- Appears as one of the best budget deals available on the market

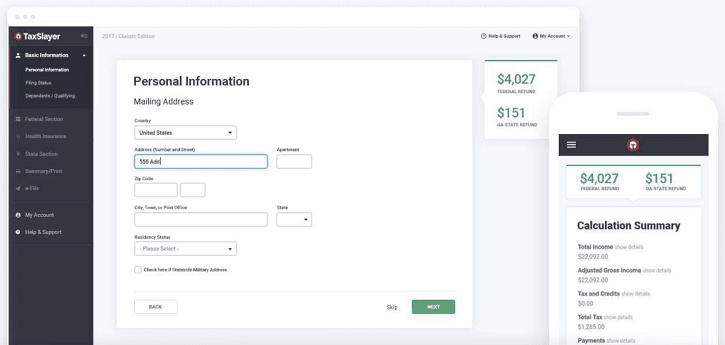

- Provides clean user interface and support options comparable to other providers costing twice as much

- Comes with less powerful/robust tax filing support than offered by some competitors

Table of Contents

TaxSlayer Review

If you have little experience preparing your tax return or can consider yourself a tax return veteran, TaxSlayer is a great option for you to consider. The service is a bargain compared with competitors though it does offer less-robust support. This, however, lowers the price and does not cost anything near the elite tax return software on the market. The software is best suited towards those with simple returns or experienced users who know their way around their tax returns.TaxSlayer Overview

This TaxSlayer tax software review will go over the most important things you need to know if you’re considering this product. TaxSlayer.com began as a company offering traditional tax preparation and filing services in 1998. Since its founding, the company has grown to offer tax returns and related services to millions of individuals annually each tax filing season. The service aims to give customers great tax software and technical support during tax season each year. It does so by combining affordability, an easy-to-use interface and support options – all at half the price of some competitors. Users receive free technical support through email and telephone while Premium and Self-Employed software version users may submit questions directly to tax professionals.TaxSlayer Pros –

- Affordable pricing compared to peers. TaxSlayer has better pricing options available than most other programs addressed during this tax software review. The software is easy to use and offers adequate functionality for the price you pay. The best value comes for single and married filers with no dependents. These individuals can file Form 1040 with limited deductions and credits and pay nothing.

- Offers free tax return knowledge base. As you proceed through your tax return, the program offers explanatory knowledge base to help you understand the part of your return being addressed. While more high-level in nature, they can be useful, easily understood explanations to provide direction on what each section of the tax return needs.

- Technical phone support available. If you have a technical question arise during your tax return preparation, you have access to phone support to answer your technical questions. If you have a tax-specific question, you must pay extra to speak with a tax professional to understand your problem and walk you through what you must do.

- Active-duty military members get TaxSlayer Classic for free. While they might get TaxSlayer Classic for free ($17 value), they must still pay for their state return ($29 per state). Under TaxSlayer Military, all tax situations and forms come as part of the service offering.

TaxSlayer Cons –

- Audit assistance available only with the most expensive options. The software offers audit assistance, not defense, in the event you receive an IRS letter which proceeds to an audit. However, these features only come standard in the Premium version of the software.

- Access to a tax professional only provided with Premium option. Despite TaxSlayer claiming they provide their customers with the best support, that support comes with a price tag. However, this remains true of all the tax software programs in the market.

TaxSlayer Review 2020, Packages and List Prices

| Package | Prices & Description |

|---|---|

Free edition | TaxSlayer's free federal version allows you to file a 1040 and a state return for free. Allows for a free, basic Schedule C preparation. This option works for people who don’t have complex filing situations and do not plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit. |

Classic | The Classic package allows for 1099 or W-2 income, itemized deductions and dependents. If you are a small business owner, have rental income, or investment gains/losses, you will need to purchase the top of the line Premium version. Comes with access to "Refund Advance" product. |

Premium | Nearly identical to Classic option but is a great option for people who want audit assistance and priority support for any questions they might have on their return. Comes with access to "Refund Advance" product. |

