It can be difficult to teach children how to spend and save responsibly, but it doesn’t have to be. A debit card can be a valuable educational tool, especially when the kid is in charge of their own spending with guardrails installed by parents.

Better still, you can get these tools at no cost. Many free debit cards represent the first pathway into financial responsibility because they start to give kids and teens control over their spending and provide them an early glimpse into what it’s like to manage money on their own.

But which of these products is best for you and your children?

Read on as we discuss some of the best free debit cards for kids and teens, highlighting their features, drawbacks, and other important information to help you choose one that will work best for your minor’s needs!

Best Free Debit Cards for Kids & Teens—Our Top Picks

|

4.4

|

3.6

|

3.5

|

|

Free (no monthly fees).

|

Free (no monthly fees).

|

Free (no monthly fees).

|

What Are the Best Free Debit Cards for Kids and Teens?

Below, we’ve compiled a list of the best free debit cards for teens and kids that should work for your needs. Look carefully at each card; we’ll help you compare features so you can determine which one makes the most sense.

| App | Apple App Store Rating + Best For | Fees |

|---|---|---|

Capital One MONEY Capital One MONEY | ☆ 4.9 / 5 Free, feature-filled checking + debit card from a major bank | No monthly fees |

Axos First Checking Axos First Checking | ☆ 4.7 / 5 Teens ready to learn about money management | No monthly fees |

Nationwide First Checking Nationwide First Checking | ☆ 4.7 / 5 Teens to learn essential financial skills and avoid fees | No monthly fees |

Revolut <18 Revolut <18 | ☆ 4.8 / 5 Parent-paid bonuses | No monthly fees |

Current Current | ☆ 4.8 / 5 Innovation and product features | No monthly fees |

Till Financial Till Financial | ☆ 4.7 / 5 Teaching about smart spending | No monthly fees |

Chase First Banking Chase First Banking | ☆ 4.8 / 5 High customer satisfaction from a major bank without fees | No monthly fees |

Chase High School Checking Chase High School Checking | ☆ 4.8 / 5 Free checking account with a strong mobile app from a major bank | No monthly fees |

| * Apple App Store Rating as of July 28, 2025. | ||

1. Axos Bank First Checking (Best Free Debit Card for Teens at an Online-Only Bank)

- Available: Sign up here

- Price: Free (no monthly fees)

First Checking by Axos Bank is the ultimate starter checking account for teens, and it comes with a debit card.

The world of banking can be a little scary, but not with the simplicity and power of Axos’ First Checking Account. It works as a joint checking account between a parent or guardian and their teen, allowing for easy-to-set, customizable parental controls with a debit card dashboard.

Parents and teens can manage almost every part of the banking experience through a convenient mobile app or through the online desktop portal. Perfect for modern families who always find themselves on the go.

The First Checking account from Axos Bank gives teens their first taste of financial independence by giving them their own checking account (which pays interest!) and free debit card for teens. But it also provides safeguards against teens getting carried away with the money held in their account, such as daily limits on cash transactions ($100) and debit transactions ($500).

Further, you can receive up to $12 in domestic ATM fee reimbursements per month, and you avoid any monthly maintenance, overdraft, and non-sufficient funds fees—essentially making the account free! Meanwhile, users can also earn a modest 0.10% APY on any balance—lower than the national average rate, but fair for a simple teen checking account and debit card product.

The account carries the highest level of security through biometric authentication techniques like fingerprint readers, voiceprints and facial recognition (pending smartphone feature availability).

The product has a minimum age requirement of 13 and is recommended for ages 13 to 17. It will convert to an Axos Checking Account after the minor reaches the age of majority. Read more in our Axos First Checking Account review.

- Axos Bank First Checking is a joint checking account targeted for teenagers ages 13-17 and their parents.

- Account holders get a Visa or Mastercard debit card that can be used to spend online or in person, or to withdraw cash at any ATM. (Axos provides up to $12 in monthly domestic ATM fee reimbursements.)

- No monthly maintenance, overdraft, or non-sufficient fund fees.

- The debit card's security features include account alerts, card locking, and daily transaction alerts of $100 (cash) and $500 (debit).

- Currently, you can earn up to 0.10% APY on any balance.

