Who doesn’t love getting a little more? An extra slice of pizza, overtime at the game, a bigger tax refund than expected—we’ll take it all!

And if one of our dividend-paying investments decides to give us a little pay raise, we’ll take that, too.

Some companies try to reward shareholders by paying them dividends—cash distributions represent a differentiated source of return, so we don’t always have to rely on rip-roaring bull markets to enjoy a return on our investments. And many of these companies aren’t content to just sit on their hands. Every now and then (or ideally, on a regular basis), these companies will increase the amount they dole out to us, putting more cash in our pockets.

Today, I’ll walk you through a few blue-chip stocks from the S&P 500 that have recently announced upgrades to their dividend programs.

Why Dividend Stocks?

Dividend stocks can do wonders for the long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return—even when share prices aren’t cooperating.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

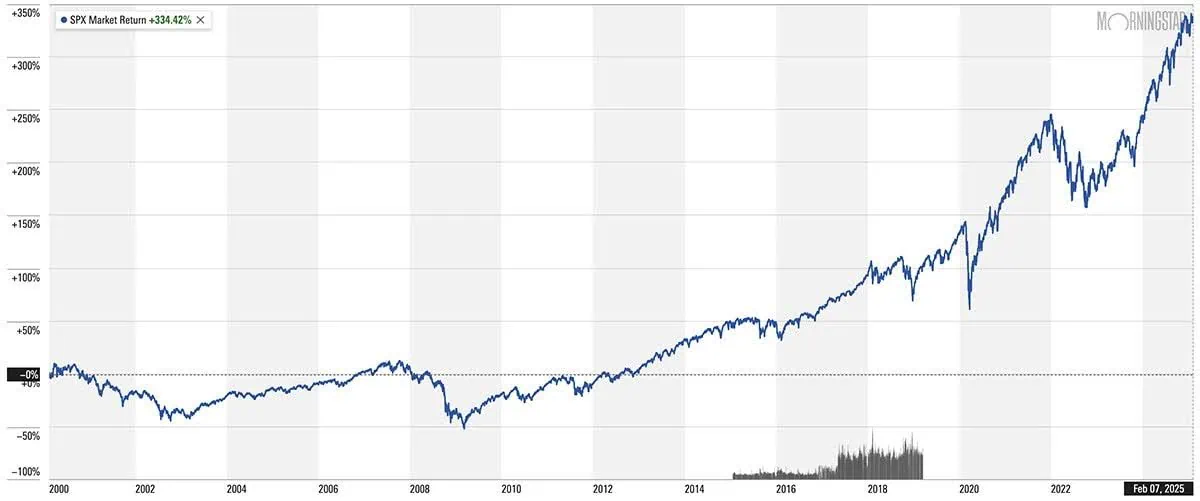

Here’s a look at the return someone could expect if they received just the price returns from the S&P 500 over the past 25 years:

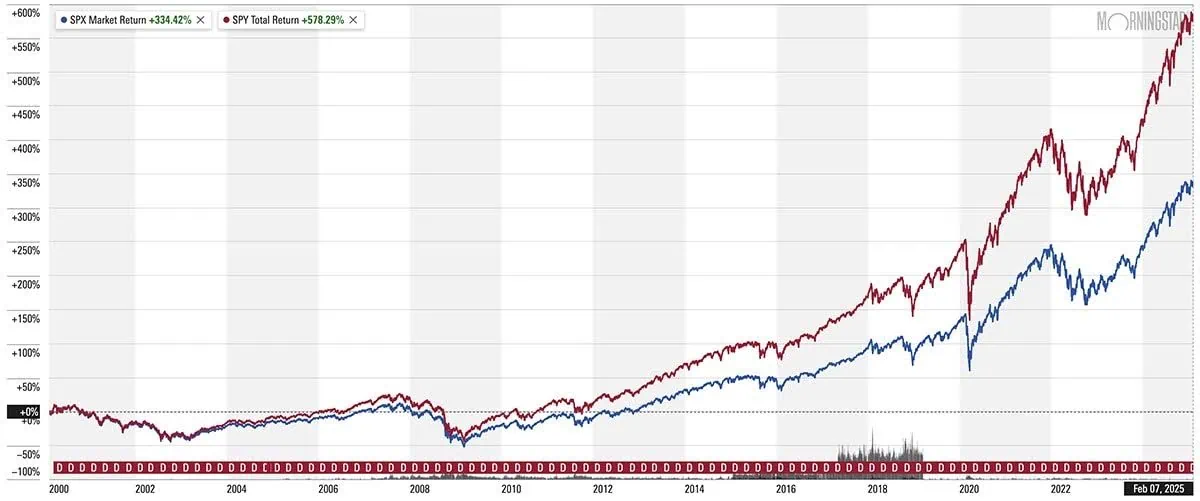

Now look at how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance):

The price return is a little more than 330%. The total return (price plus dividends) is nearly 580%!

