Layoffs are often sudden and expected, and as a result, they often leave people in at least a temporary financial lurch.

You might start sending out resumes hours within losing your job, and you might file for unemployment benefits the very next day. Still, even if you do everything “right,” it might be a while before you have a new stream of cash flow—and in the case of unemployment, that cash flow might not be enough to fulfill your obligations.

That lack of cash flow can have you start looking at all of your available options, and it might not be long before you consider dipping into your retirement savings.

Today, I’ll discuss the ins and outs of dipping into your retirement savings before you retire—and more specifically, before you hit a critical age threshold. Early withdrawals have some significant drawbacks … but you also have a few ways of limiting the damage.

Featured Financial Products

How Dipping Into Retirement Savings Early Can Hurt You

The appeal of tapping into your retirement savings in a pinch is pretty obvious. If your cash flow has dried up, and you have a substantial sum saved in accounts you otherwise wouldn’t plan on touching for decades, it’s perfectly logical that you would consider using some of that money to tide you over until you get back on your feet.

However, that shouldn’t be your Plan A. Early withdrawals from tax-advantaged retirement accounts can have some severely negative consequences.

Early Withdrawal Penalties

Traditional individual retirement accounts (IRAs), traditional 401(k)s, and equivalent accounts allow you to save money free of any tax consequences until you withdraw funds once you’re near or in retirement. Once you withdraw those funds, you pay normal income taxes on that money.

However, if you withdraw those funds earlier than age 59½, you’ll not only have to pay income taxes, but an additional 10% penalty. A few exceptions apply—for instance, the penalty can be waived if funds withdrawn from IRAs and SEP plans are used to pay health insurance premiums while unemployed—but for the most part, you’re simply out that extra 10%.

Early withdrawal penalties on Roth IRAs

Roth IRAs and similar accounts work a little differently.

Contributions to a Roth IRA can be withdrawn at any time without penalty or taxes (because you contributed on an after-tax basis). However, if you withdraw earnings before age 59½, you’ll have to pay taxes and a 10% penalty on that withdrawal unless it falls under one of several exempt situations.

Potentially Higher Tax Costs

If despite your job loss, you still end up being in a higher tax bracket than what you’ll be in during retirement, that means you’ll also be eating higher tax costs on your withdrawals.

For instance, you might be in the 24% tax bracket now, when you take the withdrawal, but only be in the 22% or even 12% tax bracket by retirement. (Assuming the tax brackets don’t materially change by then.)

Lost Opportunity Cost

Yes, you’ll pay income tax no matter when you withdraw funds. But if you withdraw funds when you’re, say, 30 or 40, you’re also losing the earnings those funds would have generated for the next 20 to 40 years until you retire.

Example

You’re 40. You’re single. You’re laid off during the second half of 2025.

You have earned $48,475 from your job in 2025, some of which would be taxed at 10%, and some of which would be taxed at 12%.

However, you withdraw $30,000 from your traditional 401(k) to cover various expenses. This pushes you up to $78,475 in income, and all of that $30,000 falls within the 22% tax bracket. Plus, you would owe a 10% penalty. Lastly, you’d lose out on any potential earnings that would’ve been generated by that $30,000.

Assuming you plan to retire at age 65, and your investments average an 8% annual return until then, here’s what you would lose:

- Income tax: $6,600

- Tax penalty: $3,000

- Opportunity cost of $30,000: $175,454.26

In other words, one way or another, that $30,000 withdrawal cost you an additional $185,000 long-term.

For some retirees, losing that amount of money could result in something as drastic as retiring a few years later than planned.

Related: How Long Will My Savings Last in Retirement? 4 Withdrawal Strategies

What Are the Best Ways to Take Early Withdrawals?

Of course, while taking early withdrawals from a retirement account isn’t ideal, it’s sometimes the least-bad choice. If taking a withdrawal will keep you from losing your home or fund necessary medical expenses, for instance, you might just have to plug your nose and go through with it.