- Free (no monthly maintenance fees)

- ATM fee reimbursements (up to $12 per month)

- Converts to adult checking account after minor reaches age of majority

- No paired investment account

- No robust financial literacy resources

Related: Best Teen-Friendly Debit Cards

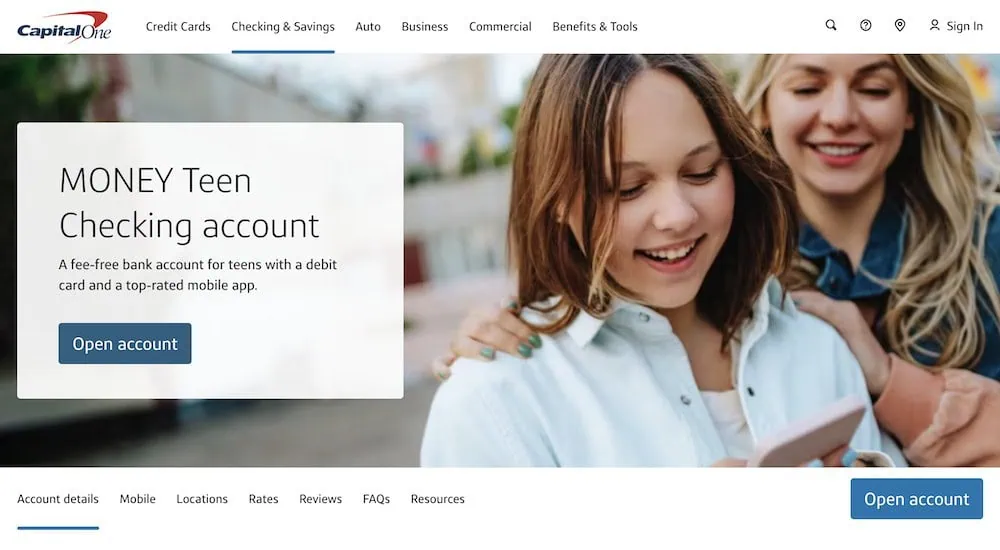

2. Capital One MONEY (Best Free Teen Checking Account)

- Available: Read our review and sign up

- Price: Free (no monthly fees)

Capital One MONEY Teen Checking is one of Young and the Invested’s top choices for parents who want to financially empower their kids at an early age. Yes, this free checking account is predominantly aimed at teenagers, but it’s actually available to kids as young as 8 years old.

This joint checking account offers flexibility for kids and a touch of tranquility for parents. Kids get a Mastercard debit card that they can use at millions of merchants across the U.S., as well as in roughly 210 countries and territories worldwide. Your teen also enjoys access to one of the largest fee-free ATM networks among kids debit cards—more than 70,000+ Capital One, MoneyPass, and AllPoint machines. They can also send and receive money via Zelle, receive direct deposits from employers, and even cash paper checks by snapping a couple photos within the highly rated Capital One app.

Parents, meanwhile, can also pay their kids a regular allowance, or make one-time payments as gifts or rewards. They also can monitor their teens’ transactions, lock and unlock their child’s card, and control their kid’s access to (and transfer limits within) Zelle.

To learn more about the account, read our Capital One MONEY Teen Checking review. Or you can sign up today by clicking “Get Started” above.

- Capital One MONEY is a full-fledged money management account that comes with both a debit card and a highly rated mobile app.

- Boasts one of the largest nationwide fee-free ATM networks, which currently stands at more than 70,000 machines nationwide.

- Security features include monitoring tools and easy card lock/unlock.

- Age requirement: 8+ with a parent-sponsored account

- APY: 0.10%

- Minimum deposit: None

- Minimum balance required: None

- Free account and card

- Access to 70,000+ fee-free ATMs

- Access to Zelle

- Mobile check deposit

- Cash deposits

- Allowance

- Ability to migrate account to 360 Checking when minor becomes 18

- Sparse educational tools

- Few rewards or perks

Related: 10 Best Money Apps for Teens [Invest, Spend, Budget + Pay]

3. Nationwide Bank First Checking

- Available: Sign up here

- Price: Free (no monthly fees)

With a teen checking account product that’s highly comparable to Axos First Checking, and indeed provided by Axos, Nationwide’s First Checking also acts as an ultimate starter checking account with a debit card for teens. We feel both products deserve spots on this list for their features and free price point.

