overall market. Most of the stocks on this list yield more than 2%, some north of 3%,and one yields more than 5%. (If that’s too low a baseline yield for you, I suggest you instead read our list of high-yield dividend stocks, where 5%-plus yields are the norm.)

- Have an earnings payout ratio below 70%. This is a generally safe level where there’s still at least some room for dividend growth, and the lower the payout ratio, typically the more growth potential there is. (Note: Free cash flow payout ratio is an even better metric, but screening data for this tends to be unreliable.)

- Have at least a consensus Buy rating according to analysts tracked by S&P Global Market Intelligence. S&P boils down consensus ratings down to a numerical system where anything less than 1.5 is a Strong Buy, 1.5 to 2.5 is a Buy, between 2.5 and 3.5 is a Hold, 3.5 to 4.5 is a Sell, and anything greater than 4.5 is a Strong Sell. In this case, I only included stocks with a 2.0 rating or less—so at least a pretty firm consensus Buy rating, if not an outright Strong Buy.

I also limited the energy sector to just two stocks. Energy companies were extremely overrepresented in the screen; most problematic is that several sport variable dividends that rise and fall based on available cash flow, which is largely tethered to the motion of energy prices. So a 3% yield today could be 1% in a year, 2% the year after, and so on. The rest of the list is populated with stocks that have more traditional dividend programs—regular payouts that typically only change when the company announces a hike.

The equities here are listed in reverse order of their consensus analyst rating, starting with the worst-rated stock and ending with the best-rated stock.

Related: 7 Best High-Dividend ETFs for Income-Hungry Investors

Featured Financial Products

Best Dividend Stock #10: Emerson Electric

- Sector: Industrials

- Market cap: $77.3 billion

- Dividend yield: 1.6%

- Consensus analyst rating: 1.86 (Buy)

Industrial firm Emerson Electric (EMR), founded in 1890 and headquartered in St. Louis, has established itself as a global leader in technology and engineering. It provides innovative solutions in process control, industrial automation, heating, ventilation, and air conditioning (HVAC), and more.

The company’s emphasis on technological advancement and diversified market penetration has been crucial in maintaining a competitive edge over the past 125-plus years. What once was a maker of electric motors and fans is now a global industrial-technology giant that produces not just tens of thousands of products, but even industry, automation, and operations management software.

“Emerson is a blue-chip Industrial company that we believe can generate high single-digit EPS growth over the long term, driven by 3%-4% revenue growth, margin improvement, and share buybacks,” says Argus Research analyst John Eade, who is among 19 Buy calls (versus seven Holds and two Sells). “The company has shifted its focus in recent quarters, divesting legacy segments and investing in new businesses that target energy security and affordability, sustainability and decarbonization, nearshoring, and digital transformation. These are good long-term businesses. The company’s earnings growth is also improving as management integrates the new acquisitions.”

Investors have “an opportunity to buy pure-play automation at a discount,” add BofA Global Research analysts, who also see EMR as a Buy. “We see potential upside as the company executes on [2023 acquisition] National Instruments synergies. The transition to a pure-play industrial automation firm should also lead to higher valuation multiples over time, in our view.”

Its most recent payout increases haven’t been much to crow about. However, Emerson Electric is one of the best dividend stocks for payout growth, boasting 69 years of uninterrupted hikes to the amount of distributions it pays annually—good enough to qualify it for membership among the Dividend Aristocrats. Most recently, that includes a 5% improvement to its payout, to 55.5¢ per share quarterly, announced in November 2025. Meanwhile, the company pays out just 30% of 2026’s expected earnings—a conservative ratio that offers safety and room to grow.