Just like price return on stocks can be improved upon with dividends, though, a stock that pays dividends but doesn’t go anywhere isn’t exactly ideal, either. Thus, the best dividend stocks will provide both a steady baseline of income and provide you with the potential for meaningful price upside.

Related: The 15 Best ETFs to Buy for a Prosperous 2025

Dividend Yields (And Dividend Safety)

Dividend yield is a simple calculation—annual dividend / price x 100—that can mean a world of difference for investors, especially those reliant on income.

But dividend yield isn’t everything. Sometimes, stocks with high yields can look more attractive, but they’re actually flashing a warning signal that the dividend isn’t sustainable. You see, a company can get a very high annual dividend yield in two very different ways: the dividend growing very rapidly, or the share price falling very quickly.

For example, Alpha Corp., which trades for $100 per share, pays a 75¢-per-share quarterly dividend, or $3 across the whole year. It yields 3%. In a month, however, it yields 6%. Here are two ways that could have happened:

- Alpha Corp. doubled its dividend to $1.50 per share quarterly, good for a $6-per-share annual dividend. The share price stays the same. ($6 / $100 x 100 = 6%)

- Alpha Corp. kept its dividend at 75¢ quarterly ($3 annually), but its share price plunged in half to $50 per share. ($3 / $50 x 100 = 6%)

In one of those scenarios, Alpha Corp. has a very safe dividend. In the other one, Alpha’s dividend could be ready to implode.

That’s why, whenever you’re sniffing out dividend stocks, make sure you’re not just looking at yield, but also gauging a dividend’s safety. Among other things, you’ll want to look at payout ratio, which determines what percentage of a company’s profits, distributable cash flow, and other financial metrics (depending on the type of stock) are being used to finance the dividend. Generally speaking, the lower the payout ratio, the more sustainable the payout.

Related: 13 Best Long-Term Stocks to Buy and Hold Forever

Why Dividend Growth Matters

Whenever you read about dividend yield in an article or on a data site, what you’re looking at is “headline” or “current” dividend yield—the yield based on the current stock price.

In other words: the yield you would get if you bought that stock right now.

But another yield you should be equally as concerned about is dividend yield on cost. That’s the yield on the shares at the price you bought them, and ideally, you want that to change (for the better) over time.

An example of how yield on cost works?

You buy Omega Corp. at $100 per share. Its headline yield was 3%, as it paid 75¢ per share quarterly, or $3 annualized. ($3 / $100 x 100 = 3%)

In five years, Omega Corp. stock has doubled to $200 per share, and its quarterly dividend has doubled to $1.50 per share, or $6 annualized. As a result:

- The headline yield is still 3% ($6 / $200 x 100 = 3%)

But you didn’t buy stock at $200 per share—you bought at $100 per share. As a result:

- Your yield on cost is 6% ($6 / $100 x 100 = 6%)

“Yay, more money!” Absolutely! It’s not a stretch to say that when you invest, it’s great when you can earn more money!

However, dividend growth is more than just nice to have—it’s a vital characteristic if you depend on your dividend income, which many people do once they reach retirement. That’s because, virtually every year, inflation will take a little bite out of the purchasing power of your dividend dollars. Thus, if your dividends are only growing a little each year, you might only be breaking even, and if they don’t grow at all, you actually will be falling behind!

Healthy dividend growth ensures that the dividend checks you receive spend just as well (if not better) than they did the year before.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Dividend Increases, Feb. 19-Feb. 26

Dividend increases often are announced in tandem with quarterly earnings reports. So, given that we’re still in the meat of fourth-quarter earnings season (when companies report their Q4 2024 results), it should be no surprise that we’re seeing plenty of payout hikes right now.

JPMorgan analysts Bram Kaplan and Daniel Motoc note that for the week ended Feb. 25, “29 S&P 500 members announced new dividends in line with their previous payouts, 20 announced hikes, and there were no new cuts or suspensions.”

Read on as I check out some of the most prominent names that have announced improvements to their regular cash distributions to shareholders.

Note: Listed dividend yields reflect the most recently announced dividend, which in virtually all cases will not have been paid out as of this writing.

Related: 7 Best Schwab Index Funds for Thrifty Investors

Home Depot (HD)

- Market cap: $387.8 billion

- Dividend yield: 2.4%

- Dividend increase: +2.2%

Home Depot (HD), which rules an American home-improvement retail industry diarchy alongside competitor Lowe’s (LOW), announced a roughly 2% upgrade to its payout on Feb. 25 as part of its fourth-quarter and full-year 2024 earnings report.

Specifically, Home Depot raised its quarterly payout by 5¢ per share, to $2.30 per share. The new dividend will be payable on March 27 to shareholders of record as of the close of business on March 13.

Home Depot noted that its upcoming payment will represent its 152nd consecutive quarterly dividend, marking 38 years of cash distributions. But the raise itself was on the light side, at least relative to recent history. Home Depot improved its dividend by 8% in 2024—about in line with its ~9% dividend growth rate over the past five years.