Like Axos’ First Checking, this Nationwide account works as a joint account between a parent or guardian and their teen, allowing for easy-to-set, customizable parental controls with a debit card dashboard. Nationwide’s account is otherwise equipped with the same features, functionality, and ability to earn a modest APY.

- A joint checking account, provided by Axos Bank through Nationwide, for teenagers ages 13-17.

- No monthly maintenance fees or overdraft fees.

- Debit card with account alerts.

- Earn up to 0.10% APY from $0 account balance.

- Up to $12 domestic ATM fee reimbursements per month.

- Daily transaction limits ($100 cash, $500 debit).

Related: Best Investing Apps for Teens Under 18 [Stock Apps for Teens]

4. Revolut <18 (Best for Parent-Paid Bonuses)

- Available: Sign up here

- Price: No monthly fees

Revolut <18 is a prepaid debit card for kids designed to teach them money skills for life. Aimed at building healthy money habits from an early age, the unique, customizable card1 empowers parents to have full insight into their kids’ card activity through providing instant spending alerts and parental controls.

You can choose to freeze the card, as well as set controls on how they use the cards online and with contactless payments through your Revolut app. You can also set spending limits on how much your child can use with the prepaid card.

Parents use the card and accompanying app to teach kids about earning, budgeting, saving and even investing money (depending on the plan chosen). You can also use the card to manage chores and allowance, set savings goals as a family, and help your children manage their money.

And if your child did something deserving of a reward? You can send parent-paid bonuses when they complete specific tasks. Simply add money to their digitized piggy bank through the app. You can send and receive money in seconds through Revolut’s payments feature, which allows fast transfers between account holders and also global transfers at transparent rates.

You must have a personal Revolut account before you can open a Revolut <18 account for your children. You can add up to five Revolut <18 accounts per parent account.

To learn more about Revolut <18, visit their site and open an account for yourself and your child.

- Revolut <18 is a prepaid debit card for kids designed to assist parents teach kids ages 6-17 about money. Families can handle chores and allowance, create budgets, set parental controls and more.

- Revolut <18 comes with unique, customizable cards* that parents can use to set up tasks and goals to work on together as a family.

- Prepaid debit card for teens

- Parental controls

- Round-ups

- Chore and allowance management

- Customizable designs (fees apply)

- Children can't load funds, only parents can

- Parents need to have a personal Revolut account

Related: Best Online Jobs for Teens to Make Money While at Home

5. Current (Great No-Monthly-Fee Teen Card)

- Available: Sign up here

- Price: Free (No monthly fees)

The Current banking app is designed with families in mind. It offers both adult and teen accounts, with the latter acting like prepaid debit cards that parents load for their children. The Current app allows you to track your teen’s spending in real-time, set limits on how much your children can spend, and even block specific merchants on its Visa-enabled debit cards. You also get the peace of mind that comes with knowing your children’s money is safe because it’s not cash—no temptations, just a tool parents can use to help teach teens financial responsibility.

Among Current’s features:

- No minimum required balances, no fees on transfers to other Current accounts, and no hidden fees.

- Create Savings Pods, or Giving Pods, that allow you to save up for various goals.

- Round-Ups allow you to round up purchases to the nearest dollar amount and store the difference in Savings or Giving Pods.

- Buy and sell 27 different cryptocurrencies with zero trading fees.

Teens will love easy allowance deposits, a card they can use in stores or online, instant gas hold removals when buying gas, and access to more than 40,000 fee-free Allpoint ATMs nationwide. They’ll also have the opportunity to learn about financial responsibility and financial independence through Current’s Budgets feature, which allows them to track their spending and even receive alerts when they get too close to (or exceed) a predetermined limit.

Current doesn’t specifically state a minimum age requirement, but the company’s marketing suggests teens are the target audience. Still, you might be able to open an account for a younger child.

- Current is a financial technology platform that lets teens enjoy not just traditional banking basics, but numerous features meant to simplify spending, streamline saving, and set them on the path toward more organized finances.

- Teens can spend with the Current Visa debit card, which allows them to purchase in-store and online, as well as withdraw money fee-free from more than 40,000 in-network Allpoint ATMs.

- Current Teen Accounts also come with Savings Pods, which earn 0.25% APY and allow you to round up purchases (overages are funneled into your savings).

- Parents can monitor their kids' spending, adjust maximum ATM withdrawal and spending limits, and even toggle spending categories (and the Current debit card itself) on and off.

