Whether you distrust big banks, want a more lucrative place to store your money, or desire features you haven’t found in banks, you’re in luck. If you don’t want to store your money in a traditional bank, there are plenty of alternatives that can keep your cash secure.

Today, I want to discuss the best options for where to keep your money other than a traditional bank. I’ll go over the pros and cons for each alternative, and you’ll find that some of these options offer great perks in addition to safety.

Whether you want to take all of your money out of a traditional bank, or you like your bank but want to store some of your money elsewhere for a strategic reason, read on.

Why Wouldn’t You Want to Store Your Money in a Bank?

Some people choose not to keep their money in a traditional bank for a plethora of reasons.

To start, a different financial institution, such as an online-only bank, may offer more financial flexibility and better tools. Often, credit unions and other bank alternatives provide better rates on loans to finance big purchases, such as auto loans and mortgages. And many people also choose not to put all of their money in checking and savings accounts because other types of financial products and accounts can be more fruitful ways to grow their savings.

Best Places to Keep Your Cash Other Than a Traditional Bank

Where you might want to stash your extra cash will largely boil down to why you want to avoid a traditional bank. So, the following list of alternatives is designed with several different reasons in mind—that means there’s something here for just about every use case.

1. Treasury Bills

Just as many consumers and businesses do, the U.S. government borrows money to make ends meet. It does so through the U.S. Treasury, which issues three primary kinds of debt:

- Treasury bonds (T-bonds): Mature in 20 to 30 years

- Treasury notes (T-notes): Mature in two to 10 years

- Treasury bills (T-bills): Mature in 4 to 52 weeks

Treasury bills—which can have maturities of four, eight, 13, 17, 26, and 52 weeks—are sold in increments of $100 (which is also the minimum purchase amount), up to a maximum of $10 million. You can typically purchase these through the U.S. government’s Treasury Direct website or through a bank or broker.

When you buy a T-bill, you lend money to the U.S. government for a specified period of time. The price for a T-bill will vary, but typically will be below the bond’s face value, or “par value.” (For instance, a $1,000 T-bill might cost $975 to purchase.) When the T-bill matures, you receive the full par value of the bond—so the return on your investment is the difference between the discounted price you paid at auction and the par value of the T-bill.

Treasuries are one of the most secure investments in the world due to their virtually guaranteed repayment—the federal government hasn’t defaulted on a debt payment since moving away from the gold standard in 1971.

When you receive the repayment of your T-bills’ face value, the income generated is exempt from state and local taxes, which can make them a good choice for investors looking for reliable, tax-advantaged income.

Invest With Public.com

Public.com, an investing platform that allows you to invest in stocks, ETFs, crypto, and alternatives, has launched a product that allows you to invest in Treasury bills.

This investing product allows you to earn a higher yield than even the most competitive rates on high-yield savings accounts—with equal accessibility to your cash. That is, you can tap your balance anytime; you don’t have to wait for your T-bill holdings to mature.

To participate, you’ll need to open an account with Public.com and make a deposit of as little as $100. The Treasury product is offered through Public by Jiko Securities, Inc., a registered broker-dealer, member FINRA and SIPC.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Lock in a 6% yield with Public.com's Bond Account, which allows you to invest in a diversified portfolio of investment-grade and high-yield bonds.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Special offer 1: Receive up to $10,000 when you transfer your investment portfolio to Public.**

- Special offer 2: Receive an uncapped 1% match on transfers into a Public IRA.

- Fractional shares

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

Related: The 7 Best Mutual Funds for Beginners

2. Credit Unions

Credit unions are member-owned, not-for-profit financial institutions. They are often highly involved in a local community and are known to provide excellent customer service.

These financial institutions are just as safe as banks. Credit unions have their own equivalent to the Federal Deposit Insurance Corporation (FDIC), which is the National Credit Union Administration (NCUA). The NCUA insures the money in each credit union member’s account up to $250,000.

Credit unions offer all the functions you’d expect from a bank, such as direct deposit, mobile pay, loans, and much more. But because credit unions don’t have shareholders to pay, they can offer their members better terms on loans and more competitive rates on savings accounts.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

3. Online Banks

Online banks allow users to conduct all of their banking functions through an internet connection.

