Being a successful stock picker isn’t impossible, but it sure ain’t easy.

Professional stock picking and portfolio management are like many other professions: You don’t pick it up in a day. It takes years of education, practice, and experience to become competent at it—and even after all that, you still need to put in the time to keep your skills sharp.

Only a handful of people have the time, aptitude, and interest to become skilled and utterly independent stock pickers. But most of us simply don’t—we either need a helping hand, or a lot more. And that’s why many investors gravitate toward the likes of Seeking Alpha and Motley Fool.

Seeking Alpha and Motley Fool are two of the best-known investing resources you’ll come across. They offer a wealth of information for free—but at their hearts are powerful paid subscription products that scores of investors rely on when building their portfolios.

And if you’re here spending a little time with me, that means you’re wondering which of the two services makes the most sense for you.

Today, I’ll pit Motley Fool vs. Seeking Alpha. I’ll explain what each company’s core services provide to investors, how much they cost, where they fall short—and most importantly, who can get the most out of them. You see, all of the services I’m about to discuss are rated extremely well in my book, but you won’t maximize their value unless you pick the best fit for you.

Table of Contents

What Is Seeking Alpha?

Seeking Alpha is a crowdsourced platform for investors, by investors. Rather than just reading opinions from “sell-side” analysts, the Seeking Alpha website provides access to a variety of views from thousands of professional and amateur contributors alike, served up to a community of millions. It also contains a wealth of other vital information for investors, including fundamental data, stock screeners, breaking news, corporate conference call transcripts, and more.

Seeking Alpha has a free Basic tier that simply requires an email registration. With that, you get a few perks—the ability to look up stock prices and Seeking Alpha charts, get real-time alerts for stocks, and read news. You also get extremely limited access to SA’s contributor content (one free Premium article).

I’ve used the free side of Seeking Alpha several times, and if you have no money, it’s better than nothing. But to get the most of Seeking Alpha, you need to dive into one of its two core paid plans:

- Seeking Alpha Premium is an economically priced plan that offers just about everything that intermediate and advanced investors could want, whether they prefer to do their own research or receive stock recommendations. If you navigate across our site, you’ll see that Seeking Alpha Premium is among our top choices in several investing service categories.

- Seeking Alpha Pro is a costlier and higher-end product, primarily geared toward advanced investors, that includes everything within Premium, as well as exclusive content and trading ideas.

Of course, you’ll want to know a lot more than that. So let’s dive further into what you get with these two foundational Seeking Alpha plans.

What Comes With a Seeking Alpha Paid Plan?

Here’s what you get from each of Seeking Alpha’s two core plans: Premium and Pro.

Seeking Alpha Premium

Seeking Alpha Premium naturally comes with all the features of the Basic plan, while unlocking all Premium content and adding in a host of other benefits.

With a subscription to Seeking Alpha Premium, you can expect the following:

- Unlimited access to Premium content

- Premium investing ideas

- Recordings and transcripts of earnings and other event conference calls

- Financial statements (with multiple views) going back up to 10 years

- Performance tracking

- Alerts about upgrades and downgrades on stocks in your portfolio

- And more

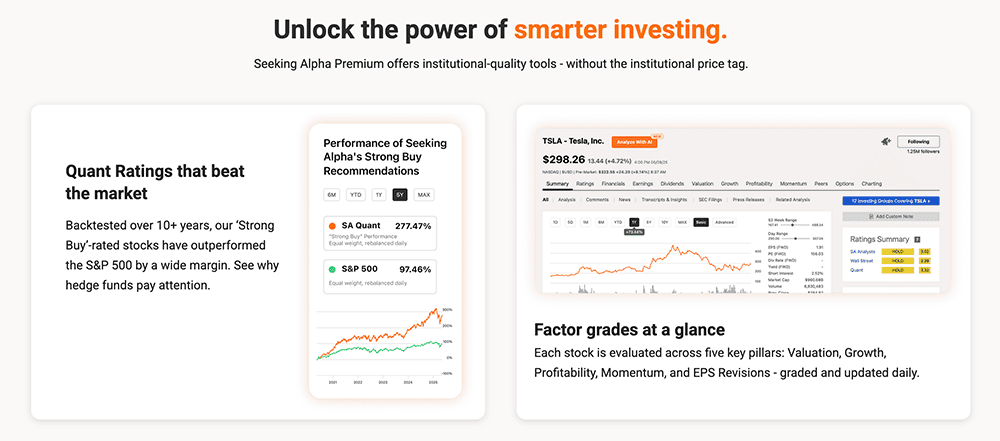

- Stock Quant Ratings

- Compare a stock’s value, growth, profitability, and more to its peers

- Factor Scorecards for stocks, real estate investment trusts (REITs), and ETFs

- Enjoy easy-to-understand grades (A+ through F) detailing value, profitability, growth, momentum, and EPS (earnings per share) revisions.