- Parents can also automate allowance payments, pay for chores, instantly transfer money to their teens, and more.

- Free account (no monthly maintenance fees)

- Good parental controls

- Fee-free ATMs

- Cash reloads

- Gas hold deposits

- 24/7 email and live-chat support

- No direct deposit

- No paired investment account

- No card customization

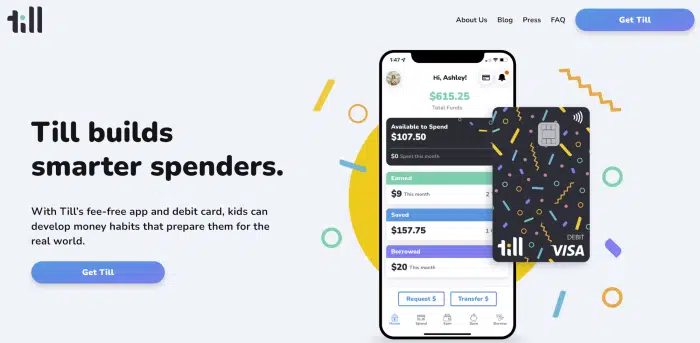

6. Till Financial (Best for Spending Lessons)

- Available: Sign up here

- Price: Free (no monthly fees)

Earning, saving, and investing money are important cornerstones for every child to learn before setting out into the world. But just as important is the fourth pillar: how to spend money wisely.

That’s where Till Financial wants to help.

The free debit card and banking platform for kids describes itself as a collaborative family financial tool that empowers children to become smarter spenders. They do this by designing their banking product to encourage “open and honest” discussions between parents and kids.

Further, they allow kids to establish savings targets based on goals. For example, if a teen wants to save up to buy a new laptop or iPad, they can set up an account to save toward this goal themselves, but also solicit help from family members to contribute the same (or more) funds. They can also track their progress along the way, which helps to encourage them to continue saving because the path to their goal feels more real.

Till Financial also wants to further their money education effort by helping kids to “learn by doing,” gaining confidence in their spending decisions along the way. They do this by giving them responsibility over their financial actions through the service, such as learning about the costs of recurring subscriptions like Netflix or Spotify.

Another thing that stands out about Till Financial are all the various ways children can receive money. These include:

- Quick gives: One-time instant transfers from parent wallets to kids’ wallets.

- Allowance: An automated recurring transfer from parents’ wallets to kids’ wallets.

- Tasks: You create a chore, a frequency and an associated payment for your child to complete. If your child marks the task as completed, you’ll be notified—if you confirm the task actually was completed, the funds will be transferred.

- Direct deposit: Does your child have a job with direct deposit? They can have their checks sent directly to their Till account.

- Contributions: You can send recurring contributions toward your child’s savings goal. This can be set as a percent match to each of your child’s contributions, an interest payment (percent match to total amount) or weekly contributions.

- Transfers: A child or adult can transfer money between their Save and Spend balances. (If the child initiates the transfer, it must be approved by an adult.)

- Other contributions: Grandparents, aunts, uncles, and other close friends can contribute to a child Till user’s goal.

If you’d like to sign up for a free account with Till Financial, you’ll be equipped with a bank account, digital and physical debit card, and goal-based savings features. The debit card can be used online or in person, and parents enjoy safety features like one-tap card freezes should their child lose their physical card.

- Till Financial is a free app and debit card for kids aimed at creating "Smart Spenders" by fostering discussions between parents and children.

- The app aims to teach kids the importance of spending wisely, setting goals, and understanding the value of money.

- Till Financial's app features a host of ways to transfer money, including allowance, Tasks (chores), direct deposit, "quick gives," recurring contributions, and more.

- Free debit card for kids

- Numerous ways to contribute to a child's account

- Strong financial education core

- Savings goals with progress tracking

- Can only link one funding source at a time

- No cash deposits

- Limited educational tools

Related: How Old Do You Need to Be to Buy Stocks?

7. Chase First Banking (Best Free Debit Card for Kids and Teens)

- Available: Sign up here

- Price: Free (no monthly fees)

Ready to teach your little ones about money, but not quite sure if you have the time, patience and expertise?

Chase First BankingSM offers simple banking for both of you in one location: the Chase Mobile® App—for free. Manage all accounts with this mobile app and encounter no fees as well as find yourself able to withdraw money on 16,000 Chase ATMs around the country. The account is designed with kids 6-12 in mind, and available for ages 6-17.