Just like traditional brick-and-mortar banks, most internet-based banks offer Federal Deposit Insurance Corporation-insured accounts, so your money is safe, as is your personal information.

An online savings account is simple to open, as these banks typically either don’t require a minimum balance to get started, or a very low one. And because they don’t have to spend money on physical buildings and associated costs, they can pass some of those savings on to their depositors—in the form of higher rates on savings and other interest-bearing vehicles. Fees are often lower, too.

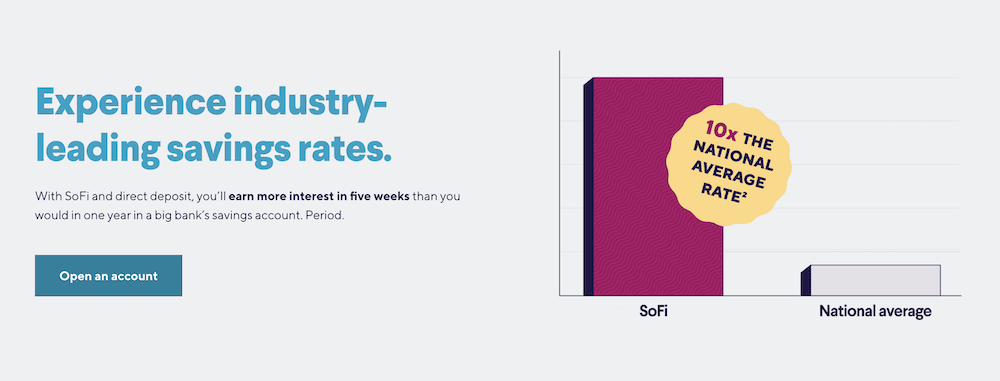

SoFi Checking and Savings Account

The SoFi Checking and Savings Account sounds like your run-of-the-mill bank account, but it’s more: It’s also a high-yield savings account that earns 10 times the national average percentage yield (APY) and more than the average high-yield account. Better still, it boosts your ability to save right off the bat by rewarding you with $50 to $300 upon sign-up.

Sofi Checking and Savings covers all of the basics: No monthly account fees, no minimum balances, and website and mobile app access. But it also has several perks that match or top the competition.

- SoFi's Checking and Savings Account is a free, no-monthly fee account that offers an above-average yield on the savings side, and up to 15% cash back when using your checking account's debit card.

- SoFi's high-yield savings account currently pays 4.00% APY, which is 10x the national average savings rate, and higher than the average high-yield rate.

- Additional available FDIC insurance of up to $2 million is 8x the typical insured amount at most financial institutions.*

- Round up debit card purchases, and the excess is automatically sent to your savings Vault.

- Special Offer: If you set up a qualifying direct deposit within the promotion period, you can earn up to a $300 cash bonus.**

- No account fees

- Above-average yield (4.0% APY) on its high-yield savings account

- Offers up to $50 of overdraft coverage with minimum monthly direct deposits in place

- Round-ups

- Up to $2 million in FDIC insurance

- Not as competitive yield as other banking institutions

- High direct deposit threshold for maximum cash bonus

Related: 15 Best High-Yield Investments [Safe Options Right Now]

4. Cash Management Accounts

A cash management account is similar to an online bank account. However, instead of a bank, the providers are typically broker-dealers or advisory firms that partner with banks to hold your cash. These products usually combine features from investment, checking, and savings accounts, all within one account. If you want fewer accounts to manage, a cash management account may be an excellent fit for you.

Often, cash management accounts have minimal or no fees and offer above-average interest rates. The banks they partner with to hold your cash and earn interest are generally FDIC-insured, meaning your savings are secure, but you should read the fine print associated with the account to make sure you understand any limits or exceptions that apply.

Related: 17 Best Income-Generating Assets [Invest in Cash Flow]

Earn 5% on Your Cash With Robinhood Gold

- Robinhood is a pioneer in the investing app world, offering commission-free trades on stocks, ETFs, options, and cryptocurrency, as well as one of the deepest libraries of investing educational content.

- Investing for retirement? Robinhood will match 1% of any IRA transfers or 401(k) rollovers, as well as any annual contributions*, made to your Robinhood Retirement account—and you can get a 3% match on any new contributions if you subscribe to Robinhood Gold.