But if you do need to take an early withdrawal, be strategic about it. There are several carve-outs that allow people to avoid 10% penalties based on certain circumstances.

Let’s take a look.

Featured Financial Products

Know the 10% Penalty Exceptions

If you have a qualified plan (401(k), 403(b), 457, etc.) or another retirement plan, such as an IRA, SEP, SIMPLE IRA, or SARSEP, there are some withdrawal situations that are exempted from the 10% tax penalty.

Reaching age 59½ is the most obvious of those exemptions. However, others include:

- Up to $5,000 per child for qualified birth or adoption expenses

- Up to $10,000 toward expenses for qualified first-time homebuyers

- Up to $22,000 to qualified individuals who sustain an economic loss by reason of a federally declared disaster where they live

- Any health insurance premiums paid while unemployed (only applies to IRAs, SEPs, SIMPLE IRAs, and SARSEPs)

These exceptions only apply to the penalty; you’ll still owe applicable taxes.

Also, when it comes to IRAs and a few other accounts, you can repay withdrawn funds to that account (or another qualified account) within 60 days to avoid tax liabilities and penalties alike. Just note that this is an extremely risky financial maneuver, especially if you’ve just been laid off and have no certain way of raising the funds to repay them.

You can read the full list at IRS.gov.

Related: Financial Prep If You’re Worried About Being Laid Off

Take a Hardship Distribution (If Eligible)

Some workplace retirement plans allow participants to take hardship distributions, which aren’t subject to the 10% penalty.

The IRS’s primer on hardship distributions states that a withdrawal only counts as a hardship distribution if you have an “immediate and heavy financial need” and the withdrawal can only be the “amount necessary to satisfy that financial need.”

Whether your situation meets those standards depends on your specific plan’s terms. However, there are “safe harbor” distributions that automatically qualify. These include the following:

- Medical costs for the worker, their spouse, dependents or beneficiary

- Expenses directly related to the purchase of one’s principal residence (excludes mortgage payments)

- Some costs to fix damage to a primary residence

- Payments to prevent eviction from a primary residence or foreclosure on the mortgage

- Tuition and some related costs for the employee, their spouse, child, dependent, or beneficiary (limited to the next 12 months)

- Funeral costs for the worker, their spouse, children, dependents, or beneficiary

In addition to only withdrawing the amount necessary to satisfy a qualifying financial need, you might be limited in other ways. Hardship distributions can usually only be made from elective deferrals, employer nonelective contributions, and regular matching contributions. Earnings on elective deferrals generally aren’t allowed.

Same as with the 10% penalty exceptions, hardship distributions only eliminate the 10% penalty, but not the income tax liability. Also, you cannot repay that money.

Related: What Are the Average Retirement Savings By Age?

Use the Rule of 55 (If Eligible)

If you’re at least 55 years old (or at least age 50 and a public safety employee, such as a firefighter or EMT), you might be eligible to withdraw from a 401(k) or equivalent workplace account through the “Rule of 55.”

The Rule of 55 allows you to start taking distributions from your 401(k) without the early withdrawal penalty if you have lost or left your job during or after the calendar year in which you turn 55. Taxes will still apply, of course, just like they would if you were age 59½ or older—you’re just dodging the penalty.

This rule only applies to workplace accounts; IRAs, for instance, wouldn’t qualify. However, the Rule of 55 isn’t limited to traditional qualified workplace accounts—it also applies to Roth workplace accounts. While you can withdraw contributions from your account without taxes or penalties, the earnings portion of your withdrawal would be subject to taxes and the 10% penalty … and the Rule of 55 would exempt you from that penalty.

Also, the Rule of 55 only applies to the account you were contributing to when you were laid off. You can’t tap into an older 401(k) or a traditional IRA. And if you roll that employer plan into an IRA, the Rule of 55 ceases to apply.

Lastly, you don’t have to retire to take advantage of this rule. You’re welcome to get a new job and are even allowed to keep taking penalty-free distributions while you work elsewhere. However, even if you’re able to avoid the 10% penalty, it’s generally recommended to only withdraw what you need for essentials. Depleting your account balance still limits its future growth potential.