At the heart of Chase First BankingSM sits one of the best free debit cards for kids and teens that works anywhere Visa is accepted.

Need insight and oversight into your child’s spending and saving? You can set spend alerts and limits as well as specific locations all in your Chase Mobile® app.

Teach your kids to spend, save and earn—all from the Chase Mobile® app. Chase First BankingSM helps parents teach teens and kids about money by giving parents the control they want and kids the freedom they need to learn.

To get started, you’ll first need to be a Chase customer with a qualifying Chase checking account.

Once you open a qualifying Chase Checking account (Chase Total Checking SM or Chase Secure BankingSM), you may apply for a Chase First BankingSM account for your child. Read more in our Chase First Banking review.

- Chase First Banking offers simple banking for both of you in one location: the Chase Mobile® App—for free.

- The account is designed with kids 6-12 in mind, and available for ages 6-17.

- You can set spend alerts and limits as well as specific locations all in your Chase Mobile® app.

- Teach your kids to spend, save and earn with Chase First Banking. The account helps parents teach teens and kids about money by giving parents the control they want and kids the freedom they need to learn.

- No monthly maintenance fees

- Chore and allowance functionality

- Parental controls on types of expenses

- No paired investment account

- No interest

Related: Best Bank Accounts for Kids

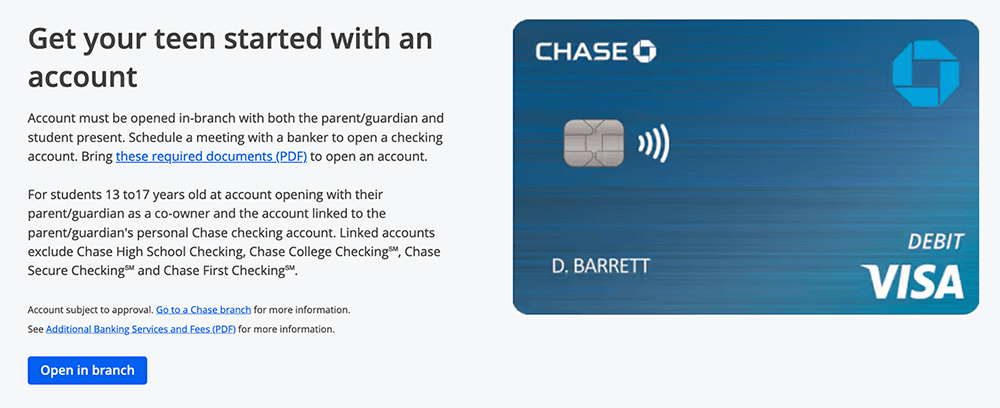

8. Chase High School Checking (Best Teen Checking from a Mega-Bank)

- Available: Get your code here, then sign up in a branch

- Price: No monthly fees

- Special offer: $125 when you open an account1

Chase High School Checking℠ is an account tailor-made for parents who want their teen to build money independence and enjoy the benefits of banking with a large national bank, but also want to keep an eye on their teen’s finances as they learn the ropes.

This checking account for teens (ages 13-17 at account opening) lets your teen enjoy the convenience of mobile banking through the Chase Mobile® App, as well as a debit card that can be stashed in a virtual wallet, or used to withdraw cash from Chase’s massive nationwide network of 16,000 ATMs.

With Chase High School Checking℠, your teen can …

- Use direct deposit to get paid from their summer job, or use Chase QuickDeposit℠ on their phone to remotely (and securely!) deposit physical checks from odd jobs or birthdays.

- Build their savings hassle-free with Autosave, which automatically transfers money from checking to savings.

- Use Zelle® (through the Chase Mobile® app) to send and receive money from friends and family—even if they don’t bank with Chase.

- Have their Chase High School Checking℠ convert into a Chase Total Checking® account when they turn 19.

Meanwhile, parents can stay in the know through account alerts.

Chase High School Checking℠ accounts must be opened in a physical branch, using a coupon code you can receive from Chase here. A parent or guardian must be present, and will be the account co-owner. Students should bring at least one primary ID and one secondary ID.