Related: The 10 Best Index Funds You Can Buy Now

Best Dividend Stock #9: BlackRock

- Sector: Financials

- Market cap: $155.1 billion

- Dividend yield: 1.9%

- Consensus analyst rating: 1.71 (Buy)

BlackRock (BLK) is one of the world’s largest asset management firms, boasting more than $12 trillion in assets across its many lines of business. Individual investors know it well for both its BlackRock mutual funds and closed-end funds (CEFs), as well as its iShares exchange-traded funds (ETFs). But it also manages money for institutional clients, including pension plans, foundations, charities, and insurance companies, among others.

With the exception of a few understandable hiccups (COVID, for instance), BlackRock has been in a broader consistent uptrend since the depths of the Great Recession. That has come alongside similar progression in both the company’s top and bottom lines.

It’s difficult to find any Wall Street pros with something negative to say about BLK. Shares currently enjoy 13 Buy calls versus four Holds and no Sells, and the analysts’ consensus for long-term earnings growth sits at an encouraging 12% annually.

“We believe that BLK remains well positioned to deliver above-peer organic growth given its unmatched product breadth and distribution footprint (helped by its iShares franchise),” say Keefe, Bruyette & Woods analysts Aidan Hall and Kyle Voigt, who rate BLK at Outperform (equivalent of Buy). “Also, its scale and demonstrated ability to generate operating leverage bodes well for future earnings growth and operating leverage. The firm’s increasing alternatives presence and growing technology revenue stream add further breadth to what is already a diverse product/solutions offering.”

BlackRock has been a fount of dividend growth since the Great Recession, too. In the past decade alone, BLK has managed to average 10% annual dividend growth, though that pace has been slowing in recent years—its most recent hike, announced in January 2025, was a mere 2% bump to $5.21 per share. Still, a payout ratio around 40% should keep investors plenty confident in the dividend’s health and its ability to keep growing.

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

Best Dividend Stock #8: Vici Properties

- Sector: Real estate

- Market cap: $29.9 billion

- Dividend yield: 6.3%

- Consensus analyst rating: 1.70 (Buy)

VICI Properties (VICI) is a real estate investment trust (REIT) that specializes in gaming, hospitality, and entertainment properties. A reminder: REITs are structured differently than regular businesses. They receive significant tax breaks, but in return, they must pay out at least 90% of their taxable income back to shareholders in the form of dividends.

While you’re probably most familiar with its Vegas real estate, which includes Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas, VICI actually owns 54 gaming properties and 39 other “experiential” properties—such as golf courses and Bowlero bowling alleys—across roughly two dozen states and Canada.

VICI and other gaming REITs are a way to invest in gambling/gaming with the potential for less volatility. That’s because their revenues aren’t directly driven by ups and downs in the business—they collect rent. So while a prolonged economic downturn, say, could weigh on operators’ ability to pay their bills, VICI is a bit more insulated from quarter-to-quarter issues. Also helping VICI’s stability is that roughly 90% of its contractual rent is subject to CPI-linked escalators over the full lease term, which is well above the industry average.

“We believe VICI can outperform given attractive valuations relative to traditional triple-net REITs, although more challenged capital markets have weighed on acquisition activity,” says Citi Research Analyst Nick Joseph (Buy). “Current dividend yield is ahead of REITs, and we note nearly all contractual rent is subject to CPI escalators, providing some protection against inflation.”

“Its investment activity has been more varied as it diversifies into other areas of experiential real estate (i.e., youth sports, golf, wellness, bowling), and while these deals tend to be smaller than gaming transactions, they create more of a ‘flow’ of transactions,” adds JPMorgan’s North American Equity Research team, which rates VICI at Overweight (equivalent of Buy). “When combined with free cash flow, VICI should have the ability to drive about 2% in external growth annually.”

Citi and JPMorgan are among 18 Buy-equivalent ratings on VICI shares, which sports five Holds and zero Sells. That doesn’t just put it among the pros’ best dividend stocks for 2026; it’s also among the best REITs to buy.