Related: Tax Implications of Getting Laid Off

Use Rule 72(t) (If Eligible)

Rule 72(t) is another way eligible people can take penalty-free withdrawals from retirement accounts.

Unlike the Rule of 55, this rule works for IRAs as well. Also unlike the Rule of 55, Rule 72(t) doesn’t have a minimum age requirement.

Rule 72(t) does require you to receive at least five substantially equal periodic payments (SEPPs) or adhere to the payment schedule until age 59½ (whichever is longer), and you don’t get to choose the payment amount—they’re determined by one of three methods that account for your life expectancy and a couple of other factors.

Rule 72(t) shares the same major downside as the Rule of 55. Although it offers you penalty-free income now, it hurts your retirement savings in the long run. Still, it’s useful for anyone whose financial situation necessitates withdrawals as it lets you skip the penalty.

Related: Is It Better to Pay Off Your Credit Card or Keep a Balance?

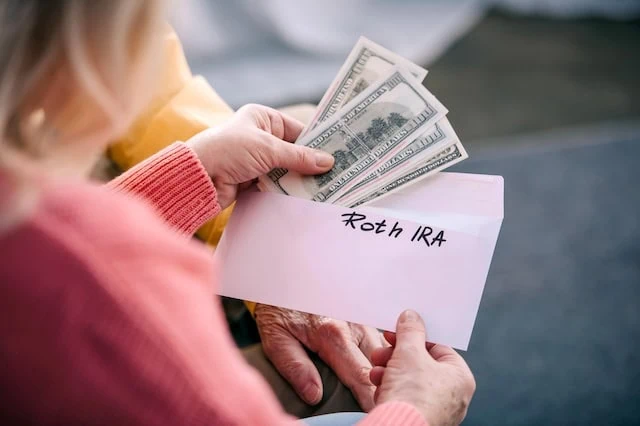

Withdraw From a Roth IRA First

Is one of your retirement accounts a Roth IRA? Has the account been open for at least five years?

If you answered yes to both of those questions, it likely makes sense to withdraw from your Roth IRA, rather than a tax-deferred account, if you need money to tide you over after a layoff.

That’s because, as a Roth IRA is funded with after-tax dollars, contributions can be withdrawn at any time without being subject to taxes and penalties.

If you’re younger than 59½, the earnings portion of your withdrawal will be taxed, and if your account hasn’t been open for at least five years, you’ll also face a 10% penalty on that portion. (Again, some exceptions apply.) Still, that’s a lot better than the hit you’d take on a 401(k) or traditional IRA withdrawal, as the entirety of that withdrawal would be subject to taxes and penalties.

Related: What to Do With Your 401(k) When You Retire

What About My Emergency Fund?

Do you have an emergency fund? This is exactly the type of situation they’re meant for, so you should feel free to use it if you’re laid off to cover your essential expenses.

If your emergency fund is held in a standard savings account or money market account, you almost certainly will not incur a withdrawal penalty. Today, many high-yield savings accounts have no limits on the number of withdrawals, and even if your account does have a limit, it should be easy to remain within it.

If your emergency fund is held in a certificate of deposit (CD), you likely will absorb an early withdrawal penalty—that will range from a few months’ to a year’s worth of interest—but that likely still would better than tapping a tax-advantaged retirement account.

Sometimes, people are reluctant to use their emergency funds because they fear an even bigger emergency may be just around the corner. Avoid the temptation to hoard your emergency fund. If an expense is urgent and necessary, such as paying rent after a layoff, it makes sense to use your savings before taking on high-interest debt or dipping into a retirement account.

Featured Financial Products

Related: How to Invest for (And in) Retirement: Strategies + Investment Options

![Should You Max Out Your 401(k) Each Year? [Yes...and No] 20 should you max out your 401k each year or invest elsewhere](https://youngandtheinvested.com/wp-content/uploads/should-you-max-out-your-401k-each-year-or-invest-elsewhere-600x403.webp)