The parent must have an existing qualifying Chase checking account, which will be linked to the High School Checking account. Among the accounts that qualify is Chase Total Checking®:

- Chase Total Checking® also grants access to 16,000 Chase ATMs and more than 4,700 branches as well as a $300 sign-up bonus when you set up direct deposit within 90 days of coupon enrollment. You can pay $0 in monthly fees, subject to meeting certain conditions2.

Learn more and get your code for Chase High School Checking℠ here.

- Chase High School Checking℠ is a free checking account that helps teens learn financial independence through the Chase Mobile® App and a Visa debit card.

- Enjoy features such as Autosave (automated saving), QuickDeposit℠ (mobile deposit), and account alerts for parents.

- Zelle® lets you send money to (and receive money from) friends and family as long as they have an eligible account at a participating U.S. bank.

- Teens must sign up in a physical branch with a parent or guardian that has an existing qualifying Chase checking account.

- Age requirement: 13-17 at account opening.

- Annual percentage yield (APY): None

- Minimum deposit: None

- Minimum balance required: None

- Special offer: Get $125 when you sign up.¹

- No monthly fees

- Mobile app

- Sign-up bonus

- 16,000-plus fee-free ATMs

- Limited parental controls

- No APY

- Tight age restrictions

- Must sign up in a physical branch

Other Kids Debit Card Options to Consider (Not Free)

While free is always the right price, you might want more functionality for a higher cost. Below are some of the other debit cards for kids and teens you might consider trying out before committing to a free option above. One distinction between free and paid debit cards for kids: many paid cards offer plans for up to five kids.

| App | Apple App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Greenlight Greenlight | ☆ 4.8 / 5 Customer rating, parental controls, goal setting, chore and allowance management, and ability to learn investing fundamentals | Core: $5.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each plan supports up to 5 children.) | None |

Copper Banking Copper Banking | ☆ 4.8 / 5 Teen financial independence | Copper: $4.95/mo., Copper + Invest: $7.95/mo. | None |

Acorns Early Acorns Early | ☆ 4.7 / 5 Accessible customer service support | Acorns Early: $5/mo. for 1 child. $10/mo. for 2-4 children. Acorns Gold: $12/mo., includes Acorns Early for up to 4 children. | Free 30-day trial + $5 allowance upon signup |

BusyKid BusyKid | ☆ 3.4 / 5 Teaching balanced financial approach through chores & allowance; investing fundamentals | $3.99/mo. (5 cards); $38.99/yr. | 30-day money back guarantee |

FamZoo FamZoo | ☆ 4.6 / 5 Financial literacy resources | $5.99/mo. per family | Free month trial |

| *Apple App Store Rating as of Dec. 12, 2024 | |||

What Is a Debit Card for Kids and Teens?

Children generally can’t open their own bank account until they reach the age of majority in their state—often 18 years old. Thus, parents often look for other paths, such as opening a sub-account from their own bank account so they can provide their children with a card to use.

In that event, your child likely will need to be at least 13 years old before receiving a card.

Unfortunately, these bank accounts might not come with the custom spending controls, parental oversight, or feature-filled mobile apps provided by many new debit cards for kids. These new apps provide numerous controls over your children’s spending, including spending notifications, limiting where your child can use the card, and even allowing you to quickly lock and unlock the card. And in many cases, you simply fund your child’s debit card, so it effectively functions as a prepaid debit card.

Traditional banks or prepaid debit cards might not allow you to do this beyond keeping the account balance at a certain level.

What to Do Before Getting a Free Debit Card for Kids

Take these things into consideration before opening a debit card for your child:

- Monthly fees. The best debit cards for kids should not have fees associated with their online portals to review the child’s spending or educational tools that manage money.

- Major card networks. One of the best cards for your child to use is one backed by a major credit card network. Companies like Amex, Mastercard, Visa, or Discover. This means your child can use the card as a debit or credit when needed.

- Parental Controls. An online account that not only lets you see where cash flows and when it changes hands, but also lets you monitor your child’s spending habits is a smart investment for both security purposes and to teach them strong money management skills.

- Prepaid card. To start, you may want to consider a prepaid debit card. You can also tie a new card to your existing accounts as another authorized user. The new card will access those accounts as your child spends.

- Credit scores. There are various ways to load money onto a debit card for kids. For example, you could purchase a convertible credit card for kids and put the money that they want into it; however, make sure you pay off your balance every month in order to avoid interest charges. Not paying off your monthly balance might be bad for your own credit score.