- I’ve worked with a number of data providers that only provide net income and EPS figures for REITs, and those figures don’t tell the whole profitability story for real estate stocks. But Seeking Alpha provides data and ratings for funds from operations (FFO) and adjusted funds from operations (AFFO), which are much more appropriate metrics.

- Exclusive stock and ETF Dividend Grades

- Dividend Growth Grade

- Dividend Safety Grade

- Dividend Yield Grade

- Dividend Consistency Grade

- Seeking Alpha Author Ratings

- See what SA contributors think about potential stock picks

- Seeking Alpha author and article performance

- See which authors tend to make the most accurate predictions

- Personalized alerts

- Synchronize with brokerage accounts (Basic members have to manually enter individual stocks to track)

- View holdings across several brokerages to track your total account value and gain useful insights

- Ad-free experience

A Seeking Alpha Premium account simply has much deeper research capabilities than a Basic account. And if you want to use Seeking Alpha for stock recommendation purposes at all, Basic can’t get you there—at a minimum, you need Seeking Alpha Premium.

Seeking Alpha Pro

Seeking Alpha Pro doesn’t just give you more—it also helps you sort through the best of what’s already there. So it includes not only Seeking Alpha Premium features, but also:

- Instant access to investment ideas from Seeking Alpha’s top 15 analysts, including

- The PRO Quant Portfolio for active traders (delivers new high-conviction ideas weekly)

- Exclusive coverage of stocks that have no Wall Street analyst coverage

- Exclusive access to short-selling ideas from SA analysts

- Easy, real-time access to the day’s upgrades and downgrades

- Top-shelf customer service

Seeking Alpha Pro is a powerful subscription product—one ideal for more active investors, professional investors, and/or high-net-worth (HNW) investors.

If you’re a more casual investor, Seeking Alpha Premium is likely the better fit for you.

How Much Do Seeking Alpha’s Paid Plans Cost?

Seeking Alpha’s Basic plan, as mentioned before, is free (all you do is register with an email address), but it provides extremely limited access to SA’s resources.

Seeking Alpha Premium typically involves a discounted one-month trial, then the subscription begins at the regular price (currently $299 per year). You will receive a reminder email a few days before the discounted trial is set to end. SA will occasionally offer promotional rates on Premium.

However, if you sign up with our exclusive link, you’ll usually receive promotional benefits. Currently, that includes a free one-week trial of Premium, as well as a discounted first-year subscription rate.

Seeking Alpha Pro, which you can sign up for here, involves a discounted one-month trial, then the subscription begins at the regular price (currently $2,400 per year). Again, you’ll receive a reminder a few days before the trial ends. SA will occasionally offer promotional rates on Pro.

- Seeking Alpha Premium and Pro help you find profitable investing ideas, improve your portfolio, research stocks better and faster, track the news to find investing opportunities, and connects you to the world's largest investing community.

- A Premium subscription provides access to Seeking Alpha's stock and ETF ratings, including Seeking Alpha Quant Strong Buy recommendations, which have greatly outperformed the stock market over time.

- Premium also gives you access to Seeking Alpha's portfolio health check, which will analyze your portfolio's quality, risk level, and performance.

- Advanced and professional investors can sign up for Pro, where they'll get everything from Premium, as well as instant access to ideas from SA's top 15 analysts, the PRO Quant Portfolio (for active traders), short-selling ideas, and more.

- Black Friday deal on Premium: New subscribers through our link receive a $60 discount off the price of Seeking Alpha Premium in their first year.*

- Black Friday deal on Pro: New subscribers through our link receive a $480 discount off the price of Seeking Alpha Pro in their first year.**

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

- Minimal mutual fund coverage

Related: Seeking Alpha Premium + Pro Review

What Is Motley Fool?

