It is no secret that credit scores are essential for anyone who wants to buy a home, car, or take out any form of loan. If you can’t get approved for credit on your own, what do you do?

One option might be getting authorized user status on someone else’s account. However, authorized users don’t have the same rights or responsibilities as joint cardholders—something credit rating bureaus take into account when assigning this credit account to your credit reports.

With joint credit cards, each joint account holder holds responsibility for the payments due on the credit card account, exposing them to equal liability for repaying. In short, joint credit cardholders both equally share the responsibility and benefits of the account.

This article will examine joint credit card accounts, how they work, their pros and cons, and how they compare to authorized users for building credit.

What is a Joint Credit Card?

A joint credit card held with another person works precisely like a traditional, single account holder credit card with a slight twist.

Instead of only having one cardholder appear on the account which carries legal responsibility for adhering to the card terms (i.e., making payments for purchases made on the credit card by specified payment dates), a joint credit card account has two people on the account with the same legal responsibilities.

In other words, both account holders are legally responsible for credit card payments and staying within the stated spending limits while also sharing the ability to make purchases and use the card as they wish.

The joint account holders each receive their card attached to the same joint account. In effect, they share a credit card account but have two cards that can draw against the line of credit.

The primary difference between joint credit card accounts and a single user credit card account is the shared legal responsibility.

You could have a single credit card holder with an authorized user who can also use the credit account but isn’t legally responsible for payments or balance due on the credit account.

Likewise, a joint credit card account can also have an authorized user added who can receive their card and access the account’s spending limit, but they do not face legal responsibility for paying the bill.

Related:

How Does a Joint Account Work for Credit Cards?

With joint credit card accounts, what’s good for the goose is good for the gander. Meaning, each person gets to make their own decisions on using the joint credit card in a legal sense.

While the joint account holders should discuss how to use the joint account, each can make their own choices and judgments about spending against their shared credit limit.

This also means if one party chooses to make purchases on the card while the other joint account holder does not, they both hold responsibility for paying the bill.

While all well and good, a joint credit card has become increasingly rare in today’s lineup of financial products. Many credit card issuers no longer offer the opportunity to open a joint credit card together, instead preferring you to open individual accounts and add a spouse and loved ones as authorized users.

These financial products don’t have many offers that appear available to consumers these days. Now, you’ve got two primary ways to share a credit card with another person:

- adding an authorized user to an existing credit card (or being added as an authorized user on another person’s credit card account)

- opening a joint account with a co-signer or co-borrower

We cover more about authorized users and co-signers below.

Related: Best Credit Cards for Teenagers

Pros and Cons of Joint Credit Card Accounts

Pros of Joint Credit Cards

- Convenient for sharing finances with a spouse or loved one (including kids if you’d like to help your children build credit as their parents).

- Easier for tracking expense and payment history while also keeping better control over your credit utilization ratio—positives for building good credit scores.

Cons of Joint Credit Cards

- Can’t remove a joint account holder from the account for any reason. Can quickly lose track of the balance due, thinking the other party will handle the payment—resulting in a late payment (or missed) and causing a potentially lower credit score for both parties.

- To close the account and settle any debt, you will need to pay off the balance or transfer it to another credit card, thus clearing your ability to close the joint account.

Related: How to Build Credit as a College Student

Can a Joint Credit Card Account Help Build Credit?

A joint credit card account can provide both joint account holders with positive (or negative) credit score implications. All activity on the joint credit card account will affect both account holders.

Because both parties are responsible for the joint account, credit rating bureaus assign heavier weight to joint accounts than if listed as an authorized user on someone else’s account.

These joint accounts can help you build credit if both users have a good handle on their credit. Further, an open pathway to communication is a good idea to maintain a pristine payment history.

Related: Best Credit Cards for Students with No Credit

What is an Authorized User?

By becoming an authorized user on someone else’s credit card—be it a parent, guardian, or other trusted adult—the credit card issuer will send a credit card to the primary cardholder having your name appear on the card.

The credit card company holds the person who signed up to be the primary account holder responsible for paying charges on their account.

If an authorized user on an unsecured card makes purchases but doesn’t pay toward the balance, they are not responsible for repaying the balance.

Before getting an unsecured card and being added as an authorized user, make sure you and the primary account holder have agreed on whether or not to use the card you receive.

Further, you should determine this ahead of time because any charges that you make will be their legal responsibility, even if you agree to pay them.

Credit card issuers report your balance and payments every month to credit bureaus. So, even if you don’t receive a physical card, it affects your credit in the same way.

If you don’t meet the requirements for credit cards on your own, having an authorized user status on a cardholder’s account might be beneficial to your credit history and “payment history,” a credit scoring component.

It may cut the time it takes to get a FICO score—one of the most common credit-scoring models—down to less time if you don’t already have one used by credit reporting agencies to mark your creditworthiness. Further, it might also get credit cards in your hands sooner than later.

Related: 9 Best Credit Cards for No Credit History [Starter Credit Cards]

Authorized User vs. Joint Credit Card vs. Co-Signer

Authorized users are not responsible for paying the balance due on an account, while joint accounts assign equal responsibility to all account holders.

A co-signer differs from a joint cardholder because they provide financial backing to someone who applies for a card from credit card issuers.

Co-signers can help a loved one get approved for a card, especially if they want to help them build or rebuild their credit. Further, co-signers can help with getting more favorable card terms than applying alone without stellar credit.

Co-signers only carry responsibility for making payments if the original cardholder fails to make a payment. If the primary account holder can’t afford to pay, it becomes the duty of co-signers to submit payment for a debt owed on the card.