Related: The 10 Best Index Funds You Can Buy

Walmart

- Market cap: $387.8 billion

- Dividend yield: 2.4%

- Dividend increase: +13.3%

Walmart (WMT), the world’s largest retailer, announced the biggest improvement to its dividend in more than a decade.

On Feb. 20, Walmart’s board of directors approved a 13.3% increase to its quarterly dividend, to 23.5¢ per share. The first affected dividend will be payable April 7 to shareholders of record as of the close of business on March 21. And Walmart’s a bit of an outlier in that it provides all four quarterly payment dates in advance. Its other dividends:

- May 27 (May 9 record date)

- Sept. 2 (Aug. 15 record date)

- Dec. 12 (Jan. 5, 2026, record date)

In addition to marking Walmart’s greatest dividend increase since a 20%-plus hike to its 2011 payout, the company’s recent announcement also represents its 52nd consecutive year of distribution growth. That not only cements another year as a member of the S&P 500 Dividend Aristocrats (S&P 500 companies that have improved their dividends on an annual basis for at least 25 consecutive years), but the Dividend Kings (companies with 50-plus years of uninterrupted dividend growth).

Related: The 10 Best Vanguard Index Funds You Can Buy

Realty Income

- Market cap: $50.4 billion

- Dividend yield: 5.7%

- Dividend increase: +1.5%

Realty Income (O) is a real estate investment trust (REIT) that owns some 15,600 single-tenant commercial properties, which it leases out to tenants such as 7-Eleven and Dollar Tree under long-term, net-lease contracts. (Rent paid to Realty Income is “net” of taxes, insurance, and maintenance, which tenants are responsible for).

REITs are a special business structure that, in return for exemption from federal income taxes, is required to pay out at least 90% of its taxable income to shareholders in the form of dividends. REIT dividends tend to be more generous than your typical stock, and that’s certainly the case for Realty Income, whose already high yield of more than 5% ascended a little more recently.

But Realty Income also stands out because it’s an uncommon monthly dividend stock—whereas most U.S. firms distribute dividends every three months, Realty Income sends a check each and every month.

On Feb. 19, Realty Income upped that monthly check to 26.8¢ per share—a modest increase, yes, but if history is any indication, that likely won’t be the only increase shareholders enjoy this year. Realty Income is indeed another S&P 500 Dividend Aristocrat at 30 consecutive years of payout growth—but the REIT also boasts 129 quarterly dividend hikes since it came public in 1994, meaning it raises its distribution multiple times per year in most years.

The new dividend is payable March 14 to shareholders of record as of March 3.

Related: The 10 Best Fidelity Funds You Can Own

Coca-Cola

- Market cap: $305.7 billion

- Dividend yield: 2.9%

- Dividend increase: +5.0%

Another Dividend King, Coca-Cola (KO), has added a little more fizz to its quarterly dividend of late.

On Feb. 20, Coca-Cola’s board green-lit the company’s 63rd consecutive annual dividend increase—a 5.2% improvement, to 51¢ per share quarterly. The pace is a touch quicker than its 4.5% average annual growth rate over the past five years. The dividend is payable April 1 to shareholders of record as of March 14.

The announcement came a little more than a week after its fourth-quarter financial release, which showed 6% and 12% growth in revenues and adjusted profits—both ahead of estimates. The company has been working on reinvigorating its portfolio by paring back unproductive drinks and adding innovative products. That includes additions to its ready-to-drink portfolio, which will add Bacardi & Coca-Cola to beverages that feature Jack Daniel’s and Topo Chico Hard Seltzer.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Domino’s Pizza

- Market cap: $16.6 billion

- Dividend yield: 1.4%

- Dividend increase: +5.0%

Domino’s Pizza (DPZ) has delivered for income shareholders, recently announcing a double-digit increase to its dividend as it tries to recover from a largely flat 2024.

On Feb. 19, Domino’s board OK’d a quarterly dividend of $1.74 per share—15% better than what it was paying previously. The first newly improved distribution will go out on March 28 to shareholders of record as of March 14.

That continues a downright impressive run of dividend growth. The pizza chain has rapidly expanded its distribution—by more than 17% on average over the past five years, and by more than 41% on average since 2015. That includes a 25% increase at the start of 2024, which was pretty much the only salve for a virtually breakeven year that greatly underperformed the market.

Don’t feel too bad for shareholders. DPZ shares have roughly doubled the market over the past decade.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

![10 Best Investments for Roth IRA Accounts [Tax-Smart Growth] 27 best investments for roth ira](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-roth-ira.webp)

![How to Use Your HSA for Retirement [Tax-Efficient Investing Tool] 28 how to use your HSA in retirement](https://youngandtheinvested.com/wp-content/uploads/how-to-use-your-hsa-in-retirement-600x403.png.webp)