The Motley Fool has helped millions of investors outperform the stock market with a variety of investment recommendation services.

The Motley Fool has a long and sterling history within the investment recommendations community. It started out as an investment newsletter in 1993, and a year later, the founders brokered an online content deal with AOL, where The Fool’s content lived until moving to its own site in 1997.

The company has since gained acclaim through Fool.com and its Motley Fool stock picking services. And today, I’m going to talk about the two most popular services: Motley Fool Stock Advisor and Motley Fool Epic)

What Is Motley Fool Stock Advisor?

Motley Fool Stock Advisor, started in 2002, is the company’s signature stock picking service. It does the grunt work of researching stocks for you. The service’s advisors usually lean on well-known, not-too-volatile companies that they believe can beat the stock market. Each pick has a long term bent, with an expected holding period of at least five years.

The Motley Fool Stock Advisor service provides monthly stock picks from two investing teams: Team Everlasting and Team Rule Breakers.

Per Motley Fool, Team Everlasting looks for:

- “High-quality companies that have the sustained potential to keep growing and beat the overall market over extremely long periods”

- “Founder-led companies”

- “Companies employing a strong corporate culture”

- “Businesses that have built a strong enough bond with their customers that they command substantial pricing power and have identifiable proprietary advantages”

- “Cash-rich, low-debt companies”

And Team Rule Breakers looks for:

- “First-mover companies in emerging, but important industries that have become the top dogs in their niches”

- “Companies with sustainable competitive advantages”

- “Sizable past increases in share prices”

- “Companies with good management teams”

- “Businesses with strong consumer appeal that have built up brand awareness”

- “Stocks that are grossly overvalued according to mainstream financial media sources”

What Comes With a Motley Fool Stock Advisor Subscription?

The Motley Fool’s Stock Advisor service offers much more than stock picks—it also provides community and investment resources. The whole package includes:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

How Much Does Motley Fool Stock Advisor Cost?

Motley Fool Stock Advisor is usually priced at $199 per year, with a 30-day full membership-fee-back guarantee.

However, if you sign up using our exclusive link, you’ll typically receive a deep discount on your first year of Stock Advisor. Currently, that’s a 50% discount to $99 for your first year, after which you’ll pay the regular $199 annual price.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Related: Motley Fool Review: Is Stock Advisor Worth It? [Our Take]

What Is Motley Fool Epic?

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually.

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses.

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing income from the best dividend stocks. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

What Comes With a Motley Fool Epic Subscription?

In addition to the services mentioned above, an Epic subscription also comes with …

- Monthly stock picks: Five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

- Access to Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- Access to GamePlan+: GamePlan, which comes with Stock Advisor, is a hub of financial planning content and tools. GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Access to Epic Opportunities: A members-only podcast.

How Much Does Motley Fool Epic Cost?

Motley Fool Epic is a much wider-ranging service than Stock Advisor, and its price reflects that. It’s typically priced at $499 per year, again with a 30-day full membership-fee-back guarantee.

But again, if you sign up using our exclusive link, you’ll typically receive a deep discount on your first year of Epic. Currently, that’s a 40% discount to $299 for your first year, after which you’ll pay the regular $499 annual price.

- Motley Fool's Epic is a discounted combination of four foundational stock-investing services rolled up into one membership.

- Get access to more than 300 recommendations, reports, and analyses across the Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor services.

- Get at least five new stock recommendations every month,

- Membership also unlocks GamePlan+ financial planning content and tools, Fool IQ+ stock research tool, a members-only podcast, and more.

- Limited-Time Offer: Get your first year with the Epic for $299 (vs. $499 usual value)—a 40% discount for new members!—by clicking our link and using the EPICSALE coupon code.*

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- Diversified array of recommendations for investors targeting growth, income, or both