- Want more advanced trading tools? Download Robinhoold Legend—a desktop trading platform with real-time data, customizable layouts, deeper asset analysis, and more—for free.

- Robinhood's robo-advisory service, Robinhood Strategies, will build you a custom portfolio of stock and bond ETFs (and individual stocks for accounts with at least $500), for a low 0.25% in AUM, which is capped at $250 annually for Robinhood Gold members.

- Robinhood Gold also includes Level II market data provided by Nasdaq, higher interest rates on uninvested brokerage cash, lower margin trading rates, bigger Instant Deposits, and access to the Robinhood Gold Card (a 3% cash-back Visa credit card).

- Special offer: Sign up for Robinhood, link a bank account, and fund your account with at least $10, and receive a randomly selected cash amount between $5 and $200 to put toward certain fractional shares.

- Very good selection of available investments in brokerage accounts

- 1% match on rollovers, IRA transfers, and new contributions to IRAs and Roth IRAs (3% new-contribution match with Robinhood Gold)

- Automated recommended portfolios

- Intuitive interface

- Robo-advisory service (Robinhood Strategies)

- Extensive educational library

- No mutual funds in brokerage or IRAs

- Match doesn't apply to Robinhood Strategies accounts

5. Investment Accounts

Investment accounts can grow your money much faster than traditional savings accounts, high-yield savings accounts, or basically any other type of non-investment account. But they also come with far higher risk than those options. Money you put into stocks, bonds or other securities should generally be money you’re prepared to invest for the long term to give you the best chance of growing your funds.

While some investment accounts allow you to invest in alternative assets like cryptocurrencies and options, the safer markets to put your money to work in are the traditional stock and bond markets. Consider the investments below:

Stock market

- Individual stocks

- Stock mutual funds

- Stock exchange-traded funds (ETFs)

Bond market

- Individual bonds

- Bond mutual funds

- Bond ETFs

Related: 11 Best Alternative Investments [Options to Consider]

6. Money Market Accounts

A money market account is an interest-bearing product, similar to a savings account, that may also allow limited debit card transactions or check-writing privileges, with a monthly cap on such transfers.

The interest rates on money market accounts are often higher than those of a standard savings account. Deposits are insured for money market accounts up to $250,000 per depositor, making this a secure place to keep your cash.

As money market accounts typically offer high interest rates and permit a predetermined number of transactions each month, some people keep their emergency fund in these accounts. The money earns a competitive interest rate but is still readily accessible if needed. Just note that money market accounts sometimes have minimum balance requirements, and they sometimes have lower yields than high-yield savings accounts.

Related: 17 Best Investment Apps and Platforms [Free + Paid]

7. Money Market Mutual Funds

A money market mutual fund is a fixed-income fund that invests in debt securities. These funds are known for being low-risk and holding securities with very short maturities.

There are three categories of money funds: government, prime, and municipal. The funds are an excellent place to store money as they are secure, stable, and liquid.

While it may not match the returns of other fixed-income funds, a money market mutual fund is generally much safer. They are excellent places to keep your emergency fund or hold cash while you’re waiting for other investment opportunities to become available.

Related: 17 Best Stock Research & Analysis Apps, Tools and Sites

8. Certificates of Deposit

A certificate of deposit (CD) is a savings vehicle that earns interest on a lump sum for a predetermined period of time.

CDs’ main selling point is their high interest rates. They offer a higher annual percentage yield (APY) than traditional savings accounts and usually beat out high-yield savings accounts, too. Also, a CD’s interest rate is locked in until it matures—the yield on a high-yield savings account can move over time.

The downside to the CD is that the money is illiquid for the duration of its term. Terms usually last from a few months to a few years, though some are longer. If you withdraw money before the term is over, an early withdrawal penalty is charged.

Related: 11 Best CD Alternatives to Capture Interest With Low Risk

9. Prepaid Cards

Prepaid cards have money loaded onto them that you can spend as you would with a debit card. But unlike debit cards, prepaid cards aren’t connected to a savings or checking account.

For some people, the downside to a checking account is that it’s easy to overdraw the balance. Prepaid cards help some people stay within their budgets better. Additional money can be added at any time.