Unlike regular stocks, with which we use profits or free cash flow to determine payout ratio, REIT dividend coverage is typically gauged by funds from operations (FFO), a metric of profitability that falls outside of generally accepted accounting principles (GAAP) standards. FFO payout ratio standards are somewhat different, with 70% to 80% considered quite healthy. VICI? It pays out about 75% of adjusted FFO (AFFO) estimates for 2026. That should help it continue its short streak of dividend hikes, which included a 4% bump in the payout in late 2025 to 45¢ per share.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

Best Dividend Stock #7: Bunge Global

- Sector: Consumer staples

- Market cap: $17.9 billion

- Dividend yield: 3.1%

- Consensus analyst rating: 1.67 (Buy)

Bunge Global (BG) is a leading agribusiness and food company, operating across the entire agricultural supply chain through its many subsidiaries. All told, its operations span roughly 23,000 employees across more than 300 facilities in over 40 countries.

The U.S.-headquartered but Switzerland-incorporated firm is a leading global oilseed processor and producer of vegetable oils and protein meals. It sources, processes, and distributes grains such as soybeans, wheat, and corn. It produces agricultural products such as fertilizers and sugars. And that’s just some of what this ag giant does.

Bunge has been a “patience stock” for years thanks to lower margins on crush (the process that produces soybean oil and protein meal), as well as delays to its proposed mega-acquisition of Canadian grain handling business Viterra. However, investors who have had patience are finally seeing the payoff, with the stock up 20% as of mid-December amid optimism over renewable volume obligation (RVO) and the closing of its Viterra deal.

“[Bunge] reiterated 2025 EPS guidance of ~$7.75 (ex Viterra) including $0.10 impact from corn milling business divestiture, with Q3 below consensus and Q4 above,” says BMO Capital Markets Analyst Andrew Strelzik, who rates the stock at Outperform. “We believe BG remains an attractive opportunity given negative sentiment and historically depressed multiple on our estimate of potential 2026 pro forma EPS of $9 to $10, from which BG can grow.”

The analyst camp is solidly in Bunge’s bull camp, with seven Buys versus two Holds and no Sells.

Bunge, meanwhile, can pay investors at least a modest sum for their patience. The nearly 3% yield, on a quarterly dividend of 70¢ per share, is close to 2 percentage points better than what you’ll get from the S&P 500. That dividend has also grown by a decent 33% over the past four years, and it’s as safe as you could want it, with Bunge maintaining a conservative payout ratio of 30% of 2026 profit estimates.

Featured Financial Products

Related: 9 Best Dividend Stocks for Beginners

Best Dividend Stock #6: Bank of America

- Sector: Financials

- Market cap: $394.0 billion

- Dividend yield: 2.1%

- Consensus analyst rating: 1.64 (Buy)

Bank of America (BAC) is one of the world’s largest banks, serving roughly 69 million Americans through 3,800 branches and 15,000 ATMs across 39 states. However, BofA is much, much more than its consumer business—it also provides financial products and services for small and midsized businesses, large corporations, institutional investors, and even governments. Its offerings range from checking and savings accounts to commercial loans, trade finance, treasury management, and securities clearing.

BAC shares enjoyed a market-beating 35% return in 2024; they’re not pacing quite that well in 2025, but they’ve still thrown off a total return of 18% that’s ahead of the S&P 500. Relatively volatile markets have helped push trading revenues higher, loans are growing, and the company’s net interest income continues to improve.

“BAC’s 2025 Investor Day, its first since 2011, made us more convinced that BAC has entered a new period of consistent, sustained positive operating leverage after eight straight quarters of negative operating leverage in 3Q23-2Q25,” says Morgan Stanley analyst Betsy L. Graseck, who rates the stock at Overweight and calls Bank of America her “top pick” in big banks heading into 2026.