- Additional value from GamePlan financial planning content and tools

- High renewal price

- Not every stock is a winner

Related: Motley Fool Epic Review

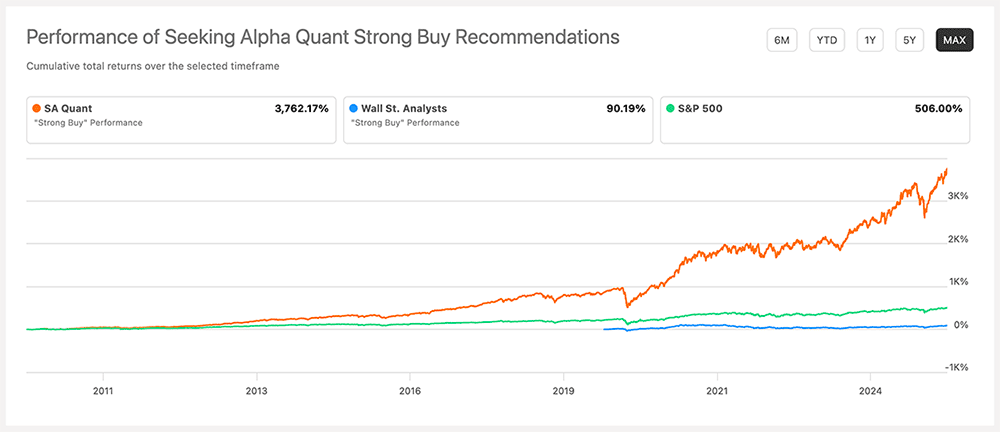

How Have Seeking Alpha’s Stock Picks Performed?

As mentioned above, a Seeking Alpha Premium subscription provides access to the service’s Stock Quant Ratings. The Quant Ratings involve an evaluation of each stock based on data such as financial statements, price performance, and analysts’ estimates of future profits and sales. All told, SA looks at 100 metrics for each stock, uses those metrics to compare it to all other stocks in the sector, then assigns ratings and associated scores. It also provides letter grades for five factors (value, growth, profitability, momentum, and earnings-per-share revisions).

The service’s Top-Rated Stocks collection, for instance, is a list of top-rated securities that have earned a “Strong Buy” or “Buy” rating from each of three sources: Seeking Alpha’s Quant System, independent analysts on Seeking Alpha, and Wall Street analysts.

All this attention to detail pays off, too. Have a look at the dramatic market outperformance seen by Seeking Alpha’s Quant “Strong Buy” recommendations compared to the S&P 500, as well as to stocks that enjoy “Strong Buy” ratings from Wall Street analysts:

How Have Motley Fool Stock Advisor Stock Ideas Performed?

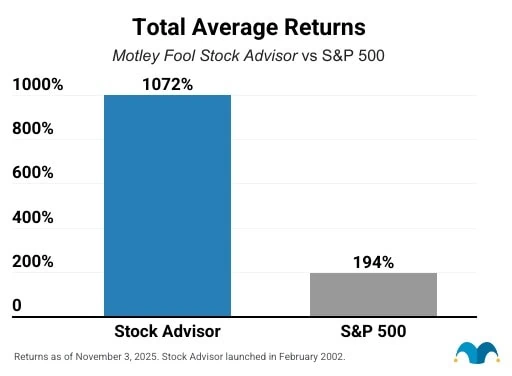

Stock Advisor stock picks have performed exceptionally well over the service’s 22-year existence. The service has made 190 stock recommendations that have historically delivered 100%+ returns.

Overall, the Motley Fool Stock Advisor stock subscription service has more than quintupled the return of the S&P 500 since Stock Advisor’s inception in February 2002 through Nov. 3, 2025. This number is calculated by averaging the return of all stock recommendations it has made over the past 23 years.

Examples of Stock Advisor recommendations include Amazon (AMZN, +30,558% since Sept. 6, 2002), Netflix (NFLX, +59,878% since Dec. 17, 2004), Walt Disney (DIS, +5,853% since June 7, 2002), and Nvidia (+116,472% since April 15, 2005). All performance numbers are as of Nov. 3, 2025.

Is Seeking Alpha Worth the Money?

A Seeking Alpha Premium subscription is absolutely worth the money as long as you have even a modest nest egg to invest.

What do I mean? Well, let’s say you have just $500 to invest. If Seeking Alpha costs $299 per year (at the regular rate), more than half your funds are going to what I’d call “research and management” costs. That’s simply too high as a percentage.

But if you’re at least dealing with a few thousand dollars—and especially if you already have more or plan to contribute more in the future—Seeking Alpha offers a compelling value proposition, on multiple fronts.