Which Features Should You Look For in a Free Kids Debit Card?

- Direct Deposit: One of the best features that may be available on free debit cards for kids is direct deposit. Direct deposit is an automated transfer of money, typically from an employer to a person’s bank account. This is an excellent feature you want your kids to have, because your child’s paycheck will go directly into their account. That beats being handed an envelope from work that’s later handed over to Mom and Dad to manage. A few debit cards for teens even allow free early direct deposit if they open a premium checking account. This allows teens to get paid up to two days faster than with regular direct deposit.

- Transfer Money Instantly: The instant money transfer capability is really beneficial for parents with young children. Instant money transfers allow parents to, say, pay allowance to kids or compensate children for their weekly or monthly chores. And this feature eliminates the need to make a trip into an actual bank, which saves a trip for adults and kids pressed for time. Many free debit cards for kids, then, offer a quick “reload” option so parents can keep on top of their kids’ accounts, even when pressed for time.

- Mobile App: Many parents and guardians find that banking mobile apps make it much easier to keep track of their children’s spending. Think about all the parental controls you can find on some debit cards’ mobile apps: spending limits, controls on where kids can use their cards, restricting card use at certain times of the day, spending notifications, even the ability to lock down the card. Moreover, mobile apps often include things like lessons, quizzes, and videos teaching kids about financial responsibility at an early age.

- Parental Controls: Parental controls are among the most pivotal features you’ll need in a debit card for teens and/or kids. If your card offers controls, they should be easy to set up, customizable, and suited to any parent’s needs. Parents should be able to choose what notifications they want, set spending limits, manage ATM withdrawals, determine which merchants kids can visit, and even lock and unlock kids’ cards.

- Money Management Features: Money management features can be especially attractive when deciding on a kids’ debit card. Money management tools obviously won’t create more money, but they can help your children begin to understand the concepts of budgeting so they can spend their money more wisely and get more out of it.

- Establish Savings Goals: One really important money management feature that many parents want for their children is savings goals. In general, kids can benefit enormously from the virtues of saving. Saving from an early age can enforce the idea of delayed gratification—the idea that accomplishments can be just as (if not more) satisfying when they’re worked for and earned over time. Also, saving can help instill responsibility in your child. It’s a building block to understanding what it means to budget, diversify their financial resources, and even invest for better returns. As a note, some paid debit cards offer a feature called parent-paid interest, where parents can pay interest on savings held on a child’s account.

Is There a Debit Card for Kids With No Fees?

Yes! As we’ve covered above, you can find not just one, but several kid debit cards, free or paid.

One of the best debit cards for kids and teens without a monthly service fee comes from Step, a newer financial technology company focused on offering financial products to minors and young adults. The free prepaid debit card empowers kids to learn about earning, saving and spending their money through teaching teens about the basics of banking and budgeting. The app offers the ability for teens to budget and set goals while giving parents monitoring oversight of purchases made in real-time.

Together, these features provide productive tools for parents and teens to engage in ongoing financial conversations, providing both groups with greater confidence in money decisions made now and in the future.

And it’s easy to see why this matters: The company’s mission of bolstering financial literacy in teens can equip them to make smarter money choices down the road. We’ve highlighted other options above and some other ones include Capital One MONEY Teen checking account, Bank of America’s Clear Access account and Chase’s High School Checking.

Disclosures

Chase High School Checking℠

1 Your teen gets $125 when you open a new Chase High School Checking℠ account together with qualifying activities within 60 days of coupon enrollment. Your child can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. To receive the bonus: 1) Open a new Chase High School Checking account, which is subject to approval; AND 2) Complete at least 5 qualifying transactions within 60 days of coupon enrollment. Qualifying transactions include: debit card purchases, online bill payments, Chase QuickDeposit℠, Zelle®, or ACH credits. After your child has completed all the above requirements and the 5 qualifying transactions have posted to their account, we’ll deposit the bonus into their new account within 15 days. To receive this bonus, the enrolled account must not be closed or restricted at the time of payout. Eligibility may be limited based on account ownership. Bonus is considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

2 Account subject to approval. Monthly fee waived for any month in which you have electronic deposits of $500 or more made to this account, or a balance at the beginning of each day of $1,500 or more in this account, or an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances.

Revolut <18

1 Customized cards may require fees.