“Investor Day goals outlined for the company at large over the medium term included deposit growth of 4%, loan growth of 5%, operating leverage of 200-300 basis points leading to an efficiency ratio of 55%-59%, EPS growth of at least 12%, and a return on tangible common equity of 15% in the near term and 16%-18% in the medium term,” adds Argus Research analyst Stephen Biggar (Buy). “We believe the targets are achievable given the company’s breadth of products and investment capabilities, and are competitive enough to push BAC into the upper range on these metrics in the peer group.”

Analysts are broadly bullish on the Big Four bank, with 21 Buys against just four Holds and no Sells. As for the dividend? Bank of America has raised its cash distribution by 55% between 2020 and today. Most recently, it announced a roughly 8% hike, to 28¢ per share, effective as of the September 2025 payout. That dividend is very well-covered at just 25% of 2026’s expected earnings.

Related: 7 Best Fidelity Index Funds for Beginners

Best Dividend Stock #5: NiSource

- Sector: Utilities

- Market cap: $19.7 billion

- Dividend yield: 2.7%

- Consensus analyst rating: 1.57 (Buy)

NiSource (NI) is a natural gas and electric utility company founded in 1847 that serves more than 4 million customers in six states across the Midwest and East Coast.

It shouldn’t surprise that one of the best dividend stocks for 2026 comes from the utility sector, which is known for steady operations and sustainable dividends. Remember: NiSource and many other utilities are regulated, which means they must request permission to raise their prices and usually only do so by a couple percent every year or two. Plus, much of their money tends to be reinvested in infrastructure like electric lines and water pipes, or distributed as dividends to shareholders. So there’s usually not much growth to be had here.

Still, NiSource is coming off its third consecutive quarter of double-digit year-over-year revenue growth, and shares are up 15% with just a couple weeks left in 2025. That’s a sizable gain for a utility stock, and it has actually prompted a couple analysts to tone down their optimism about NI shares in the short term. Still, Wall Street remains bullish on the stock, at 11 Buys versus three Holds and no Sells.

“This Midwestern utility has streamlined operations and has been outpacing peers in terms of cost savings,” says Argus Research Analyst Marie Ferguson (Buy). “The region has growing residential and manufacturing demographics, and management is optimistic that its capital plans can boost its base rate by 8%-10% through 2029.”

NiSource’s dividend is well-covered at 55% of 2026’s projected earnings. That distribution was last raised in February 2025, to 28¢ per share—up about 6% from its previous payout, and 40% better than what it was paying five years ago.

There’s nothing exciting about buying a natural gas company and harvesting the dividends, but stability and income are nonetheless important aspects of many investors’ portfolios … and NiSource serves those needs.

Related: 7 Best Vanguard Dividend Funds to Buy

Best Dividend Stock #4: Cigna

- Sector: Health care

- Market cap: $72.0 billion

- Dividend yield: 2.3%

- Consensus analyst rating: 1.56 (Buy)

Cigna Group (CI) is perhaps best known for the Cigna brand, which is one of America’s largest health insurers, offering health, dental, and other plans. But Cigna actually makes up less than half of Cigna Group’s revenues—60% come from its Evernorth Health Services unit, which includes its Express Scripts pharmacy and pharmacy benefit management businesses, Accredo specialty pharmacy, MDLive telehealth, and more.

“In our view, Cigna remains one of the more attractive stocks in our space due to its diversified and stable earnings flow, solid growth avenues, and attractive valuations,” says Oppenheimer, which rates shares at Outperform. “The company’s service-based platform leaves minimal exposure to risk-products that are igniting volatility across the managed care space. Overall, we continue to favor Cigna due to its attractive portfolio and solid growth prospects within the volatile managed care space.”

Oppenheimer is among 21 Buy-equivalent calls on the stock, which compares nicely to just four Holds and no Sells. Also among the bulls is UBS analyst BofA Global Research analyst Kevin Fischbeck, who believes the company’s pharmacy benefit manager (PBM) business is misunderstood.