Self-Employed | Provides all functionality of the Premium version plus added deduction help for business owners and people who want self-employed tax assistance. Also provides streamlined experience for side-hustlers and independent contractors. Comes with access to "Refund Advance" product. |

Pay with Your Refund

TaxSlayer offers a useful feature which can reduce out-of-pocket expenses. Instead of paying upfront for the software, you have the ability to pay with your tax refund. This makes for more financial flexibility because it avoids expenses hitting your credit or debit card now.Refund Advance

TaxSlayer offers a TaxSlayer Prepaid Visa Card, allowing you to apply your tax refund directly to the card once you e-file. The service offers two loan amounts; $500 and $1,000, depending on your needs. The loans can hit the Prepaid Debit Card in as little as 24 hours after applying. Specifically, their website claims you pay no upfront fees nor interest on the refund advance loan product. To secure this loan (and reduce TaxSlayer’s risk for offering this product), TaxSlayer deducts the tax preparation and refund transfer service fees from any federal tax refund amount issued by the IRS. TaxSlayer boasts you may apply for its Refund Advance loan and receive money without ever leaving home.Offers to Buy U.S. Savings Bonds with Your Refund

Another option for your tax refund includes the ability to purchase U.S. Savings Bonds through TaxSlayer. Specifically, the available options for your refund include: applying for a Refund Advance Loan on a Prepaid Visa Card, direct depositing your refund into your bank account, receiving a check, or purchasing U.S. Savings Bonds in your name.Import Previous Year’s Refund

If this is your second consecutive year using TaxSlayer to prepare your refund, you can import your tax return from the prior year and have many of your fields automatically populate. This saves you time and hassle. The site says you are able to upload a tax return from another tax service when attempting to import last year’s tax return information.Assistance with IRS Notices for 1 Year

TaxSlayer says they will work with you to resolve IRS inquiries regarding your federal and state return for up to one year after the IRS accepts your e-file. Further, they guarantee 100% accurate calculations when preparing your return.How TaxSlayer Compares

| Pricing Options* | Import Return into Tax Software? | Service & Support | Audit Assistance | |

|---|---|---|---|---|

TurboTax TurboTax | TurboTax: Deluxe: $39 Premier: $89 Self-Employed: $129 (+$39/state for DIY) TurboTax Live Assisted (Full Service): Basic: $0 ($169) Deluxe: $89 ($219) Premier: $139 ($329) Self-Employed: $169 ($359) (+$49/state for Live Assisted / Full Service) Simple tax returns free | Yes; may import PDF of return from previous software | 24/7 live support | Provides basic audit support for all returns and personalized audit assessment with Premier |

H&R Block | Basic: $25 Deluxe + State: $49 Premium: $75 Premium & Business: $89 (+$39.95/state) (Deluxe + State, Premium, and Premium & Business include 1 state) Simple tax returns free | Allow for a W-2 photo import; can import previous year’s return information from H&R Block on all non-free versions | Phone and live chat; in-person assistance at branch network | Peace of Mind®, In-person audit support |

TaxAct | Deluxe: $24.99 Premier: $34.99 Self-Employed: $64.99 (+$39.99/state for Free; $44.99 for Deluxe, Premier and Self-Employed) Simple tax returns free | Yes, may import last year’s tax information or third-party software information. May import PDF files of IRS forms from TurboTax and H&R Block | Live support via phone call after submitting help request | Audit Defense services |

TaxSlayer | Classic: $22.95 Premium: $42.95 Self-Employed: $52.95 (+$39.95/state) Simple tax returns free | May upload PDF of previous year’s return; pulls in data automatically if used TaxSlayer previous year | Email or phone, FAQs, video tutorials, definitions of key terms. Priority support for Premium an Self-Employed plans | Audit protection included in Premium and Ultimate plans |

eFile | Deluxe: $20.99 Premium: $37.49 (+$22.49 for each additional state return) Simple tax returns free | No | None displayed | |

Cash App Taxes | Free, no fees | No | Support Library, no live support offered | Provided |

| * Prices subject to change; consult individual sites for most accurate and updated pricing. | ||||