That’s because Seeking Alpha Premium makes it simple to find, evaluate, and monitor stocks in your portfolio—it can do virtually everything except execute trades, which you’ll need a stock app to do. It also has a leg up on many other data platforms in that it includes more REIT-specific data, and you can even evaluate ETF fundamentals through the platform.

But if you’d prefer to just lean on stock recommendations, you can always just screen for Seeking Alpha’s Strong Buy Quant picks and rely on them instead. It’s not quite the same as a traditional stock picking service—where one advisor or advisor team explains in narrative form why they’re recommending certain stocks—but Seeking Alpha’s picks still have an admirable track record.

I think intermediate and advanced traders can get the most out of Seeking Alpha Premium. While Seeking Alpha’s Pro benefits are alluring, most everyday investors can’t foot that bill—it’s only worth it if you have tens if not hundreds of thousands of dollars to invest with and want to take a very active role in your portfolio management.

Is Motley Fool Legitimate?

In a word: Yes. Motley Fool is a legitimate business. Stock Advisor is one of the most successful, long-running investment services I’ve reviewed, and Epic combines Stock Advisor with other high-value recommendation products.

In fact, I can tell you a little about Stock Advisor firsthand.

In grad school, I turned roughly $10,000 worth of contributions into $25,000 by investing in stocks either recommended by Stock Advisor, or that I learned about through the Motley Fool’s CAPS Community discussion board—one of the benefits of subscribing to one of the Fool’s services.

I followed the stocks regularly, and I always looked forward to reading the stock analysis for each recommendation. The Fool’s analysts laid out a compelling buy case—and clearly, the market agreed.

Simply subscribing to Motley Fool kept me more interested in the financial markets more broadly. Even that aspect helped turn me into a more educated, informed investor.

Just note that Motley Fool Stock Advisor and Epic are fundamentally different from what you’re getting with Seeking Alpha Premium + Pro. Which brings us to my conclusion …

Which Service Should You Consider for Picking Investments in the Stock Market?

Seeking Alpha and Motley Fool are both highly respected, trustworthy stock subscription services. And they both offer an abundance of resources to help you choose the best individual stocks to invest in.

Fortunately, they’re also fundamentally different products—making a decision pitting Motley Fool vs. Seeking Alpha a lot easier than you’d think.

Seeking Alpha Premium and Pro are more geared toward discovering stock ideas on your own and conducting your own due diligence through robust stock research and analysis. While you can use its rankings and grades like recommendations, there’s no single analyst or analyst team providing the theses for these stocks—you’re provided with quantitative grades, and you can read research about these stocks from the Seeking Alpha contributor community. That research, by the way, can include not just bull cases, but bear cases, too, which can be a valuable perspective to have when you’re trying to figure out what kind of risks you’re taking on.

Motley Fool’s Stock Advisor and Epic, on the other hand, are recommendation-focused. You are paying primarily for stock picks, which include detailed analyses of the companies that are mentioned. That said, Motley Fool did recently overhaul its subscription products to include more research tools such as Fool IQ, so it has improved in that respect. Also, while you do have access to some outside commentary—via Motley Fool’s CAPS Community—it’s not quite as extensive as the Seeking Alpha network. And most importantly, you’re not buying tools that can help you discover opportunities or conduct research on stocks outside of the Fool’s recommendations.

In a nutshell …

- Seeking Alpha is a better fit for more self-starting intermediate and advanced investors who want to explore the investment universe and find their own opportunities.

- Motley Fool, on the other hand, is better for beginning to intermediate investors who simply want to learn about stocks with market-beating potential so they can put them to use in their own portfolios.

Thinking about which to try? Seeking Alpha offers a true 7-day free trial through our link. You have to pay for Motley Fool up front, but you do get but get a 30-day membership-fee-back window to request a refund. Still, both offer a way to sample what each service has to offer before fully committing your money.

Whichever side you choose, though, rest well knowing you’re receiving an honest-to-goodness value.

Related:

![10 Financial Gifts for Babies, Kids & Grandkids [No More Toys] 24 best financial gifts children kids babies](https://youngandtheinvested.com/wp-content/uploads/best-financial-gifts-children-kids-babies-600x403.webp)

![7 Best Investments for Kids [Investing for Children] 25 best investments for kids 1](https://youngandtheinvested.com/wp-content/uploads/best-investments-for-kids-1-600x403.webp)