“The market appears to be concerned about a race to the bottom on PBM margins,” he says. “We haven’t seen any evidence of margin compression outside of the largest accounts and we believe that the move to the new model is misunderstood and CI screens cheap even assuming the implementation costs don’t go away over time despite what we see as an improved PBM business (extended contracts, derisked legislatively, PBM a smaller part of earnings).”

Unlike many of the dividend stocks on this list, Cigna doesn’t have a particularly illustrious dividend history. In 2004, the company cut its quarterly payout by 92%, to 2.5¢ per share (adjusted for its 3-for-1 stock split in 2007). Then in 2008, the company transitioned to 4¢ annual dividends, which lasted until 2021, when Cigna announced a new quarterly dividend of $1 per share. Since then, the company has raised its payout by another 51%, to $1.51 per share.

Cigna certainly has more headroom for higher dividends going forward—the company’s current payout represents just 20% of 2026’s expected earnings.

Related: 9 Best Fidelity ETFs for 2026 [Invest Tactically]

Best Dividend Stock #3: Citizens Financial Group

- Sector: Financials

- Market cap: $25.3 billion

- Dividend yield: 3.2%

- Consensus analyst rating: 1.43 (Strong Buy)

Citizens Financial Group (CFG) is the holding company behind Citizens Bank, a large regional bank with roughly 1,000 branches serving 14 East Coast and Midwest states as well as Washington, D.C. It provides a wide variety of consumer and commercial banking services, including deposits, mortgages, credit cards, business loans, wealth management, foreign exchange, corporate finance, and more.

One noteworthy area of growth for CFG is Citizens Private Bank, which offers personal banking, wealth management, and other services to people with at least $10 million in net worth and at least $5 million in liquid assets. Since launching near the end of 2023, Private Bank has accumulated $12.5 billion in deposits, $5.9 billion in loans, and $7.6 billion in investments.

“Management has remained confident that Private Bank will deliver 20% to 25% return on equity for FY2025 and maintain this over the medium term, contribute more than 7% to total CFG earnings in 2025, and continue to add deposits, loans, and investments to reach 2025 year-end goals ($12 billion, $7 billion, and $11 billion, respectively),” says Argus Research analyst Kevin Heal, who rates Citizens’ shares at Buy.

“CFG has among the strongest [return on tangible common equity] improvement stories among large regional banks, supported by net interest income/net interest margin improvement, Private Bank buildout, balance sheet optimization efforts, and a capital markets recovery,” add Keefe, Bruyette & Woods analysts, who have the stock at Outperform. “Overall, we continue to believe CFG has among the most attractive risk/reward setups for super regional banks.”

All told, CFG has a broad bull camp of 19 Buys versus two Holds and no Sells.

Citizens Financial has paid a dividend every year since its initial public offering (IPO) in 2014. Its dividend-growth history is less consistent; nonetheless, the quarterly payout has improved by 360% since its initial 10¢ payout. Most recently, in October 2025, it announced a 9.5% improvement to the dividend, to 46¢ per share. It’s a very well-covered payout that represents less than 40% of Citizens’ anticipated profits for 2026.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Best Dividend Stock #2: Diamondback Energy

- Sector: Energy

- Market cap: $45.8 billion

- Dividend yield: 2.5%

- Consensus analyst rating: 1.39 (Strong Buy)

Energy businesses are typically referred to by their “stream.” Upstream companies search for and extract oil, gas, and other raw energy resources; midstream companies transport, store, and sometimes process those resources; and downstream companies refine these resources into final products such as gasoline, diesel, and natural gas liquids (NGLs).

Diamondback Energy (FANG) is an upstream firm—an independent oil and natural gas exploration and production (E&P) firm that operates “unconventional” onshore reserves in West Texas’ Permian Basin.

E&P companies are more beholden to commodity prices than the other “streams,” so as oil and nat gas prices go, so go their shares. Their differences boil down to operational efficiency, and FANG is among the best, according to Wall Street analysts, who as a group have a whopping 29 Buys on the stock, versus two Holds and no Sells.