This is why a co-signer wants to ensure the primary cardholder can handle the responsibility before agreeing to co-sign.

Related:

- Best Prepaid Debit Cards for Teens & Families [Reloadable]

- Best Free Debit Cards for Kids & Teens [Earn, Spend & Save]

What is a Credit Score?

A credit score is a number that predicts how likely you are to repay borrowed money.

It’s a three-digit numerical representation of the information in your credit report, managed by credit bureaus like Equifax, Experian, and TransUnion.

This score ranges from 300 to 850 under the FICO scoring system, with lenders looking at these numbers when deciding whether or not to approve potential loans.

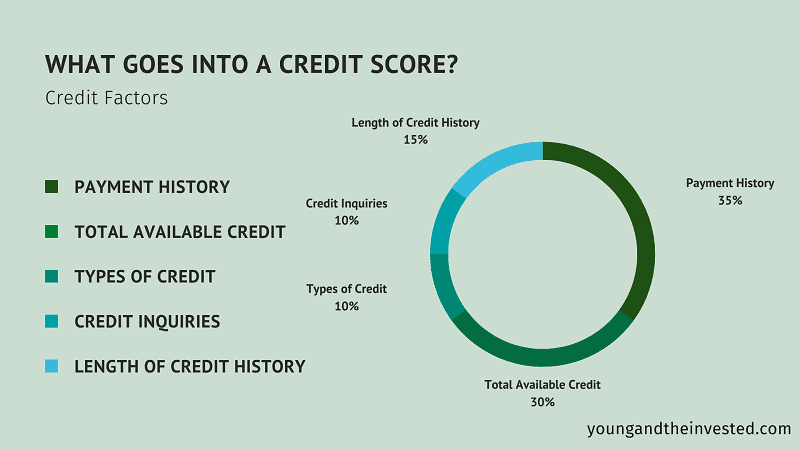

The most critical factor in determining your credit score is payment history, accounting for about 35% of the total. The other most significant factors are amounts owed (30%) and length of credit history (15%).

Balances on different types of loans make up less than 15%, while new account activity only contributes about ten percent.

Building good credit doesn’t happen overnight, as it measures your ability to manage loans and lines of credit wisely and responsibly over time.

Related:

- How Old Do You Need to Be to Get a Credit Card? [Minimum Age]

- How Old Do You Have to Be to Have or Open a Bank Account?

What Goes into a Credit Score?

1. Payment History

Making timely payments is essential for your credit score, representing as much as 35% of your total FICO score.

Missing one payment can harm your credit score, though it shouldn’t ruin it entirely.

Why such a significant impact? Lenders want to assess your ability to repay debts promptly, meaning you pay what you agree to pay when you agree to pay it.

Do this consistently and over long periods, and you will see your credit score increase.

Because of the outsized importance of this credit factor, staying on top of payment due dates and amounts becomes a necessity to build credit.

Keep track of when payments must go to creditors by setting up automatic payments where possible.

Setting your bills on auto-pay can save not only time for individually initiating each payment but also the headache of being late and dinging your credit score.

2. Total Available Credit / Credit Utilization Ratio

Your credit usage, especially concerning your available credit, can determine your credit rating as well.

The metric used to measure this credit usage, called the credit utilization ratio, is calculated by dividing your outstanding revolving credit balances by your total available revolving credit balances.

This ratio provides valuable insight to creditors about how you use credit.

Lenders want to know how much credit you are using, especially how much credit is available.

A high credit utilization ratio (above 30%) will likely hurt your credit score, while a low one (below 20%) may help it or not have any effect at all on your credit rating.

This accounts for 30% of your credit score.

3. Length of Credit History

Lenders want to see how long you’ve had credit and how well you’ve handled while open. This credit factor can determine 15% of your FICO score by evaluating the average age of your open lines of credit.

All things equal, longer average credit histories result in better credit scores.

4. Types of Credit (Diversity or Mix of Credit Lines)

Not only do lenders care about your history and your ability to make timely payments (both huge credit factors), but they also like to see a diversity of good credit opportunities you’ve had in the past and maintain today.

This means having several credit accounts, managing your credit limit responsibly, and maintaining an excellent payment history.

Children won’t have many opportunities to have a wide array of credit lines, but they don’t need these just now. Instead, they can start with a single line of credit as an authorized user through a family member’s existing or new credit line.

If teenagers start building credit now, this new line of credit will still help them in the long run so long as the account remains open.

5. Credit Inquiries (New Attempts to Access Credit)

Creditors also want to see how often you seek new credit. Regularly going after financing may indicate an increased risk because you constantly seek new forms of financing to make your finances stay afloat.

Whether true or not, this can still serve as a red flag on your score, potentially hurting your credit if done too often.

These pulls on your credit, called hard inquiries, stay on your report for two years or longer, depending on the type of inquiry.

A child or person with a thin credit file shouldn’t worry too much about this, as any inquiry that hits their report now will likely fall off before they need it.

At this age, the child wants to establish credit and slowly build their credit limit through having wise credit use and more extended credit history.

Related: Best Debit Cards for Kids

![9 Best Banking Apps for Kids & Teens [Kid + Teen Banking] 16 banking apps for kids and teens](https://youngandtheinvested.com/wp-content/uploads/banking-apps-for-kids-and-teens.jpg)

![7 Best Teen Checking Accounts [Banks for Teens] 18 best teen checking accounts](https://youngandtheinvested.com/wp-content/uploads/best-teen-checking-accounts.jpg)