A disadvantage to prepaid cards is that they charge fees. Depending on the card, that may include an initial activation fee, card reloading fees, inactivity fees, and much more.

10. Cash

Cash is king, or so the saying goes. Many small businesses only accept cash payments, and some large businesses have a minimum amount you must spend to pay with a card. And during times of crisis, such as a natural disaster, credit card readers can go dark—cash always works.

But cash won’t grow in value. And if you lose it, it’s gone—bank and other accounts offer much more protected. So while it’s wise to have a little cash around, it’s a good idea to have most of your money saved or invested.

Where Is the Safest Place to Keep Your Money?

The safest place to keep your money is in debt issued by the federal government, such as savings bonds or T-bills. However, you can’t keep all of your money in savings bonds and similar assets, as they aren’t completely liquid.

Bank accounts are a wonderful place to keep money, since up to $250,000 per depositor, per institution, is FDIC-insured. Certificates of deposit are another safe, FDIC-insured option, though they are not liquid unless you pay an early-termination fee.

Also on the list of safe places to store your funds are money market accounts at banks with FDIC coverage and credit unions with NCUA coverage.

Is It Safe to Keep Your Money at a Bank?

Yes, it’s safe to save money at a bank. However, many people seek alternatives for various reasons. Many bank alternatives offer a higher annual percentage yield, letting you grow your money faster. Depending on the savings vehicle, there can be many other perks, as well.

So while it’s safe to keep some of your money in a bank, it can be strategic to have some of your funds in other places, as well.

Are There Risks to Keeping My Money Somewhere Other Than a Bank?

Banks are not the only financial institutions that keep your money secure. Government debt, such as T-bills or savings bonds, are backed by the federal government and are therefore extremely safe.

To determine whether your money is safe in another non-bank financial institution, check whether your money is insured through the FDIC or NCUA. If your money is insured, it’s safe.

Cash, prepaid cards, and similar physical funds could be stolen, but that’s preventable with proper precautions. For an online bank or similar account, make sure security measures are in place to protect your personal information, such as your name and Social Security number.

Related Questions on the Best Bank Alternatives

What are the risks to keeping money with a non-bank financial institution?

Some non-bank financial institutions have no physical locations. If something goes wrong, it can be more challenging to get a hold of an employee to fix the problem. You’ll need to call or go online for help.

Make sure any financial institution you work with has security measures in place to protect both your money and your personal information. It’s also important to only work with financial institutions where your money is covered by one of the government-sponsored insurers, like the FDIC.

Do savings account alternatives pay interest?

Yes! Not only do savings account alternatives pay interest; they usually pay much higher interest rates than traditional bank accounts. However, depending on the alternative, you may sacrifice some liquidity to earn that higher rate.

Do bank account alternatives have early withdrawal penalties?

Depending on the bank account alternative you’re using, there may be early withdrawal penalties. Some accounts, such as checking accounts at credit unions, let you withdraw money any time you want with no penalty.

Other alternatives, such as CDs, charge a penalty if you withdraw before the maturity date. Some accounts, like a money market account, give you a limited number of withdrawals per month.

Can you get a checking account at a non-traditional bank?

Yes, you can get a checking account at a non-traditional bank. Credit unions and online banks are popular options for checking accounts.

Are savings accounts covered by FDIC insurance?

Yes, savings accounts are insured by the FDIC up to $250,000 per depositor, per insured bank, for each account ownership category.

Related: How to Get Free Stocks for Signing Up: 13 Apps w/Free Shares

Disclosures

Public.com Disclaimer

This does not constitute investment advice. Investing involves the risk of loss, including the potential loss of principal. Brokerage services for US-listed, registered securities available on Public are offered by Open to the Public Investing, Inc. (OTTP), a member of FINRA & SIPC, and a wholly-owned subsidiary of Public Holdings, Inc. Brokerage services for alternative investments are offered by the Dalmore Group, LLC, a member of FINRA & SIPC. Alternative investments are over-the-counter equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933. Cryptocurrency trading is provided by Apex Crypto LLC (NMLS ID 1828849). Apex Crypto is licensed to engage in the virtual currency business by the New York State Department of Financial Services. New customers of OTTP receive free stock valued between $3 – $1,000 (0.3% receive the maximum value).