“Diamondback’s best-in-class cost structure, ample tier-1 inventory, and operational efficiencies generate the upstream group’s highest free cash flow per barrel of oil equivalent (BOE) produced,” says William Blair analyst Neil Dingmann, who recently initiated coverage at FANG with an Outperform rating. “Strong FCF, paired with solid financials, provides capital allocation optionality, including opportunistic buybacks. The company’s large mineral subsidiary, Viper Energy (VNOM), also provides unparalleled upside.”

“FANG delivered production above guidance levels, and its cash cost per barrel of oil equivalent continues to improve,” says CFRA Analyst Stewart Glickman, who has a Strong Buy rating on shares. “We recognize that the consensus view on WTI crude prices is quite dour in 2026, calling for a 25% reduction from projected 2025 levels, but we think the bearishness is overdone and that commodity markets may surprise to the upside.”

Diamondback, like a growing number of energy companies, has a base-plus-variable dividend that provides a combination of flexibility for the company and security for investors. Specifically, it pays $1 per share quarterly in base dividends (35% of 2026 earnings estimates), and it will distribute additional variable dividends as cash flow allows. The current yield reflects no special dividends over the past year, however.

Featured Financial Products

Best Dividend Stock #1: Targa Resources

- Sector: Energy

- Market cap: $39.4 billion

- Dividend yield: 2.2%

- Consensus analyst rating: 1.32 (Strong Buy)

Targa Resources (TRGP) deals in the midstream energy market segment—alongside its subsidiary, Targa Resource Partners LP, it owns a wide array of gathering, processing, logistics, and transportation assets across numerous natural resource plays, including the Permian Basin, Bakken Shale, Anadarko Basin, and the Gulf of Mexico, among others. The Permian Basin is arguably Targa’s biggest growth driver; roughly 3 in 5 lower-48 U.S. shale rigs are located there, and about 80% of Targa’s natural gas inlet volumes are sourced from there.

Targa went public in 2010, peaked in 2014, cratered, then largely hovered for a few years after that. But after bottoming out during COVID, the stock has roared back to life and nearly doubled in 2024 to hit all-time highs. Despite a cooling-off in 2025, the analyst community remains wildly bullish: 21 Buys dwarf a single Hold call and no Sells, making TRGP one of the market’s best dividend stocks for 2026.

Much of this can be attributed to Targa’s positioning in the Permian.

“TRGP has become an integrated midstream player from the wellhead to the export dock with a dominant position in the Permian Basin, which has the best growth profile of any basin in the U.S.,” say Stifel analysts, who rate shares at Buy. “Additionally, we continue to favor Targa’s attractive financial profile with leverage well within its 3.0x to 4.0x range and a dividend that is well covered. Lastly, we believe TRGP should continue to generate meaningful FCF, which should allow for incremental return of capital longer-term.”

“Management indicated that it is tracking to the high end of FY 2025 guidance range and likely has a degree of conservatism baked in,” adds BMO Capital Markets’ Ameet Thakkar, who recently initiated Targa’s stock at Outperform. “More significantly, we think TRGP’s comments expecting FY 2026 double-digit volumetric growth and confidence in FY 2027 may help improve investor sentiment despite crude/[natural gas liquids] pricing.”

Energy infrastructure stocks are a different breed. Many of them are master limited partnerships (MLPs), which are required to return a majority of their income to unitholders (shares in MLPs) in the form of distributions (dividend-like payments to shareholders that have different tax consequences). Targa is technically a corporation, so it pays dividends like a traditional stock. But like an MLP, the proper metric for its payout ratio is distributable cash flow (DCF) … and by that gauge, Targa’s quarterly distribution is well-covered, indeed. Even after the company’s 2025 hike—a 33% improvement to $1 per share—the distribution is only 20% of DCF projections for the year.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.